|

市场调查报告书

商品编码

1644437

先进配电管理系统:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Advanced Distribution Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

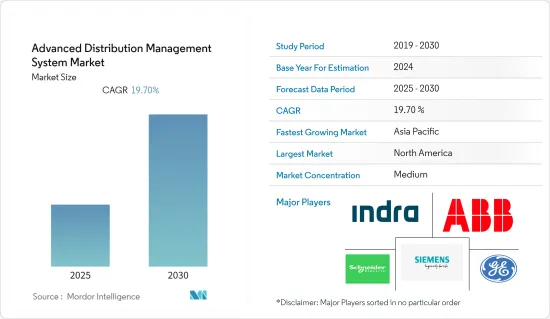

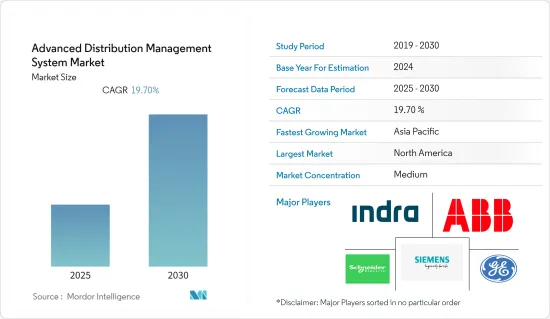

预计预测期内先进配电管理系统市场复合年增长率将达 19.7%。

主要亮点

- 推动市场扩张的主要因素之一是全球对高效率能源资源的需求不断增加。 ADMS 有助于优化电网性能并实现停电恢復的自动化。此外,先进测量基础设施 (AMI) 的日益普及也推动了市场的成长。 AMI 有助于远端检测电力使用情况、电压监控以及停电识别和隔离。它还使公用事业公司和客户能够相互通讯。此外,将连网设备与物联网 (IoT) 整合、使用先进的组件和控制系统来降低整体成本和功率损耗并提高安全性等技术改进正在推动市场扩张。

- 同时,智慧电网技术的采用不断增加,从而推动了市场的成长。 ADMS 透过优化能源使用和检测电网问题来帮助有效地传输电力和资料。预计推动市场向前发展的其他因素包括加大智慧城市建设力度以及政府实施各种措施以提高碳效率。例如,美国能源局最近的估计预测,到2024年智慧电网投资将达到138亿美元以上,占美国电网资讯与控制总投资的64%以上。

- 阿联酋推出了《2050能源政策》,据说这是该国第一个全面的、基于需求和供应的能源战略。该策略旨在2050年节省1,900亿美元,并将可再生能源在整体能源结构中的占比从25%提高到50%。我们也计划将发电产生的二氧化碳排放减少 70%。此外,它还旨在将企业和个人的消费效率提高40%。预计这些政府政策将为市场成长提供巨大的机会。

- 美国能源资讯署称,全球每年的能源投资自去年以来已增至1.9兆美元,总投资回到了金融危机前的水平。然而,能源结构正从传统的燃料生产转向电力和终端使用领域。儘管许多能源公司的财务状况仍然脆弱,但有迹象表明,开发商正计划利用宽鬆的货币政策和政府支持创造的机会,投资征兆开发和新计画。这些对后疫情时代的研究市场产生了正面影响。

- 在建筑物或企业中实施全自动 ADMS 系统需要大量的前期成本。每个产业都在寻求降低消费成本。这需要一个能源管理系统来追踪不同机器和工厂使用了多少能源。虽然从长远来看,使用节能解决方案和做法可以显着节省成本和能源,但它们需要大量的初始投资。特定公司、部门或工业设施内可能会存在需要投资更多资源于 EMS 的情况。对于中小型企业来说,这样的投资是不可行的。大多数情况下,能源管理系统的硬体部分比软体和服务部分贵得多。

高阶配电管理系统 (ADMS) 市场趋势

软体领域成长强劲,推动市场

- 一些软体具有一些功能,允许用户透过将能源支出映射到业务指标来获取其能源支出的简介。一些公司提供可与现有楼宇管理系统、ERP 和各种其他系统整合的工具。此外,云端基础的能源管理软体的出现进一步推动了需求。

