|

市场调查报告书

商品编码

1644585

印尼设施管理:市场占有率分析、产业趋势与成长预测(2025-2030 年)Indonesia Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

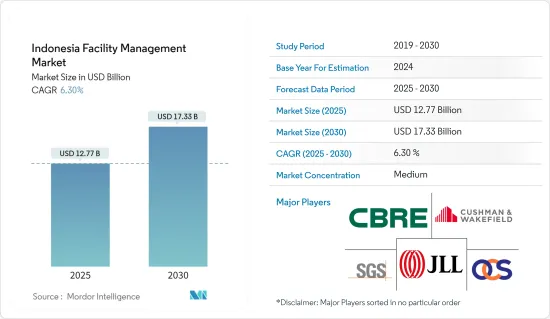

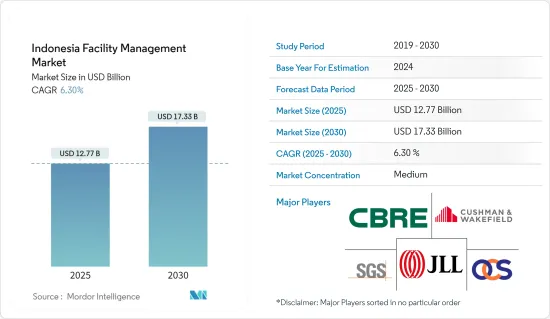

印尼设施管理市场规模预计在 2025 年为 127.7 亿美元,预计到 2030 年将达到 173.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.3%。

在印尼,市场的成长主要归因于设施管理的日益普及。这一趋势主要由抵御干扰、自然灾害和意外事件的復原能力需求所驱动。此外,对环保设施管理服务的需求不断增加,以减少碳排放,从而提升了市场前景。

关键亮点

- 此外,提供即时资料和控制的智慧建筑技术与自动化的整合进一步推动了印尼设施管理的发展。最后,越来越多的企业正在寻找经济高效的设施管理解决方案。

- 预计商业和工业设施需求的增加将推动市场发展,这可能为市场参与企业提供开发新服务以满足客户需求的机会。例如,根据印尼央行的数据显示,印尼商业房地产需求指数自2020年第一季以来一直呈上升趋势,并将在2023年第二季达到高峰+3.85点。需求激增主要是由于零售商数量的增加和外国投资的涌入。此外,2023 年第二季商业房地产租赁供应指数 (CPSI) 年成长 1.63%,高于 2023 年第一季的 1.05% (年成长)。

- 根据 2023 年印尼政府的声明,印尼在 2024 年预算中已拨款 40.6 兆印尼盾(2,700 万美元)用于建设新首都。总统府和 12 套工人公寓预计于 2024 年竣工。 2019年,东南亚地区宣布计画在婆罗洲岛建立新首都努桑塔拉,以取代过度拥挤且正在下沉的雅加达。预计这座新城将于 2045 年完工,耗资 320 亿美元。迄今为止,政府已在水坝和收费公路等基础设施建设上投资了 32 兆印尼币(2,100 万美元)。

- 对于国家对设施管理的需求的认知仍然较低。当地的商业环境带来了巨大的挑战,阻碍了从内部设施管理转向对专业公司的依赖。许多参与企业FM 服务业的企业所面临的另一个挑战是获取新客户所需的努力。挑战源于最终用户对更快的投资回报和更低的前期投资的偏好。

- 印尼GDP的成长对设施管理市场扩张起着至关重要的作用。经济成长推动了建设活动、基础设施开发和房地产投资的激增,所有这些都刺激了对 FM 服务的需求。此外,强劲的经济表现将促使企业将设施管理等非核心业务外包。例如,根据国际货币基金组织的预测,以现行价格计算,印尼的国内生产总值(GDP)预计从 2024 年到 2029 年将成长总合7,191 亿美元(成长 48.73%)。

