|

市场调查报告书

商品编码

1644455

公共 Wi-Fi -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Public Wi-Fi - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

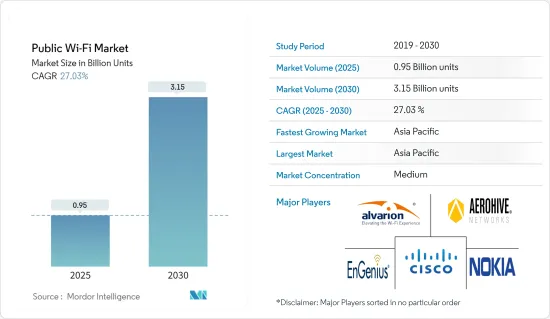

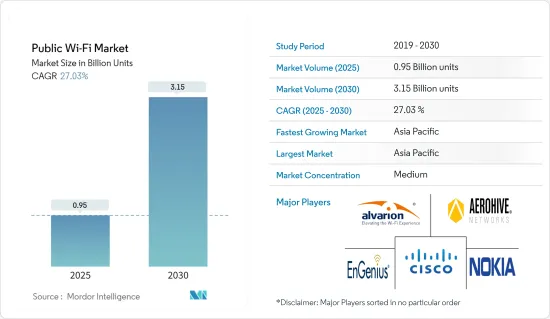

预计2025年公共Wi-Fi市场规模将达到9.5亿台,预计2030年将达到31.5亿台,预测期内(2025-2030年)的复合年增长率为27.03%。

新兴经济体越来越多地采用5G技术,行动用户数量预计将呈指数级增长。根据爱立信的报告,2020 年北美的 LTE 用户数将达到 3.5 亿,由于 5G 用户需求预计增长,到 2026 年这一数字将下降到 8,000 万。 2019年该地区5G用户数为100万,预计2026年将达3.4亿人。

关键亮点

- 在行动主导的世界中,市场参与企业比以往任何时候都更加依赖良好的 Wi-Fi 连线作为频宽应用和户外、客户端密集场景的最终用户。

- 公司开始提供支援新技术的解决方案,以促进户外 Wi-Fi 技术的市场成长。通讯技术供应商 Grandstream Networks 等公司已经开发出远距802.11ac Wave-2 Wi-Fi 接入点。接入点配备内建控制器,并支援集中式、可扩展的管理系统,例如云端託管/云端 SaaS 或基于前提的虚拟WLAN 控制器。

- 这些网路基地台配备了专属式的功能、网路标准和协议,例如 MU-MIMO 技术、多个 SSID、频段控制、双 2.4GHz/5GHz 无线电频段、带 PoE/PoE+ 的Gigabit乙太网路连接通讯协定、802.11ac、网状网路、802.11ac 2、可携式连接埠、 Wave客户端控制和强制用户端。

- 瞻博网路正在推出四个新的基于人工智慧的 Wi-Fi 6网路基地台,以帮助合作伙伴解决由 COVID-19 疫情推动的新应用案例。 Juniper 网路 Wi-Fi 产品组合中的新解决方案主要针对目前在偏远地区业务的企业以及注重成本的中小型企业的户外应用。

公共 Wi-Fi 市场趋势

政府在加速农村地区 Wi-Fi 普及化方面所扮演的角色

- 许多地区的政府正在加强推广公共 Wi-Fi,以加速宽频连线的普及。爱立信预计,到2026年终,全球固定宽频连线数量将达到15亿。该公司还预测,到 2026年终,光在北美,5G 用户数就将达到 3.4 亿。因此,预计这种成长将对未来几年公共 Wi-Fi 市场的成长产生积极影响。

- 市场参与企业正在推动各个地区采用公共Wi-Fi,这为近年来的市场创造了机会。据思科称,目前约有 37 亿人仍未接入网路。 14% 的美国学龄儿童家庭没有网路连线。在当前远距学习日益兴起的环境下,这一点极为重要。思科认识到了这种数位鸿沟,并正在积极致力于帮助美国美国以便捷的方式上网。该公司透过识别无处不在的连接所面临的各种障碍,迈出了解决这一问题的第一步。

