|

市场调查报告书

商品编码

1644481

印度工业泵:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)India Industrial Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

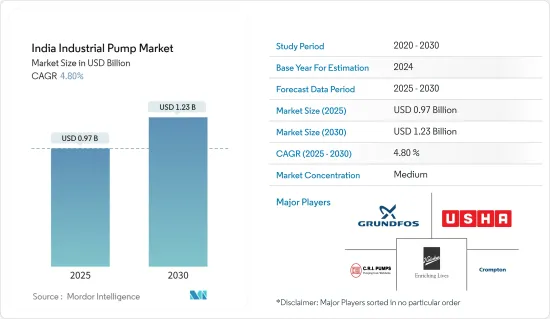

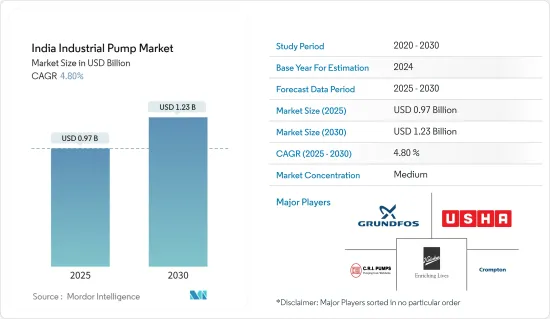

印度工业泵浦市场规模预计在 2025 年为 9.7 亿美元,预计到 2030 年将达到 12.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.8%。

关键亮点

- 从中期来看,工业化和都市化活动的活性化,加上政府的支持倡议,预计将推动印度对工业泵的需求。

- 然而,高昂的营运和维护成本预计会阻碍印度工业泵市场的成长。

- 不断提高技术进步以生产具有更好运作效率的节能泵预计将为印度工业泵市场创造重大机会。

印度工业泵浦市场趋势

离心式帮浦可望主导市场成长

- 离心式帮浦因其高效率而闻名。它旨在有效地将输入能量转换为流体的动能。泵浦设计和技术的进步使现代离心式帮浦能够达到更高的效率,从而降低消费量并降低营业成本。工业对能源效率和永续性的关注推动了对离心式帮浦的需求,离心泵提供了一种经济高效的解决方案。

- 离心式帮浦广泛应用于许多行业。适用于处理各种黏度的液体,使其在供水、污水处理、化学加工、发电、石油和天然气等领域用途广泛。离心式帮浦能够处理大流量和中高压,广泛应用于各种工业製程。

- 此外,与其他泵浦相比,离心式帮浦的安装和维护相对容易。它的结构简单,运动部件少,不易发生机械故障。安装和维护的简单意味着减少停机时间并降低工业营业成本,进一步增加了人们对离心式帮浦的偏好。

- 发电厂,尤其是化石燃料发电厂,需要大量冷却水来维持最佳运作温度。离心式帮浦将冷却水循环通过冷凝水、热交换器和冷却系统的其他部分。离心式帮浦有助于将发电过程中的热量转移到冷却介质,确保发电厂的高效运作。

- 由于基础设施开发活动活性化和人口不断增长,预计预测期内电力需求将大幅增加,从而推动离心式帮浦的需求。

- 例如,截至2023年6月,印度严重依赖火力发电,总设备容量为23,726兆瓦,占全国总发电量的56%以上。

- 此外,2022年9月,印度能源部宣布,准备在2030年增加高达5,600万千瓦的燃煤发电能力,以满足不断增长的电力需求。新增燃煤发电量将比目前285座燃煤发电厂的204吉瓦燃煤发电量高出25%。

- 因此,如上所述,离心式帮浦的需求很可能在预测期内主导市场研究。

石油和天然气产业预计将大幅成长

- 由于人口成长、都市化和工业发展,印度的能源需求不断增加。需求的成长要求扩大石油和天然气的探勘、生产和精製活动,从而增加对该领域的投资。

- 印度政府采取了各种倡议来提高国内石油和天然气产量,减少进口依赖并实现能源安全。开放土地许可政策(OALP)和碳氢化合物勘探和许可政策(HELP)等措施正在吸引对探勘和生产活动的投资,从而推动对工业泵的需求。