印尼设施管理市场趋势

硬体设施管理服务领域占据了很大的市场占有率

- 硬设施管理服务是指建筑物实体资产的维护和管理,例如暖通空调系统、电气系统、管道系统和建筑结构。这些服务对于确保您的设施顺利运作以及为居住者维持安全舒适的环境至关重要。

- 国内对空调的需求不断增加可能会推动市场的需求。例如,根据日本冷冻空调工业协会的预测,2023年印尼的空调设备需求量将为269.3万台。 2023年住宅空调保有量将达到262.2万台。

- 在印尼,智慧建筑和绿色建筑实践的兴起推动了节能暖通空调和电气系统的整合,刺激了对专业设施管理服务的需求,以确保正确的安装、维护和监控。此外,印尼的快速经济成长和基础设施扩张推动了都市区和农村对可靠的电力和管道系统的需求。

- 截至 2024 年 7 月,PT Wijaya Karya (Persero) Tbk (WIKA) 已赢得价值印尼币(7.7 亿美元)的新契约。这些新契约的最大贡献来自工业领域,其次是基础设施和建筑、房地产和 EPCC 领域。 7月份的新契约包括母公司及其子公司获得的新合同,例如位于峇里岛曼吉斯综合码头的新1号码头的建设,以及位于雅加达和峇里岛的BMKG InaTEWS(印尼海啸预警系统)建设。

- 截至 2023 年 9 月,PT WIJAYA KARYA (Persero) Tbk (WIKA) 已赢得价值 21.44 万亿印尼币(1400 万印尼币)的新契约,较去年同期的 19.6 万亿印尼盾(1300 万美元)增长 12.5%(同比增长)。新契约成长的主要贡献者是基础设施建筑领域,占49.6%,其次是工业、EPCC、房地产和投资。 9月份的新契约名单包括位于中爪哇和东爪哇之间的Karangnongko大坝计划、北苏门答腊的Gatot Subroto地下通道,以及母公司及其子公司赢得的其他几个合约。

- 再加上政府措施和工业区的扩张,人们越来越关注建筑的永续性,为硬体维修供应商创造了更多的机会。企业和业主对适当的设施管理所带来的长期成本节约和法规遵从性的认识不断提高,这也使市场受益。

- 总体而言,国内商业和零售业的成长正在推动对硬体维修服务的需求。对最佳资产绩效的日益增长的需求、快速变化的技术以及外包趋势预计将在未来几年继续推动市场成长。

工业终端用户产业细分市场占主要市场占有率

- 工业领域涵盖电子、食品饮料和汽车等製造业的主要应用。此外,采矿业和石油天然气产业也为工业部门做出了贡献。由于政府主导的计划、低税率以及有利于自动化和製造业发展的商业友善法规,工业部门对设施管理服务的需求日益增加。

- 2024年5月,斯米克集团旗下雷顿亚洲订单印尼雅加达资料中心建置完工合约。该计划是为现有客户(一家跨国科技公司)开发的,位于资料中心园区内。雷顿亚洲预计将于 2023 年顺利完工。该计划包括安装一个配备机械、电气、管道、消防和安全设施的资料中心,以支援额外的 10MW IT 负载。 2023 年,雷顿亚洲交付了校园基础设施,包括一座拥有两个资料资料的资料以及用于交付、安全和其他营运设施、机械、电气和管道服务、建筑幕墙和外部工程的相关建筑。

- 2024 年 3 月,L&T Construction 透过其日本合作伙伴双日株式会社,赢得了一份价值至少 1.207 亿美元的铁路系统合同,用于印尼雅加达雅加达大众捷运 (MRT) 第 2A 期延伸计划的舾装工程。雅加达地铁第 2A 阶段将是现有雅加达地铁的延伸,从 Bundaran HI 到 Kota 约 12.5 公里,设有 7 个地下车站。

