|

市场调查报告书

商品编码

1644431

美国OTT:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)US OTT - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

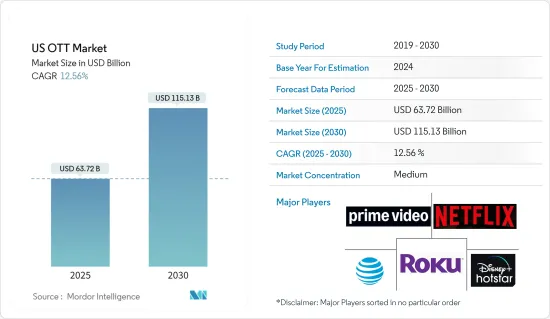

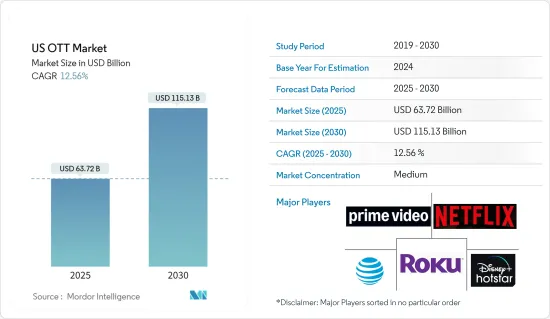

预计 2025 年美国OTT 市场规模为 637.2 亿美元,到 2030 年将达到 1,151.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 12.56%。

美国是全球最大的OTT市场之一。智慧型电视和智慧型手机等智慧型装置的高普及率、对 VOD 内容的不断增长的需求以及每用户的高付款率是推动该国 OTT 市场发展的主要因素。 Netflix 和亚马逊等全球大多数顶级 OTT 供应商都位于美国,这使得他们在这个区域市场中具有优势。

主要亮点

- 对 OTT 内容的日益关注将使美国公民摆脱有线电视、地理限制和广播时间表的限制,从根本上改变影片的销售、製作和消费方式。因此,由于类型客製化、包装灵活性、可在多种设备上使用、互联网普及率和低成本,采用率正在增加。 Netflix 和 Amazon 是全国订阅量最大的 OTT 平台。

- 随着收益的增长,OTT影片内容观看时间份额的激增反映了串流媒体的成长,这正在改变该国的娱乐格局。据 Uscreen 称,美国观众每周平均观看 21 小时的内容,到 2024 年,这将相当于一份串流数位媒体的兼职工作。值得注意的是,65% 的内容是透过行动和电视应用程式而不是网路浏览器消费的。

- 然而,对于OTT提供者而言,消费量的增加也意味着成本的上升,并且根据所采用的内容传递网路模式,服务会受到不同程度的影响。 CDN 服务通常会对传输的内容收费,因此随着 OTT 观看次数的增加,OTT 提供者的传输成本也会增加。

- 此外,人们看电视的时间越来越长,并且已经习惯了在线观看电视内容。因此,我们预计短期内将实现正成长。在供应商方面,提供直接面向消费者(D2C)服务并由美国免费串流服务Pluto TV支援的维亚康姆是重要的供应商。

美国OTT 市场趋势

智慧型电视普及率高,成长显着

- 该地区正看到越来越多的内容拥有者,如迪士尼、通讯业者(AT&T)和纯 OTT 提供者(如亚马逊)直接向消费者提供串流内容。同时,4K 串流媒体的出现也推动了 OTT 内容的成长,并使其能够在智慧电视格式中提供。

- 串流媒体设备使用量的持续增长、互联网普及率的提高以及对智慧型电视的需求,为媒体公司进入Over-The-Top(OTT) 行业提供了丰厚的机会。多家电视製造商正在推出创新的智慧电视。

- 例如,SONY电子在2023年3月发布了2023年BRAVIA XR电视阵容,搭载认知处理器XR,提供家庭娱乐体验。该公司推出了其 BRAVIA XR 系列的几款新产品:X95L、X93L Mini LED、X90L 全阵列 LED、A95L QD-OLED 和 A80L OLED。所有型号均整合技术,为观看电影、玩游戏、串流媒体应用等创造身临其境的体验。

- 在内容消费方面,消费者的观看模式正在改变。网路消费的成长速度快于传统电视观看。推动市场发展的关键因素是可负担价格的订阅计划的灵活性。消费者对家庭娱乐的兴趣日益浓厚,他们在地下室使用智慧型电视来营造家庭剧院体验。此外,内容类型的多样性、舒适性、自由度和时间灵活性正在推动市场成长。

- 内容创作者与 Netflix 合作,将其内容独家发布在该平台上。例如,2023 年,佩里和 Netflix 达成创新伙伴关係关係,根据一份多年期协议,佩里将参与编写、监督和製作长电影长片。据Netflix称,2024年第一季,该串流平台在美国和加拿大的付费用户群已达8,266万,足见该平台的受欢迎程度。许多製作人正在与 Netflix 合作,利用我们的整合功能赚取更多收益。

