|

市场调查报告书

商品编码

1644603

工业紧固件:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Industrial Fasteners - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

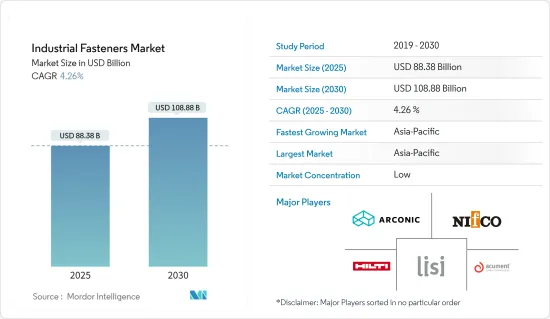

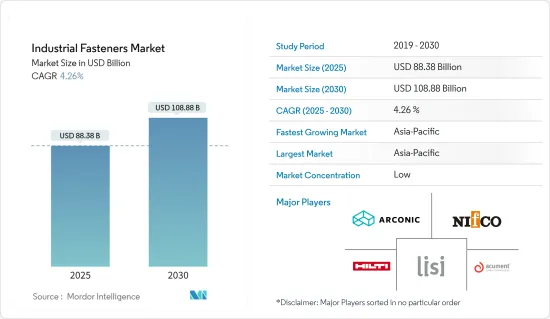

预计 2025 年工业紧固件市场规模为 883.8 亿美元,到 2030 年将达到 1,088.8 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.26%。

市场主要受到建筑、汽车和航太等各行业不断增长的需求的推动。

主要亮点

- 工业紧固件是由金属、塑胶、合金和其他材料製成的多种部件。它们可用于各种地方,以永久或半永久地将两个或多个物体连接或固定在一起。其中许多是机械的,例如螺母、螺栓、铰链、铰链、手柄、铆钉、旋钮、法兰和螺丝。对于工业应用,紧固件通常具有深螺纹。它们通常具有多种形式,包括压紧端盖内六角螺丝、倒刺桿螺纹和滚压端盖未拧紧三通螺母。

- 全球工业部门的成长、安全法规和先进技术的渗透率的显着提高是推动研究市场发展的关键因素之一。过去几十年来,汽车、製造业、航太、食品饮料等产业都实现了显着成长。例如,根据OICA的数据,2022年全球汽车产量约为8,500万辆。

- 紧固件广泛应用于建设产业,以非永久性的方式将两个或多个物体连接在一起,以防止分离、防止接头洩漏和传递负载。近年来,建筑业经历了强劲成长,尤其是在印度、中国和巴西等新兴市场,预计将继续推动研究市场的成长机会。例如,根据巴西奥迪布雷希特公司预测,到2025年,巴西基础建设产业的GDP预计将达到992亿美元,高于2021年的813亿美元。

- 此外,航空工业技术的快速进步也推动了更新、更耐用的航太紧固件的生产。此硬体有助于有效地固定民航机、喷射机、弹道飞弹和太空火箭的零件。

- 然而,预计在汽车行业的黏合和 NVH 应用中,黏合剂和胶带越来越多地替代金属紧固件将限制市场的成长。

- 此外,工业紧固件(尤其是金属紧固件)容易生锈和腐蚀,而塑胶紧固件对热敏感,这仍然是预测期内影响市场成长的主要挑战。

工业紧固件市场趋势

金属板块占据市场主导地位

- 金属紧固件由多种材料製成,包括钢、不銹钢、黄铜、铝、青铜、镍、铜、钛和其他非铁金属。最终使用者对材料的选择主要基于所需强度、腐蚀环境的存在、应力、重量、电磁性能、电气、所需电镀/涂层、预期寿命和再生性等考虑。

- 金属紧固件可以采用多种製造方法生产,包括数控加工和冷镦。据 Boulons Plus & Precision Bolts 称,超过 90% 的紧固件都是由钢製成的,因为钢具有固有的强度特性、易于加工并且与其他材料相比成本相对较低。此外,製造紧固件主要使用三种类型的钢:合金钢、低碳钢和中碳钢。

