|

市场调查报告书

商品编码

1644620

线性稳压器电源管理 IC:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Linear Regulator Power Management IC - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

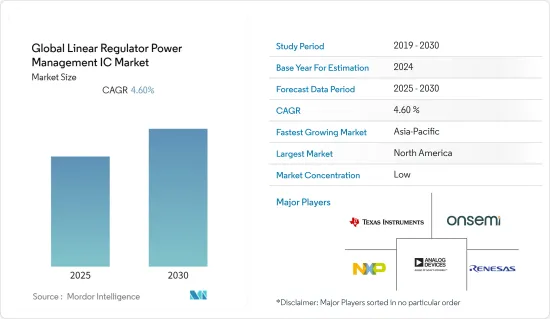

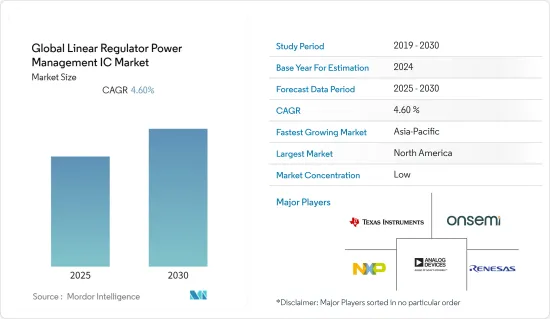

预计预测期内全球线性调节器和电源管理 IC 市场的复合年增长率将达到 4.6%。

线性稳压器在电子设备中的应用越来越多,因为它们可以从输入电压输出较低的稳态电压。在电子设备内部,感测器、MCU等元件需要稳定的电压,线性稳压器IC主要从电池供应的电源产生后续系统所需的电压。

汽车产业是线性稳压器PMIC的主要消费者之一。预计汽车行业的成长将推动所调查市场的成长。欧洲汽车工业协会称,2021年前9个月欧洲乘用车註册量成长8.0%,达1,100万辆。

过去几年,消费性电子产品市场也经历了显着的成长。例如,根据美国人口普查局和CTA的数据,美国智慧型手机销售额预计将在2021年增加到747亿美元。随着线性稳压器电源管理IC(PMIC)在智慧型手机和穿戴式装置等产品中的应用,其需求预计会增加。

然而,线性稳压器PMIC具有无法提高输入电压、由于热损失大导致效率低等局限性,这可能会限制所调查市场的长期成长。

COVID-19 对研究市场产生了重大影响,主要是由于供应链中断和终端用户行业的需求不稳定。例如,欧洲汽车产业受到严重影响,汽车整体产量下降。不过,随着情况恢復正常,汽车领域对线性稳压器电源管理IC(PMIC)的需求预计将增加。

线性稳压器电源管理 IC 的市场趋势

消费性电子领域占较大市场占有率

消费性电子产品功能的不断增强以及智慧型装置和智慧型穿戴装置的日益普及是预计在预测期内推动线性稳压器电源管理 IC 采用的一些关键因素。高效能行动装置(包括 5G)的日益普及以及人工智慧和高效能运算 (HPC) 等先进技术的渗透正在推动对线性稳压器电源管理 IC 的需求。

智慧型手机占据了很大的市场占有率,随着5G智慧型手机的出现,需求预计会进一步增加。三星等全球公司正在加大对半导体业务的投资,以成为 5G 智慧型手机领域的知名智慧型手机供应商。

智慧型手錶和健身带等智慧穿戴装置的日益普及和功能也推动了行动消费领域的成长。此外,由于智慧家庭的日益普及,预计预测期内智慧家电的应用和销售成长将显着扩大。

许多家用电子电器产品製造商也正在加大市场投入,开发更节能的电源管理线性稳压器。有多家公司生产节能积体电路,特别是针对消费和工业应用。

此外,2021 年 3 月,MagnaChip 半导体公司推出了一种具有超快速瞬态响应的新型低压差 (LDO) 线性稳压器,用于基于通用快闪记忆体 (UFS) 的多晶片封装 (MCP)。 UFS 是 eMMC(嵌入式多媒体控制器)的演变,旨在提供更快的读写速度。包含 UFS 控制器和记忆体 IC(例如 DRAM 和NAND快闪记忆体)的记忆体模组称为基于 UFS 的 MCP。它主要用于智慧型手机的储存目的。