- 云端服务有效地降低了开发和维护软体以及维护内部IT专家和基础设施以收集、储存和分析能源资料的营运成本所花费的直接财务成本、时间和资源。此外,美国能源资讯署称,去年智慧电网管理资讯科技预计投资 47 亿美元,智慧电网相关资讯技术投资为 19 亿美元。如此巨额的投资可能会为软体产业创造成长机会。

- 例如,联想提供基于策略的集中能源管理解决方案XClarity Energy Manager。该软体可协助您追踪、管理和规划伺服器的电源使用情况。该软体有助于降低能源成本并更好地控制资料中心的电力使用。

- Honeywell也为其云端基础的能源管理软体 Inncom INNcontrol 5 增加了推播通知、警报和增强型使用者介面。 INNcontrol 5 具有即时仪表板,可显示物业级别资料、HVAC 分析报告以及每个房间中房间自动化 IoT 设备的状态(恆温器、居住感测器、门感测器、照明控制等)。

- 数位解决方案能够在日益复杂的电网中收集、处理和增强测量资料。正是在这样的背景下,去年三月,萨基姆交付目的地SICONIA 软体套件,该套件包括一个多能源、可扩展的前端系统 (HES) 和一个基于巨量资料的仪表资料管理系统 (MDMS)。这一重大计划标誌着瑞士智慧电网之旅的开始以及与 E 集团的长期伙伴关係。

预计北美将出现显着成长

- 根据美国能源资讯署统计,过去几年,美国初级能源消费量约98兆英热单位(Btu),占全球初级能源消费量约604兆Btu的16%左右。美国占世界人口的4%,人均初级能源消费量位居世界第十。如此巨大的能源消耗可能会增加能源工厂的生产能力,并影响该地区惯性系统的成长。

- 2023 年 1 月,Landis+Gyr Group AG 的子公司 Landis+Gyr Technology Inc. 与一家美国投资者拥有的电力公司签署了一份新合同,对该公司的计量软体基础设施进行现代化改造。该公用事业公司的现代化计画仍需获得监管部门的批准。这份为期20年的合约包括电錶资料管理软体、软体即服务(SaaS)和支援该公司50万台传统单向通讯电錶的服务,该计划最终预计将整合超过50万台新一代智慧电錶设备。

- 美国国防部(DOD)是联邦政府中最大的能源消耗部门,占联邦政府总能源消费量的77%。能源管理对于国防部的运作至关重要。国防部依靠能源来确保任务行动的准备和恢復能力,从维护基地和训练设施到为喷射机和船隻动力来源。能源效率意味着使用更少的能源提供相同或更优质服务,这可以在长期内节省资金,特别是对于国防部这样的机构而言,能源开支约占其年度预算的 2%。

- 根据纽约州能源研究与发展局 (NYSERDA) 的说法,启用智慧技术和即时能源管理系统可以平均降低 15% 的成本、减少能源浪费并创建提高员工生产力的生态系统,从而提高收益。此外,过去两年建筑业的二氧化碳排放增加。在这里,也越来越需要按照 SDS 计画在建筑物中实施能源管理系统。

