|

市场调查报告书

商品编码

1644501

德国国内宅配、快捷邮件和小包裹(CEP) -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Germany Domestic Courier, Express, And Parcel (CEP) - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

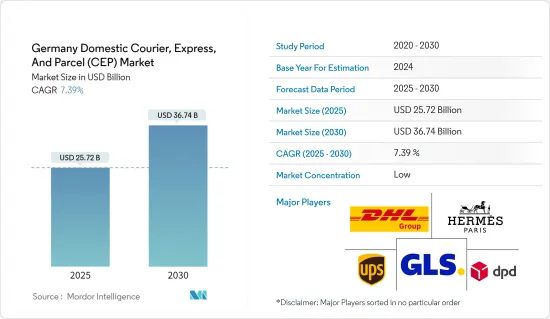

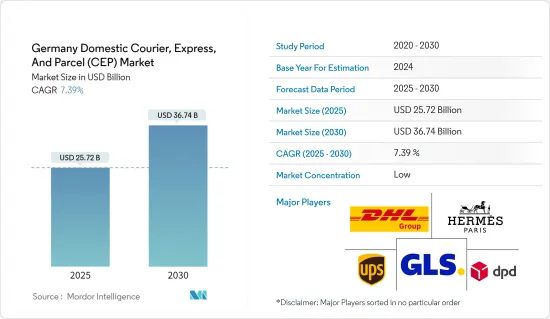

德国国内宅配、快捷邮件和小包裹市场规模预计在 2025 年为 257.2 亿美元,预计到 2030 年将达到 367.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.39%。

关键亮点

- 德国宅配市场主要受电子商务的兴起和互联网的高普及率所推动。

- 德国在物流和运输方面有着丰富的历史,这使得其成为一个充满活力且成熟的小包裹市场。各种经济和政治因素影响着这个市场的发展。因此,德国是欧洲最大的小包裹市场。

- 德国的小包裹市场由众多中小企业组成的活跃格局所支撑。超过 12,000 家公司在德国 CEP 市场上运营,其中北莱茵-威斯特法伦州的公司集中度最高。该市场由德国邮政DHL、爱马仕集团和DPD集团主导。即使在德国 CEP 行业激烈的竞争和技术不断创新的情况下,过去 20 年来,各公司每批货物的收益一直保持稳定。仔细观察收益来源就会发现,小包裹服务是德国 CEP 市场的主要收益驱动力。

- 不断的技术创新正在推动规模收益的提高。历史趋势表明,经济受益于投资创新。在德国CEP市场,企业为了确保技术创新和可观的收益,持续投入大量资源进行研发。这项承诺是明确的:德国 CEP 市场每年平均在创新方面投资超过 2.5 亿欧元(2.7309 亿美元),将其视为对未来利益的策略投资。

- 随着数位化重塑全球社会和经济格局,个人和商业活动越来越依赖网路和智慧型设备。在过去十年中,企业对消费者(B2C)领域一直主导着德国的小包裹运输,约占总量的三分之二。 B2C 销售额的激增凸显了企业与消费者之间直接交易日益增长的重要性。

德国国内宅配、快递与小包裹(CEP) 市场趋势

B2C 市场占据很大份额

B2C电子商务持续连年爆炸性成长。在德国,大型网路商店占该国电子商务总销售额的40%以上。

由于产品种类和竞争因素的增加,德国消费者越来越多地转向网路购物。在此背景下,amazon.de脱颖而出,成为德国网路购物的首选,并拥有最高的收益。

说到网上购物,电子产品位居最受欢迎的商品之首。此外,网路购物的频率也引人注目,超过20%的德国人每月购物数次。德国电子商务各细分领域收益成长预测表明,网路购物趋势持续,时尚和电子产品等类别的收益显着增长。

总而言之,德国 B2C 电子商务格局显示出稳健的成长指标和消费者偏好的变化。但经济压力迫使企业做出策略调整。作为欧洲最大的电子商务市场之一,即使面临当前挑战,德国仍有望继续成长。

基础建设投资推动市场

2024年,德国政府将大力投资加强基础设施,其中570亿欧元(622.6亿美元)将用于绿色计画。此举对于改善运输网路并提高宅配、快递和小包裹(CEP)市场的效率至关重要。

