|

市场调查报告书

商品编码

1644383

欧洲智慧停车场 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Smart Parking - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

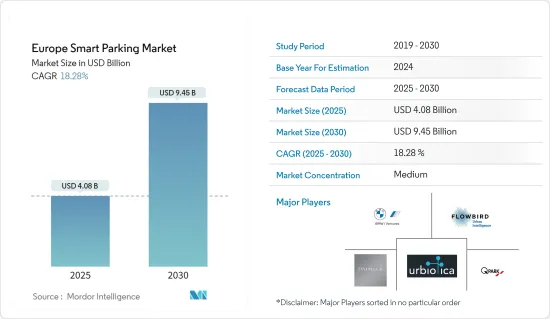

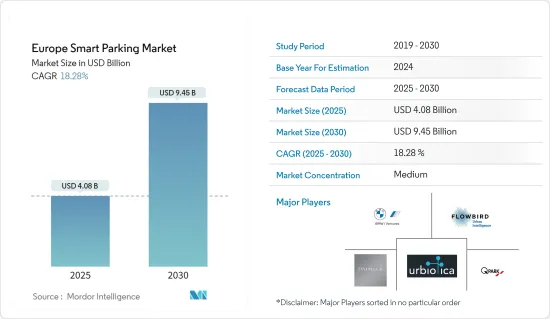

预计2025年欧洲智慧停车市场规模为40.8亿美元,2030年将达到94.5亿美元,预测期间(2025-2030年)的复合年增长率为18.28%。

都市区不断扩张,因为它们对服务、就业、休閒、商业和文化具有吸引力,这对市政当局和市民都带来了挑战。智慧城市正在寻求增强可持续的出行解决方案,以减少污染,分配公共和私人空间以缓解交通拥堵,减少车辆寻找停车位的时间,并普遍提高城市中心的可及性和吸引力。

关键亮点

- 此外,对停车位短缺的担忧也是推动市场成长的主要驱动力之一。例如,国际道路运输联盟(IRU)参与了一项欧盟资助的研究,该研究显示缺乏安全可靠的停车场(SSTPA)是欧洲的一个主要问题。

- 此外,这些系统的一个主要驱动力是智慧城市的日益发展趋势。许多政府已经认识到高效率的停车系统对于实现良好的市场环境的重要性。市场研究供应商也正在进行类似的计划。

- 整合自动化解决方案的持续使用以及无线和数位付款技术的进步可能会推动市场扩张。机器对机器 (M2M) 连接、资料分析、智慧感测器、智慧停车收费表以及用于停车位註册和线上付款的行动应用程式是构建这些系统的一些技术。这些技术旨在识别停车位是否空置或已满,分析此类资讯并将其传输到行动或线上应用程式。这些技术进步有望成为市场扩张的驱动力。

- 由于环境问题、交通拥挤和人口成长等问题,欧洲各国政府都期待智慧城市的发展。因此,该地区的政府优惠政策预计将对市场成长做出重大贡献。

- COVID-19 导致公共场所和购物中心关闭,全球范围内启动在家工作模式,并大幅减少了全球交通量。由于各国实施封锁措施,路边和路外停车场已停止服务。随着疫情结束,公共场所、购物中心和办公室开放,导致交通量增加,对智慧停车的需求可能会增加。

欧洲智慧停车市场趋势

技术进步以及理事会和技术提供者之间的持续合作

- 预计连通性和通讯技术的增强将使这些解决方案更加经济实惠且更受欢迎。随着行动装置普及率的提高,停车解决方案的应用程式支援预计也会成长。提供将客户客户群融入智慧停车解决方案的解决方案的供应商有望获得更多关注并增强策略竞争力。

- 由于这些服务价格实惠,因此可以实施人工智慧、机器学习、速度监控、影像识别、追踪功能等技术,有望改善和增强市场上的使用者体验。

- 停车是创造智慧互联的交通环境的一个重要参数。智慧城市计画下的智慧交通计划预计将在预测期内推动需求成长。

- 英国政府正在推动快速、永续的伙伴关係,以实现其未来城市的愿景。此外,欧洲智慧城市和社区创新伙伴关係(EIP-SCC)旨在汇集城市、企业和公民的力量,改善城市生活。该计划旨在加速智慧城市解决方案的商业部署。