SVoD 市场占有主要市场占有率

- 订阅随选视讯(SVoD)类似于传统电视套餐,用户只需支付固定费率即可观看任意数量的内容。主要服务包括 Sky(及其子公司 Now TV)、Amazon Prime Video、Netflix 和 Hulu。

- 美国六大平台主导 SVoD:Netflix、亚马逊、Disney+、Paramount+、Apple TV+ 和 HBO。 SVoD平台的出现也有助于吸引更多消费者。预计未来五年美国的 SVoD 订阅数量将大幅增加。

- 美国OTT市场的SVoD部分是关键部分之一。到2025年,预计将有12个平台拥有超过500万付费用户,显示美国市场领先世界其他地区。由于来自 Disney+、Peacock 和 CBS All Access 等年轻竞争对手的激烈竞争,亚马逊、Netflix 和 Hulu 等现有参与者可能会面临成长挑战。

- 根据Media Play的资料,SVoD预计在2023年贡献525亿美元,到2029年达到546亿美元。市场的主要企业正在提供更便宜的订阅计划以吸引更多的客户。 OTT 平台具有内容多样性、灵活性、身临其境型体验和提供本地内容的特点,是推动市场成长的主要因素。

美国OTT 产业概况

随着越来越多的公司进入市场,美国OTT市场正在逐步整合,参与企业。主要市场参与者正在采取各种策略来扩大市场占有率,包括併购。此外,电视广播广播公司也透过推出应用程式或投资替代 OTT 平台进入市场。最终,在未来几年,预计大多数有线电视营运商都将投资这些经营模式,以确立其在该行业的地位。

- 2024 年 4 月:Roku 宣布与 The Trade Desk、iSpot 和 NBCUniversal 建立合作关係。此次合作旨在解决连网电视面临的问题,例如程式化采购和易于测量等。此外,透过与 NBCUniversal 合作,2024 年巴黎奥运的精彩片段将在 Roku 平台上播出。与 The Trade Desk 的合作将允许独立需求方平台 (DSP) 存取 Roku 库存资料,从而使媒体购买者能够更精准地定位受众。

- 2024 年 3 月,华特迪士尼宣布将在美国向迪士尼捆绑用户推出 Disney+ 上的 Hulu。这使得用户可以探索数以千计的综合娱乐节目,并在提供个人化体验的同时享受 Hulu 和 Disney+ 内容。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- COVID-19 对产业的影响

第五章 市场动态

- 市场驱动因素

- 智慧型电视的高普及率和主要 OTT 供应商的存在将促进该地区 OTT 的普及

- 强调透过市场整合建立合作与伙伴关係

- 市场限制

- 资料隐私和安全问题

第六章 市场细分

- 按类型

- SVoD

- TVoD

- AVoD

第七章 OTT 播放市场类型

第八章 竞争格局

- 公司简介

- Netflix

- Disney+

- Amazon Prime Video

- Roku

- HBO Max(AT&T Inc.)

- CBS All Acess(Viacomcbs Inc.)

- Sling TV LLC

- Apple Inc.

- YouTube(Google LLC)

第九章投资分析

第十章:市场的未来

The US OTT Market size is estimated at USD 63.72 billion in 2025, and is expected to reach USD 115.13 billion by 2030, at a CAGR of 12.56% during the forecast period (2025-2030).

The United States is one of the largest OTT markets in the world. The high penetration of smart devices, like smart TVs and smartphones, growing demand for VOD content, and a high rate of per-user payment are some of the major factors driving the country's OTT market. Most of the top global OTT vendors, like Netflix and Amazon, are US-based, providing an advantage to the regional market.

Key Highlights

- The increasing gravitation toward OTT content allows US citizens to get rid of cables, geographic restrictions, and broadcast schedules and fundamentally changes how video is sold, produced, and consumed. Thus, increasing adoption has been attributable to customized genre choices, package flexibility, wider device availability, internet penetration, and lower costs. Netflix and Amazon are the most commonly subscribed OTT platforms in the country.

- With increasing revenue numbers, the surging percentage of viewing time going to OTT video content reflects the streaming growth and is changing the country's entertainment landscape. According to the Uscreen, viewers spend an average of 21 hours per week consuming content in the United States, equivalent to a part-time job streaming digital media in 2024. Notably, 65% of content is consumed via mobile or TV apps rather than web browsers.

- However, some costs for OTT providers also rise along with increased consumption, with services impacted by varying degrees depending on the content delivery network model employed. As the OTT viewing amount increases, so does the OTT provider's delivery cost since CDN services are usually charged for the content delivered.

- Moreover, the hours spent on TV have risen, and people are getting used to watching TV content online. This entails a positive growth outlook on a near-term basis. On the vendor front, Viacom is a significant vendor offering a direct-to-consumer (D2C) service on the back of Pluto TV, the free streaming service company in the United States.

US OTT Market Trends

High Penetration of Smart TV Witnesses Significant Growth

- Streaming content in the region has intensified as content owners like Disney go directly to consumers, telcos (AT&T), and OTT-only operators like Amazon, to name a few. Simultaneously, the emergence of 4K for streaming has propelled OTT content growth to be made available across smart TV formats.