高阶配电管理系统 (ADMS) 产业概览

由于有多家参与者,先进配电管理市场竞争较激烈。市场参与者正在采用产品创新、併购等策略来扩大产品系列、增加其地理覆盖范围,并主要为了保持市场竞争力。

2022 年 5 月,Advanced Utility Systems 推出了 Harris Computer 的 Infinity 客户资讯系统 (CIS)。它是一个现代化的、云端基础的客户资讯和计费软体平台,对于公用事业转变客户服务和计费、客户体验和现场劳动力管理至关重要。随着公共事业对其客户体验进行数位化和现代化,整合 Advanced 的 Infinity CIS 将使他们能够增强客户服务和参与倡议。 Infinity CIS 拥有无与伦比的能力,可以帮助公共事业满足其所有需求,甚至更多。 2022 年 2 月,能源与智慧电网解决方案供应商 Swell Energy Inc. 宣布其专有的分散式能源资源管理系统 GridAmp 全面上市。扩展的 DERMS 平台将把分散式能源资源(DER)(例如太阳能和电池储存)整合到虚拟发电厂(VPP)中,为公共事业提供额外的电网功能。作为 Swell 家庭电池奖励计划的一部分,GridAmp 将使用电錶后太阳能电池管理多个电网服务运营,Swell 是正在瓦胡岛、电錶后端和大岛开发的 80 兆瓦分布式 VPP(由夏威夷电力公司承包并获得夏威夷公共产业委员会的核准)。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 智慧电网技术的快速应用

- 日益增长的能源需求和高效率的配电管理系统

- 新兴国家增加基础建设投资

- 市场限制

- 增加初始投资

- 市场机会

- 产业吸引力-波特五力模型

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响

第五章 市场区隔

- 透过提供

- 软体

- 服务

- 咨询

- 系统整合

- 支援和维护

- 依系统类型

- 配送管理系统 (DMS)

- 自动抄表/进阶计量基础设施 (AMR/AMI)

- 分散式能源资源管理系统 (DERMS)

- 能源管理系统 (EMS)

- 客户资讯系统(CIS)

- 仪表资料管理系统 (MDMS)

- 按最终用户产业

- 能源与公共产业

- 资讯科技/通讯

- 製造业

- 国防和政府机构

- 基础设施

- 运输和物流

- 其他最终用户产业

- 按地区

- 北美洲

- 美国

- 加拿大

- 欧洲

- 德国

- 英国

- 法国

- 其他欧洲国家

- 亚太地区

- 中国

- 印度

- 日本

- 其他亚太地区

- 中东和非洲

- 北美洲

第六章 竞争格局

- 公司简介

- ABB Group

- General Electric Company

- Siemens AG

- Advanced Control Systems

- Schneider Electric SE

- Survalent Technology

- ETAP/Operation Technology,Inc.

- S&C Electric Company

- Capgemini Consulting

- Open Systems International, Inc

- Alstom SA

第七章:未来市场展望

The Advanced Distribution Management System Market is expected to register a CAGR of 19.7% during the forecast period.

Key Highlights

- One of the primary reasons driving market expansion is the increasing demand for efficient energy resources worldwide. ADMS assists in optimizing distribution grid performance and automating outage restoration. Furthermore, the increased adoption of advanced metering infrastructure (AMI) boosts market growth. AMI assists in remotely measuring electricity usage, monitoring voltage, and recognizing and isolating outages. It also allows utilities and customers to communicate with one another. Furthermore, technological improvements such as integrating connected devices with the Internet of Things (IoT) and using modern components and control systems to improve security while reducing total costs and electricity loss propel market expansion.

- In accordance with this, increased implementation of smart grid technologies boosts the market growth. ADMS assists in effectively transporting electricity and data by optimizing energy usage and detecting grid issues. Other reasons, including the increased building of smart cities and the implementation of various government efforts to improve carbon efficiency, are expected to propel the market forward. For instance, according to the recent estimates of the US Department of Energy, smart grid investments are expected to reach over USD 13.8 billion by 2024, accounting for over 64% of the total grid information and control investments in the United States.

- The United Arab Emirates introduced "Energy Policy 2050," which is regarded as the nation's first comprehensive supply-and-demand-based energy strategy. The strategy intends to save USD 190 billion by 2050 and boost the share of renewable energy in the whole energy mix from 25% to 50%. It also aspires to lower the carbon footprint of power generation by 70%. Additionally, it aims to improve corporate and individual consumption efficiency by 40%. Such policies by the government will significantly create opportunities for the market to grow.

