|

市场调查报告书

商品编码

1644496

欧洲弹性办公室:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Flexible Office - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

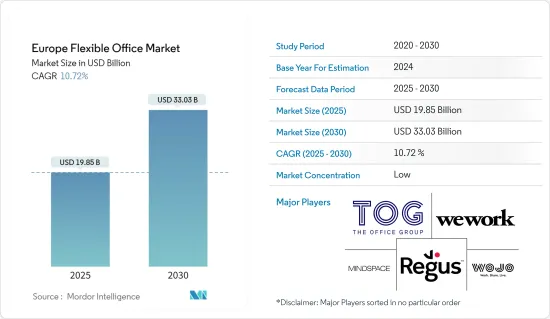

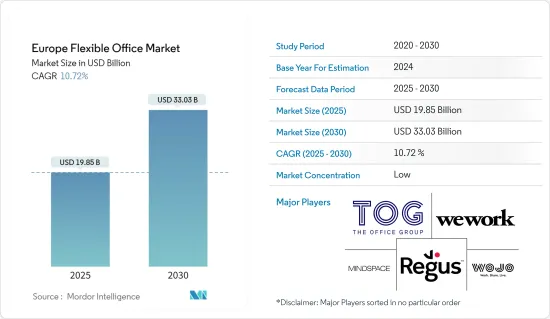

预计2025年欧洲弹性办公市场规模为198.5亿美元,到2030年预计将达到330.3亿美元,预测期内(2025-2030年)的复合年增长率为10.72%。

主要亮点

- 2023 年第一季,欧洲弹性办公空间将占办公空间总使用量的 4%,低于 2019 年的尖峰时段8% 和 2022 年第一季的 7%。排名榜首的是伦敦金融城,占 13%,其次是布拉格(占 8%)和阿姆斯特丹(占 6%)。美国大城市也出现了类似的模式,弹性办公室的使用率从 2019 年的 7% 下降到 2023 年的 1.5%。这一趋势与全球变化相吻合,小型企业正在进入市场并将其业务扩展到大城市以外的地区。

- 中小企业的崛起是欧洲所有主要城市都出现的趋势,新的工作方式与地点和产业无关。这些趋势正在推动欧洲弹性办公市场的发展。该地区的新兴企业数量预计将推动市场成长。

- 数位系统日益增长的重要性以及执行密集型工作的需求导致员工对独立工作的渴望激增,无论是在办公室还是在他们选择的任何地方。

- 这使得欧洲公司有机会透过更好地利用办公空间、减少员工出行时间并提高员工满意度来提高工作效率和生产力。预计这将在预测期内促进灵活办公市场的成长。

- 虽然对灵活办公室的需求持续成长,但采用这种模式仍面临一些障碍。人们普遍关心的是更开放的环境中的资讯安全、保密性和隐私问题。这导致主要企业担心其对行销的潜在影响,尤其是可能会削弱自己的品牌。然而,这些担忧被企业可能需要在投资组合中增加更多灵活空间的风险所抵消。这是由于劳动力市场正在发展,许多雇主难以留住和吸引高技能工人。

欧洲弹性办公市场的趋势

共享办公空间需求不断成长

租户对灵活办公空间和房东安装的办公空间越来越感兴趣。此举是为了因应装修和资金筹措成本的上升,以及开发完工的延迟。选择这些空间将有助于减轻这些风险并为您的租户提供灵活性和便利性。此外,关键位置优质弹性办公空间的稀缺性导致业主对配套空间的需求增加,一些中心报告称其已满租。

传统上,小型租户更喜欢 5,000 平方英尺以下的办公空间,但我们看到 5,000 至 10,000 平方英尺办公空间的交易明显增加。

2022 年,伦敦金融城 10,000 平方英尺以下业主自配空间的交易量将翻倍。 2022 年,房东提供的空间占伦敦金融城所有 10,000 平方英尺以下办公室租赁交易的 42%,较 2021 年的 21% 大幅成长。

此外,对于由业主提供软服务的全面管理空间的需求也日益增长。预计规模较小的租户将继续青睐健身空间,尤其是随着包含软服务的「套装保险契约」变得越来越普遍。

英国占市场主导地位

管理合约在英国越来越受欢迎,到 2023 年上半年将占交易的 43%,而 2019 年仅为 9%。目前,英国有 14 家服务式办公室营运商正在积极寻求超过 20,000 平方英尺的空间,其中 93% 的人倾向于管理合约模式。

