|

市场调查报告书

商品编码

1644617

远端油箱监控系统:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Remote Tank Monitoring System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

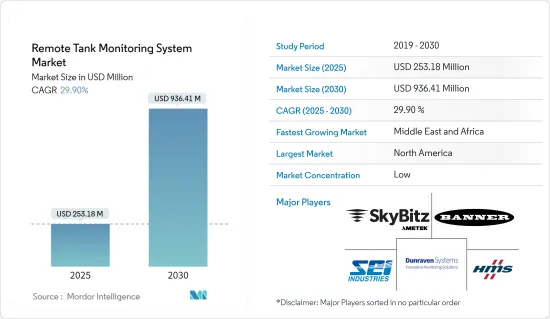

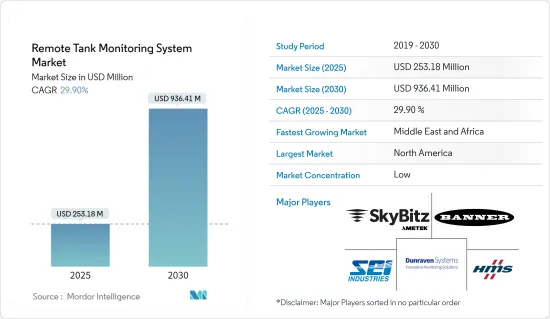

远端油箱监控系统市场规模预计在 2025 年为 2.5318 亿美元,预计到 2030 年将达到 9.3641 亿美元,预测期内(2025-2030 年)的复合年增长率为 29.9%。

支援物联网的远端油箱监控系统透过即时监控油箱液位,彻底改变了流体管理。这些系统由安装在油箱上的感测器和汇总感测器资料的中央网关设备组成。随着物联网和感测器技术的进步,这些系统正在提高资料分析的准确性和可靠性。

主要亮点

- 在市场对更高服务标准和竞争力的需求的推动下,越来越多的企业采用先进的监控技术。这些系统不仅满足了客户的期望,而且还提供了能源管理优势,例如优化能源使用和减少浪费,进一步促进了它们的广泛采用。因此,远端油箱监控系统在各个领域越来越受欢迎。

- 智慧物联网系统将使能源公司能够监控石油和天然气仓储设施,以确保它们能够满足消费者的需求。 Software AG 和 Infosys 等产业参与者正在开发客製化解决方案来满足这些特定需求,例如支援智慧物联网的远端油箱监控系统。儘管仓储设施分布在全球各地,这些解决方案仍可即时洞察储存、接收和消费模式。

- 当今,生产活动对石油燃料的需求不断上升。这项需求涉及从运输原油到精製,再到最终以汽油和柴油等各种形式将精製油发行给最终用户的复杂过程。这个复杂过程涉及车辆运输、精製油罐储存、加油站等,凸显了对强大的远端油罐监控系统的需求。

- 2024 年 4 月,工业资产监控领域的全球领导者 Anova 推出了具有雷达液位感测器的通用油箱监控器。此项技术发展势头强劲,尤其是在管理中型散货箱(IBC)中液体的公司。除了减少包装浪费,该公司还旨在简化这些公司的追踪和管理流程。

- 远端油箱操作的挑战各不相同,并且可能受油箱类型和监控设备的影响。常见问题包括液位测量设备故障、控制阀失灵以及潜在洩漏。这些挑战在维护和维修资源有限的偏远地区更加严重,阻碍了市场的成长。

远端油箱监控系统的市场趋势

石油和天然气行业的扩张推动了对远端油罐监控系统的需求

- 石油天然气和化学工业正在快速成长,对远端油箱监控系统的需求也随之增加。随着这些产业的扩张,对高效、安全的储存槽管理的需求也随之增加。远端油箱监控系统可即时了解储罐液位、压力和温度,让您能够微调库存管理、减少停机时间并避免洩漏和溢出。

