|

市场调查报告书

商品编码

1644639

中东和非洲纸袋:市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)Middle East & Africa Paper Bags - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

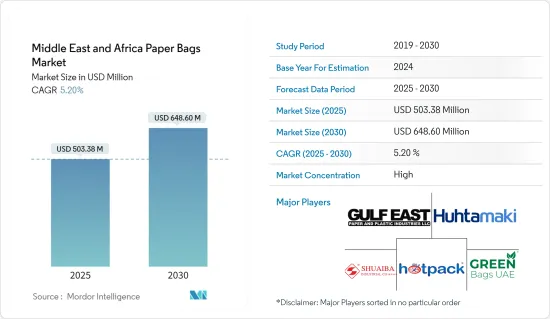

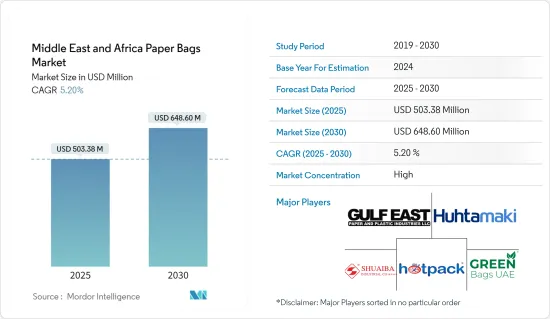

中东和非洲纸袋市场规模预计在 2025 年为 5.0338 亿美元,预计到 2030 年将达到 6.486 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.2%。

关键亮点

- 餐厅、旅馆、咖啡馆和餐饮场所对纸袋的使用率急剧上升。越来越多的人偏好在旅途中用餐,以及网路杂货配送的兴起,进一步推动了这一趋势。中东国家生活方式的改变大大增加了餐饮业对纸包装的需求。现今的消费者更喜欢方便、可立即提供能量的餐点。此外,纸袋的生物分解性和可回收性等环境效益也使其在具有环保意识的消费者中越来越受欢迎。

- 此外,都市化正在带来消费行为的重大改变。现今的消费者花费更多时间在户外参与社交聚会、户外活动和体育活动。因此,外出用餐的需求不断增加。越来越多的健康食品选择迎合了这一趋势,以满足城市居民快节奏的生活方式。

- 旨在限制塑胶使用的政府法规正在推动该地区纸袋市场的发展。为了实现永续性目标,阿联酋计划从 2024 年 1 月起禁止使用一次性塑胶袋。该倡议由 2022 年第 380 号部长决议推动,该决议规范并要求逐步淘汰包括塑胶购物袋在内的一次性塑胶製品。阿联酋还计划于 2026 年禁止外带食品包装中常见的发泡聚苯乙烯包装。

- 阿治曼市政府和规划部门已宣布禁止使用塑胶购物袋,这股势头可见一斑。此外,阿联酋每年的5月16日都会举办「无塑胶购物袋日」活动,以强调其减少塑胶垃圾的努力。这些发展反映了全部区域对永续包装解决方案的追求,推动了对纸袋和其他环保替代品的需求。

- 此外,随着多家公司加强在该地区的业务,沙乌地阿拉伯的纸袋市场也有望成长。 LuLu 大型大卖场采取重大倡议,在沙乌地阿拉伯所有门市推出了一系列可重复使用的纸袋。该倡议符合抵制塑胶使用和支持环境保护的更大策略。 LuLu 的积极倡议恰逢沙乌地阿拉伯国庆节,使其成为该国大卖场中的先驱,并带动了人们更多地采用环保纸袋。

- 可靠、便携的纸质产品已经存在多年,但它们的寿命却带来了挑战。纸袋主要由纤维素纤维製成,可以由原始材料製成,也可以从树木中回收製成。造纸业正面临原物料成本上涨和供应瓶颈的困境。该地区原材料供应和成本的波动严重阻碍和减缓了包装市场的成长。激烈的价格竞争迫使供应商降低价格以保持竞争力和价格负担能力。

中东和非洲纸袋市场的趋势

零售领域可望满足大量需求

- 零售业正在经历显着成长,快餐店(QSR)越来越多地采用一次性包装,尤其是纸袋,以降低环境风险。纸袋之所以受欢迎,是因为它们生物分解性、再生性和可回收。此外,特殊场合社交聚会的增加也进一步推动了该国对纸袋的需求。

- 纸张的可回收性质是推动市场扩张的关键因素,使供应商能够实现其永续性目标。此外,政府对塑胶使用的严格监管和消费者日益增强的环保意识进一步推动了纸袋的普及。市场也受益于纸袋製造技术的进步,这使得纸袋更加耐用、功能齐全,成为塑胶袋的可行替代品。