- According to EIA, from the past year, annual global energy investment was set to rise to USD 1.9 trillion, bringing the total investment volume back towards pre-crisis levels. However, the composition has shifted towards power and end-use sectors - and away from traditional fuel production. While many energy companies remain in a fragile financial state, there are signs developers are using the window provided by accommodative monetary policy and government backing to plan infrastructure developments and investments in new projects. These positively affected the studied market during the post covid.

- Significant upfront costs are associated with installing an entirely automated ADMS system in buildings or enterprises. Every industry seeks to reduce the cost of its consumption. Therefore, they need energy management systems to track how much energy various devices and factories use. Even while using energy-efficient solutions and practices results in significant long-term cost and energy savings, it necessitates a hefty initial investment. There may be circumstances when certain businesses, sectors, or industrial facilities need more resources to invest in EMS. For small- or medium-sized companies, such an expenditure is not practical. In most cases, the hardware parts of energy management systems are substantially more expensive than the software and service parts.

Advanced Distribution Management System (ADMS) Market Trends

Software Segment would Experience Significant Growth and Drive the Market

- Some software comprises features, such as the user getting a snapshot of energy spending mapped to business metrics. Some of the companies provide tools that integrate with the existing building management systems, ERP, and various other systems. Moreover, the advent of cloud-based energy management software further fuels the demand.

- Cloud services effectively minimize operational costs of software development and maintenance and direct monetary costs, time, and spent resources on maintaining in-house IT professionals and infrastructure for gathering, storing, and analyzing energy data. Further, According to EIA, the Admin Information technology of smart grids is expected to invest USD 4.7 billion in the last year, and smart grid-related information technology investment is USD 1.9 billion. Such huge investments would create an opportunity for the software segment to grow.

- For instance, Lenovo offers XClarity Energy Manager, a centralized policy-based energy management solution. The software helps track, manage, and plan server power utilization. It helps decrease energy costs and further control data center power usage.

- Also, Honeywell added enhancements to its cloud-based energy management software, Inncom INNcontrol 5, with push notifications, alarms, and enhanced UI, which allows multi-property scalability for full portfolio management. INNcontrol 5 features a live dashboard with property-level data and HVAC analytics reports, as well as the status of each guestroom's room automation IoT devices, such as the thermostat, occupancy sensor, door sensor, and lighting controls.

- Digital solutions make it possible to collect, process, and enhance the metering data in increasingly complex grids, and in this context, in March last year, Sagemcomwas selected by Groupe E for the delivery of its SICONIA Software suite, which is composed of Multi-energy and scalable Head-End System (HES) and Big data-based Meter Data Management system (MDMS). This large-scale project is the beginning of the Smart Grid journey in Switzerland and a long-term partnership with Groupe E.

North America is Expected to Experience Significant Growth

- According to US Energy Information Administration, past few years, total primary energy consumption in the United States was around 98 quadrillion British thermal units (Btu), accounting for approximately 16% of total global primary energy consumption of approximately 604 quadrillion Btu. The United States had a 4% share of the global population, and the country had the world's tenth highest per capita primary energy consumption. Such huge consumption of energy would increase the production capacity of energy plants that would impact the growth of inertia systems in the region.

- In January 2023, Landis+Gyr Technology Inc., a subsidiary of Landis+Gyr Group AG, and a U.S. investor-owned utility have signed a new agreement to modernize the company's metering software infrastructure. The utility's plans to modernize are still subject to regulatory clearance. The 20-year contract comprises meter data management software, Software as a Service, and services to support the utility's 500,000 legacy one-way communicating electric meters, and the project will eventually incorporate over 500,000 next generation smart metering devices.

- The US Department of Defense (DOD) consumes the most energy of any federal entity, accounting for 77% of total federal government energy consumption. The control of energy is critical to DOD operations. DOD relies on energy to ensure readiness and resiliency for mission activities, from maintaining bases and training facilities to powering jets and ships. Energy efficiency-providing the same or better quality of service with less energy-can lower agency expenses over time, especially for a department like the DOD, where energy accounts for around 2% of the annual budget.