汉堡地铁 U5 线路的开发和 A281 高速公路的拓宽等重大计划旨在提高都市区的连接性和可及性。这种升级对于物流业务至关重要,以确保小包裹及时可靠地递送。

改善的公路和铁路系统预计将缩短运输时间并降低营运成本。透过更顺畅的物流业务,CEP 公司可以扩大规模,以满足快速成长的电子商务产业日益增长的需求。

这项基础建设将会在CEP领域创造就业机会。广泛的物流网络将需要更多的劳动力来满足日益增长的配送需求,在经济成长和弥合产业技能差距方面发挥关键作用。

德国国内宅配、快捷邮件与小包裹(CEP) 产业概况

德国国内 CEP 市场较为分散,存在多家参与者,但没有一家大型参与者占据大部分市场占有率。国内快递主要由 DHL、Hermes、DPD、GLS 和 UPS 等公司主导。 DHL和Hermes等德国公司在国内市场影响,在国际上也拥有强大的影响力。

宅配业者和第三方小包裹营运商正在投资技术,以在全国范围内取得优势并扩大其服务范围。疫情爆发后,网路配送量大幅增加,宅配公司正在寻求利用此机会。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场洞察

- 当前市场状况

- CEP 产业的技术趋势与自动化

- 政府法规和倡议

- 德国物流仓储市场概况

- 德国货运市场概况

- 德国电商板块亮点(国内电商说明)

- 地缘政治与疫情将如何影响市场

第五章 市场动态

- 市场驱动因素

- 电子商务快速扩张推动市场

- 高网路普及率推动市场

- 市场限制

- 影响市场的监管问题

- 影响市场的全球事件

- 市场机会

- 市场驱动的技术进步

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

第六章 市场细分

- 按经营模式

- B2B(B2B)

- B2C(B2C)

- 客户对客户 (C2C)

- 按类型

- 电子商务

- 非电子商务

- 按最终用户

- 服务业(BFSI(银行、金融服务、保险))

- 批发零售(电子商务)

- 医疗

- 製造业

- 其他的

第七章 竞争格局

- 市场集中度概览

- 公司简介

- Deutsche Post DHL

- Hermes

- DPD

- GLS

- UPS

- Steinfurth & Co. GmbH

- Kurierdienst Dago Express

- Overnight Courier Uhlenbrock GmbH

- CCD-Kurier Hamburg

- SPEED Courier Service GmbH*

- 其他公司

第 8 章:市场的未来

第 9 章 附录

- GDP 分布(按活动和地区划分)

- 洞察资本流动

- 经济统计-运输和仓储业对经济的贡献

The Germany Domestic Courier, Express, And Parcel Market size is estimated at USD 25.72 billion in 2025, and is expected to reach USD 36.74 billion by 2030, at a CAGR of 7.39% during the forecast period (2025-2030).

Key Highlights

- The German courier market is mainly driven by increasing e-commerce and high internet penetration.

- Germany boasts a rich history in logistics and transportation, leading to a vibrant and well-established parcel market. Various economic and political influences have shaped the evolution of this market. Consequently, Germany stands as Europe's largest parcel market.

- Germany's parcel market is bolstered by a vibrant landscape of numerous small and medium-sized firms. Over 12,000 companies operate in Germany's CEP market, with North Rhine-Westphalia housing the densest concentration. Dominating the scene are Deutsche Post DHL, Hermes Group, and DPD Group. Even amidst fierce competition and relentless innovation in Germany's CEP industry, firms have managed to maintain consistent revenue per shipment over the past twenty years. A closer look at the revenue streams reveals that parcel services are the primary revenue drivers in Germany's CEP market.

- Continuous innovations drive increasing returns to scale. Historical trends show that economies benefit from investing in innovation. In Germany's CEP market, firms consistently allocate significant resources to research and development, aiming to innovate and secure substantial earnings. This commitment is evident, with the German CEP market investing an average of over EUR 250 million (USD 273.09 Million) annually in innovation, viewing it as a strategic investment for future gains.

- As digitalization reshapes social and economic landscapes globally, there's a heightened dependence on the internet and smart devices for both personal and business activities. Over the past decade, the business-to-consumer (B2C) segment has dominated parcel shipments in Germany, accounting for approximately two-thirds of the total. This surge in B2C sales underscores the growing significance of direct transactions between businesses and consumers.

Germany Domestic Courier, Express, And Parcel (CEP) Market Trends

B2C segment holding a significant share in the market

B2C e-commerce continues to witness explosive growth year after year. In Germany, leading online shops account for over 40 percent of the nation's total e-commerce revenue.

German consumers have a clear affinity for online shopping, driven by factors like a broader product selection and competitive pricing. Dominating this landscape, amazon.de stands out as the top choice for German online shoppers, boasting the highest revenue.