- Picodi 的一项调查发现,与中欧和东欧的主要城市相比,里加居民支付的停车费最高。该市每年的合约金额从 300 欧元到 1,200 欧元(1,203.77 美元)不等。居住在付费停车区域的个人可以购买该区域的会员资格。会员可享有无限次停车和停车费折扣等福利。明斯克和基辅居民不享有这些福利。正常情况下,您必须获得车库停车位或会员资格,或将车停放在付费停车场外。

预计德国将占据较大市场占有率

- 德国城市和其他欧洲城市一样,古老而拥挤。街边停车是最常见的停车选择,但街边停车场(Parkplatz)、地上停车场(Parkhaus)和地下停车场(Tiefgarage)也很常见。

- 寻找停车位很困难,这就是为什么近年来寻找停车位的数位支援在德国几家新兴企业中占据主导地位。一项研究发现,找到免费的停车位平均需要 10 分钟。德国汽车製造商奥迪进一步分析发现,大约 30% 的交通拥堵是由于人们寻找停车位造成的。因此,科技颠覆者必须勇于承担责任,提出开创性的解决方案。

- 此外,这些系统背后的一个主要驱动力是智慧城市概念的扩展。许多政府已经认识到高效率的停车系统对于市场实现良好环境的重要性。参与市场研究的供应商也正在进行类似的计划。

- 此外,汽车(尤其是混合动力汽车汽车和电动车)的成长预计将推动国内汽车产业的成长,使企业能够专注于解决停车问题的技术。预计这将对市场成长产生积极影响。德国汽车工业正在融合智慧技术,引领全球汽车产业的创新。

- 此外,Cleverciti Systems 的智慧停车创新也用于监控市中心的停车位可用性。该系统为城市停车部门提供了宝贵的信息,包括免费停车位大小、停留时间、限制区和装卸区等参数。

- 根据 OCIA 的数据,2015 年至 2019 年乘用车销量有所成长。由于疫情的影响,个人更倾向于拥有汽车,因此 2019 年的销售量创下了最高纪录。由于疫情导致的供应链中断、生产停工和在家工作,乘用车销售量从 2019 年到去年略有下降。

欧洲智慧停车产业概况

欧洲智慧停车市场区隔程度适中,众多参与企业占了相当大的市场。由于进入市场所需的投资成本高,因此进入门槛很高。智慧停车市场的知名参与企业包括 UrbIoTica、BMW I Ventures、戴姆勒移动、Flowbird SASU(Parkeon SA)、Q-Park 等。

2022年5月,Stellantis NV计画收购宝马集团和宾士集团的Share Now汽车共享业务。 Stellantis NV 的基于 Free2Move 应用程式的停车、租赁和租用服务拥有约 200 万名客户。 Share Now 拥有超过 340 万用户,并在欧洲 16 个城市提供所谓的自由浮动汽车共享服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 工业影响评估

- 产业生态系统分析

- 欧洲的主要使用案例

- 英国的自动停车与自动平行停车

- UrbIoTica 在德国的创新智慧停车解决方案

- 法国和东欧的智慧城市计划以智慧停车为重点

第五章 市场动态

- 市场驱动因素

- 汽车数量的稳定增长引发了人们对停车位安全的担忧

- 技术进步以及理事会和技术提供者之间的持续合作

- 市场问题

- 成本和基础设施问题

- 市场机会

- 联网汽车需求的不断增长预计将带来新的机会

第六章 市场细分

- 按类型

- 停车场经营者

- 停车场管理公司

- 基础设施提供者(硬体和软体)

- P2P停车应用程式

- 其他的

- 按国家

- 德国

- 英国

- 法国

- 西班牙

- 荷兰

- 欧洲其他地区 (北欧、义大利)

第七章 竞争格局

- 公司简介

- UrbIoTica

- BMW I Ventures

- Daimler Mobility

- Flowbird SASU(Parkeon SA)

- Q-Park

- JustPark

- Cleverciti

- FlashParking

- Indigo Group

第八章投资分析

第九章:市场的未来

The Europe Smart Parking Market size is estimated at USD 4.08 billion in 2025, and is expected to reach USD 9.45 billion by 2030, at a CAGR of 18.28% during the forecast period (2025-2030).