亚太地区将经历最高成长

亚太地区在汽车和消费性电子产品领域正在经历显着的成长。由于这些是线性稳压器电源管理IC的主要终端用户产业,因此整个全部区域的需求正在增加。

随着亚太地区各区域政府加大对这些领域的投资,预计所研究的市场将会成长。例如,根据IBEF的数据,到2025年,印度家用电器和家用电子电器产业规模预计将成长一倍以上,达到1.48兆印度卢比。此外,2000 年 4 月至 2021 年 12 月期间,印度电子产业吸引了 31.9 亿美元的外国直接投资。

中国作为最大的汽车製造国,正在进一步加大对汽车领域的投资,以巩固其市场领导地位。例如,2021年12月,中国政府取消了一些外商投资限制,以促进国内汽车製造业的发展。

中国政府对半导体产业的日益重视,导致对线性稳压器电源管理IC的需求增加。该国积极的成长策略目标是到 2025 年透过国内生产满足中国 70% 的半导体需求。此外,「十四五」科技自主规划(2021-2025年)也支持政府设定的目标。

线性稳压器电源管理 IC 产业概况

线性调节器电源管理 IC 市场竞争激烈,有许多地区和全球参与者。主要参与者包括德克萨斯、安森美半导体、恩智浦半导体、ABLIC Inc. 和瑞萨电子。

2022 年 4 月-瑞萨电子推出了一款低成本线性稳压器,可从电信和资料通讯应用中常用的中间分散式电压产生低压偏压电源。这些设备用作Start-Ups或连续低功率调节器。

2022 年 3 月 - ROHM 半导体公司宣布推出新电源技术 QuiCur,该技术可改善负载瞬态响应特性,包括 LDO(线性稳压器)后级的响应速度和电压稳定性。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业价值链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 消费性电子产品的快速成长推动了对线性稳压器电源管理IC的需求

- 高可靠性、低成本

- 市场限制

- 调节大功率负载的局限性

第六章 市场细分

- 按应用

- 车

- 消费性电子产品

- 产业

- 通讯设备

- 其他最终用户

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 世界其他地区

第七章 竞争格局

- 公司简介

- Texas Instruments Incorporated

- On Semiconductor

- STMicroelectronics

- Analog Devices Inc.

- NXP Semiconductors

- Renesas Electronics Corporation

- Microchip Technology Inc.

- Infineon Technologies AG

- Maxlinear

- Infineon Technologies AG

第八章投资分析

第九章:市场的未来

The Global Linear Regulator Power Management IC Market is expected to register a CAGR of 4.6% during the forecast period.

As a linear regulator can output a lower steady voltage from the input voltage, they are increasingly being used in electronic devices. Inside an electronic device, components such as sensors and MCUs require a steady voltage, a linear regulator IC creates the necessary voltage for subsequent systems mainly from the power supplied by the battery.

The automotive industry is among the major consumer of linear regulator PMICs. The growth of the automotive industry is expected to drive the growth of the studied market. According to European Automobile Manufacturers Association, Europe's passenger car registrations went up by 8.0% to 11 million units during the first nine months of the year 2021.

The consumer electronics market has also witnessed significant growth over the past few years. For instance, according to US Census Bureau and CTA, the value of smartphone sales in the United States was forecasted to increase to USD 74.7 billion in 2021. As linear regulator Power Management ICs (PMIC) are used in products such as smartphones, wearables, etc., the demand is expected to witness an upward trend.

However, limitations of linear regulator PMICs, such as their inability to step up the input voltage, and lower efficiency due to high heat loss, may limit the growth of the studied market in the longer run.

The significant impact of COVID-19 has been observed on the studied market, primarily due to supply chain disruption and unstable demand across its end-user industries. For instance, the European automotive industry was severely impacted and experienced a decline in overall automotive production due to stringent supply chain disruption caused by imposed lockdowns. However, with the conditions returning to normalcy, the demand for linear regulator Power management ICs (PMIC) is expected to increase in the automotive sector.

