|

市场调查报告书

商品编码

1644434

亚太地区小型蜂窝 5G -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Asia-Pacific Small Cell 5G - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

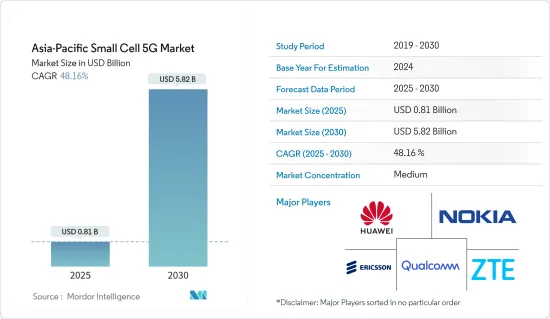

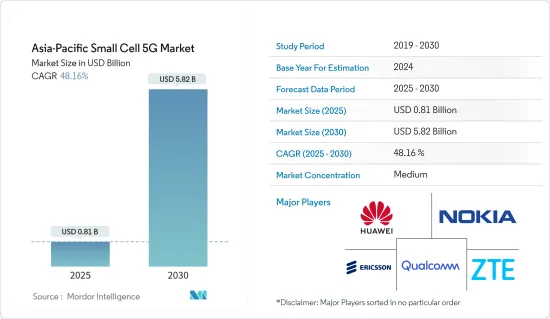

亚太地区小型蜂巢 5G 市场规模预计在 2025 年为 8.1 亿美元,预计到 2030 年将达到 58.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 48.16%。

人工智慧(AI)和物联网(IoT)的趋势正在各个领域中体现,为了发展城市景观,各国政府正在致力于智慧城市模型。

关键亮点

- 智慧城市的关键特征包括强大的光纤连接、Wi-Fi、智慧交通管理、智慧停车和节能街道照明。小型基地台对于这些智慧城市的发展至关重要,因为它们可以提供下一代解决方案。

- 亚太地区并没有形成一个占主导地位的营运商集团,各国的通讯发展水准参差不齐。该地区的一些国家缺乏足够的光纤覆盖,并且目前运营的大多数宏站点缺乏光纤回程传输连接。小型基地台的有效部署和大型行动通信基地台现有光纤化水准的提高需要光纤回程传输的支援。

- 由于铺设地下光纤成本高、耗时长,日本引进了架空光纤,这是一个相对快速且简单的安装过程。由于 5G 基础设施的安装需要时间,小型基地台 5G 市场可能会受到限制。

- 为了提供更好的室内覆盖,爱立信于 2023 年 2 月开发了室内无线电单元 IRU 8850,无论建筑物的规模或复杂程度如何,都能提供更好的网路效能和使用者体验。该公司声称,新储存的容量将达到以前型号的四倍。

亚太地区小型基地台 5G 市场趋势

通讯业者预计将占很大份额

- 5G在亚太地区的出现正加速小型基地台的部署,以实现高速网路连线。许多国家正在製定可应用于新小型蜂窝部署的豁免标准。例如,在新加坡,通讯媒体发展局(IMDA)已指示建筑开发商和业主允许通讯业者免费提供屋顶空间用于通讯设备。

- 日本政府已批准在全国20.8万个交通号誌上安装5G基地台。地方政府和通讯业者共同承担使用交通号誌的费用,用于5G部署。这将使得更多的解决方案能够在更短的时间内部署,从而更快地在全国范围内推出 5G 连线。

- 截至2022年2月底,韩国已安装了202,903个5G基地台,并正在投资进一步扩大网路。这为突破性的5G应用和服务打开了大门,例如职场中机器人的整合、智慧城市规划和自动驾驶汽车。例如,SK电讯和三星电子共同开发了5G Option 4技术,这是现有5G独立技术的进阶选项。

预计中国将占很大份额

- 中国正在引领全球5G发展。全国已建成超过254万个5G基地台,超过5.75亿人拥有5G智慧型手机。中国也计划到2025年投资1.2兆元人民币(1742亿美元)用于5G网路建设。对稳定的 5G 网路不断增长的需求正在加速该国小型蜂窝解决方案的部署。

- 在5G发展的同时,6G技术的研究也不断进行。国家已经成立6G推进小组,加速6G技术研发。预计2030年左右6G将在全球商用。中国已率先支持5G商用,这将为6G发展提供强大基础。

- 华为、中兴通讯和(国有)大唐电信等科技领导企业是中国 5G 基础建设支出的最大受益者。例如,中国移动北京分公司、中国移动研究院、中国交通通讯资讯集团、中兴通讯等均在进行5G非地面电波网路(NTN)测试合作。