- 阿布达比环境局也禁止使用一次性塑胶袋。同时,杜拜政府将推出新收费,旨在遏制该酋长国一次性塑胶的使用。这些禁令和政府措施有望扩大该地区的纸袋市场。此外,随着旅游业的成长和零售业经济活动的发展,预计未来几年对纸袋的需求将会飙升。

- 电子商务的兴起大大改变了零售业格局。这种改变消费者习惯和零售模式的变革趋势在中东地区尤其强劲。由于人均收入高、物流、网路存取不断扩大以及精通技术的消费者数量不断增加,这一领域为行业相关人员提供了巨大的潜力。沙乌地阿拉伯的零售额预计将从 2021 年的 1,261 亿美元成长。预计到 2024 年将达到 1,556 亿美元,为纸袋市场创造机会,重点是禁止使用替代包装选项。

预计阿联酋将占据主要市场份额

- 由于民众精通科技以及政府积极推动数位经济的发展,阿拉伯联合大公国已成为中东线上市场的领导者。强大的基础设施、精简的物流、有利于商业的法律以及杜拜作为区域电子商务中心的崛起,使得阿联酋的电子商务市场蓬勃发展。网路商务的蓬勃发展吸引了本地新兴企业和跨国公司来到杜拜,巩固了该市作为领先电子商务目的地的地位。因此,全球纸袋公司也正在向该地区扩张,并与当地製造商和配送合作伙伴合作。

- 此外,政策和合规性将对纸袋製造业的发展轨迹产生重大影响。随着对一次性塑胶的限制越来越多,製造商面临越来越大的压力,需要遵守该地区严格的环境和废弃物管理标准。消费者偏好的变化以及电子商务和宅配的快速增长,激发了人们对纸袋的购买兴趣。这一趋势反映了消费行为的变化,并为企业探索提供了有利可图的途径。对永续包装解决方案日益增长的需求使得製造商能够创新和扩大其产品线以满足市场需求。

- Deliveroo UAE 报告称,受全国杂货订单大幅增长的推动,其按需杂货业务实现强劲增长。 2023年,杜拜的订单激增62%,阿布达比的订单激增135%,导致按需杂货站点数量增加了一倍。这一增长反映了 Deliveroo UAE 的战略扩张,为该地区的纸袋製造商创造了机会。

- 此外,根据美国农业部对外农业服务局的数据,2020 年阿联酋食品电商零售额从 4.21 亿美元成长至 10.72 亿美元。这也催生了使用纸袋送餐的市场。

- 电子商务公司正在创新和合作以促进永续性并创造市场机会。例如,线上食品配送领域的知名参与者 Deliveroo UAE 已根据公司的环境、社会和管治(ESG) 策略推出了一家新的基于网路的包装商店。与具有环保意识、以可回收和生物分解性解决方案而闻名的 Syneo Packaging 合作,为伙伴关係关係带来了专业知识。透过该平台,Deliveroo 的餐厅合作伙伴将获得 20 种环保物品,从纸袋和瓶子到食品容器、餐巾和刀叉餐具。

中东和非洲纸袋产业概况

中东和非洲纸袋市场正在整合。然而,由于几家现有的参与企业在全球具有强大的影响力,供应商正专注于扩大其在中东的市场影响,以最大限度地扩大其在该地区,特别是在新兴市场的影响力。主要企业包括 Gulf East Paper and Plastic Industries LLC、Hotpack Packaging LLC、Shuaiba Industrial Company (KPSC) 和 Green Bags UAE。

2023 年 6 月,零售商 Spinneys 和阿联酋永续包装供应商 Hotpack Global 联手开创了一项开创性的倡议。两家公司联合推出了一系列完全由 100% 消费后回收 (PCR) 树脂製成的购物袋。这项里程碑彰显了 Spinneys 对永续性的承诺,这种环保包装解决方案使其成为阿联酋零售业的先驱。

2023 年 6 月,全球永续包装和纸张公司 Mondi 推出了针对建筑领域的突破性水溶性袋 SolmixBag。 SolmixBag 是一种一体式创新产品,设计用于容纳和运输水泥和砂浆混合物等干燥建筑必需品;在混合阶段与水接触后,袋子会无缝溶解,纤维与产品交织在一起。这不仅减少了废弃物,而且还降低了纸张管理成本。此外,袋子无需打开即可直接放入搅拌机,大大减少了施工现场的灰尘。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场动态

- 市场驱动因素

- 电子商务领域纸袋包装的不断增长

- 市场问题

- 对材料可得性的担忧

第六章 市场细分

- 按类型

- 白色工艺

- 布朗工艺品

- 最终使用者类型

- 零售

- 食物

- 建造

- 农业和化学

- 其他的

- 按国家

- 阿拉伯聯合大公国

- 沙乌地阿拉伯

- 南非

- 奈及利亚

第七章 竞争格局

- 公司简介

- ENPI Group

- Huhtamaki Group

- Gulf East Paper and Plastic Industries LLC

- Hotpack Packaging LLC

- Shuaiba Industrial Company(KPSC)