- Consistent growth in streaming device usage, increasing internet penetration, and demand for smart TVs have provided lucrative opportunities for media companies to enter the over-the-top (OTT) industry. Several TV makers are introducing innovative smart TVs.

- For instance, in March 2023, Sony Electronics announced the 2023 BRAVIA XR TV Lineup, equipped with Cognitive Processor XR, for a home entertainment experience. The company launched a few new BRAVIA XR lines: X95L and X93L Mini LED, X90L Full Array LED, A95L QD-OLED, and A80L OLED. All models are integrated with technology to create an immersive experience for watching movies, gaming, streaming apps, and others.

- Consumer viewership is transforming in terms of content consumption. There is more growth in online consumption than traditional TV viewership. Major factors driving the market are the flexibility of subscription plans that are available at affordable prices. Consumers have grown their interest in home entertainment by using Smart TVs in their basement areas to create home theater experiences. Additionally, it allows a diversity of content genres, comfort, freedom, and time flexibility, propelling the market's growth.

- Content producers are partnering with Netflix to feature their content exclusively on the platform. For instance, in 2023, Perry and Netflix signed a creative partnership in which Perry contributed to writing, directing, and producing feature films under a multi-year deal. According to Netflix, the number of subscribers paying for streaming platforms in the United States and Canada accounted for 82.66 million in Q1 2024, which shows the popularity of the platform. Many producers are collaborating with Netflix to generate more revenue using integrated capabilities.

SVoD Segment to Hold Significant Market Share

- Subscription video-on-demand (SVoD) is similar to traditional TV packages, allowing users to consume as much content as they desire at a flat monthly rate. Major services include Sky (also its subsidiary Now TV), Amazon Prime Video, Netflix, and Hulu.

- Six major US-based platforms, namely Netflix, Amazon, Disney+, Paramount+, Apple TV+, and HBO, dominate the SVoD landscape. The emergence of SVoD platforms is also helping to attract more consumers. The number of SVoD subscriptions in the United States is projected to grow significantly in the next five years.

- The SVoD segment in the US OTT market is one of the significant segments. By 2025, the country is expected to witness a dozen platforms with more than 5 million paying subscribers, revealing just how ahead the US market is compared with the rest of the world. Growth for established players such as Amazon, Netflix, and Hulu will be affected due to intense competition from younger rivals such as Disney+, Peacock, and the augmented CBS All Access.

- As per the data by Media Play, SVoD contributed USD 52.5 billion in 2023, which is expected to reach USD 54.6 billion by 2029. Major market players are offering cheaper subscription plans to attract more customers. OTT platforms featuring content diversity, flexibility, immersive experiences, and regional content offered are the major drivers that foster the market's growth.

US OTT Industry Overview

The US OTT market is witnessing increasing competitive rivalry as more companies enter, leading to the gradual consolidation of the market. The major market players are involved in various strategies to expand their market share, including mergers and acquisitions. Moreover, TV broadcasters are entering the market either by launching their app or investing in another OTT platform. Eventually, in the coming years, most TV cable operators are expected to invest in these business models to establish their presence in the industry.

- April 2024: Roku announced a partnership with Trade Desk, iSpot, and NBCUniversal. This alliance aims to solve the problem faced during connected television space, which includes ease of programmatic buying and measurement. Moreover, in collaboration with NBCUniversal, it will provide 2024 Paris Olympics highlights, featuring all available sports for Olympics coverage on the Roku platform. In partnership with the Trade Desk, it facilitates independent Demand Side Platform (DSP) to gain access to Roku data on Roku inventory, which will allow media buyers to target viewers with more precision.

- March 2024: Walt Disney announced the launch of Hulu on Disney+ in the United States for Disney Bundle subscribers, which brought a variety of genres with integrated content libraries. This allowed subscribers to explore thousands of general entertainment titles, bringing Hulu and Disney+ content together with a personalized experience.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Report

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitutes

- 4.3 COVID-19 Impact on the Industry

5 MARKET DYNAMICS

- 5.1 Market drivers

- 5.1.1 High Penetration of Smart TV and the Presence of Major OTT Providers have Contributed to the Growth of OTT Adoption in the Region

- 5.1.2 Market Consolidation to Result in Emphasis on Collaboration and Partnerships

- 5.2 Market Restraints

- 5.2.1 Data Privacy and Security Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 SVoD

- 6.1.2 TVoD

- 6.1.3 AVoD

7 OTT PLAYBACK MARKET - BY GENRE

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Netflix

- 8.1.2 Disney+

- 8.1.3 Amazon Prime Video

- 8.1.4 Roku

- 8.1.5 HBO Max (AT&T Inc.)

- 8.1.6 CBS All Acess (Viacomcbs Inc.)

- 8.1.7 Sling TV LLC

- 8.1.8 Apple Inc.

- 8.1.9 YouTube (Google LLC)