|

市场调查报告书

商品编码

1644399

中国煤炭:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)China Coal - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

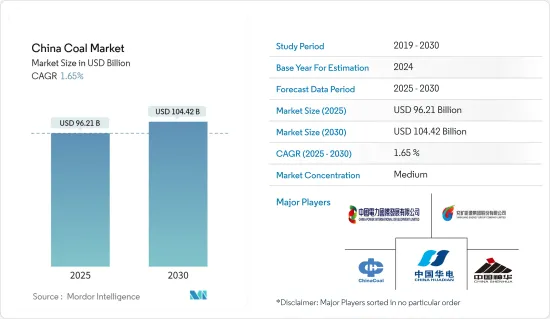

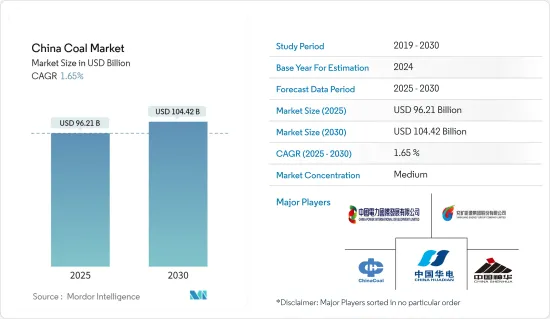

预计2025年中国煤炭市场规模为962.1亿美元,预计2030年将达到1,044.2亿美元,预测期内(2025-2030年)的复合年增长率为1.65%。

关键亮点

- 从长远来看,预计电力需求增加和煤炭产业投资等因素将推动市场发展。

- 另一方面,人们对煤炭使用和再生能源来源采用的环境问题的日益担忧是阻碍市场成长的主要因素。

- 捕碳封存等技术在煤炭开采和提取价值方面的应用日益广泛,预计将为中国煤炭市场创造巨大机会。

中国煤炭市场趋势

发电领域预计将主导市场

- 由于全国对电力的需求不断增加,预计发电业将在预测期内占据市场主导地位。

- 2022年,中国煤炭消费量量占世界比重将超过54.7%,煤炭约占全国初级能源消耗的55.46%。

- 由于经济从疫情中快速復苏,中国 2022 年的发电量将达到 8,848.7 TWh,较 2021 年成长 3.6%。中国是2022年能源需求增加的少数国家之一,且增幅位居全球首位。煤炭占该国能源来源的61%。

- 此外,中国过去几十年来经济快速成长导致能源需求激增。因此,中国政府优先考虑确保稳定和充足的能源供应,从而继续依赖煤炭。

- 例如,根据中国能源部统计,2022第一季,中国各省政府核准的新建燃煤电厂计画总合容量为863万千瓦。核准计划之一是在中国上海建造一座新的15GW燃煤发电厂,该计画于2022年9月获得核准。

- 因此,鑑于上述情况,预测期内发电可能主导中国煤炭市场。

可再生能源的日益普及正在限制市场

- 中国政府正透过补贴、减税和法规等政策和奖励积极推动可再生能源生产。此类政府援助帮助了可再生能源领域的成长,并且未来这种趋势可能会持续下去。

- 中国多年来遭受严重的空气污染,造成了公共卫生问题和经济损失。风能和太阳能等再生能源来源被视为石化燃料的清洁能源来源,有助于减少空气污染。

- 此外,中国的能源需求高度依赖进口石化燃料。这使得它们容易受到价格波动和供应中断的影响。透过投资可再生能源,中国可以最大限度地减少对外国能源来源的依赖并增强其能源安全。

- 此外,近年来可再生能源成本大幅下降,使其比石化燃料更具竞争力。在某些情况下,可再生能源已经比燃煤发电厂便宜。可再生能源成本低廉,对希望减少能源开支的中国来说是个有吸引力的选择。

- 2022年,中国可再生能源装置总设备容量将达到1,171.55吉瓦,较2021年成长14.19%。预计预测期内同一趋势仍将持续。

- 例如,2022年3月,中国政府宣布计画在戈壁滩等沙漠地区建造450吉瓦的太阳能和风能发电能力。目前,约有100吉瓦的太阳能发电容量已在建设中。

- 因此,由于上述因素,可再生能源的成长可能会阻碍中国煤炭市场的成长。

中国煤炭产业概况

中国的煤炭市场是半固定的。市场的主要参与企业(不分先后顺序)包括中国中煤能源集团有限公司、中国神华能源股份有限公司、兖州煤业股份有限公司、中国电力国际发展有限公司和华电国际电力股份有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 电力需求不断成长

- 加大对煤炭产业的投资

- 限制因素

- 越来越多采用再生能源来源

- 驱动程式

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 应用

- 发电(动力煤)

- 炼焦煤(焦煤)

- 其他的

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- China Coal Energy Group Co. Ltd.