- 用于工业紧固件的常见不銹钢包括 200、300 和 400 系列,其中主要使用 400 系列,因为它具有高耐腐蚀性以及改进的强度、耐磨性和氧化性能。这些钢材的分类是根据美国钢铁协会 (AISI) 的适用性进行的。

- 製造业、建设业和汽车业等各领域的活动不断增加,推动了对工业金属紧固件的需求。例如,根据联准会的数据,2023年7月美国製造业生产指数达到102.9。

- 对金属紧固件的需求不断增长将鼓励供应商进一步扩大其业务。例如,2023 年 7 月,Commercial Metals Company 从 MiddleGround Capital 收购了 EDSCO Fasteners LLC。 EDSCO Fasteners 是电力传输市场领先的锚固解决方案提供商之一,提供专门设计的锚笼、紧固件和螺栓系列,主要由钢筋製成,广泛用于将高压传输电线电线杆固定到混凝土基础。

快速成长的亚太市场

- 从事汽车、机械和零件製造的跨国和国内公司在亚太地区对其产品的需求正在增加。此外,印度和中国主要製造地製造业务的快速扩张预计将进一步推动市场成长。

- 中国是该地区最大的工业紧固件生产国和出口国之一,拥有多家中小型企业。产业参与者正在投资塑胶和特殊紧固件的研究、开发和生产,以满足最终用户的应用需求并确保竞争激烈的市场中的永续成长。

- 在印度,汽车产业的强劲成长推动了工业紧固件的需求。儘管面临疫情的挑战,印度汽车产业仍在稳步復苏,并受益于政府增加的投资和扶持该产业的倡议。

- 此外,製造业已成为印度高成长产业之一。印度总理推出「印度製造」计划,致力于将印度打造製造地。因此,预计未来几年工业紧固件的需求将会上升。例如,为了支持本地化并减少汽车和其他製造业的进口依赖,印度政府实施了多项与生产挂钩的奖励(PLI)。

- 日本也是亚太地区工业紧固件的重要市场。据日本紧固件协会称,日本紧固件产业由约3,000家製造商组成,每年生产价值约1兆日圆的紧固件。多年来,该地区强劲的经济成长也增强了市场。

工业紧固件产业概况

工业紧固件市场比较分散,由有影响力的参与者组成。其中一些主要参与者目前在市场占有率方面控制着市场。这些在市场上占有重要份额的关键参与者正致力于扩大海外基本客群。这些公司利用策略协作行动来增加市场占有率和盈利。主要市场参与者包括 LISI Group、Nifco Inc.、Acument Global Technologies, Inc. 和 Hilti Corporation。

2024 年 3 月,高科技密封紧固件和开关套管製造商 ZAGO Manufacturing Co. 旨在透过推出专门的义大利语和德语网站,提高喜欢使用母语互动的客户的可近性和参与度。

2023 年 10 月:Brighton-Best International 与 Parker Fasteners 建立策略伙伴关係。这项合作将缩短国产不銹钢插座的前置作业时间,带来紧固件产业的革命。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 疫情对产业的影响

第五章 市场动态

- 市场驱动因素

- 建筑业和汽车市场强劲復苏

- 科技快速进步,研发成本不断上升

- 市场挑战

- 在某些应用中,越来越多地用胶带和黏合剂取代金属紧固件

第六章 市场细分

- 按原料

- 金属

- 塑胶

- 按产品

- 外螺纹紧固件

- 内螺纹紧固件

- 非螺纹紧固件

- 航太级紧固件

- 按应用

- 车

- 航太

- 建筑和施工

- 工业机械

- 家电

- 管道产品

- 其他用途

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Acument Global Technologies, Inc.

- Arconic Corporation

- LISI Group

- Nifco Inc.

- Hilti Corporation

- Stanley Black & Decker, Inc.

- MacLean-Fogg Company

- MISUMI Group Inc.

- Precision Castparts Corp.

- SFS Group

- Illinois Tool Works Inc.

