|

市场调查报告书

商品编码

1644569

全球商用车远端资讯处理 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Commercial Vehicle Telematics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

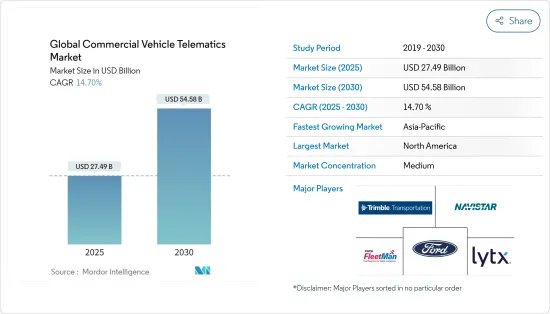

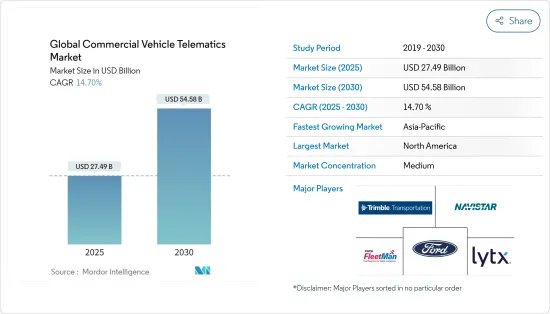

2025 年全球商用车远端资讯处理市场规模预估为 274.9 亿美元,预计到 2030 年将达到 545.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 14.7%。

关键亮点

- 商用车远端资讯处理是指使用两种技术:全球定位系统 (GPS) 和机载诊断(OBD)。 GPS 是一种基于卫星的导航系统,可提供地理空间定位,而 OBD 允许远端资讯处理系统存取有关单一车辆各个系统的资讯。预计市场将进一步受到对联网汽车日益增长的需求的推动,以实现更好的安全管理,以及导航系统和车辆追踪和监控解决方案的部署。

- 连网汽车领域的研究和开发正在蓬勃发展,对该技术的需求来自北美。在欧洲和亚太等地区,商用车在物流、建筑和其他应用领域的使用日益增多,推动了商用车市场的发展。因此,这些地区的远端资讯处理市场预计将会成长。

- 印度政府宣布了与生产连结奖励计画(PLI) - 汽车计划,预算拨款为 35.27 亿美元 (2593.80 亿印度卢比),为期五年(2022-23 财年至 2026-27 财年)。 PLI-AUTO 计画的主要目标是提高先进汽车技术 (AAT) 产品的产量。此外,它还旨在简化和鼓励 AAT 产品的在地化,促进国内和国际供应链的发展。因此,这些投资将有助于投资建构用于车辆安全目的的商用车远端资讯处理软体。

- 由于远端资讯处理领域受到车辆需求的驱动,对商场卡车、皮货车和其他轻型商用车的需求不断增长,以及对安全管理解决方案、保险远端资讯处理和车辆追踪系统的需求不断增长,将推动市场成长。

- 皮卡车、小型卡车和其他轻型商用车等商用车由于通勤方便而快速成长。例如,物流业和电子商务业务的兴起正在推动商用车产量的成长。根据Shopify的资料,到2027年,预计约23%的零售额将在线上完成,预计将推动远端资讯处理市场的成长。

- 智慧型手机和平板电脑已经成为日常生活中不可或缺的一部分,将这些设备与车辆配对可以将车载资料传输到智慧型手机中,以便快速检查即时资料。这使车主能够追踪与速度相关的事故、管理维护成本、节省汽油费用等等。

- 远端资讯处理解决方案的复杂性为业界带来了挑战。需要在硬体、软体和通讯协定上进行大量的前期投资,这是一个障碍,尤其是对于中小型企业 (SME) 而言。此外,还需要保护来自车辆的大量资料,包括位置、驾驶员行为和车辆性能。维护资料安全并遵守隐私法规非常复杂且成本高昂,限制了市场成长。