Urban areas constantly expand due to their attractiveness for services, work, leisure, commerce, and culture, creating challenges for municipalities and citizens alike. Smart cities are looking for enhanced sustainable mobility solutions to reduce pollution, lower congestion by allocating public and private spaces, reduce time spent by circling vehicles searching for parking spaces, and generally improve accessibility and city center attractiveness.

Key Highlights

- Moreover, concerns related to inadequate parking spaces are also one of the major drivers for the growth of the market. For instance, the International Road Transport Union (IRU) participated in an EU-funded study that revealed that the lack of Safe and Secure Parking Areas (SSTPAs) is a significant concern in Europe, wherein approximately 90% of drivers and transport operators stated that the current parking supply is insufficient.

- Moreover, a significant driver for these systems is increasing smart city initiatives. Several governments recognize the importance of efficient parking systems in helping the market attain a favorable environment. Vendors in the market studies are taking up similar projects.

- The increased use of integrated automated solutions and advances in wireless and digital payment technologies likely drive market expansion. Machine-to-Machine (M2M) connectivity, data analytics, sophisticated sensors, smart parking meters, and mobile applications for slot registrations and online payments are the technologies used to build these systems. These technologies are intended to identify whether a parking lot is available or occupied and analyze and send such information to mobile and online apps. These technological advances are projected to drive market expansion.

- Growing environmental concerns, traffic congestion, and population growth are prompting European governments to anticipate the development of smart cities, which will significantly improve the quality of life while assisting authorities in resource conservation. As a result, favorable government policies in this region are expected to contribute considerably to market growth.

- COVID-19 led to the closure of public places, shopping malls, and the beginning of global work-at-home scenario, which significantly reduced global traffic. The lockdown implications in countries rendered the on-street and off-street parking areas underutilized. Now the pandemic is over, public places, shopping malls, and offices are open, traffic has increased, thus the necessity of smart parking will also increase.

Europe Smart Parking Market Trends

Technological Advancements and Ongoing Collaborations Between Local Councils and Technology Providers

- The technological enhancement in connectivity and communication is expected to make these solutions more affordable and sought-after. App support for parking solutions is expected to grow with high mobile penetration. The vendors offering solutions that integrate their client's customers with smart parking solutions are expected to gain more traction and be strategically more competitive.

- Many technologies, such as AI, machine learning, speed monitoring, image recognition, and tracking capabilities, are expected to improve and enhance the user's experience in the market, as the adoption is possible due to the affordability of these services.

- Parking is an essential parameter in creating a smart and connected transportation environment. The smart city concept's smart transportation projects are expected to boost demand over the forecast period.

- The UK government is pushing for rapid and sustainable partnerships to realize its vision for future cities. Moreover, the European Innovation Partnership on Smart Cities and Communities (EIP-SCC) brings cities, businesses, and citizens together to improve urban life. The initiative is designed to accelerate the commercial roll-out of smart city solutions.

- According to a survey conducted by Picodi, Compared to the main cities in Central and Eastern Europe, Riga residents are paying maximum parking in the paid parking zone. Annual subscriptions in this city varied from 300 to 1,200 EUR (1203.77 USD). Individuals who reside in a paid parking zone can purchase a membership in their region. It has benefits such as unlimited parking and lower pricing. Residents of Minsk and Kyiv do not have these advantages. Under regular conditions, they must acquire a garage space or a membership or park their automobile outside the paid parking zone.