- 政府、非营利组织和企业也在共同努力,推动重点人群的网路存取。最近,思科系统公司与亚利桑那州的公共图书馆合作,帮助教师和学生参与和实施数位化学习。思科正在与亚利桑那州合作,将公共 Wi-Fi 接入扩展到该州高需求社区,以帮助人们在 COVID-19 疫情期间保持联繫。思科计划在图书馆安装外部无线接入点,教师和学生可以进行远距学习,人们可以从图书馆建筑外存取 Wi-Fi。

- 2020年6月,美国联邦通讯委员会(FCC)决定采用竞标程序,向服务不足的地区提供高达160亿美元的资金。其中包括约 600 万农村住宅和企业。 FCC 的提案也将 SpaceX 的低地球轨道卫星系统纳入竞标之中。 SpaceX 正在利用低地球轨道卫星开发低延迟网路宽频系统。

亚太地区将经历最高成长

- 该地区主要城市和公共场所免费 Wi-Fi 接入的普及正在推动市场的成长。公共 Wi-Fi 存取提供了一种经济实惠、可扩展且多功能的资源,可以提高网路存取的普及率,尤其是在印度、中国和日本等国家向 5G 迈进的情况下。

- ICRIER BIF 最近的一项研究估计,到 2020 年,网路对印度 GDP 的贡献将达到 16% 左右,即 5,340 亿美元。因此,许多投资者热衷于在该地区投资,并且有巨大的机会可供挖掘。根据思科分析,到2020年,印度公共Wi-Fi热点数量将从2015年的6万个增加到420万个。

- 此前,印度已提案《2018年国家数位通讯政策》(NDCP),其中为「互联印度」计画下都市区公共Wi-Fi热点的建设设定了关键目标。这将创建一个强大的数位通讯基础设施,从而实现公共Wi-Fi 热点的部署。目标是到2020年达到500万台,到2022年达到1000万台。在这项措施下,印度製定了在都市区设立100万个热点的「NagarNet」计画和在农村地区设立200万个热点的「JanWiFi」计画。

- 印度电讯监管局 (TRAI) 建议对公共 Wi-Fi 采取自由化方式,并采用专用标准 WANI 来实现公共热点之间的互通性。

- 2020年12月,印度政府公布了在全国推出公共Wi-Fi的计划,称为「PM-Wani」。这三层系统旨在提供最后一哩的连接,让印度约 13.6 亿人口能够上网。据电子和资讯技术部称,任何人都可以向公共资料办公室(PDO)註册。无需註册、申请许可证或付款任何费用。

公共 Wi-Fi 产业概览

公共 Wi-Fi 市场较为分散,主要有几家市场参与企业,例如思科系统公司 (Cisco Systems Inc.)、EnGenius Technologies 和 Socifi Ltd,每家都占有少量市场占有率,此外还有许多其他参与者。公司不断创新和研发以保持市场占有率。

- 2020 年 7 月,思科系统公司收购了无线回程传输系统供应商 FluidMesh Networks。 Fluidmesh 技术描述了关键任务应用的无线解决方案,例如高速铁路、公共交通以及号誌强度具有挑战性的大型分散式站点(例如港口和城市环境)。 Fluidmesh 的解决方案为客户提供快速部署和配置、经济高效且维护成本低的解决方案。

- 2020 年 4 月-EnGenius Technologies 宣布透过墙板接入点扩展其云端解决方案,以满足室内 Wi-Fi 的需求,以连接学生宿舍、酒店和度假村、老年人和辅助多用户住宅网路基地台、公寓和多户建筑中的众多无线客户端和物联网设备。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第 4 章 户外 Wi-Fi 技术概述

第五章 市场动态

- 各地区公共 Wi-Fi 普及率

- 公共 Wi-Fi收益模式

- 相关人员分析

- 公共 Wi-Fi 市场挑战

- 公共 Wi-Fi 的主要收益使用案例

- 区域分析

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

- 公共Wi-Fi服务策略概览

第六章 竞争格局

- 公司简介

- Aerohive Networks Inc.