- 本次检查中,同步、广播、存取、资料传输等所有通讯实例均成功测试。

- 2022年8月,中国移动与京信通讯合作部署小型蜂巢式基地台。它们专为复杂的室内位置而设计,为中型和大型室内无线网路带来高度的灵活性和效率。

亚太地区小型基地台 5G 产业概览

亚太地区小型基地台 5G 市场集中度适中,领导参与企业推动整体市场。过去几年,蜂巢式网路不断发展,5G 等新技术推动了对更快、更有效率连接选项的需求。为了满足这些新技术的需求,这些技术供应商正在大力投资开发和改进解决方案,例如可以绕过障碍物并提高讯号效能的小型基地台。主导市场的参与企业包括诺基亚、华为、爱立信、中兴通讯、三星电子和高通。

2022年10月,HFCL与高通合作开发5G室外小型基地台解决方案。随着印度开始推进 5G 建设,通讯业者需要小型蜂窝解决方案来补充其在机场、火车站和体育场等公共场所的宏观网路。这些小型蜂窝解决方案支援 5G 非独立 (NSA) 和独立 (SA) 模式。这些小型基地台将安装在街道桿、建筑物墙壁和屋顶上,以覆盖高流量热点区域。

2022 年 10 月,新加坡电信开始在其 5G 网路中使用爱立信无线基地台。与上一代 5G 无线电相比,新加坡电信网路中使用的 AIR 3268 无线电可降低能耗高达 18%,重量减轻约 40%。此解决方案提供即时通道估计并消除不必要的杂讯干扰,提高容量、覆盖范围和连接速度。新加坡电信的目标是成为新加坡最环保的 5G 网络,到 2050 年实现净零排放。透过采用该解决方案,电讯营运商可以优化其营运中的电力和能源使用。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 对市场的影响

第五章 市场动态

- 市场驱动因素

- 行动资料流量增加

- 网路技术和连接设备的演变

- 市场限制

- 回程传输连线不良

第六章 技术简介

- 毫微微基地台

- 微微型基地台

- 微蜂巢

- 区域基地台

第七章 市场区隔

- 操作环境

- 室内的

- 户外的

- 按最终用户产业

- 电讯营运商

- 企业

- 住宅

- 国家

- 中国

- 印度

- 韩国

- 日本

- 澳洲和纽西兰

第八章 竞争格局

- 公司简介

- Qualcomm Technologies Inc.

- Nokia Corporation

- Huawei Technologies Co. Ltd.

- Telefonaktiebolaget LM Ericsson

- Airspan Networks Inc.

- ZTE Corporation

- CommScope Inc.

- Cisco Systems Inc.

- Qucell Inc.

- Samsung Electronics Co. Ltd.

- NEC Corporation

- Baicells Technologies Co. Ltd.

第九章投资分析

第十章:投资分析市场的未来

The Asia-Pacific Small Cell 5G Market size is estimated at USD 0.81 billion in 2025, and is expected to reach USD 5.82 billion by 2030, at a CAGR of 48.16% during the forecast period (2025-2030).

The trend of artificial intelligence (AI) and the Internet of Things (IoT) is observed in every sector, and to develop the urban outlook, Governments are working on smart city models.

Key Highlights

- Smart cities' essential features are robust optical fiber connectivity, Wi-Fi, intelligent traffic management, smart parking, and energy-efficient street lighting. Small cells will be crucial in developing these smart cities because they can offer next-generation solutions.

- In the Asia-Pacific region, dominant operator groups are absent, and different countries have different levels of telecom development. Some countries of the region lack appropriate fiber penetration, and most currently operational macro sites lack fiber backhaul connectivity. Fiber backhaul support is required to deploy small cells efficiently and raise the current fiberization levels of large cell sites.

- Since underground fiber installation is costly and time-consuming, aerial fibers have been implemented in Japan due to their comparatively quick and straightforward installation processes. The slow installation of 5G infrastructure will restrain the small cell 5G market.

- To offer better indoor coverage, in Feb 2023, Ericsson developed the IRU 8850 indoor radio unit that will provide better network performance and user experience, regardless of the size or complexity of the building. The company claims it delivers up to four times the capacity of its predecessors.

Asia-Pacific Small Cell 5G Market Trends

Telecom Operators are expected to Hold Significant Share

- The advent of 5G in the Asia-Pacific region has accelerated small-cell deployment for high-speed network connectivity. Many nations have created exemption standards that can be applied when deploying new Small Cells. For instance, in Singapore, The Infocomm Media Development Authority (IMDA) has directed the building developers and owners to provide rooftop spaces free of charge for telecommunication equipment the telecom providers.

- Japan's Government has granted permissions for installing 5G base stations on 208,000 traffic lights across the country. Local administrations and operators jointly shared the costs of using the traffic lights for 5G deployments. This will help with more deployment of the solution in less time, thereby circulating 5G connectivity faster throughout the country.

