|

市场调查报告书

商品编码

1644476

搅拌机研磨机:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Mixer Grinder - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

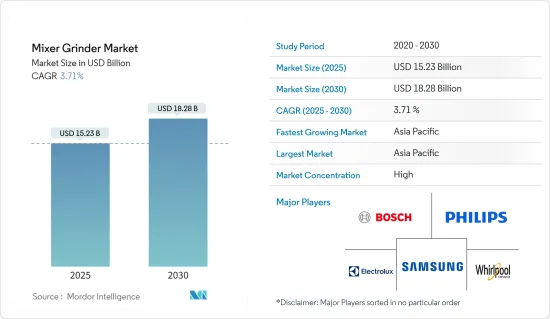

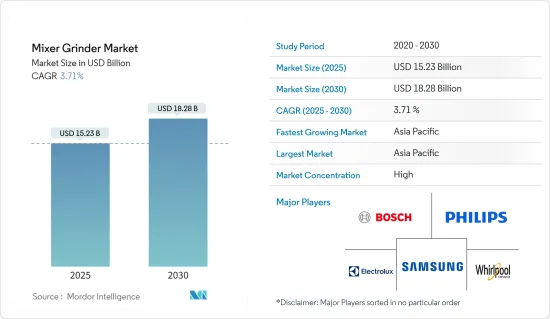

搅拌机研磨机市场规模预计在 2025 年为 152.3 亿美元,预计到 2030 年将达到 182.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 3.71%。

由于几个关键因素,市场有望实现成长。这些因素包括职业女性和生活忙碌的个体数量的增加、消费者的可支配收入的提高、家庭数量的增加以及对智慧厨房家用电子电器的依赖性的增加。产品在专业零售领域和线上平台的渗透率不断提高也推动了市场扩张。

此外,新兴经济体的快速都市化和全球高端住宅对搅拌机研磨机的采用预计将推动市场成长。然而,产品价格上涨及相关处理风险等挑战正在抑制市场扩张。机会在于开发创新产品、瞄准新的客户群以及透过电子商务平台提高产品的可近性。

消费者越来越偏好容量大、功能齐全、价格实惠的便利产品。作为回应,製造商正在使用机器人技术将易于使用的介面整合到搅拌机-研磨机和类似设备中,以简化操作。此举旨在满足多样化的客户需求并增强整体市场竞争力。

搅拌机研磨机的市场趋势

电子商务是搅拌机研磨机快速成长的分销管道

搅拌机研磨机等厨房家用电子电器的网路购物日益流行,导致透过电子商务通路的销售额迅速成长。线上平台的兴起使得消费者可以舒适地在家中研究和购买搅拌机研磨机。电子商务的吸引力在于具有竞争力的定价、种类繁多的产品、客户评论以及送货上门,所有这些都增加了其作为搅拌机研磨机首选分销管道的吸引力。

电子商务的兴起在全球搅拌机研磨机市场尤为明显,其中亚太地区处于领先地位。在印度、中国和日本的带动下,该地区对搅拌机研磨机的需求正在激增,不仅在家庭中,而且在商务用厨房和食品加工行业中也是如此。尤其是这些国家电子商务平台的日益普及,进一步推动了电子商务作为搅拌机研磨机机分销管道的主导地位。

此外,新冠肺炎疫情起到了催化剂的作用,加速了向电子商务的转变。消费者已经转向网路购物以保持社交距离,这种趋势即使在疫情结束后仍将持续下去,巩固了电子商务在搅拌机研磨机市场的关键作用。

亚太地区是最大的消费国

中国占据搅拌机研磨机市场的最大份额,其次是印度、美国、巴西和印尼,使亚太地区成为搅拌机研磨机最大的市场。亚洲国家是搅拌机研磨机的最大消费国,因为这些国家人口众多,家庭、中小型企业都购买搅拌机研磨机用于各种用途。这使得该地区成为搅拌机的最大消费国,而北美成为搅拌机成长最快的市场。

搅拌机研磨机产业概况

搅拌机研磨机市场细分化,竞争激烈,有许多大大小小的参与企业。该公司正在努力创新新型多功能搅拌机研磨机,以保持市场竞争力并吸引客户。相关人员正在实施全通路行销策略,以接触全球大量客户。相信产品和销售地点的多样化将有助于该公司未来维持业务。许多新兴企业也正在创新不同的产品,例如 BSH 和 GoWISE 的 Power Smokeless研磨机,这可能会为知名品牌带来更激烈的竞争。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第 3 章总结

第四章 市场洞察与动态

- 市场概况

- 市场驱动因素

- 市场限制/挑战

- 市场机会

- 价值链/供应链分析

- 波特五力分析

- 供应商的议价能力

- 购买者和消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 深入了解搅拌机研磨机市场的消费者购买行为

- 深入了解搅拌机研磨机市场的技术突破

- COVID-19 市场影响

第五章 市场区隔

- 依产品类型

- 立式搅拌机

- 传统搅拌机

- 按分销管道

- 多品牌专卖店

- 专卖店

- 网路商店

- 其他的

- 按最终用户

- 住宅

- 商业的

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Bosch Global

- Whirlpool Corporation

- Haier Inc.