- 这些系统不仅提高了业务效率并确保了法规遵循,而且还透过及早发现潜在问题提高了安全性。利用远端监控的企业可以透过简化物流和减少人工检查和维护来降低营运成本。

- 因此,石油天然气和化学工业越来越多地转向先进的远端监控解决方案,以应对其不断扩大的业务的规模和复杂性,同时保持生产力和安全基准。

- 国际能源总署(IEA)报告称,美国已连续六年位居全球原油产量首位,凸显了美国在石油生产领域的主导地位。预计 2023 年美国原油产量(包括冷凝油)平均为 1,290 万桶/日,12 月将达到 1,330 万桶/日以上。

- 2023年,美国、沙乌地阿拉伯和俄罗斯将共同贡献全球石油产量的40%(3,280万桶/日)。儘管自1971年以来,主要生产国的位置偶尔会发生变化,但这三个国家的表现一直优于其他国家。相较之下,接下来的三大生产国伊拉克、加拿大和中国到 2023 年的总合将达到 1,310 万桶/天,超过美国产量。

- 展望未来,石油输出国组织(OPEC)预测轻质石油产品(主要是汽油和乙烷)的需求将增加。到 2045 年,汽油需求预计将激增至每天 2,880 万桶,柴油和汽油总需求预计将达到每天 3,170 万桶,从而支持市场成长。

北美占有最大市场占有率

- 受技术型产业、石油和天然气需求激增以及数位化推动的推动,北美预计将见证远端油箱监控系统的显着成长。

- 美国公司处于领先地位,不仅为石油和天然气提供此类系统,还为水资源管理和农业提供此类系统。这些系统通常在油箱中安装感测器,并将从填充水平到温度的重要资料传递到中央资料库或仪表板。透过利用 GSM 网路和 SMS,这些系统比以前更经济高效且更易于存取。

- 2023 年 5 月,Gallagher Group Limited 与 Gasbot Pty Ltd 签署独家协议,将先进的基于卫星的液体监测系统引入北美。该系统采用 Gasbot 的无线感测器技术,提供液位的即时资料,让农民了解精确的液体管理。此外,卫星通讯意味着偏远地区的农民可以透过行动电话轻鬆取得油箱资料。

- 美国是世界化学製造中心,远端油罐监控系统的应用范围不仅限于石油和天然气。化学品的出口和分销受到严格审查,运输部、国际航空运输协会、环保署等机构发挥关键作用。

- 安格斯能源 (Angus Energy)、Anova 和 ATEK Access Technologies (TankScan) 等公司在北美不断发展的远端油箱监控领域处于领先地位,并迅速适应最尖端科技。

远端油罐监控系统产业概况

远端油箱监控系统市场分散,有 SkyBitz Inc.、Banner Engineering Corp.、EI Industries Ltd. 等多家参与者。市场参与者不断创新新产品和解决方案以满足客户的复杂需求。它还达成了各种合作、收购和协议,以更好地满足不断变化的消费者需求。

2024 年 5 月,AMETEK 液位测量解决方案 (LMS) 推出了 BrightTEK,这是一款尖端的无线工业物联网 (IIoT) 解决方案,旨在重新定义各行业的业务效率和成本效益。 BrightTEK 利用无线技术促进 AMETEK LMS 品牌发射器(包括 Magnetrol、Drexelbrook、Orion Instruments、SWI 和 B/W Controls)的无缝资料传输,提供关键变数的可视性以优化现场操作。 BrightTEK 网路伺服器提供对製程变数(例如储罐液位、容量和位置资料)的即时可见性。可自订的通知、警报和警报允许用户主动管理营运、供应链和库存。

2023 年 12 月,Halo Systems 推出了其 X 系列远端监控解决方案。 Halo 的 X 系列具有两个数位输入、一个类比输入和 SDI-12,可简化流程并最大限度地减少冗余,以满足各种监控需求,包括流量测量、罐和筒仓液位监控、土壤湿度监控等。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 石油天然气和化学工业的快速成长推动了对远端油箱监控系统的需求

- 云端基础的远端油箱监控系统解决方案的兴起

- 市场挑战

- 成本和营运问题

第六章 市场细分

- 按类型

- 完整性监测

- 储罐液位监控

- 基于资产的状态监测

- 按最终用户产业

- 石油和天然气

- 化学

- 饮食

- 水资源管理和处理

- 医疗

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚洲

- 澳洲和纽西兰

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- SkyBitz Inc.