- 此外,印度正在建立新的炼油厂和石化综合体,以满足对石油和化学产品日益增长的需求。这些计划需要工业泵用于各种应用,包括原油加工、产品运输和製程流体循环。

- 例如,2023年2月,印度印度斯坦石油公司(HPCL)宣布,将于2024年1月开始营运位于拉贾斯坦邦的巴尔梅尔炼油和石化计划。该计划占地 4,800 英亩,年精製能力为 900 万吨。此外,该计划的石化部分年产量将达240万吨,将大幅减少印度每年约31.4亿美元的石化进口支出。

- 此外,印度的液化天然气(LNG)进口量一直在稳步增长,以满足对清洁能源来源日益增长的需求。再气化过程涉及将液化天然气转换回天然气,这需要工业泵来处理和循环低温流体。

- 2022 年国内天然气总消费量量约为 59,969 百万立方米,而去年同期为 64,159 百万立方米。该国严重依赖天然气,但俄罗斯和乌克兰的衝突扰乱了天然气进口,导致天然气消费量下降。然而,预计预测期内消费量将大幅成长。

- 因此,如上所述,石油和天然气产业很可能在预测期内占据市场研究的主导地位。

印度工业泵产业概况

印度工业泵浦市场是半细分的。主要企业(不分先后顺序)包括 Kirloskar Brother Limited、Grundfos AS、CRI Pumps Pvt. Ltd.、Crompton Greaves Consumer Electricals Limited 和 Usha International Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 工业化的兴起

- 政府倡议

- 限制因素

- 初期投资高

- 驱动程式

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 类型

- 离心式帮浦

- 正排量泵

- 最终用户产业

- 石油和天然气

- 用水和污水

- 化工和石化

- 矿业

- 发电

- 其他的

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Kirloskar Brother Limited

- KSB SE & Co. KGA

- Grundfos AS

- CRI Pumps Pvt. Ltd

- Crompton Greaves Consumer Electricals Limited

- Usha International Limited

- V-Guard Industries Limited

- Xylem Inc.

- Chemlin Pumps and Valves Pvt. Ltd.

- La Gajjar Machineries Pvt. Ltd.

- Unnati Pumps Pvt. Ltd.

- Shakti Pumps (India) Ltd.

- CNP Pumps India Pvt. Ltd.

- Falcon Pumps Pvt. Ltd.

- Kishor Pumps Pvt. Ltd.

第七章 市场机会与未来趋势

- 技术进步

简介目录

Product Code: 72353

The India Industrial Pump Market size is estimated at USD 0.97 billion in 2025, and is expected to reach USD 1.23 billion by 2030, at a CAGR of 4.8% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, the increasing industrialization and urbanization activities coupled with supportive government policies are expected to increase the demand for the industrial pump market in India.

- On the other hand, high operations and maintenance costs are expected to hinder India's industrial pump market growth.

- Nevertheless, the increasing technological advancements in the market to produce energy-efficient pumps with higher operational efficiency are expected to create huge opportunities for the Indian industrial pump market.

India Industrial Pump Market Trends

Centrifugal Pump Expected to Dominate the Market Growth

- Centrifugal pumps are known for their high efficiency. They are designed to convert input energy into fluid kinetic energy efficiently. With advancements in pump design and technology, modern centrifugal pumps can achieve higher levels of efficiency, resulting in lower energy consumption and reduced operating costs. The focus on energy efficiency and sustainability in industries drives the demand for centrifugal pumps as they offer cost-effective solutions.

- Centrifugal pumps have a broad range of applications across various industries. They are suitable for handling liquids of different viscosities, making them versatile in water supply, wastewater treatment, chemical processing, power generation, and oil and gas. The ability of centrifugal pumps to handle high flow rates and moderate-to-high pressures makes them widely applicable in diverse industrial processes.

- Moreover, centrifugal pumps are relatively easier to install and maintain than other pumps. They have a simple construction with fewer moving parts, making them less prone to mechanical failures. This ease of installation and maintenance translates to reduced downtime and lower operational costs for industries, further driving the preference for centrifugal pumps.

- Power plants, particularly thermal power plants, require significant cooling water to maintain optimal operating temperatures. Centrifugal pumps circulate cooling water through condensers, heat exchangers, and other cooling systems. They facilitate the transfer of heat from the power generation process to the cooling medium, ensuring efficient operation of the power plant.

- With the increasing infrastructure development activities and rising population, the electricity demand is expected to increase significantly during the forecasted period, consequently driving the demand for centrifugal pumps since India relies heavily on thermal energy sources for power generation and is likely to continue a similar trend due to the increasing electricity demand.

