|

市场调查报告书

商品编码

1644446

北美豪华乙烯基瓷砖 (LVT) 市场:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)North America Luxury Vinyl Tile (LVT) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

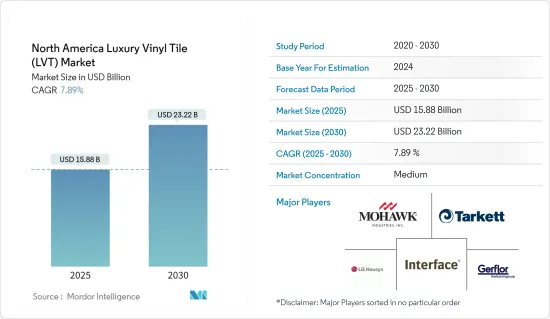

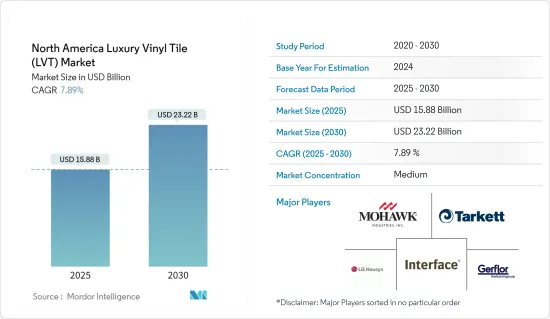

北美豪华乙烯基瓷砖 (LVT) 市场规模预计在 2025 年为 158.8 亿美元,预计到 2030 年将达到 232.2 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.89%。

预计,建筑业的扩张、改造和装修计划的增加以及瓷砖日益增长的吸引力将推动对豪华乙烯基瓷砖 (LVT) 的需求。由于房地产投资的增加,建筑业正在扩张。办公室、购物中心和教育设施等商业建筑的建设不断增加,推动了豪华乙烯基瓷砖 (LVT) 的市场需求。随着全球住宅建筑计划的增加,对豪华乙烯基瓷砖 (LVT) 的需求预计也会增加。此外,随着製造流程技术的进步,乙烯基地板材料市场在性能、应用和设计方面都在不断扩大。装修和建筑计划成本上升等变数将对市场产生正面影响。

此外,旨在加强基础设施和房地产行业扩张的政府变化和法规可能会促进建筑业的成长,从而增加对豪华乙烯基瓷砖(LVT)的需求。豪华乙烯基瓷砖 (LVT) 的需求是由不断提高的生活水准和客户对改善室内设计和美观度(尤其是在地板材料方面)的渴望所推动的。

北美豪华乙烯基瓷砖 (LVT) 市场趋势

住宅领域领先市场

除了提高建筑的视觉吸引力之外,LVT 还具有抵抗恶劣天气、舒适性和耐用性等特性。预计这些因素将在预测期内推动住宅市场的发展。此外,人均收入的提高和都市化的快速发展也推动了现有住宅翻新和修復计划的增加。预计住宅市场对豪华乙烯基瓷砖 (LVT) 的需求也将受到维护成本上升的推动。豪华乙烯基瓷砖 (LVT) 具有防水功能,是地下室、洗衣房、厨房和浴室的理想选择。此外,卧室中的 LVT 可防止灰尘和宠物皮屑进入。

美国豪华乙烯基瓷砖 (LVT) 市场的扩张

近年来,美国豪华乙烯基瓷砖 (LVT) 市场经历了显着成长。 LVT 因其耐用性、经济性和美观的多功能性而受到消费者和商业领域的欢迎。包括 LVT 在内的弹性地板材料在美国消费者中越来越受欢迎。 LVT 的多功能性使其适用于住宅和商业的各种应用。它非常适合零售店、医疗机构和办公室等商业空间以及厨房、浴室和走廊等人流量大的区域。在商业领域,酒店、医疗保健、零售和办公室等行业都采用了 LVT,因为它耐用、设计灵活且易于维护。随着商业建筑和维修计划不断增加,这些领域对 LVT 的需求预计将增长。

北美豪华乙烯基瓷砖 (LVT) 行业概况

北美豪华乙烯基瓷砖(LVT)市场需要变得更有凝聚力。该研究涵盖了参与北美LVT市场的外国主要公司。就市场占有率而言,少数大公司占据市场主导地位,包括 Mohawk Industries、LG Hausys、Tarkett、Interface 和 Gerflor。然而,随着产品和技术的改进,中小企业正在透过扩大市场占有率来获得新业务并扩展到尚未开发的领域。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 房地产市场的扩张正在推动市场

- 建设产业的成长推动了市场

- 市场限制

- 与其他地板选项的竞争

- 原料成本上涨

- 市场机会

- 网路零售和电子商务的成长创造了机会

- 价值链/供应链分析

- 波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 洞察市场技术进步

- COVID-19 市场影响

第五章 市场区隔

- 依产品类型

- 难的

- 柔软的

- 按最终用户

- 住宅

- 商业的

- 按分销管道

- 家装中心

- 旗舰店

- 专卖店

- 网路商店

- 其他分销管道

- 按国家

- 美国

- 加拿大

- 北美其他地区

第六章 竞争格局

- 公司简介

- Mohawk Industries

- LG Hausys

- Interface

- Gerflor

- Tarkett

- Shaw Industries Group Inc.