受新兴企业、办公室租赁需求飙升以及灵活工作空间出现的推动,伦敦的办公空间市场正在迅速扩张。

中小企业的快速成长是全国性的趋势,新的工作方式超越了地点和产业的界限。

这些动态正在推动伦敦灵活的办公市场,蓬勃发展的Start-Ups公司刺激了该地区的进一步扩张。

伦敦办公大楼市场受到几个关键因素的影响。这些显着的趋势包括竣工数量激增、租赁期限缩短、灵活工作空间领域的强劲增长、以及由于持续关注品质而导致的优质办公空间供应过剩。

2023 年的最新研究强调,伦敦对弹性办公空间的需求日益增长。随着越来越多的企业希望重返办公室,灵活的工作安排为现场办公和远距办公都带来了好处。

需求的增加将导致弹性办公供应的减少和相关成本的增加。例如,2022 年,弹性工作空间中永久办公桌的租金每季增加 3.4%,达到每月 690 英镑(867.19 美元)。

欧洲弹性办公产业概况

欧洲弹性办公市场较为分散,弹性办公空间市场参与者众多。此外,随着对休閒办公环境的需求不断增长,许多公司正在进入市场。欧洲灵活办公市场中的公司正在采取多项成长和扩大策略以获得竞争优势。主要参与者包括 The Office Group、WeWork、WOJO、Regus Group、Mindspace 等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场动态与洞察

- 当前市场状况

- 科技趋势

- 产业价值链分析

- 政府法规和倡议

- 办公室租金洞察

- 办公空间规划洞察

- COVID-19 对市场的影响

第五章 市场动态

- 驱动程式

- 远距工作热潮推动市场

- 新兴企业和小型企业的崛起

- 限制因素

- 提供类似服务的供应商增加将影响市场

- 影响市场的经济不确定性与监管因素

- 机会

- 有潜力拓展尚未开发的市场

- 对远距工作者和自由工作者日益增长的需求也推动了市场的发展。

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者/购买者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 按类型

- 私人办公室

- 共享办公空间

- 虚拟办公室

- 按最终用户

- 资讯科技/通讯

- 媒体与娱乐

- 零售和消费品

- 按地区

- 德国

- 英国

- 法国

- 其他欧洲国家

第七章 竞争格局

- 公司简介

- The Office Group

- WeWork

- WOJO

- Regus Group

- Mindspace

- KNOTEL

- Ordnung ApS

- Matrikel1

- Green desk

- DBH Business Services

- 其他公司

第 8 章:市场的未来

第 9 章 附录

第十章 免责声明

The Europe Flexible Office Market size is estimated at USD 19.85 billion in 2025, and is expected to reach USD 33.03 billion by 2030, at a CAGR of 10.72% during the forecast period (2025-2030).

Key Highlights

- In Q1 2023, flex office take-up in Europe constituted 4% of the total office take-up, marking a decline from its peak of 8% in 2019 and the 7% recorded in Q1 2022. Leading the pack, London City accounted for 13% of the take-up, with Prague at 8% and Amsterdam at 6%. A similar pattern emerged in major US cities, with flex office take-up dwindling from 7% in 2019 to 1.5% in 2023. This trend aligns with a global shift, where smaller operators enter the market and expand their footprint beyond major cities.

- The increase in small and medium-sized businesses is a trend observed across all major cities of Europe, while new working practices are neither location nor sector-specific. These trends have fueled the flexible office market in Europe. The number of startups in the region is expected to boost the market's growth.

- The growing significance of digital systems and the need for completing knowledge-intensive tasks has transformed into a surging desire among employees to work from the office or from any desired location in an independent way.

- This has offered firms in Europe a chance to utilize the office space more proficiently, reduce the traveling hours of employees, and increase employee satisfaction, thereby boosting their work efficiency and productivity. This will help the flexible office market grow during the forecast period.

- Although the demand for flexible office space continues to grow, some obstacles stand in the way of the adoption of this model. Commonly raised concerns include the issues of information security, confidentiality, and privacy in a more open environment. This leads to the companies worrying about the potential impact on their marketing, especially because it could weaken their brands. However, such concerns are outweighed by the risk that companies may need more flexible space in their portfolios. This is due to the developments in the labor market, with many employers worrying about either keeping or attracting the most highly skilled workers.

