|

市场调查报告书

商品编码

1644401

欧洲生质燃料:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Biofuel - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

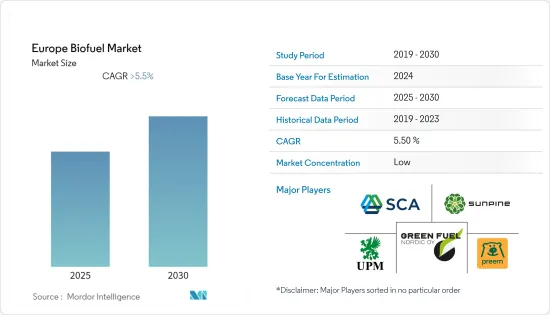

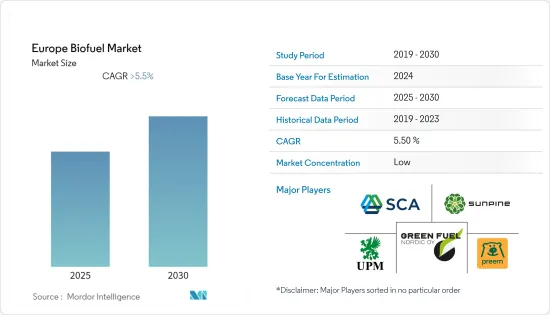

预计预测期内欧洲生质燃料市场的复合年增长率将超过 5.5%。

由于地区封锁和生质燃料需求减少,COVID-19 疫情对市场产生了负面影响。

关键亮点

- 预计环境、石油高峰、能源安全、燃料多样性和永续性问题等因素将推动该地区生质燃料市场的发展。

- 然而,生质燃料提供能源的初始成本远高于石化燃料,这可能会对市场造成限制。

- 一些国家,例如德国、英国、荷兰和瑞典,希望将生物柴油与其他燃料混合,以获得可用作柴油引擎燃料的纯生物柴油。

- 德国连续三年成为最大的生质燃料市场,也是欧盟最大的生质燃料消费国。

欧洲生质燃料市场的趋势

生质柴油可能占据市场主导地位

- 生物柴油是一种利用国内可再生资源生产的清洁替代燃料。这种生质燃料由植物油、动物脂肪和再生油製成。生质柴油是一种无毒燃料,可用于柴油车辆。

- 欧洲生产的生质燃料(如生质柴油和乙醇)比其他地区都多。 2020 年,该地区生产了 3.02 亿桶生质燃料,高于 2015 年的 2.6 亿桶。

- 此外,由于燃料转化有限,生物柴油主要用于重型车辆、农业、建筑、采矿和其他重工业。引擎效率的提高将抵消经济成长带来的需求成长。

- 2022 年 3 月,BioEnergy International GmBH 将在匈牙利开设最先进的生物柴油生产设施,预计将为 70,000 辆汽车提供燃料并减少 150,000 吨二氧化碳。新工厂将为匈牙利实现 2030 年减少温室气体排放 55% 和 2050 年实现气候中和的目标做出重大贡献。

- 由于这些变化,生物柴油市场预计将在预测期内增长。

德国可望主导市场

- 德国是世界领先的生质燃料生产国之一。该国正在鼓励公路运输领域使用生质燃料,以减少温室气体排放。

- 2021年,该国每天生产5.4万桶油当量的生质燃料,相当于全球生质燃料产量的4%。

- 2022 年 2 月,BDI-BioEnergy International GmbH 宣布已与再生能源集团签署合同,透过安装原料预处理技术来加工油脂,从而升级德国的两家生物柴油工厂。该计划预计将于 2023 年底开始试运行。

- 德国农业部计划在2030年逐步停止使用由向日葵和大豆油等粮食和饲料作物製成的生质燃料。主要原因是俄罗斯入侵乌克兰导致供应链中断和原物料成本上升。由于俄罗斯入侵乌克兰,自 2022 年 3 月起,每月向欧盟运送 20 万吨葵花籽油停止。由于欧盟炼油厂使用的 35% 至 45% 的葵花籽油来自乌克兰,该地区的供应预计可持续四至六週。乌克兰和俄罗斯约占全球葵花籽油出口的80%,因此俄罗斯入侵乌克兰使得欧盟等进口国寻找替代品。因此,这可能会抑制德国生物柴油生产对饲料和作物的需求。

- 2021年5月,德国政府推出了新的生质燃料法。新法将迫使石油公司在运输领域大幅增加生质柴油、生质乙醇和生物甲烷的使用,以减少二氧化碳排放。

- 这可能会促进该国的生质燃料市场,并有望在预测期内支持欧洲生质燃料市场的成长。

欧洲生质燃料产业概况

欧洲生质燃料市场是分散的。市场的主要企业(不分先后顺序)包括 UPM-Kymmene Oyj、Green Fuel Nordic Oy、Svenska Cellulosa AB、Preem AB、SunPine AB、Galp Energia、SGPS SA、Biomethanol Chemie Nederland BV、Beta Renewables SpA 和 Borregaard ASA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2028年的市场规模及需求预测(单位:百万桶)

- 最新趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 生质柴油

- 乙醇

- 其他的

- 原料

- 粗粒

- 糖料作物

- 植物油

- 其他成分

- 地区

- 德国

- 英国

- 法国

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- UPM-Kymmene Oyj

- Green Fuel Nordic Oy

- Svenska Cellulosa AB

- Preem AB

- SunPine AB

- Galp Energia SGPS SA

- Biomethanol Chemie Nederland BV

- Beta Renewables SpA

- Borregaard ASA

第七章 市场机会与未来趋势

The Europe Biofuel Market is expected to register a CAGR of greater than 5.5% during the forecast period.