- 此阶段将涉及跨多个学科的各种系统的采购和实施,遵循包括全面系统整合在内的设计-建构方法。计划范围包括轨道工程、架空线系统、变电站系统、配电系统、号誌系统和通讯系统、SCADA设施、屏蔽门、现有OCC、车站和列车安装设备的改造(从第一阶段开始)。

- 印尼正在实现工业化,不断建立新的製造工厂,特别是在电子和汽车等领域。根据印尼统计局的数据,预计 2023 年印尼的汽车进口额将达到约 51.8 亿美元。

- 此外,随着印尼不断提高食品安全和卫生标准,食品和饮料行业严重依赖设施管理来维持遵守卫生法规并确保最佳业务效率。

印尼设施管理产业概况

印尼的设施管理市场高度分散,国内和国际参与企业都拥有数十年的产业经验。综合 FM 供应商透过采用强大的竞争策略来发挥他们的专业知识。他们在广告上花了很多钱。

此外,市场领先的供应商正专注于提供整合解决方案来吸引消费者。预计中小型供应商和新进业者将比大型供应商更加重视保持成本效益,进一步加剧国内的竞争。随着国家公共部门日趋成熟,人们可能会更加关注私营部门。

主要市场参与企业包括 PT.SGS Indonesia(Societe Generale de Surveillance SA(SGS SA))、CBRE GROUP INC.、Cushman &Wakefield PLC、Jones Lang LaSalle Incorporated 和 OCS Group Holdings Ltd.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 评估市场的宏观经济因素

第五章 市场动态

- 市场驱动因素

- 商业和工业设施需求不断增加

- 公共部门对建筑业的投资增加

- 市场限制

- 设施管理服务认知度低

第六章 市场细分

- 按类型

- 内部设施管理

- 设施管理外包

- 单调频

- 捆绑 FM

- 整合调频

- 按服务

- 硬体维修

- 软调频

- 按最终用户产业

- 商业的

- 设施

- 公共/基础设施

- 工业的

- 其他的

第七章 竞争格局

- 公司简介

- PT. SGS Indonesia(Societe Generale de Surveillance SA(SGS SA))

- CBRE GROUP INC.

- Cushman & Wakefield PLC

- Jones Lang LaSalle Incorporated

- OCS Group Holdings Ltd

- PT Shield On Service Tbk(SOS)

- PT Sodexo Sinergi Indonesia(Sodexo Group)

- PT ISS Indonesia(ISS A/S)

- PT Patra Jasa

- PT. Spektra Solusindo

第八章投资分析

第九章 市场机会与未来趋势

The Indonesia Facility Management Market size is estimated at USD 12.77 billion in 2025, and is expected to reach USD 17.33 billion by 2030, at a CAGR of 6.3% during the forecast period (2025-2030).

In Indonesia, the market is witnessing growth primarily due to the rising adoption of facility management. This trend is driven mainly by the need for resilience against disruptions, natural disasters, or unexpected events. Furthermore, there's an increasing demand for eco-friendly facility management services to reduce carbon footprints, bolstering the market's positive outlook.

Key Highlights

- Additionally, the integration of smart building technologies and automation, which offer real-time data and control, further propels facility management's growth in Indonesia. Lastly, businesses are increasingly seeking cost-effective solutions for efficient facility management.

- The rise in the demand for commercial and industrial facilities is expected to drive the market and may create an opportunity for the market players to develop new services that cater to the demands of the clients. For instance, according to Bank Indonesia, Starting in Q1 2020, Indonesia's commercial property demand index has been on the rise, peaking at 103.85 index points in Q2 2023. This surge in demand is largely attributed to a growing number of retailers and an influx of foreign investments in the country. Further, The Commercial Property Supply Index (CPSI) for leased commercial property in the second quarter of 2023 grew 1.63% (yoy), up from 1.05% (yoy) in the first quarter of 2023.