- Green Bags UAE

- Maimoon Papers Industry

- Bag The Future(Pinnacle Enterprises General Trading LLC)

- Western Modern PAC

- Waks Paper Bags Manufacturing LLC

第八章投资分析

第九章:市场的未来

The Middle East & Africa Paper Bags Market size is estimated at USD 503.38 million in 2025, and is expected to reach USD 648.60 million by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

Key Highlights

- Restaurants, hotels, cafes, and catering establishments are witnessing a surge in the adoption of paper bags. This trend is further fueled by the rising preference for on-the-go dining and the rise in online grocery deliveries. The changing lifestyle dynamics in Middle Eastern countries are notably amplifying the demand for paper-based packaging in the food service sector. Today's consumers prefer convenient, on-the-go food options, looking for a fast energy boost. Additionally, the environmental benefits of paper bags, such as biodegradability and recyclability, are driving their popularity among eco-conscious consumers.

- Further, urbanization has led to a significant shift in consumer behavior. Modern consumers spend more time away from home at social gatherings, outdoor events, or sports activities. Consequently, the demand for on-the-go food options is on the rise. This trend is also supported by the increasing availability of diverse and healthy food choices that cater to the fast-paced lifestyle of urban dwellers.

- Government regulations aimed at curbing plastic usage are propelling the paper bag market in the region. In line with its sustainability goals, the United Arab Emirates planned to ban single-use plastic bags starting in January 2024. This initiative is driven by Ministerial Resolution No. 380 of 2022, which regulates and mandates the phasing out of single-use plastic products, including plastic bags. The United Arab Emirates is also eyeing a ban on Styrofoam containers, commonly found in takeaway food packaging, slated for 2026.

- The momentum is further evident as the Ajman Municipality and Planning Department have already taken steps to announce a ban on plastic bags. Additionally, the Emirates observes an annual 'Plastic Bag Free Day' on May 16, emphasizing its commitment to reducing plastic waste. These measures reflect a broader regional trend toward sustainable packaging solutions, driving demand for paper bags and other eco-friendly alternatives.

- Also, the paper bags market in Saudi Arabia is poised for growth, as several companies are ramping up their operations in the region. LuLu hypermarkets made a significant move by unveiling a range of reusable and paper bags in all its Saudi stores. This initiative aligns with a larger strategy to combat plastic usage and champion environmental conservation. LuLu's proactive stance coincides with Saudi National Day, positioning it as a pioneer among the Kingdom's hypermarkets and setting the stage for increased adoption of eco-friendly paper bags.

- While reliable and easily transportable paper products have existed for some years, their longevity has brought challenges. Paper bags, primarily crafted from cellulose fibers, can be sourced from either virgin materials or recycled from trees. The paper industry grapples with escalating raw material costs and supply bottlenecks. Fluctuations in raw material availability and costs in the region have significantly disrupted and delayed the growth of the packaging market. Intense price competition has compelled vendors to slash prices, aiming to stay competitive and affordable.

Middle East & Africa Paper Bags Market Trends

The Retail Segment is Expected to Address a Major Demand

- The retail industry is witnessing significant growth, with quick-service restaurants (QSRs) increasingly turning to disposable packaging, particularly paper bags, to mitigate environmental risks. Paper bags are favored for their biodegradability, reusability, and recyclability. Moreover, the rising trend of social gatherings during special occasions further fuels the demand for paper bags in the country.

- The recyclable nature of paper stands out as a pivotal factor propelling the market's expansion, enabling vendors to align with sustainability objectives. Additionally, the government's stringent regulations on plastic usage and the increasing consumer awareness regarding environmental conservation are further driving the adoption of paper bags. The market also benefits from technological advancements in paper bag manufacturing, which enhance durability and functionality, making them a viable alternative to plastic bags.

- The Abu Dhabi Environment Agency has also banned single-use plastic bags. At the same time, the Dubai government is set to introduce new charges aimed at curbing the use of single-use plastics in the Emirates. These bans and government initiatives are poised to expand the paper bag market in the region. Moreover, with a rising influx of tourists and developing economic activities in the retail sector, the demand for paper bags will surge in the coming years.

- The rise of e-commerce has profoundly reshaped the retail landscape. This transformative trend, altering consumer habits and retail frameworks, is gaining momentum, particularly in the Middle East. The sector holds immense promise for industry players, buoyed by robust per capita income, advanced logistics, expanding internet access, and tech-savvy consumers. Retail sales in Saudi Arabia have shown an upward trend from USD 126.10 billion in 2021. They are projected to reach USD 155.60 billion by 2024, creating an opportunity for the paper bag market with a focus on the ban on alternative packaging options.