- China Shenhua Energy Company Limited

- Huadian Power International Corporation Limited

- Yanzhou Coal Mining Company Limited

- China Power International Development Limited

- Huaneng Power International Inc.

- China Resources Power Holdings Company Limited

- Datang International Power Generation Company Limited

- Shandong Energy Group Co. Ltd.

- Zijin Mining Group Co. Limited

第七章 市场机会与未来趋势

- 越来越多的方式可以开采煤炭,并利用不同的技术从中获取价值

简介目录

Product Code: 71556

The China Coal Market size is estimated at USD 96.21 billion in 2025, and is expected to reach USD 104.42 billion by 2030, at a CAGR of 1.65% during the forecast period (2025-2030).

Key Highlights

- Over the long term, factors like increasing electricity demand and investments in the coal industry are expected to drive the market.

- On the other hand, increasing environmental concern over the use of coal and adopting renewable energy sources is a major restraint hindering the market's growth.

- Nevertheless, the increasing ways to mine coal and extract value from coal using technologies like carbon capture and storage technologies are expected to create enormous opportunities for the China coal market.

China Coal Market Trends

The Power Generation Segment Expected to Dominate the Market

- The power generation segment will likely dominate the market during the forecast period owing to the increasing demand for electricity across the country.

- In 2022, China accounted for more than 54.7% of the global share in total coal consumption, and about 55.46% of primary energy consumption in the country was attributed to coal.

- China produced 8848.7 TWh of electric power in 2022, up 3.6% compared to 2021, driven by rapid economic recovery from the pandemic. China was one of the few countries to see an increase in its energy demand in 2022 and the most significant rise globally. Coal accounted for 61% of the source of energy in electricity generation in the country.

- Additionally, China's rapid economic growth over the past few decades led to a surge in demand for energy. As a result, the Chinese government prioritized ensuring a stable and abundant energy supply, which meant continuing to rely on coal.

- For instance, in the first quarter of 2022, provincial governments in China approved plans to build new coal power plants totaling 8.63 GW, according to the Chinese Department of Energy. One approved project is a new 15 GW coal-fired thermal power plant in Shanghai, China, which was approved in September 2022.

- Therefore, from the above points, power generation will likely dominate the Chinese coal market during the forecast period.

Increasing Adoption of Renewable Energy to Restrain the Market

- The Chinese government actively pushed renewable energy production through policies and incentives such as subsidies, tax breaks, and regulations. This government assistance aided growth in the renewable energy sector and is likely to continue in the future years.

- China struggled with severe air pollution for many years, leading to public health problems and economic losses. Renewable energy sources like wind and solar are considered a cleaner alternative to fossil fuels and can help reduce air pollution.

- Furthermore, China relies heavily on imported fossil fuels to cover its energy demands. It exposes the country to price swings and supply disruptions. China can minimize its reliance on foreign energy sources and boost its energy security by investing in renewable energy.

- Additionally, the cost of renewable energy has dropped dramatically in recent years, making it more competitive with fossil fuels. Renewable energy is already cheaper than coal-fired power facilities in some circumstances. Because of its low cost, renewable energy is an appealing choice for China, which is looking to lower its energy expenses.

- In 2022, China's total installed renewable energy capacity was 1,171.55 GW, an increase of 14.19% compared to 2021. A similar trend is expected to be followed during the forecasted period.

- For instance, in March 2022, it was announced by the Chinese government announced that they intended to construct a solar and wind power generation capacity of 450 GW in desert regions such as the Gobi desert. Currently, around 100 GW of solar power capacity is already under construction.

- Therefore, due to the factors mentioned above, the growth of renewable energy can hinder China's coal market growth.

China Coal Industry Overview

The Chinese coal market is semi-consolidated. The key players in the market (in no particular order) include China Coal Energy Group Co. Ltd, China Shenhua Energy Company Limited, Yanzhou Coal Mining Company Limited, China Power International Development Limited, and Huadian Power International Corporation Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Electricity Demand

- 4.5.1.2 Rsing Investments in the Coal Industry

- 4.5.2 Restraints

- 4.5.2.1 Increasing Installation of Renewable Energy Sources

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Power Generation (Thermal Coal)

- 5.1.2 Coking Feedstock (Coking Coal)

- 5.1.3 Other Applications

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 China Coal Energy Group Co. Ltd.

- 6.3.2 China Shenhua Energy Company Limited

- 6.3.3 Huadian Power International Corporation Limited

- 6.3.4 Yanzhou Coal Mining Company Limited

- 6.3.5 China Power International Development Limited

- 6.3.6 Huaneng Power International Inc.

- 6.3.7 China Resources Power Holdings Company Limited

- 6.3.8 Datang International Power Generation Company Limited

- 6.3.9 Shandong Energy Group Co. Ltd.

- 6.3.10 Zijin Mining Group Co. Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Ways to Mine Coal and Extract Value From Coal Using Different Technologies

02-2729-4219

+886-2-2729-4219