- Armstrong Flooring

- Mannington Mills Inc.

- American Biltrite

- Adore Floors Inc.*

第七章 市场趋势

第八章 免责声明

The North America Luxury Vinyl Tile Market size is estimated at USD 15.88 billion in 2025, and is expected to reach USD 23.22 billion by 2030, at a CAGR of 7.89% during the forecast period (2025-2030).

Luxury vinyl tile demand is anticipated to be driven by the expanding building sector, an increase in remodeling and renovation projects, and the growing appeal of tiles. The building sector has expanded due to a rise in real estate investments. The growth in constructing commercial structures, including offices, commercial complexes, and educational facilities, drives the market's desire for high-end vinyl tiles. The demand for premium vinyl tiles will rise as more housing projects are built globally. In addition, the market for vinyl flooring has expanded in terms of performance, installation, and design due to growing technological developments in the manufacturing process. The market is positively impacted by variables, including rising costs for remodeling and construction projects.

Furthermore, government changes and regulations aimed at bolstering the expansion of their infrastructure and real estate sectors may boost the growth of the building sector and increase demand for high-end vinyl tiles. The need for luxury vinyl tiles is driven by customers' inclination towards improved interior design and aesthetics, particularly regarding flooring, as living standards rise.

North America Luxury Vinyl Tile Market Trends

The Residential Segment Leads the Market

LVTs have several qualities, including resilience to harsh weather, comfort, and durability, in addition to improving a building's visual attractiveness. During the forecast period, these factors are anticipated to propel the residential segment of the market. Furthermore, the rising number of existing home remodeling and restoration projects is being driven by rising per capita income and fast urbanization. Luxury vinyl tile demand in the residential market is also anticipated to be driven by rising maintenance costs. Because luxury vinyl tiles are waterproof, they are ideal for basements, laundry rooms, kitchens, and bathrooms. Moreover, LVTs in bedrooms don't collect dust or pet dander.

Increasing Luxury Vinyl Tile Market in United States

The luxury vinyl tile (LVT) market in the United States has been experiencing significant growth in recent years. LVT has gained popularity among consumers and commercial sectors due to its durability, affordability, and aesthetic versatility. Resilient flooring, including LVT, has become increasingly popular among consumers in the United States. LVT's versatility makes it suitable for various applications in both residential and commercial settings. It is suitable for installation in commercial spaces like retail stores, healthcare facilities, and offices, as well as high-traffic areas like kitchens, bathrooms, and corridors. The commercial sector has been significantly used in Industries such as hospitality, healthcare, retail, and offices, which have embraced LVT for its durability, design flexibility, and ease of maintenance. As commercial construction and renovation projects continue to rise, the demand for LVT in these sectors is expected to increase.

North America Luxury Vinyl Tile Industry Overview

The luxury vinyl tile (LVT) market in North America needs to be more cohesive. Major foreign companies involved in the LVT market in North America are included in the research. In terms of market share, a select group of large enterprises now dominate the market, including Mohawk Industries, LG Hausys, Tarkett, Interface, and Gerflor. But with product and technology advances, by expanding market share, mid-size and smaller businesses win new business and break into untapped sectors.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increasing Real Estate Market is Driving the Market

- 4.2.2 Increasing Construction Industry is Driving the Market

- 4.3 Market Restraints

- 4.3.1 Competition from Other Flooring Options

- 4.3.2 Rise in Raw Material Costs

- 4.4 Market Opportunities

- 4.4.1 Growth of Online Retail and E-Commerce is Creating an Opportunity

- 4.5 Value Chain/Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Technological Advancements in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Rigid

- 5.1.2 Flexible

- 5.2 By End User

- 5.2.1 Residential

- 5.2.2 Commercial

- 5.3 By Distribution Channel

- 5.3.1 Home Centers

- 5.3.2 Flagship Stores

- 5.3.3 Specialty Stores

- 5.3.4 Online Stores

- 5.3.5 Other Distribution Channels

- 5.4 By Country

- 5.4.1 United States

- 5.4.2 Canada

- 5.4.3 Rest of North America

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Mohawk Industries

- 6.1.2 LG Hausys

- 6.1.3 Interface

- 6.1.4 Gerflor

- 6.1.5 Tarkett

- 6.1.6 Shaw Industries Group Inc.

- 6.1.7 Armstrong Flooring

- 6.1.8 Mannington Mills Inc.

- 6.1.9 American Biltrite

- 6.1.10 Adore Floors Inc.*