When it comes to online purchases, electronics emerge as the frontrunner in popularity. Additionally, online shopping frequency is notable, with over 20% of Germans making purchases several times a month. Segment-wise forecasts for revenue growth in German e-commerce indicate a lasting trend in online shopping, with categories like fashion and electronics poised for substantial revenue increases.

In summary, Germany's B2C e-commerce landscape showcases robust growth metrics and shifting consumer preferences. However, economic pressures are prompting businesses to make strategic adjustments. As one of Europe's largest e-commerce markets, Germany holds promise for continued growth, even in the face of present challenges.

Infrastructure investments driving the market

In 2024, the German government is channeling substantial funds into infrastructure enhancements, notably dedicating EUR 57 billion (USD 62.26 billion) to green initiatives. This move is pivotal for refining the transportation network, which in turn, boosts the efficiency of the Courier, Express, and Parcel (CEP) market.

Major projects like the U5 Hamburg Subway Line Development and the expansion of Highway A281 aim to bolster connectivity and accessibility in urban areas. Such upgrades are essential for logistics operations, ensuring parcels are delivered timely and reliably.

Improvements in highways and rail systems promise reduced delivery times and lower operational costs. As logistics operations smoothen, CEP companies can scale up to meet the surging demands of the booming e-commerce sector.

These infrastructure upgrades are set to generate jobs in the CEP sector. A broadened logistics network will necessitate a bigger workforce to handle rising delivery demands, playing a vital role in economic growth and bridging skill gaps in the industry.

Germany Domestic Courier, Express, And Parcel (CEP) Industry Overview

The domestic CEP market in Germany is fragmented considering that there are several companies operating in the market with major players not holding most of the market share. Domestic deliveries are dominated by companies like DHL, Hermes, DPD, GLS, and UPS. Companies like DHL and Hermes, which are German companies, have a strong market presence in the country and also a strong international presence.

The delivery and third-party parcel companies are investing in technology to gain an edge and scale up their services in the country. After the pandemic, the volume of online deliveries has increased significantly, and delivery companies are trying to capitalize on this opportunity.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Methodology

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Current Market Scenario

- 4.2 Technological Trends and Automation in the CEP Industry

- 4.3 Government Regulations and Initiatives

- 4.4 Overview of the Logistics and Warehousing Market in Germany

- 4.5 Brief on Germany Freight Forwarding Market

- 4.6 Spotlight on Germany E-commerce Sector (Commentary on Domestic eCommerce)

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid e-commerce expansion driving the market

- 5.1.2 High internet penetration driving the market

- 5.2 Market Restraints

- 5.2.1 Regulatory challenges affecting the market

- 5.2.2 Global events affecting the market

- 5.3 Market Opportunities

- 5.3.1 Technological advancements driving the market

- 5.4 Value Chain/Supply Chain Analysis

- 5.5 Industry Attractiveness - Porter's Five Forces Analysis

- 5.5.1 Threat of New Entrants

- 5.5.2 Bargaining Power of Buyers/Consumers

- 5.5.3 Bargaining Power of Suppliers

- 5.5.4 Threat of Substitute Products

- 5.5.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Business Model

- 6.1.1 Business-to-Business (B2B)

- 6.1.2 Business-to-Customer (B2C)

- 6.1.3 Customer-to-Customer (C2C)

- 6.2 By Type

- 6.2.1 eCommerce

- 6.2.2 Non-eCommerce

- 6.3 By End User

- 6.3.1 Services (BFSI (Banking, Financial Services and Insurance))

- 6.3.2 Wholesale and Retail Trade (E-commerce)

- 6.3.3 Healthcare

- 6.3.4 Industrial Manufacturing

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Market Concentration Overview

- 7.2 Company Profiles

- 7.2.1 Deutsche Post DHL

- 7.2.2 Hermes

- 7.2.3 DPD

- 7.2.4 GLS

- 7.2.5 UPS

- 7.2.6 Steinfurth & Co. GmbH

- 7.2.7 Kurierdienst Dago Express

- 7.2.8 Overnight Courier Uhlenbrock GmbH

- 7.2.9 CCD-Kurier Hamburg

- 7.2.10 SPEED Courier Service GmbH*

- 7.3 Other Companies

8 FUTURE OF THE MARKET

9 APPENDIX

- 9.1 GDP Distribution, by Activity and Region

- 9.2 Insights on Capital Flows

- 9.3 Economic Statistics - Transport and Storage Sector, Contribution to Economy