- Banner Engineering Corp.

- SEI Industries Ltd

- Dunraven Systems

- HMS Networks

- ATEK Access Technologies

- Mobiltex

- Schneider Electric

- Powelectrics Limited

- Oriel Systems Limited

第八章投资分析

第九章:市场的未来

The Remote Tank Monitoring System Market size is estimated at USD 253.18 million in 2025, and is expected to reach USD 936.41 million by 2030, at a CAGR of 29.9% during the forecast period (2025-2030).

Remote tank monitoring systems powered by IoT revolutionize fluid management by enabling real-time monitoring of tank fluid levels. These systems consist of sensors affixed to tanks and a central gateway device that aggregates sensor data. With global advancements in IoT and sensor technologies, these systems offer heightened accuracy and reliability in data analysis.

Key Highlights

- Driven by a market demanding higher service standards and a competitive edge, companies are increasingly turning to advanced monitoring technologies. Beyond meeting customer expectations, these systems offer energy management benefits, such as optimized energy usage and reduced wastage, further fueling their adoption. Consequently, remote tank monitoring systems are gaining traction across diverse sectors.

- Smart IoT-enabled systems empower energy companies to oversee their oil and gas storage facilities, ensuring they align with consumer demands. Industry players like Software AG and Infosys have developed tailored solutions, like the smart IoT-enabled remote tank monitoring system, to cater to these specific needs. Despite the global distribution of storage facilities, these solutions provide real-time insights into storage, receipt, and consumption patterns.

- Today, the demand for petroleum fuels in production operations is on the rise. This demand encompasses a complex journey, from crude oil transportation to refining and eventually distributing refined oil to end users in various forms like gasoline and diesel. This intricate process, involving fleet transportation, refined oil tank storage, and filling stations, underscores the necessity for robust remote tank monitoring systems.

- In April 2024, Anova, a global leader in industrial asset monitoring, unveiled its Universal Tank Monitor featuring a radar-level sensor. This technology is gaining momentum, especially among companies managing liquids in intermediate bulk containers (IBCs). It is poised to not only reduce container waste but also streamline tracking and management processes for these businesses.

- Challenges in remote tank operations can vary and can be influenced by the tank type and monitoring equipment. Common issues include faulty level measurement devices, malfunctioning control valves, and potential leakages. These challenges are compounded in remote locations, where access to maintenance and repair resources is limited, posing hurdles to market growth.

Remote Tank Monitoring System Market Trends

The Expanding Oil and Gas Industry is Fueling the Demand for Remote Tank Monitoring Systems

- The oil and gas and chemical industries are witnessing rapid growth, intensifying the need for remote tank monitoring systems. The imperative for efficient and secure storage tank management grows as these industries expand. Remote tank monitoring systems offer real-time insights on tank levels, pressure, and temperature, empowering firms to fine-tune inventory management, curtail downtime, and avert leaks or overflows.

- These systems not only boost operational efficiency and ensure regulatory adherence but also bolster safety by flagging potential issues early. Companies leveraging remote monitoring can streamline logistics, slashing operational costs by reducing manual checks and maintenance.

- Consequently, the oil and gas and chemical industries are increasingly turning to advanced remote monitoring solutions to navigate their expanding operations' scale and complexity, all while upholding productivity and safety benchmarks.

- Highlighting the United States' dominance in oil production, the International Energy Agency (IEA) reported that the country had led global crude oil production for the past six years. In 2023, crude oil production in the United States, including condensate, averaged 12.9 million barrels per day (b/d), peaking at over 13.3 million b/d in December.

- The United States, Saudi Arabia, and Russia collectively contributed 40% (32.8 million b/d) to global oil production in 2023. These three nations have consistently outproduced others since 1971, albeit with occasional shifts in the top producer. In contrast, the combined production of the next three largest producers, Iraq, Canada, and China, stood at 13.1 million b/d in 2023, surpassing the United States' output.