- 由于对远端工作和监控功能的需求,COVID-19 疫情对市场产生了影响,增加了远端资讯处理系统的价值,并使车队管理人员无需亲自到场即可监督业务。此外,随着网路购物和宅配的兴起,需要高效的车辆管理来应对日益增加的送货量,从而导致了远端资讯处理技术的采用。

全球商用车远端资讯处理市场趋势

OEM部门占据最大市场份额

- OEM部门占据商用车远端资讯处理市场的大部分份额,专注于在製造时将远端资讯处理系统直接整合到商用车中。这种方法为车队营运商和物流供应商提供了全面的嵌入式解决方案。这使得车队管理解决方案能够轻鬆快速地启动和运行,从而推动其采用。

- 随着OEM将远端资讯处理技术直接部署到车辆中,为消费者提供无缝的整合解决方案,远端资讯处理技术正成为车辆不可或缺的一部分。例如,根据国际汽车工业组织(OICA)的资料,亚洲生产的商用车数量正在增加。预计2023年中国产量为403万辆,其次是泰国,其商用车产量约126万辆。因此,随着产量的增加, OEM正在利用远端资讯处理来增强 ADAS(高级驾驶辅助系统)、连接性和远端资讯处理支援的服务等功能。

- 远端资讯处理技术有助于优化各种因素,包括燃料使用和卡车维护。此外,商用车行业广泛采用人工智慧、机器学习和 ADAS(高级驾驶辅助系统)等最新技术,以及对自动驾驶卡车的需求不断增长,对市场成长产生了积极影响。

- 分析认为,产品创新的扩大将为市场贡献巨大。例如,2023 年 10 月,康明斯公司宣布与 Eclipse 基金会和微软合作推出开放式远端资讯处理框架。此创新框架旨在彻底改变商用车的远端资讯处理软体开发。透过使公司能够编写一次远端资讯处理应用程式并将其部署在与开放远端资讯处理框架相容的任何硬体上,有望缩短产品上市时间和营运成本。

- 远端资讯处理和连网解决方案对于提高全球商用车产业的生产力、性能、安全性和驾驶体验至关重要。未来五年,远端资讯处理设备的采用预计将扩展到中型和大型卡车。

亚太地区可望大幅成长

- 预计亚太地区在预测期内将实现显着的成长率,并占据市场的大部分份额。这在很大程度上是由于中国、印度和日本等国家存在主要汽车製造商。该地区政府不断采取的倡议进一步促进了市场的成长。

- 过去十年,随着消费者偏好、法规和技术的发展,汽车变得越来越复杂。预计在连结性、自动化、共用交通和电气化方面的投资将继续增长。随着产品复杂性的增加,製造中心预计将投入更多资金来变得更加敏捷,同时继续开发精实製造方法。

- 中国政府对5G的支援是汽车製造商纷纷涌向中国开发5G联网汽车的重要原因。例如,2023年6月,全球领先的资讯与通讯技术解决方案供应商中兴通讯股份有限公司与知名运输业者天翼交通科技在2023年上海世界移动大会(MWC)上发表了5G+智慧网连网汽车系统。这套系统融合了车-路-云端技术,可望引领汽车产业。此次联合伙伴关係关係涉及签署策略合作协议,致力于加速推出自动驾驶服务。

- 在亚太地区,许多目标商标产品製造商 (OEM) 正在将远端资讯处理技术整合到他们的车辆中,以实现与售后软体的无缝连接。该软体专为车队管理分析和商业性洞察而设计,正变得至关重要。远端资讯处理使OEM能够以无线方式收集各种资料,以满足地理位置和维护要求。

- 此外,亚太地区不断增长的产品创新预计将推动市场成长。例如,2024年1月,印度商用车製造商塔塔汽车宣布将50万辆商用车连接到其先进的连网汽车平台Fleet Edge,这是一个里程碑。 Fleet Edge 使用先进的技术来提高车辆运转率并改善道路安全性。这有助于对车辆状况、健康状况、位置和驾驶员行为等指标进行即时、可操作的洞察。 FleetEdge 协助船东和车队经理优化营运、降低物流成本并提高盈利。