- In South Korea, 202,903 5G base stations were installed at the end of February 2022, and investments are being made to expand the network further. This has opened the door for ground-breaking 5G applications and services, like robotics integration into the workplace, smart city planning, and self-driving cars. For instance, SK Telecom and Samsung Electronics collaborated to develop 5G option 4 technology, which is an advanced option to the existing 5G Standalone technology.

China is Expected to Hold Major Share

- China is leading 5G development on a worldwide scale. More than 2.54 million 5G base stations have been built nationwide, and more than 575 million people now own 5G smartphones. The country further plans to invest 1.2 trillion yuan (174.2 billion USD) in 5G network construction by 2025. This growing demand for a 5G stable network is accelerating the deployment of small-cell solutions in the country.

- Along with 5G developments, research is ongoing for 6G technology. IMT-2030 (6G) Promotion Group has been formed in the country to speed up the R&D of 6G technology. Around 2030, the world is anticipated to witness the commercialization of 6G. China is leading the charge in supporting the commercialization of 5G, which will provide a strong basis for the development of 6G.

- The technology leaders like Huawei, ZTE, and (state-owned) Datang Telecom are the big beneficiaries of China's 5G infrastructure spending. For instance, the Beijing Branch of China Mobile, the China Mobile Research Institute, China Transport Telecommunications & Information Group, and ZTE all collaborated on the 5G non-terrestrial network (NTN) testing.

- Communication instances, including synchronization, broadcasting, accessing, and data transmission, were all successfully tested during this trial.

- In August 2022, China Mobile collaborated with Comba Telecom to deploy small cell base stations. These are designed for complex indoor locations to provide greater flexibility and efficiency for medium- and large-scale indoor radio networks.

Asia-Pacific Small Cell 5G Industry Overview

The Asia-Pacific small cell 5G market is moderately concentrated, with prominent players leading the overall market. Over the past few years, cellular network growth has increased, and new technologies like 5G are driving demand for fast and effective connectivity options. To cater to the needs of these emerging technologies, these technology providers are making significant investments in developing and improving solutions like small cells that enhance the performance of signals by avoiding obstructions. Some players dominating this market include Nokia Corporation, Huawei, Ericsson, ZTE Corporation, Samsung Electronics, Qualcomm, and more.

In October 2022, HFCL partnered with Qualcomm to develop 5G outdoor small-cell solutions. The 5G drive in India is taking an edge, and the telecom operators need small-cell solutions to complement their macro networks at public venues like airports, railway stations, stadiums, etc. These small-cell solutions will support 5G non-standalone (NSA) and standalone (SA) modes. These small cells will be installed on street poles, building walls, and rooftops to cover the traffic hotspot areas.

In October 2022, Singtel began to use Ericsson's radio cell on its 5G network. The AIR 3268 radio, used in Singtel's networks, reduces energy consumption by up to 18% and weight by around 40% compared to preceding generations of 5G radios. The solution provides real-time channel estimation and removes undesirable noise interferences, boosting capacity, coverage, and connectivity speeds. Singtel aims to become Singapore's greenest 5G network, achieving net-zero emissions by 2050. Adopting this solution will help telecom providers optimize power and energy utilization in their operations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of Covid-19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Mobile Data Traffic

- 5.1.2 Evolution of Network Technology and Connectivity Devices

- 5.2 Market Restraints

- 5.2.1 Poor Backhaul Connectivity

6 TECHNOLOGY SNAPSHOT

- 6.1 Femtocell

- 6.2 Picocell

- 6.3 Microcell

- 6.4 Metrocell

7 MARKET SEGMENTATION

- 7.1 Operating Environment

- 7.1.1 Indoor

- 7.1.2 Outdoor

- 7.2 End-User Vertical

- 7.2.1 Telecom Operators

- 7.2.2 Enterprises

- 7.2.3 Residential

- 7.3 Country

- 7.3.1 China

- 7.3.2 India

- 7.3.3 South Korea

- 7.3.4 Japan

- 7.3.5 Australia and New Zealand

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Qualcomm Technologies Inc.

- 8.1.2 Nokia Corporation

- 8.1.3 Huawei Technologies Co. Ltd.

- 8.1.4 Telefonaktiebolaget LM Ericsson

- 8.1.5 Airspan Networks Inc.

- 8.1.6 ZTE Corporation

- 8.1.7 CommScope Inc.

- 8.1.8 Cisco Systems Inc.

- 8.1.9 Qucell Inc.

- 8.1.10 Samsung Electronics Co. Ltd.

- 8.1.11 NEC Corporation

- 8.1.12 Baicells Technologies Co. Ltd.