- Looking ahead, the Organization of the Petroleum Exporting Countries (OPEC) projects a rising demand for lighter oil products, particularly gasoline and ethane. Gasoline demand is set to surge to 28.8 million barrels per day by 2045, with diesel and gasoline combined expected to hit 31.7 million barrels daily, underpinning market growth.

North America Holds the Largest Market Share

- North America is poised for significant growth in remote tank monitoring systems, driven by a tech-savvy industry, a surge in oil and gas demands, and a push toward digitization.

- US companies are at the forefront, offering these systems not just for oil and gas but also for water management and agriculture. Typically, these systems employ sensors on tanks, relaying crucial data, from fill levels to temperature, to a central database or dashboard. Leveraging GSM networks and SMS, these systems are now more cost-effective and accessible than ever.

- In a notable move in May 2023, Gallagher Group Limited inked an exclusive deal with Gasbot Pty Ltd, introducing a cutting-edge satellite-based liquid monitoring system to North America. This system, powered by Gasbot's wireless sensor tech, provides real-time data on liquid levels, empowering farmers with precise liquid management insights. Furthermore, it utilizes satellite communication, ensuring that even remote farmers can easily access tank data on their cell phones.

- The United States stands out as a global chemical manufacturing hub where remote tank monitoring systems find applications beyond oil and gas. Oversight on chemical exports and deliveries is stringent, with bodies like the Department of Transportation, the International Air Transport Association, and the Environmental Protection Agency playing pivotal roles.

- Companies like Angus Energy, Anova, and ATEK Access Technologies (TankScan) are leading the charge in North America's evolving remote tank monitoring landscape, adapting swiftly to cutting-edge technologies.

Remote Tank Monitoring System Industry Overview

The remote tank monitoring system market is fragmented, with various players like SkyBitz Inc., Banner Engineering Corp., and EI Industries Ltd. The market players constantly innovate new products and solutions to cater to their customers' complex needs. They are also entering various partnerships, acquisitions, and agreements to better cater to the evolving demands of consumers.

In May 2024, AMETEK Level Measurement Solutions (LMS) introduced BrightTEK, a state-of-the-art wireless Industrial Internet of Things (IIoT) solution built to redefine operational efficiency and cost-effectiveness in various industries. BrightTEK leverages wireless technology to facilitate seamless data transmission from AMETEK LMS branded transmitters, including Magnetrol, Drexelbrook, Orion Instruments, SWI, and B/W Controls, providing visibility to key variables to help optimize on-site operations. The BrightTEK web server provides real-time insights into process variables such as tank levels, volume, and location data. Users can proactively manage their operations, supply chain, and inventory with customizable notifications, alerts, and alarms.

In December 2023, Halo Systems launched its X Series remote monitoring solution. With two digital inputs, one analog input, and SDI-12, Halo's X Series streamlines processes and minimizes redundancy for various monitoring needs, including flow metering, tank or silo level monitoring, and soil moisture monitoring.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid growth of Oil and gas and Chemical Industries Creating Growing Requirement for Remote Tank Monitoring Systems

- 5.1.2 Increasing Cloud-based Solutions for Remote Tank Monitoring Systems

- 5.2 Market Challenges

- 5.2.1 Cost and Operational Concerns

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Integrity Monitoring

- 6.1.2 Tank Level Monitoring

- 6.1.3 Equipment-Based Condition Monitoring

- 6.2 By End-user Industry

- 6.2.1 Oil and Gas

- 6.2.2 Chemical

- 6.2.3 Food and Beverage

- 6.2.4 Water Management and Treatment

- 6.2.5 Medical

- 6.2.6 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia

- 6.3.4 Australia and New Zealand

- 6.3.5 Latin America

- 6.3.6 Middle East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 SkyBitz Inc.

- 7.1.2 Banner Engineering Corp.

- 7.1.3 SEI Industries Ltd

- 7.1.4 Dunraven Systems

- 7.1.5 HMS Networks

- 7.1.6 ATEK Access Technologies

- 7.1.7 Mobiltex

- 7.1.8 Schneider Electric

- 7.1.9 Powelectrics Limited

- 7.1.10 Oriel Systems Limited