全球商用车远距资讯处理产业概况

商用车远端资讯处理市场是半静态的,拥有许多地区和全球参与企业。市场供应商正致力于扩大海外基本客群,并利用策略合作措施来提高市场占有率和盈利。

- 2024 年 3 月,TRATON 集团成员公司 Navistar Inc. 宣布正在推进其自动驾驶技术,着眼于部署自动驾驶商业试验计画。透过与Plus的策略合作,Navistar将把Plus的SuperDrive Level 4自动驾驶技术融入其国际车辆和其他TRATON品牌车型。 SuperDrive 系统专为国际卡车公司开发,包含涵盖维护、远端资讯处理、安全性和可靠性的综合解决方案。

- 2024 年 1 月,福特汽车公司的商业部门 Ford Pro 推出了一套增强的软体和技术功能。这些创新旨在让车队经理更了解和控制其商用车运营,特别是降低车队风险。 Ford Pro 先进解决方案将把连网汽车的资料整合到 Ford Pro 智慧平台中,从而充分利用这些数据。透过这种集成,车队管理人员可以了解道路上车辆的使用情况以及所配备的设备。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 新冠肺炎疫情的后续影响和其他宏观经济因素将影响市场

第五章 市场动态

- 市场驱动因素

- 连网卡车的需求不断增加

- 利用即时和历史资料降低燃料成本

- 市场限制

- 通讯增加引发安全性和隐私问题

第六章 市场细分

- 按类型

- 解决方案

- 车队追踪和监控

- 驱动程式管理

- 保险远端资讯处理

- 安全与合规

- V2X 解决方案

- 其他解决方案

- 服务

- 解决方案

- 按提供者类型

- OEM

- 售后市场

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Navistar International Corporation

- Ford Motor Company

- Lytx Inc.

- Tata Motors Ltd

- Trimble Inc.

- PTC Inc.

- Volvo Trucks Corporation

- Fleetmatics Pvt. Ltd

- Hino Motors Ltd

- General Motors Company

第八章投资分析

第九章:未来机会

简介目录

Product Code: 90687

The Global Commercial Vehicle Telematics Market size is estimated at USD 27.49 billion in 2025, and is expected to reach USD 54.58 billion by 2030, at a CAGR of 14.7% during the forecast period (2025-2030).

Key Highlights

- Commercial vehicle telematics underlines the usage of two technologies, namely global positioning systems (GPS) and on-board diagnostics (OBD). GPS, as a satellite-based navigation system, provides geo-spatial positioning, and OBD enables telematics systems to access information about various systems in an individual vehicle. The market is expected to be driven further by the growing need for connected vehicles for better safety management and the deployment of navigation systems and fleet tracking and monitoring solutions.

- With significant research and development in the connected automotive sector, the demand for technology is from North America. The use of commercial vehicles for logistics, construction, and other applications has expanded in regions such as Europe and Asia-Pacific, which is driving the commercial vehicle market. As a result, the telematics market in these regions is analyzed to grow.

- The Indian Government announced the Production Linked Incentive (PLI)-Auto Scheme, allocating a budget of USD 3.527 billion (INR 25,938 crore) over a 5-year span (FY2022-23 to FY2026-27). The primary aim of the PLI-AUTO Scheme is to enhance the production of advanced automotive technology (AAT) Products. Additionally, it seeks to streamline and encourage extensive localization for AAT products, fostering the development of domestic and international supply chains. Thus, these investments help in investment in building commercial vehicle telematics software for vehicle safety purposes.

- As the telematics sector is dependent on vehicle demand, the increased demand for mall trucks, pick-up vans, and other light commercial vehicles, alongside the increasing demand for safety management solutions, insurance telematics, and fleet tracking systems, is set to boost the market's growth.