- According to the statement by the government of Indonesia in 2023, in its 2024 budget, Indonesia is allocating IDR 40.6 trillion (USD 0.027 billion) for the construction of its new capital city. The presidential office and a dozen apartment blocks for workers are slated for completion in 2024. 2019 Southeast Asia announced plans to construct a new capital, Nusantara, on Borneo Island to replace the overcrowded and sinking Jakarta. By its projected completion in 2045, the new city is expected to amass a total cost of USD 32 billion. To date, the government has already invested IDR 32 trillion (USD 0.021 billion) in foundational infrastructure, which includes a dam and a toll road.

- Awareness of the country's demand for facilities management remains low. The local business environment poses a significant challenge, hindering a transition from in-house facility management to reliance on professional firms. Another challenge many players in the FM service sector highlight is the effort required to onboard new clients. This challenge stems from end users' preference for quicker ROI and a desire for lower upfront investments.

- The growth of Indonesia's GDP plays a pivotal role in the expansion of the facilities management market. As the economy grows, there's a surge in construction activities, infrastructure development, and real estate investments, all fueling the demand for FM services. Furthermore, robust economic performance motivates businesses to outsource non-core operations, such as facilities management. For instance, according to IMF, Indonesia's gross domestic product (GDP) in current prices is projected to rise by a total of USD 719.1 billion (+48.73 %) from 2024 to 2029.

Indonesia Facility Management Market Trends

Hard Facility Management Offering Segment Holds Significant Market Share

- Hard facility management services refer to maintaining and managing a building's physical assets, such as HVAC systems, electrical systems, plumbing systems, and building structures. These services are essential to ensure the facility's smooth operation and maintain a safe and comfortable environment for its occupants.

- The rise in the demand for air conditioners in the country would propel the demand for the market studied. For instance, according to the Japan Refrigeration and Air Conditioning Industry Association, in 2023, the demand for air conditioning devices in Indonesia amounted to 2,693 thousand units. The residential Air conditioning accounts for 2,622 thousand units in 2023.

- The rise of smart buildings and green construction practices in Indonesia has led to the integration of energy-efficient HVAC and electrical systems, spurring demand for specialized FM services to ensure proper installation, maintenance, and monitoring. Additionally, Indonesia's rapid economic growth and infrastructure expansion are boosting the need for reliable electrical and plumbing systems in both urban and rural areas.

- PT Wijaya Karya (Persero) Tbk (WIKA) secured new contracts worth IDR 11.59 trillion (USD 0.77 billion) as of July 2024. The largest contribution to these new contracts came from the Industrial segment, followed by the Infrastructure & Building, Property, and EPCC segments. Several key projects included in the new contracts in July are the construction of the New Jetty 1 at the Integrated Terminal Manggis in Bali, the BMKG InaTEWS (Indonesia Tsunami Early Warning System) Buildings in Jakarta & Bali, among other contracts secured by both the parent company and its subsidiaries.

- PT WIJAYA KARYA (Persero) Tbk (WIKA) pocketed new contracts amounting to IDR 21.44 trillion (USD 0.014 billion) as of September 2023, growing by 12.5% (Y-o-Y) compared to the same period last year of IDR 19.06 trillion (USD 0.013 billion). The key contribution to the acquisition of new contracts came from the infrastructure and buildings segment at 49.6%, followed by the industrial, EPCC, property, and investment segments. Projects included in the list of new contracts in September include the Karangnongko Dam project located between Central Java and East Java, the Gatot Subroto Underpass, North Sumatra, and several other contracts obtained by both parent and subsidiary companies.

- In addition to this, government initiatives, combined with the expansion of industrial zones, are contributing to the increased focus on building sustainability, creating more opportunities for hard FM providers. The market is also benefiting from the growing awareness among businesses and property owners about the long-term cost savings and regulatory compliance offered by proper facility management.

- Overall, the growth of the country's commercial and retail sectors drives demand for hard FM services. The growing need for optimal asset performance, rapidly changing technology, and the outsourcing trend are expected to continue the market's growth in the coming years.