The United Arab Emirates is Expected to Hold Significant Share in the Market

- The United Arab Emirates (UAE) emerges as a frontrunner in the Middle East's online market, propelled by a tech-savvy populace and a proactive government keen on nurturing a digital economy. With robust infrastructure, streamlined logistics, and business-friendly laws, coupled with Dubai's rising prominence as a regional e-commerce hub, the UAE's e-commerce landscape is thriving. This surge in online commerce draws local startups and global enterprises to establish their presence, cementing Dubai's status as a premier e-commerce destination. This attracts global paper bag companies that are also spreading their presence in the region and collaborating with domestic manufacturers and delivery partners, which boosts the need for packaging in various end-user segments.

- Further, policy and compliance significantly influence the trajectory of the paper bag manufacturing industry. With tightening regulations on single-use plastics, manufacturers are compelled to adhere to the region's stringent environmental and waste management standards. Shifting consumer preferences and the surge in e-commerce and home deliveries fuel a rising appetite for paper bags. This trend reflects evolving consumer behavior and presents a lucrative avenue for businesses to explore. The increased demand for sustainable packaging solutions allows manufacturers to innovate and expand their product lines to meet market needs.

- Deliveroo UAE reports robust growth in its on-demand grocery segment, marked by a substantial surge in grocery orders nationwide. In 2023, the platform witnessed a twofold increase in on-demand grocery sites, with orders spiking by 62% in Dubai and 135% in Abu Dhabi, underscoring a dedicated response to shifting consumer demands. This growth reflects Deliveroo UAE's strategic expansion and creates opportunities for paper bag manufacturers in the region.

- Further, as per the USDA Foreign Agricultural Service, the retail value of food e-commerce in the United Arab Emirates grew in 2020; it was USD 421 million, which increased to USD 1,072 million. This has also created a market for the use of paper bags in food delivery.

- E-commerce companies have different innovations and collaborations to promote sustainability and create market opportunities. For instance, Deliveroo UAE, a prominent player in the online food delivery sector, has unveiled a new web-based packaging store, aligning with its Environmental, Social, and Governance (ESG) strategy. In collaboration with eco-conscious Sineo Packaging, a player in recyclable and biodegradable solutions, the initiative brings expertise to this partnership. Through the platform, Deliveroo's restaurant partners gain access to a selection of 20 eco-friendly items, ranging from paper bags and bottles to food containers, napkins, and cutlery.

Middle East & Africa Paper Bags Industry Overview

The Middle East and African paper bags market is consolidated. However, owing to several established players with a global presence, the vendors are focusing on expanding their market presence in the Middle East, especially in the developing regions, to maximize their market presence. Gulf East Paper and Plastic Industries LLC, Hotpack Packaging LLC, Shuaiba Industrial Company (KPSC), Green Bags UAE, and others are key players.

In June 2023, Spinneys, a retail player, and Hotpack Global, a UAE-based sustainable packaging provider, joined forces to pioneer a groundbreaking initiative. Together, they have unveiled a line of shopping bags crafted exclusively from 100% post-consumer recycled (PCR) resins. This milestone underscores Spinneys' commitment to sustainability, positioning them as the trailblazer in the UAE's retail landscape with this eco-friendly packaging solution.

In June 2023, Mondi, a global player in sustainable packaging and paper, unveils SolmixBag, a revolutionary water-soluble bag tailored for the construction sector.SolmixBag, a single-ply paper innovation, is engineered to house and convey dry construction essentials like cement and mortar mixes. Upon contact with water during the mixing phase, the bag dissolves seamlessly, intertwining its fibers with the product. This not only curbs waste but also slashes paper management expenses. Moreover, directly placing the bag into the mixer without prior opening significantly reduces dust on construction sites.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Growth of Paper Bags Packaging in the E-commerce Sector

- 5.2 Market Challenges

- 5.2.1 Concerns Regarding the Availability of Material

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 White Kraft

- 6.1.2 Brown Kraft

- 6.2 End-user Type

- 6.2.1 Retail

- 6.2.2 Food

- 6.2.3 Construction

- 6.2.4 Agriculture & Chemical

- 6.2.5 Other End-user Types

- 6.3 By Country

- 6.3.1 United Arab Emirates

- 6.3.2 Saudi Arabia

- 6.3.3 South Africa

- 6.3.4 Nigeria

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 ENPI Group

- 7.1.2 Huhtamaki Group

- 7.1.3 Gulf East Paper and Plastic Industries LLC

- 7.1.4 Hotpack Packaging LLC

- 7.1.5 Shuaiba Industrial Company ( KPSC )

- 7.1.6 Green Bags UAE

- 7.1.7 Maimoon Papers Industry

- 7.1.8 Bag The Future(Pinnacle Enterprises General Trading LLC)

- 7.1.9 Western Modern PAC

- 7.1.10 W A K S Paper Bags Manufacturing LLC