- AB Electrolux

- Panasonic

- Morphy Richards

- Philips

- Havells

- LG

- Samsung*

第七章:市场的未来

第八章 免责声明

第 9 章:关于发布者

The Mixer Grinder Market size is estimated at USD 15.23 billion in 2025, and is expected to reach USD 18.28 billion by 2030, at a CAGR of 3.71% during the forecast period (2025-2030).

The market is poised for growth, driven by several key factors. These include the increasing demographic of working women and individuals with busy lifestyles, rising disposable incomes among consumers, a growing number of households, and an increasing reliance on smart kitchen appliances. Market expansion is also supported by the penetration of products through specialty retail sectors and online platforms.

Moreover, rapid urbanization in emerging economies and the adoption of high-end residential mixer grinders worldwide are anticipated to propel market growth. However, challenges such as higher product prices and associated handling risks pose constraints to market expansion. Nevertheless, opportunities lie in developing innovative products, targeting new customer segments, and enhancing product accessibility through e-commerce platforms.

Consumer preferences gravitate towards convenient and affordable products with adequate capacity and functionality. In response, manufacturers are leveraging robotic technologies to incorporate user-friendly interfaces and streamline operations in mixer grinders and similar appliances. This approach aims to meet diverse customer demands and enhance overall market competitiveness.

Mixer Grinder Market Trends

E-commerce Emerges as a Fastest Growing Distribution Channel for Mixer Grinders

The popularity of online shopping for kitchen appliances, including mixer grinders, is surging, fueling robust sales growth via e-commerce channels. The proliferation of online platforms has empowered consumers to explore and purchase mixer grinders from their homes conveniently. E-commerce's allure lies in its competitive pricing, extensive product range, customer reviews, and doorstep delivery, all of which have bolstered its appeal as a preferred distribution channel for mixer grinders.

E-commerce's ascent is particularly pronounced in the global mixer grinder market, with the Asia Pacific leading the charge. The region, spearheaded by nations like India, China, and Japan, is witnessing a surge in mixer grinder demand, not only in households but also in commercial kitchens and food processing industries. Notably, the rising popularity of e-commerce platforms in these countries has further propelled the dominance of e-commerce as a mixer grinder distribution channel.

Moreover, the global COVID-19 pandemic acted as a catalyst, intensifying the shift towards e-commerce. As consumers embraced online shopping to comply with social distancing measures, this trend is poised to persist even post-pandemic, solidifying e-commerce's pivotal role in the mixer grinder market.

Asia Pacific is Witnessing Largest Consumer

The maximum number of mixer grinder market functions in regions of China followed by India, the United States, Brazil, and Indonesia making Asia-Pacific the largest market for Mixer Grinder. Asian countries witness the largest consumer of mixer grinders because of the high population, homes, and small businesses acquiring the mixer grinder for various purposes. It makes this region the largest consumer of mixers, and North America is the fastest-growing market for the same.

Mixer Grinder Industry Overview

The Mixer Grinder market is fragmented and highly competitive due to the presence of many small and large players. Companies are trying to innovate new multi-functional mixer grinders to remain competitive and attract customers in the market. Stakeholders are implementing an omnichannel marketing strategy to reach many customers worldwide. Diversification in terms of products and places will likely help companies maintain their businesses in the future. Many start-ups are also innovating different products, such as BSH and the Power Smokeless grinder by GoWISE, which can further increase the competition for already existing brands.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of Study

2 RESEARCH METHODOLOGY

3 EXCEUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.3 Market Restraints/ Challenges

- 4.4 Market Opportunities

- 4.5 Value Chain/ Supply Chain Analysis

- 4.6 Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/ Consumers

- 4.6.3 Threat of new Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights on Consumer Buying Behaviour in Mixer Grinder Market

- 4.8 Insights on Technological Disruption in Mixer Grinder Market

- 4.9 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By Product Type

- 5.1.1 Stand Mixer

- 5.1.2 Traditional Mixer

- 5.2 By Distribution Channel

- 5.2.1 Multi-brands Stores

- 5.2.2 Exclusive Stores

- 5.2.3 Online Stores

- 5.2.4 Other Distribution Channels

- 5.3 By End User

- 5.3.1 Residential

- 5.3.2 Commercial

- 5.4 By Geography

- 5.4.1 North America

- 5.4.2 Europe

- 5.4.3 Asia-Pacific

- 5.4.4 Latin America

- 5.4.5 Middle- East and Africa

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Bosch Global

- 6.2.2 Whirlpool Corporation

- 6.2.3 Haier Inc.

- 6.2.4 AB Electrolux

- 6.2.5 Panasonic

- 6.2.6 Morphy Richards

- 6.2.7 Philips

- 6.2.8 Havells

- 6.2.9 LG

- 6.2.10 Samsung*