- For instance, as of June 2023, India heavily relies on thermal power sources for generating electricity, with a total installed capacity of 237.26 GW, accounting for more than 56% of the country's electricity generation capacity.

- Furthermore, in September 2022, the Ministry of Energy India announced that the country is preparing to add as much as 56 GW of coal-fired generation capacity by 2030 to meet the growing electricity demand. The increase in coal-fired capacity would represent a 25% jump above the country's current 204 GW of coal-fueled generation from 285 coal thermal power plants.

- Therefore as per the above-discussed points, the demand for centrifugal pumps will likely dominate the market studies during the forecasted period.

Oil and Gas Sector Expected to Witness Significant Growth

- India's energy demand is continuously rising due to population growth, urbanization, and industrial development. To meet this growing demand, there is a need for expanding oil and gas exploration, production, and refining activities, leading to increased investment in the sector.

- The Indian government has implemented various initiatives to enhance domestic oil and gas production, reduce import dependence, and achieve energy security. Initiatives like the Open Acreage Licensing Policy (OALP) and Hydrocarbon Exploration and Licensing Policy (HELP) have attracted investments in exploration and production activities, which will drive the demand for industrial pumps.

- Furthermore, India is witnessing the establishment of new refineries and petrochemical complexes to cater to the increasing demand for petroleum products and chemicals. These projects require industrial pumps for various applications, including crude oil handling, product transportation, and process fluid circulation.

- For instance, in February 2023, Hindustan Petroleum Corp (HPCL) of India announced to commence operations at its Barmer refinery and petrochemical project in Rajasthan state by January 2024. This project, spanning 4,800 acres, is expected to have a refining capacity of 9 million tonnes annually. Additionally, the petrochemical segment of the project will produce 2.4 million tonnes per year, leading to a significant reduction of approximately USD 3.14 billion in India's annual petrochemical import expenditure.

- Additionally, India's liquefied natural gas (LNG) imports have steadily risen to meet the growing demand for cleaner energy sources. The regasification process involves converting LNG back into natural gas and requires industrial pumps for handling and circulating cryogenic fluids.

- In 2022 the total natural gas consumption in the country was around 59,969 MMSCM compared to 64,159 MMSCM. Although the country heavily relies on natural gas, due to the Russia-Ukraine conflict, natural gas imports were hampered, leading to lower gas consumption. However, it is estimated that consumption is expected to increase significantly during the forecasted period.

- Therefore, as per the points discussed above, the oil and gas sector is likely to dominate the market studies during the forecasted period.

India Industrial Pump Industry Overview

The India industrial pumps market is semi fragmented. Some of the key players (in no particular order) include Kirloskar Brother Limited, Grundfos AS, CRI Pumps Pvt. Ltd., Crompton Greaves Consumer Electricals Limited, Usha International Limited, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Growing Industrialization

- 4.5.1.2 Government Initiatives

- 4.5.2 Restraints

- 4.5.2.1 High Initial Investment

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Centrifugal Pump

- 5.1.2 Positive Displacement Pump

- 5.2 End-User Industry

- 5.2.1 Oil and Gas

- 5.2.2 Water and Wastewater

- 5.2.3 Chemicals and Petrochemicals

- 5.2.4 Mining

- 5.2.5 Power Generation

- 5.2.6 Other End-user Industries

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Kirloskar Brother Limited

- 6.3.2 KSB SE & Co. KGA

- 6.3.3 Grundfos AS

- 6.3.4 CRI Pumps Pvt. Ltd

- 6.3.5 Crompton Greaves Consumer Electricals Limited

- 6.3.6 Usha International Limited

- 6.3.7 V-Guard Industries Limited

- 6.3.8 Xylem Inc.

- 6.3.9 Chemlin Pumps and Valves Pvt. Ltd.

- 6.3.10 La Gajjar Machineries Pvt. Ltd.

- 6.3.11 Unnati Pumps Pvt. Ltd.

- 6.3.12 Shakti Pumps (India) Ltd.

- 6.3.13 CNP Pumps India Pvt. Ltd.

- 6.3.14 Falcon Pumps Pvt. Ltd.

- 6.3.15 Kishor Pumps Pvt. Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements

02-2729-4219

+886-2-2729-4219