- Alvarion Technologies

- Cisco Systems Inc.

- Nokia Corporation

- EnGenius Technologies Inc

- Fon Wireless Limited

- WiConnect(Platform)

- Hughes Systique Corporation

- Elitecore Technologies

- Discovery Technology

- Aptilo Networks

- Gozone Wifi

- Aruba Networks(HPE Development LP)

第七章投资分析

第八章 市场机会与未来趋势

The Public Wi-Fi Market size is estimated at 0.95 billion units in 2025, and is expected to reach 3.15 billion units by 2030, at a CAGR of 27.03% during the forecast period (2025-2030).

With the growing push toward 5G technology across the developed economies, mobile subscriptions are expected to see exponential growth. According to the Ericsson's report in 2020, North America's LTE subscriptions stood at 350 million and reduce to 80 million by 2026 as the demand for 5G subscriptions is expected to gain traction. The 5G subscription in the region in 2019 stood at one million and is expected to reach 340 million by 2026.

Key Highlights

- As an end user in the mobile-driven world, for heavy bandwidth applications and client dense scenarios outdoors, the market players are ever more reliant on a good Wi-Fi connectivity.

- Players have started offering emerging technology-enabled solutions, which will leverage the market growth of the outdoor Wi-Fi technology. Companies like Grandstream Networks, a communication technology provider, has developed outdoor long-range 802.11ac Wave-2 Wi-Fi access points, which are equipped with the embedded controller and it supports centralized, scalable management system choices like cloud hosted /cloud SaaS or a premise-based Virtual WLAN controller.

- These access points are also equipped with enhanced features, networking standards and protocols like MU-MIMO technology, multiple SSIDs, band steering, dual-2.4GHz/5GHz radio bands, gigabit ethernet ports with PoE/PoE+,802.11ac, mesh networking, 802.11ac Wave 2, captive portal for enterprise branding experiences, client steering, and client bridge function.

- Juniper Networks is launching four new AI-powered, Wi-Fi 6-enabled access points, which will help partners address new application cases being driven by the COVID-19 pandemic. The newly developed solution to Juniper's Wi-Fi portfolio target outdoor applications for businesses, which are now operating remotely, and small businesses, which need to be mindful of costs.

Public Wi-Fi Market Trends

Role of Government in Accelerating Regional Penetration of Wi-Fi

- Governments across different geographies are focusing on public Wi-Fi penetrations to accelerate the adoption of broadband connections. According to Ericsson, the global number of fixed broadband connections is expected to reach 1.5 billion by the end of 2026. It also forecasted that 5G would see 340 million subscriptions by the end of 2026 in the North America region only. Hence such growth is expected to influence the public Wi-Fi market's growth in the future positively.

- Players present in the market are boosting the public Wi-Fi penetration across regions, which is creating opportunities for the market in recent years. According to Cisco, there are still approximately 3.7 billion people who remain unconnected currently. 14% of the United States households with school-aged children do not have internet access. This is something critical with the current situation's distance learning movement. Cisco identifies this digital divide and actively working to bring people in rural United States areas online in a different way. The company has taken its first step in addressing the issue by identifying different barriers to ubiquitous connectivity.

- Governments, non-profit organizations, and enterprises are also coming together to push towards internet access for the major population. Recently, Cisco Systems had worked with public libraries in the Arizona state to allow teachers and students to participate in and conduct digital learning. In collaboration with the State of Arizona, Cisco seeks to expand public Wi-Fi access to highly-required communities across the state, allowing people to stay connected during the COVID-19 pandemic. Cisco had planned to install external wireless access points at libraries, where teachers and students can conduct distance learning, and people can access the Wi-Fi from outside of the library building.

- In June 2020, the United States Federal Communications Commission (FCC) voted to adopt the auction procedures to provide up to USD 16 billion to areas, which lack broadband services. This includes nearly 6 million rural houses and enterprises. The FCC proposal also planned to allow low earth orbit satellite systems, those made by SpaceX, to take participate in the auction. SpaceX was developing a low latency internet broadband system using low earth orbit satellites.