Linear Regulator Power Management IC Market Trends

Consumer Electronics Sector to Hold Significant Market Share

The increasing functionality of consumer electronic products and the growing adoption of smart devices and smart wearables are some of the major factors expected to drive the adoption of Linear Regulator Power Management IC over the forecast period. The growing adoption of like high-performance mobile devices (including 5G) and increasing penetration of advanced technologies, like AI and High-performance computing (HPC), is fuelling the need for Linear Regulator Power Management ICs

Smartphones command a significant market share, and with the advent of 5G smartphones, the demand is expected to increase even further. Global companies, like Samsung, are increasingly investing in the semiconductor business to become prominent smartphone vendors in the 5G smartphone space.

The growing adoption of smart wearables, like smartwatches and fitness bands, and their increasing functionality are also expanding the growth of the mobile and consumer segment. Besides this, smart appliances are expected to see significant applications and growth in their sales over the forecast period, owing to the increasing penetration of smart homes.

Many consumer electronic companies are also increasing their investments in the market studied to develop more energy-efficient Power management liner regulators. Several companies are manufacturing energy-efficient ICs, especially for the consumer and sectors.

Further, in March 2021, Magnachip Semiconductor Corporation announced the availability of a new low-dropout (LDO) linear regulator with the ultra-fast transient response for use in a Universal Flash Storage (UFS)-based Multi-Chip Package (MCP). UFS is a more advanced version of the Embedded Multi-Media Controller (eMMC), designed for faster read and write performance. A memory module with a UFS controller and memory ICs, such as DRAM or NAND flash, is known as a UFS-based MCP. It is primarily utilized in smartphones for storage purposes.

Asia-Pacific Region to Witness Highest Growth

Asia-Pacific has witnessed remarkable growth across various automotive and consumer electronics sectors. As these are the major end-user industries for linear regulator power management ICs, their demand has been increasing across the region.

With the various regional governments of the Asia Pacific region increasing their investments in these sectors, the studied market is expected to grow. For instance, according to IBEF, India's appliances and consumer electronics industry is expected to more than double to reach INR 1.48 lakh crore by 2025. Furthermore, the electronic goods sector in India has attracted FDI inflows of USD 3.19 billion between April 2000-December 2021.

China, the largest manufacturer of motor vehicles, is further increasing its investment in the automotive sector to strengthen its position as the market leader. For instance, in December 2021, the Chinese government removed several limits on foreign investment to boost automotive manufacturing in the country.

The growing emphasis on the semiconductor industry by the government of China is leading to the increase in demand for liner regulator power management ICs. The country's aggressive growth strategy will meet 70% of China's semiconductor demand with domestic production by 2025. In addition, the 14th Five Year Plan (2021-2025) for technology independence also supports the goal set by the government.

Linear Regulator Power Management IC Industry Overview

The Linear Regulators Power Management IC Market is competitive, with many regional and global players. Key players include Texas Instruments, On Semiconductors, NXP Semiconductors, ABLIC Inc., and Renesas Electronics Corporation.

April 2022 - Renesas launched low-cost linear regulators to generate a low voltage bias supply from intermediate distributed voltages commonly used in telecom and datacom applications. These devices will be used as start-ups or continuous low power regulators.

March 2022 - ROHM Semiconductor announced a new power supply technology, QuiCur, that improves the load transient response characteristics involving response speed and voltage stability of subsequent stages of LDOs (linear regulators).

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Industry Value Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rapid growth of Consumer Electronics Creating Growing Requirement for Linear Regulator Power Management ICs

- 5.1.2 Higher Reliability and Low Cost

- 5.2 Market Restraints

- 5.2.1 Limitations When Regulating High Power Load

6 MARKET SEGMENTATION

- 6.1 By Application

- 6.1.1 Automotive

- 6.1.2 Consumer Electronics

- 6.1.3 Industrial

- 6.1.4 Communication

- 6.1.5 Other End-Users

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Rest of the World

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Texas Instruments Incorporated

- 7.1.2 On Semiconductor

- 7.1.3 STMicroelectronics

- 7.1.4 Analog Devices Inc.

- 7.1.5 NXP Semiconductors

- 7.1.6 Renesas Electronics Corporation

- 7.1.7 Microchip Technology Inc.

- 7.1.8 Infineon Technologies AG

- 7.1.9 Maxlinear

- 7.1.10 Infineon Technologies AG