Due to regional lockdowns and a decline in the demand for biofuels, the COVID-19 outbreak had a negative effect on the market.Currently, the market has reached pre-pandemic levels.

Key Highlights

- Factors such as concerns about the environment, peak oil, energy security, fuel diversity, and sustainability are likely to drive the biofuel market in the region.

- However, the initial cost of providing energy through biofuel is much higher than that of fossil fuels, which may act as a restraint on the market.

- Some countries, like Germany, the UK, the Netherlands, and Sweden, want to blend biodiesel with other fuels to get pure biodiesel, which can be used as fuel in diesel engines.This is likely to give the biofuel market a lot of chances in the near future.

- Germany has been the largest market for biofuel for the last three years, and it is the largest consumer of biofuel in the European Union.

Europe Biofuel Market Trends

Biodiesel is Likely to Dominate the Market

- Biodiesel is a clean-burning alternative fuel produced from domestic and renewable resources. This biofuel is made from vegetable oils, animal fats, or recycled greases. Biodiesel is non-toxic and can be the source of fuel for diesel-powered vehicles.

- Europe makes the most biofuels, such as biodiesel and ethanol, than any other place.In 2020, the region produced 302 million barrels (mbbl) of biofuel, which was higher compared to 260 mbbl of biofuel in 2015.

- Moreover, due to limited fuel switching, biodiesel is the primary fuel used in heavy-duty vehicles, agriculture, construction, mining, and other heavy industries. With improved engine efficiency, this offsets the increased demand tied to economic growth.

- In March 2022, BioEnergy International GmBH built a cutting-edge biodiesel production facility in Hungary that was believed to fuel 70,000 cars and save 150,000 tons of carbon dioxide. The new facility will significantly help Hungary meet its goals to create 55% fewer greenhouse gases by 2030 and achieve climate neutrality by 2050.

- Because of these changes, the biodiesel market is expected to grow during the forecast period.

Germany is Expected to Dominate the Market

- Germany is one of the largest producers of biofuel in the world. The country is encouraging the usage of biofuel in the road transportation sector to reduce greenhouse gas emissions.

- In 2021, the country produced 54 thousand barrels of oil equivalent per day of biofuel, which is equivalent to 4% of the world's biofuel production.

- In February 2022, BDI-BioEnergy International GmbH announced a contract with Renewable Energy Group to upgrade two biodiesel plants in Germany by installing feedstock pre-treatment technology to process fats and oils. The project is expected to be commissioned by the second half of 2023.

- By 2030, Germany's Ministry of Agriculture plans to phase out the use of biofuels made from food and feed crops like sunflower and soy oils. This is mostly because of supply chain disruptions brought on by Russia's invasion of Ukraine and rising feedstock costs. The 200,000 metric tons per month of sunflower oil shipments to the European Union have been stopped since March 2022 as a result of Russia's invasion of Ukraine. Since 35% to 45% of the sunflower oil used in EU refineries comes from Ukraine, the region's supply is thought to last four to six weeks. With Ukraine and Russia accounting for about 80% of global exports of sunflower oil, Russia's invasion of Ukraine has left importers such as the European Union looking for alternatives. Thus, such instances are likely to restrain the demand for feed and food crops for biodiesel production in Germany.

- In May 2021, the German government introduced a new biofuel law. As per the new law, obligated oil companies will have to significantly increase the use of biodiesel, bioethanol, and biomethane in the transportation sector to reduce carbon emissions.

- This is likely to boost the biofuel market in the country, which is expected to support the growth of the European biofuel market during the forecast period.

Europe Biofuel Industry Overview

The European biofuel market is fragmented. Some of the key players in this market (in no particular order) include UPM-Kymmene Oyj, Green Fuel Nordic Oy, Svenska Cellulosa AB, Preem AB, SunPine AB, Galp Energia, SGPS SA, Biomethanol Chemie Nederland BV, Beta Renewables SpA, Borregaard ASA, and others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in million barrels, until 2028

- 4.3 Recent Trends and Developments

- 4.4 Market Dynamics

- 4.4.1 Drivers

- 4.4.2 Restraints

- 4.5 Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products and Services

- 4.6.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Biodiesel

- 5.1.2 Ethanol

- 5.1.3 Other Types

- 5.2 Feedstock

- 5.2.1 Coarse Grain

- 5.2.2 Sugar Crop

- 5.2.3 Vegetable Oil

- 5.2.4 Other Feedstocks

- 5.3 Geography

- 5.3.1 Germany

- 5.3.2 United Kingdom

- 5.3.3 France

- 5.3.4 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 UPM-Kymmene Oyj

- 6.3.2 Green Fuel Nordic Oy

- 6.3.3 Svenska Cellulosa AB

- 6.3.4 Preem AB

- 6.3.5 SunPine AB

- 6.3.6 Galp Energia SGPS SA

- 6.3.7 Biomethanol Chemie Nederland BV

- 6.3.8 Beta Renewables SpA

- 6.3.9 Borregaard ASA