第八章投资分析

第九章:未来市场展望

The Industrial Fasteners Market size is estimated at USD 88.38 billion in 2025, and is expected to reach USD 108.88 billion by 2030, at a CAGR of 4.26% during the forecast period (2025-2030).

The market is majorly driven by the rising demand from different industries like construction, automotive, and aerospace.

Key Highlights

- Industrial fasteners are an extensive range of components made up of metal, plastic, alloy, and other materials. They are used in many places to join or hold together two or more objects permanently or semi-permanently. Many of these are mechanical, such as nuts, bolts, studs, hinges, handles, rivets, knobs, flanges, and screws. For industrial applications, fasteners usually have a deep thread. They typically come in varied forms, such as clinched end-cap socket head cap screws, rod threaded with bar, and rolled end-cap unturned tee nuts.

- The growth of the global industrial sector, wherein the penetration of safety regulations and advanced technologies are increasing significantly, is among the significant factors driving the development of the studied market. Industries such as automotive, manufacturing, aerospace, food, and beverage, among others, have been reporting notable growth in the last few decades. For instance, according to OICA, in 2022, about 85 million motor vehicles were produced globally.

- Fasteners are extensively used in the construction industry to join multiple objects together in a non-permanent way to avoid their separation, preventing leakage of joints and transmitting loads. In recent years, the construction sector, especially in developing regions such as India, China, and Brazil, has witnessed strong growth, which is anticipated to continue to drive opportunities in the studied market. For instance, according to Odebrecht, a Brazilian company, Brazil's infrastructure construction sector's GDP is anticipated to reach USD 99.2 billion by 2025, from USD 81.3 billion in 2021.

- Further, the rapid advancement in technology in the aviation industry has led to the production of newer and more durable aerospace fasteners. The hardware helps to effectively hold the parts of commercial airplanes, military aircraft, jets, ballistic missiles, etc., and space-bound rockets.

- However, an increase in the substitution of metal fasteners for adhesives and tapes in bonding and NVH applications, majorly in the automotive industry, is expected to restrict the market growth.

- Additionally, the susceptibility of industrial fasteners, especially made of metals, to rust and corrosion, while of plastic fasteners to heat also continues to remain among the major challenges that will impact the studied market's growth during the forecast period.

Industrial Fasteners Market Trends

Metal Segment to Dominate the Market

- Metal fasteners are manufactured from various materials, such as steel, stainless steel, brass, aluminum, bronze, nickel, copper, titanium, and other non-ferrous metals. The selection of material by the end users is primarily based on considerations such as strength required, presence of corrosive environment, stresses, weight, electrical and magnetic properties, electrical, plating/coating required, expected life, and reusability.

- Metal fasteners can be manufactured using different fabrication methods, including CNC machining and cold heading. According to Boulons Plus & Precision Bolts, because of its inherent strength properties, workability, and relative cheapness compared to other materials, over 90% of fasteners are made from steel. Additionally, three types of steel are primarily used to manufacture fasteners: alloy steel and low and medium-carbon steel.

- Common stainless steels used for industrial fasteners include the 200, 300, and 400 series, out of which the 400 series is predominantly used as they offer high corrosion resistance with strength, wear resistance, and increased oxidation properties. These steel classifications are done based on their applicability by the American Iron & Steel Institute (AISI).

- The increasing activities across various sectors, such as manufacturing, construction, and automotive, drive the demand for metal industrial fasteners. For instance, according to the Federal Reserve, the manufacturing production index reached 102.9 in the United States in July 2023.

- The growing demand for metal fasteners encourages vendors to expand their presence further. For instance, in July 2023, Commercial Metals Company acquired EDSCO Fasteners LLC from MiddleGround Capital. EDSCO Fasteners is among the leading providers of anchoring solutions for the electrical transmission market, and its offerings include an engineered line of anchor cages, fasteners, and bolts that are primarily manufactured from rebar and used widely to secure high-voltage electrical transmission poles to concrete foundations.