Europe Flexible Office Market Trends

Increasing Demand for Coworking Spaces

Occupiers are increasingly showing interest in both flexible office spaces and those fitted by landlords. This trend responds to the escalating costs of fit-outs and financing and delays in development completions. Opting for these spaces helps mitigate these risks and offers occupiers enhanced flexibility and convenience. Also, the scarcity of prime flexible office spaces in key locations further fuels the demand for landlord-fitted spaces, with some centers reporting full occupancy rates.

Traditionally, smaller tenants have preferred fitted office spaces, with most deals for spaces under 5,000 sq. ft. However, there has been a noticeable increase in the number of fitted office space deals, ranging from 5,000 to 10,000 sq. ft. This trend is particularly pronounced in the City of London market.

In 2022, the City of London doubled transaction volumes for landlord-fitted spaces below 10,000 sq. ft. Landlord-fitted spaces constituted 42% of all office leasing transactions below 10,000 sq. ft in the City of London in 2022, a significant jump from the 21% seen in 2021.

Additionally, there is a rising demand for fully managed spaces where landlords offer soft services. It is anticipated that smaller tenants will continue to prefer fitted spaces, particularly as 'package deals' that include soft services gain traction.

The United Kingdom Dominates the Market

Management agreements are gaining popularity in the United Kingdom, and they accounted for 43% of deals by H1 2023, a significant jump from just 9% in 2019. Currently, 14 serviced office operators in the United Kingdom are actively searching for spaces exceeding 20,000 sq. ft, and an overwhelming 93% prefer the management agreement model.

London's office space market is rapidly expanding, fueled by its thriving start-ups and IT sectors, surging office lease demands, and the emergence of flexible workspaces.

This surge in small and medium-sized businesses is a nationwide trend, while new work practices transcend location and sector boundaries.

These dynamics drive the flexible office market in London, as the region's burgeoning start-up scene is set to fuel its expansion further.

Several key factors are shaping London's office market. These include notable trends such as a surge in completions, shorter lease terms, robust growth in the flexible workspace segment, and an oversupply of prime office spaces due to a persistent preference for quality.

Recent studies from 2023 have highlighted an increasing demand for flexible office spaces in London. As businesses increasingly call for a return to the office, flexible work arrangements benefit both in-person and remote scheduling.

This heightened demand leads to a dwindling supply of flexible offices and a subsequent rise in costs. For instance, in 2022, the rental cost for a permanent desk in a flexible workspace saw a 3.4% quarterly increase, reaching GBP 690 per month (USD 867.19 per month).

Europe Flexible Office Industry Overview

The European flexible office market is fragmented, with many players existing in the flexible office spaces market. Also, many more companies are entering the market to meet the increasing demand for casual office environments. The European flexible office market companies are involved in several growth and expansion strategies to gain a competitive advantage. The major players include The Office Group, WeWork, WOJO, Regus Group, and Mindspace.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Technological Trends

- 4.3 Industry Value Chain Analysis

- 4.4 Government Regulations and Initiatives

- 4.5 Insights into Office Rents

- 4.6 Insights into Office Space Planning

- 4.7 Impact of COVID-19 on the Market

5 MARKET DYNAMICS

- 5.1 Drivers

- 5.1.1 Booming remote work driving the market

- 5.1.2 Increasing number of start-ups and small businesses

- 5.2 Restraints

- 5.2.1 Growing number of providers offering similar services affecting the market

- 5.2.2 Economic uncertainities and regulatory factors affecting the market

- 5.3 Opportunities

- 5.3.1 The potential to expand into untapped markets

- 5.3.2 The evolving needs of remote workers and freeelancers are also driving the market

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers/Buyers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitute Products

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Private Offices

- 6.1.2 Coworking Spaces

- 6.1.3 Virtual Offices

- 6.2 By End User

- 6.2.1 IT and Telecommunications

- 6.2.2 Media and Entertainment

- 6.2.3 Retail and Consumer Goods

- 6.3 By Geography

- 6.3.1 Germany

- 6.3.2 United Kingdom

- 6.3.3 France

- 6.3.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Overview (Market Concentration and Major Players)

- 7.2 Company Profiles

- 7.2.1 The Office Group

- 7.2.2 WeWork

- 7.2.3 WOJO

- 7.2.4 Regus Group

- 7.2.5 Mindspace

- 7.2.6 KNOTEL

- 7.2.7 Ordnung ApS

- 7.2.8 Matrikel1

- 7.2.9 Green desk

- 7.2.10 DBH Business Services*

- 7.3 Other companies