- Commercial vehicles such as pick-up vans, small trucks, and other light commercial vehicles are rapidly increasing due to the ease of commute that they provide. For instance, the rise in logistics industries and e-commerce businesses has resulted in an increase in commercial vehicle production. According to Shopify's data, around 23% of total retail sales are expected to happen online by 2027, which is expected to boost the growth of the telematics market.

- Smartphones and tablets have become an integral part of everyday lives, and these devices are combined with vehicles to allow for the transfer of onboard data to smartphones for quick examination of real-time data. This allows vehicle owners to keep track of speed-related accidents, control maintenance expenses, and save money on gas, among other things.

- The complexity of telematics solutions poses a challenge for the industry. The need for substantial upfront investments in hardware, software, and communication protocols is a barrier, especially for small and medium-sized enterprises (SMEs). Moreover, protecting large amounts of data from vehicles, such as location, driver behavior, and vehicle performance. Maintaining data security and compliance with privacy regulations is complex and costly and restricts the market's growth.

- The COVID-19 pandemic impacted the market as there is a need for remote work and monitoring capabilities, which increased the value of the telematics system, facilitating fleet managers to oversee operations without being physically present. Moreover, with the growth of online shopping and home deliveries, there is a need for efficient fleet management to handle the increasing delivery volumes, leading to the adoption of telematics.

Global Commercial Vehicle Telematics Market Trends

The OEM Segment Holds the Largest Share in the Market

- The OEM segment holds a major share in the commercial vehicle telematics market, which emphasizes integrating telematics systems directly into commercial vehicles during manufacturing. This approach provides fleet operators and logistics businesses with comprehensive, embedded solutions. This facilitates the ability to instantly activate and use the fleet management solution, which is driving the adoption.

- OEMs are deploying telematics technology directly into vehicles, offering consumers seamless and integrated solutions, and telematics technology is becoming a crucial part of vehicles. For instance, as per data from the International Organization of Motor Vehicle Manufacturers (OICA), a growing number of commercial vehicles are produced in Asia. China's production volume was 4.03 million in 2023, followed by Thailand, which produced approximately 1.26 million commercial vehicles. Thus, with the growth of production, OEMs are leveraging telematics to enhance their offerings, facilitating features such as advanced driver assistance systems, connectivity, and telematics-enabled services.

- Telematics technology aids in the optimization of a variety of elements, including fuel usage and truck maintenance. Furthermore, the high adoption rate of modern technologies in the commercial vehicle industry, such as AI, machine learning, and advanced driver assistance systems, and the growing demand for autonomous trucks are positively impacting the market's growth.

- The growing product innovations are analyzed to significantly contribute to the market. For instance, in October 2023, Cummins Inc. announced the collaboration with the Eclipse Foundation and Microsoft to introduce the Open Telematics Framework. This innovative framework aims to revolutionize the development of telematics software for commercial vehicles. By enabling companies to craft their telematics applications once and deploy them across any hardware compatible with the Open Telematics Framework, the initiative is expected to reduce time-to-market and operational costs.

- Telematics and connected solutions are pivotal in elevating productivity, performance, safety, and the driving experience in the global commercial vehicle industry. In the coming five years, they are expected to grow in telematics device adoption from medium to heavy-duty trucks.

Asia-Pacific is Expected to Witness Significant Growth

- Asia-Pacific is expected to hold a significant share of the market, with a significant growth rate during the forecast period, which is largely attributed to the presence of large automotive manufacturers in countries such as China, India, and Japan. The growing government initiatives in the region are further contributing to the market's growth.

- As consumer preferences, regulations, and technology have evolved, vehicles have become increasingly complex during the last decade. Connectivity, autonomy, shared transportation, and electrification investments are expected to continue to grow. Manufacturing centers are expected to spend to become more agile as product complexity grows while continuing to develop lean manufacturing concepts.