Industrial End-user Industry Segment Holds Significant Market Share

- The industrial sector covers major applications across manufacturing industries, such as electronics, food and beverage, and automotive. In addition, the mining and oil and gas industries contribute to the industrial sector. The industrial sector has been witnessing an increasing need for facility management services owing to government-anchored projects, low taxes, and business-friendly regulations favoring automation and the manufacturing sector's advancements.

- In May 2024, CIMIC Group company Leighton Asia was selected to fit out a data center in Jakarta, Indonesia. The project was for an existing client, a multinational technology corporation, and is located within a data center campus. Leighton, Asia, successfully delivered in 2023. Work involved fitting out the data center with mechanical, electrical, plumbing, fire protection services, and security to support an additional 10 MW IT load. In 2023, Leighton Asia delivered site infrastructure for the campus, a data center building with two data halls and associated buildings for storage, security, and other operational facilities, as well as mechanical, electrical, and plumbing services, facade and external works.

- In March 2024, L&T Construction won a rail systems contract worth at least USD 120.7 million to fit out the Jakarta Mass Rapid Transit (MRT) Phase 2A extension project through its Japanese partner, Sojitz Corporation, in Jakarta, Indonesia. The Jakarta MRT Phase 2A represents an extension of the current Jakarta MRT Line, covering the stretch from Bundaran HI to Kota, totaling approximately 12.5 km with seven underground stations.

- This phase entails the procurement and implementation of various systems across multiple domains, following a design and build approach, including comprehensive system integration. The project's scope encompasses Trackworks, Overhead Contact System, Substation System, Power Distribution System, Signaling System & Telecommunication Systems, SCADA Facility, Platform Screen Doors, and modifications to the equipment installed in the existing OCC and stations/train sets from Phase 1.

- The rising industrialization in the country, especially in sectors like electronics and automotive, has led to the establishment of new manufacturing plants, which in turn increases the demand for facility management services to maintain and ensure the smooth operation of these complexes. According to Statistics Indonesia, In 2023, the estimated value of motor vehicle imports to Indonesia amounted to approximately USD 5.18 billion.

- Additionally, as Indonesia continues to push for higher standards in food safety and hygiene, the food and beverage sector has significantly relied on facility management to maintain compliance with health regulations and ensure optimal operational efficiency.

Indonesia Facility Management Industry Overview

The Indonesian facility management market is highly fragmented, with both local and international players having decades of industry experience. The integrated FM vendors are leveraging their expertise by incorporating a powerful competitive strategy. They are spending a large chunk of the amount on advertising.

Furthermore, major vendors in the market are focusing on offering integrated solutions to attract consumers. Smaller and new vendors are expected to focus on maintaining cost-benefit over major vendors, further intensifying the competition in the country. A significant share of the focus will be directed toward the private sector, owing to the public sector reaching a mature stage in the country.

Some of the major market players are PT. SGS Indonesia (Societe Generale de Surveillance SA (SGS SA)), CBRE GROUP INC., Cushman & Wakefield PLC, Jones Lang LaSalle Incorporated, OCS Group Holdings Ltd, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of Macroeconomic Factors on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising Demand for Commercial and Industrial Facilities

- 5.1.2 Increasing Public Sector Investment in Construction Activities

- 5.2 Market Restraints

- 5.2.1 Low Awareness about the Facility Management Services

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 In-house Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offerings

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End-user Industry

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Other End-user Industries

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 PT. SGS Indonesia (Societe Generale de Surveillance SA (SGS SA))

- 7.1.2 CBRE GROUP INC.

- 7.1.3 Cushman & Wakefield PLC

- 7.1.4 Jones Lang LaSalle Incorporated

- 7.1.5 OCS Group Holdings Ltd

- 7.1.6 PT Shield On Service Tbk (SOS)

- 7.1.7 PT Sodexo Sinergi Indonesia (Sodexo Group)

- 7.1.8 PT ISS Indonesia (ISS A/S)

- 7.1.9 PT Patra Jasa

- 7.1.10 PT. Spektra Solusindo