The Asia-Pacific Market to Grow Significantly

- Several multinational and domestic players engaged in automotive, machinery, and Component Manufacturing Operations have increased the product demand across the Asia-Pacific. In addition, the key manufacturing hubs across India and China are further expected to foster market growth due to the rapid expansion of manufacturing operations in these countries.

- China is one of the largest producers and exporters of industrial fasteners in the region, owing to the presence of several small and medium-scale players. Industry players are investing in R&D and production of plastic and specialty fasteners to cater to application-specific demand by end-users and sustainably in the highly competitive market.

- In India, the demand for industrial fasteners is led by the strong growth in the automotive sector. Despite the challenges of the pandemic, the Indian automotive industry is recovering steadily, also benefiting from the increasing government investments and initiatives to support this sector.

- In addition, Manufacturing has emerged as one of the high-growth sectors in India. The Prime Minister of India launched the 'Make in India' program to make India a global manufacturing hub. Thus, the demand for industrial fasteners will likely rise in the coming years. For instance, to support localization and reduce import dependency on the auto and other manufacturing sectors, the Indian government has been running several PLI (production-linked incentive) schemes.

- Japan is also a significant market for industrial fasteners in the Asia Pacific. According to the Fasteners Institute of Japan, The Japanese fastener industry comprises approximately 3,000 manufacturers that produce around JPY 1 trillion (USD 6.9 billion) of fasteners annually. Over the years, the solid economic growth in the region has also strengthened the market.

Industrial Fasteners Industry Overview

The industrial fasteners market is fragmented and consists of some influential players. Some of these important actors currently manage the market in terms of market share. These significant players with a noticeable share in the market concentrate on expanding their customer base across foreign countries. These businesses leverage strategic collaborative actions to improve their market percentage and profitability. Some key market players include LISI Group, Nifco Inc., Acument Global Technologies, Inc., Hilti Corporation, etc.

March 2024: ZAGO Manufacturing Co., a manufacturer of high-tech sealing fasteners and switch boots,launched two new websites catering to the Italian and German markets. By launching dedicated websites in Italian and German, ZAGO aims to enhance accessibility and engagement for customers who prefer to interact with the company in their native languages.

October 2023: Brighton-Best International and Parker Fasteners have formed a strategic partnership. This collaboration is poised to transform the fastener industry by enabling faster lead times on domestic stainless sockets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Impact of COVID-19 Outbreak on the Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Strong Revival in the Construction and Automotive Markets

- 5.1.2 Rapid Technological Advancement and Increased Spending in R&D

- 5.2 Market Challenges

- 5.2.1 Increase in the Substitution of Metal Fasteners by Tapes and Adhesives in Some Applications

6 MARKET SEGMENTATION

- 6.1 By Raw Materials

- 6.1.1 Metal

- 6.1.2 Plastic

- 6.2 By Products

- 6.2.1 Externally threaded fasteners

- 6.2.2 Internally threaded fasteners

- 6.2.3 Non-threaded fasteners

- 6.2.4 Aerospace grade fasteners

- 6.3 By Application

- 6.3.1 Automotive

- 6.3.2 Aerospace

- 6.3.3 Building and Construction

- 6.3.4 Industrial Machinery

- 6.3.5 Home Appliances

- 6.3.6 Plumbing Products

- 6.3.7 Other Applications

- 6.4 By Geography

- 6.4.1 North America

- 6.4.2 Europe

- 6.4.3 Asia

- 6.4.4 Australia and New Zealand

- 6.4.5 Latin America

- 6.4.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Acument Global Technologies, Inc.

- 7.1.2 Arconic Corporation

- 7.1.3 LISI Group

- 7.1.4 Nifco Inc.

- 7.1.5 Hilti Corporation

- 7.1.6 Stanley Black & Decker, Inc.

- 7.1.7 MacLean-Fogg Company

- 7.1.8 MISUMI Group Inc.

- 7.1.9 Precision Castparts Corp.

- 7.1.10 SFS Group

- 7.1.11 Illinois Tool Works Inc.