- According to the New York State Energy Research and Development Authority (NYSERDA), enabling smart technologies and real-time energy management systems can decrease costs by an average of 15% and improve the bottom line by creating an ecosystem that reduces energy waste and boosts employee productivity. Moreover, the building sector's CO2 emission has increased over the past two years. Again, this has intensified the need to install energy management systems in buildings, keeping track with the SDS program

Advanced Distribution Management System (ADMS) Industry Overview

The Advanced Distribution Management Market is moderately competitive owing to the presence of multiple players. The players in the market are adopting strategies like product innovation, mergers, and acquisitions to expand their product portfolio, expand their geographic reach, and primarily stay competitive in the market.

In May 2022, Advanced Utility Systems debuted its Infinity Customer Information System (CIS), a Harris Computer firm. It is a modern, cloud-based customer information and billing software platform that is critical in transforming customer service and billing, customer experience, and field workforce management for utilities. As utilities digitally modernize their customer experience, integrating Advanced's Infinity CIS would boost customer service and engagement initiatives. It boasts unrivaled functionality to assist utilities in accomplishing all of their needs and more. In February 2022, Swell Energy Inc. (Swell), an energy and smart grid solutions provider, announced the general availability of GridAmp, its proprietary Distributed Energy Resource Management System. The expanded DERMS platform combines Distributed Energy Resources (DERs), such as solar and battery storage devices, into virtual power plants (VPPs) to provide utilities with additional grid capabilities. GridAmp will manage multiple grid service operations using behind-the-meter solar-powered batteries as part of Swell's Home Battery Rewards program, an 80-megawatt distributed VPP being developed on the islands of O'ahu, Maui, and Hawai'i - as contracted with Hawaiian Electric and approved by the Hawai'i Public Utilities Commission.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rapid Adoption Of Smart Grid Technology

- 4.2.2 Rising Energy Demand And Efficient Distribution Management System

- 4.2.3 Increasing Investment in Infrastructure Construction in Emerging Economies

- 4.3 Market Restraints

- 4.3.1 Higher Initial Investment

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness - Porter Five Forces

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 Offering

- 5.1.1 Software

- 5.1.2 Service

- 5.1.3 Consulting

- 5.1.4 System Integration

- 5.1.5 Support and Maintenance

- 5.2 System Type

- 5.2.1 Distribution Management System (DMS)

- 5.2.2 Automated Meter Reading/Advanced Metering Infrastructure (AMR/AMI)

- 5.2.3 Distributed Energy Resources Management Systems (DERMS)

- 5.2.4 Energy Management Systems (EMS)

- 5.2.5 Customer Information Systems (CIS)

- 5.2.6 Meter Data Management Systems (MDMS)

- 5.3 End-user Verticals

- 5.3.1 Energy & Utilities

- 5.3.2 IT and Telecommunications

- 5.3.3 Manufacturing

- 5.3.4 Defense and Government

- 5.3.5 Infrastructure

- 5.3.6 Transportation & Logistics

- 5.3.7 Others End-user Verticals

- 5.4 Geography

- 5.4.1 North America

- 5.4.1.1 United States

- 5.4.1.2 Canada

- 5.4.2 Europe

- 5.4.2.1 Germany

- 5.4.2.2 United Kingdom

- 5.4.2.3 France

- 5.4.2.4 Rest of Europe

- 5.4.3 Asia Pacific

- 5.4.3.1 China

- 5.4.3.2 India

- 5.4.3.3 Japan

- 5.4.3.4 Rest of Asia Pacific

- 5.4.4 Middle East and Africa

- 5.4.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 ABB Group

- 6.1.2 General Electric Company

- 6.1.3 Siemens AG

- 6.1.4 Advanced Control Systems

- 6.1.5 Schneider Electric SE

- 6.1.6 Survalent Technology

- 6.1.7 ETAP/Operation Technology,Inc.

- 6.1.8 S&C Electric Company

- 6.1.9 Capgemini Consulting

- 6.1.10 Open Systems International, Inc

- 6.1.11 Alstom S.A.