Asia Pacific to Witness the Highest Growth

- Increasing penetration of free Wi-Fi access in major cities and public spaces across the region boosts the growth of the market studied. Public Wi-Fi access offers affordable, scalable, and versatile resources to facilitate the spread of internet access and will play a major role as the countries like India, China, and Japan, among others, move toward 5G.

- A recent ICRIER BIF study estimates the internet's contribution to India's GDP at about 16% or USD 534 billion by 2020. So, there is a significant opportunity to be explored, as several investors are willing to invest in the region. According to Cisco's analysis, in India, the number of public Wi-Fi hotspots were 0.06 million in 2015, and clocks to 4.2 million in 2020.

- Earlier the country had proposed the National Digital Communication Policy (NDCP) 2018, which has set significant targets for Public Wi-Fi hotspots in the cities and the rural areas under Connect India. This is creating a Robust Digital Communication Infrastructure, which enables the deployment of public Wi-Fi Hotspots. This had a target to reach 5 million by 2020 and 10 million by 2022. Under the policy, the country has chalked out the 'NagarNet' plan for establishing 1 million hotspots in cities and 'JanWiFi' to establish 2 million hotspots in rural areas.

- The Telecom Regulatory Authority of India (TRAI) recommends a Liberalized Approach to Public Wi-Fi and the exclusive WANI standard for inter-operability between public hotspots.

- In December 2020, India's government had revealed the plans to launch public Wi-Fi across the country called 'PM-Wani.' The three-tier system was aimed at offering last-mile connectivity and bringing India's population of approximately 1.36 billion online. According to the Ministry of Electronics and Information Technology, anyone can sign up to become a public data office (PDO). They don't require to apply for a registration, license, or cough up fees.

Public Wi-Fi Industry Overview

The Public Wi-Fi Market is a moderately fragmented market with few dominant market players like Cisco Systems Inc, EnGenius Technologies, Socifi Ltd etc having a small market share with vrious other companies in the market. The companies keep on innovating and conduct research and development in order to retain their market share.

- July 2020- Cisco Systems Inc. acquired privately-held Fluidmesh Networks LLC, a provider of wireless backhaul systems. Fluidmesh's technology delivers wireless solutions for mission-critical applications, whether it is high-speed rail and mass transit or large-scale distributed sites such as ports and urban environments where signal strength can be challenging. Fluidmesh's solutions are quick to deploy and configure, offering customers a cost-efficient, low maintenance solution.

- April 2020- EnGenius Technologies announced that it has expanded its cloud solution with a wall-plate access point to meet the demands of in-room Wi-Fi to connect the many wireless client and IoTdevices found in student housing, hotels & resorts, senior & assisted living, condos and apartment complexes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 OUTDOOR WI-FI TECHNOLOGY OVERVIEW

5 MARKET DYNAMICS

- 5.1 Regional Penetration of Public Wi-Fi

- 5.2 Public Wi-Fi Monetization Models

- 5.3 Stakeholder Analysis

- 5.4 Public Wi-Fi Market Challenges

- 5.5 Key Public Wi-Fi monetization Use-Cases

- 5.6 Regional Analysis

- 5.6.1 North America

- 5.6.2 Europe

- 5.6.3 Asia Pacific

- 5.6.4 Latin America

- 5.6.5 Middle East and Africa

- 5.7 Overview of Public Wi-Fi Service Strategy

6 COMPETITIVE LANDSCAPE

- 6.1 Company Profiles

- 6.1.1 Aerohive Networks Inc.

- 6.1.2 Alvarion Technologies

- 6.1.3 Cisco Systems Inc.

- 6.1.4 Nokia Corporation

- 6.1.5 EnGenius Technologies Inc

- 6.1.6 Fon Wireless Limited

- 6.1.7 WiConnect (Platform)

- 6.1.8 Hughes Systique Corporation.

- 6.1.9 Elitecore Technologies

- 6.1.10 Discovery Technology

- 6.1.11 Aptilo Networks

- 6.1.12 Gozone Wifi

- 6.1.13 Aruba Networks (HPE Development LP)