Germany is Expected to Hold Major Market Share

- German cities, like most other European counterparts, are old and congested. While parking on the street is the most common means of parking in the country, off-street parking lots (Parkplatz), above-ground garages (Parkhaus), and underground garages (Tiefgarage) are also common.

- Digital support in searching for a parking space occupied multiple start-ups in Germany for the past few years, as searching for a parking space is difficult. According to a survey, a person needs ten minutes on average to find a free parking space. Further analysis by German Automaker Audi showed that approximately 30% of the traffic jams during rush hour are caused by people looking for a parking space. Thus, technology disruptors must devote themselves to this problem and come up with advanced solutions.

- Moreover, a significant driver for these systems is increasing smart city initiatives. Several governments recognize the importance of efficient parking systems in helping the market attain a favorable environment. Vendors in the market studies are taking up similar projects.

- Moreover, the growth of vehicles, especially hybrid and electric vehicles, is expected to lead to the growth of the automotive industry in the country, thereby enabling the companies to focus on technologies that solve the parking issue. This is expected to impact the growth of the market positively. The German automotive industry is leading the technological innovations in the global automotive industry, integrating smart technologies.

- Furthermore, a smart parking innovation from Cleverciti Systems is used to monitor parking space availability in the city's center. The system provides the city's parking department with valuable information, including parameters such as the size of a free parking space, length of stay, and restricted and loading areas.

- According to OCIA, passenger car sales increased from 2015 to 2019. Due to the pandemic in 2019, individuals preferred owning vehicles, so there were maximum sales in 2019. Due to the pandemic supply chain disruption, manufacturing halt, and work-from-home jobs, the sales of passenger cars slightly decreased from 2019 to last year.

Europe Smart Parking Industry Overview

The Europe Smart Parking Market is moderately fragmented, with many players accounting for significant amounts of shares in the market. Due to the high investment cost needed to enter the market, there is a high barrier to entry in the market. Some of the prominent companies in the smart parking market are Urbiotica, BMW I Ventures, Daimler Mobility, Flowbird SASU (Parkeon SA), Q-Park, and other players are making strategic partnerships, mergers, acquisitions, and investments to retain their market position.

In May 2022, Stellantis NV planned to acquire BMW AG and Mercedes-Benz AG's Share Now car-sharing operation. Stellantis NV's Free2Move app-based parking, leasing, and renting services have about two million customers. Share Now, which has over 3.4 million subscribers, offers so-called free-floating car-sharing services in 16 European cities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHT

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Industry

- 4.4 Industry Ecosystem Analysis

- 4.5 Major implementation use-cases in Europe

- 4.5.1 Self-Parking and Automated Parallel Parking in the United Kingdom

- 4.5.2 Urbiotica's Innovative Smart Parking Solution in Germany

- 4.5.3 Smart City Projects in France and Eastern Europe Focused on Smart Parking Installations

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Steady Rise in Vehicles Leading to Concerns Over the Availability of Parking Space

- 5.1.2 Technological Advancements and Ongoing Collaborations Between Local Councils and Technology Providers

- 5.2 Market Challenges

- 5.2.1 Cost and Infrastructural Concerns

- 5.3 Market Opportunities

- 5.3.1 Anticipated Growth in Demand for Connected Cars to Open Up New Opportunities

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Parking Operators

- 6.1.2 Parking Management Companies

- 6.1.3 Infrastructure Providers (Hardware and Software)

- 6.1.4 P2P Parking Apps

- 6.1.5 Other Types

- 6.2 By Country

- 6.2.1 Germany

- 6.2.2 United Kingdom

- 6.2.3 France

- 6.2.4 Spain

- 6.2.5 The Netherlands

- 6.2.6 Rest of Europe (Nordics and Italy)

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Urbiotica

- 7.1.2 BMW I Ventures

- 7.1.3 Daimler Mobility

- 7.1.4 Flowbird SASU (Parkeon SA)

- 7.1.5 Q-Park

- 7.1.6 JustPark

- 7.1.7 Cleverciti

- 7.1.8 FlashParking

- 7.1.9 Indigo Group