- The Chinese government's support for 5G is a significant reason why automakers are rushing to the nation to develop 5G-connected vehicles. For instance, in June 2023, ZTE Corporation, a global leader in information and communication technology solutions, and Tianyi Transportation Technology, a prominent transportation operator, introduced the 5G+ intelligent connected vehicle system at the Mobile World Congress (MWC) Shanghai 2023. This system, integrating Vehicle-Road-Cloud technologies, is expected to drive the automotive industry. The joint partnership was accompanied by the signing of a strategic cooperation agreement, with the commitment to fast-tracking the adoption of autonomous driving services.

- Many original equipment manufacturers (OEMs) are integrating vehicles with telematics technology in Asia-Pacific, allowing seamless connectivity with aftermarket software. This software, tailored for fleet management analytics and commercial insights, is becoming essential. Telematics empowers OEMs to wirelessly collect diverse data to cater to geo-location and maintenance requirements.

- Furthermore, growing product innovations in Asia-Pacific are expected to boost the market's growth. For instance, in January 2024, Tata Motors, India's commercial vehicle manufacturer, announced a milestone achievement by linking 500,000 commercial vehicles to Fleet Edge, its advanced connected vehicle platform. Fleet Edge leverages advanced technologies to increase vehicle uptime and elevate road safety. This facilitated real-time, actionable insights on metrics like vehicle status, health, location, and driver behavior. Fleet Edge empowers owners and fleet managers to optimize operations, reduce logistics expenses, and bolster profitability.

Global Commercial Vehicle Telematics Industry Overview

The commercial vehicle telematics market is semi-consolidated, with many regional and global players. Market vendors are focusing on expanding their customer base across foreign countries and leveraging strategic collaborative initiatives to increase market share and profitability.

- March 2024: Navistar Inc., a member of the TRATON Group, announced that it is advancing its autonomous driving technology in anticipation of rolling out an autonomous commercial pilot program. In a strategic collaboration with Plus, Navistar is set to embed Plus's Level 4 autonomous SuperDrive technology into its international vehicles and other TRATON-branded models. The SuperDrive system, tailored for international trucks, offers comprehensive solutions spanning maintenance, telematics, safety, and reliability.

- January 2024: Ford Pro, the commercial arm of Ford Motor Company, announced the launch of a suite of enhanced software and technology features. These innovations were designed to empower fleet managers with deeper insights and greater control over their commercial vehicle operations, specifically to mitigate fleet risks. Ford Pro's advanced solutions harness data from connected vehicles by integrating it into the Ford Pro Intelligence platform. This integration equips fleet managers with visibility into their vehicles on the road and the usage of fitted equipment.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of the Aftereffects of the COVID-19 pandemic and Other Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Connected Trucks

- 5.1.2 Reduction of Fuel Costs with Real Time and Historical Data

- 5.2 Market Restraint

- 5.2.1 Increased Communication, Leading to Security and Privacy Concern

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Solutions

- 6.1.1.1 Fleet Tracking and Monitoring

- 6.1.1.2 Driver Management

- 6.1.1.3 Insurance Telematics

- 6.1.1.4 Safety and Compliance

- 6.1.1.5 V2X solutions

- 6.1.1.6 Other Solutions

- 6.1.2 Services

- 6.1.1 Solutions

- 6.2 By Provider Type

- 6.2.1 OEM

- 6.2.2 Aftermarket

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Navistar International Corporation

- 7.1.2 Ford Motor Company

- 7.1.3 Lytx Inc.

- 7.1.4 Tata Motors Ltd

- 7.1.5 Trimble Inc.

- 7.1.6 PTC Inc.

- 7.1.7 Volvo Trucks Corporation

- 7.1.8 Fleetmatics Pvt. Ltd

- 7.1.9 Hino Motors Ltd

- 7.1.10 General Motors Company

8 INVESTMENTS ANALYSIS

9 FUTURE OPPORTUNITIES

02-2729-4219

+886-2-2729-4219