|

市场调查报告书

商品编码

1644653

美国工程服务:市场占有率分析、产业趋势、统计数据、成长预测(2025-2030 年)United States Engineering Services - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

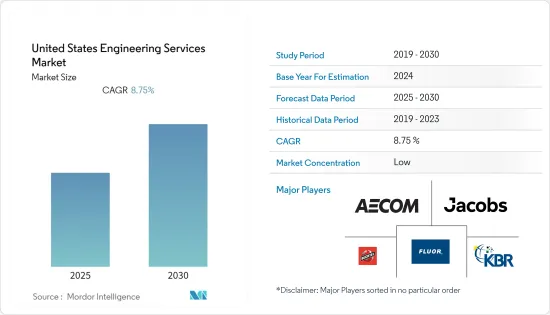

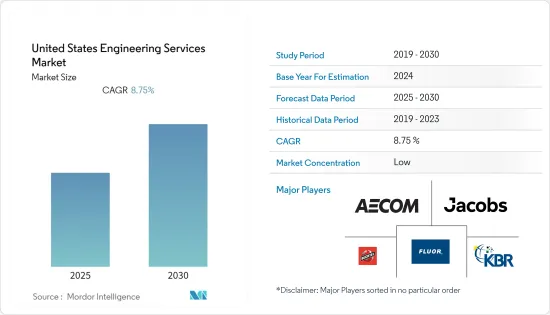

预计预测期内美国工程服务市场复合年增长率将达到 8.75%

关键亮点

- 数位化是市场的主要驱动力之一,它推动企业寻求现代 IT 解决方案,例如工程分析、物联网 (IoT) 和人工智慧 (AI),以获得竞争优势并保持发展势头。其背景是工业IoT在各行各业的应用日益广泛,推动了对管理复杂互联基础设施的工程服务的需求激增。

- 例如,2022 年 5 月,Aecom 表示其数位 Aecom PlanEngage 平台已在 Microsoft Azure 市场上线,这是一个用于购买和销售经认证可在 Azure 上运行的云端产品的线上市场。数位化 AECOM 整合了 Aecom 全球数位化重点咨询服务、託管服务产品以加速客户的数位化历程并改善计划成果,以及数位技术以改善核心工程和设计服务的交付。

- 此外,在预测期内,政府措施和大规模投资将推动工程服务市场的需求。例如,2021年11月,美国政府通过了一项两党基础设施法案《基础设施投资与就业法案》,这是对国家基础设施和竞争力的重要投资。这项两党共同支持的基础设施法案将修復美国的道路、桥樑和铁路,改善安全饮用水的获取,确保所有美国人都能使用高速互联网,应对气候危机,推进环境保护,并投资于那些经常被抛在后面的人们。

- 为了清理维护和维修积压,减少港口和机场的拥挤和排放,并促进电气化和其他低碳技术,该法案将向港口基础设施和水道投资 170 亿美元,向机场投资 250 亿美元。

- 在新冠疫情为众多产业带来重创的当下,美国公共建筑业是少数能够维持相对稳定的产业之一。虽然短期内建筑活动可能会继续,但在过去,由于供应链中断、分包商或材料短缺以及为控製成本而终止合约等各种因素,建筑施工很快就被迫停止。

美国工程服务市场的趋势

土木工程服务预计将大幅成长

- 公共和私营部门对住宅、商业、医疗保健和教育基础设施建设计划的支出增加,以及政府恢復劣化基础设施的倡议,推动了土木工程行业的强劲增长。

- 美国土木工程师学会表示,如果美国致力于确保其基础设施系统的未来发展,就必须从真正的、长期的、定期的投资开始。为了弥补2.59兆美元的投资缺口,满足未来需求,重新获得国际竞争力,到2025年,公共和私营部门的基础设施投资必须从GDP的2.5%增加到3.5%。

- 近年来,各联邦机构都透过投资重视桥樑维护。自 2010 年以来,已有 37 个州提高或改变了汽油税,以资助其中的许多工作。儘管国家增加了资金投入,美国在桥樑建设上的整体支出仍然不足。

- 根据联邦公路管理局最新的《现况与绩效报告》,现有桥樑修復积压费用估计为1,250亿美元,为改善此一状况,桥樑修復支出需要增加58%,从每年144亿美元增至227亿美元。经过分析,这些因素对预测期内的市场成长率做出了重大贡献。

预测期内建筑业预计将出现更高成长

- 公共工程建设是指公共和私人对电力、排水和水利基础建设的投资总合。这些发展需要先进的工程服务来确保安全有效的运作。预计预测期内公共产业建设价值将会扩大,这对该行业来说是一个积极的机会。

- 根据美国人口普查局预测,2022年4月建筑支出预计为1.7448兆美元,较3月修订后的1.7406兆美元增加0.2%。 2022 年 4 月的数值为 15,535 亿美元,比 2021 年 4 月的估计值高出 12.3%。 2022年1-4月建筑支出为5,208亿美元,较2021年同期的4,633亿美元成长12.4%。

- 因此,政府投资支持正在推动国内建筑业投资增加,预计将显着促进市场成长。

- 2022 年 4 月,德克萨斯州运输部(TxDOT) 选择 AECOM 作为东南连接器计划的领导工程公司,该专案旨在提高沃斯堡地区通勤者的流动性、安全性和可及性。

- 2022 年 5 月,奥斯汀交通局 (ATD) 选择 AECOM 作为工程顾问,以补充 ATD 现有的劳动力。 AECOM 将根据 ATD 的目标,即开发一个可满足该地区多样化需求的便利、可靠的交通网络,与奥斯汀交通官员提供全面的工程设计、评估和协调。

美国工程服务业概况

由于 AECOM、Bechtel Corporation 和 Flour Corporation 等多家全球性公司的存在,美国工程服务市场竞争激烈。过去十年,全球各工程公司为了在市场上站稳脚步,纷纷进行合併与联盟。

- 2022 年 6 月-德克萨斯州将位于德克萨斯州奥斯汀的 35 号州际公路 (I-35) 首都快线南段计划的建设合约授予福陆公司 (TxDOT)。 2022年第二季度,福陆公司的合约价值约为5.48亿美元。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 私人对大型计划的投资不断增加以及天然气和石油价格的回升可能会推动工业客户的需求。

- 技术进步意味着更短的前置作业时间和减少的资源开销

- 市场限制

- 市场对宏观环境和监管格局变化的敏感性

- 内部和外包工程服务业的比较分析

- 了解供应商产品(产品工程、程式工程、自动化、资产管理的趋势与发展)

第六章 市场细分

- 按工程领域

- 土木工程

- 机器

- 电

- 环境

- 按最终用户产业

- 建造

- 石油和天然气

- 製造业

- 公共产业

- 运输

- 其他的

- 地区

- 西方

- 中西部

- 东北

- 南部

第七章 竞争格局

- 公司简介

- AECOM

- Jacobs Engineering Group

- Bechtel Corporation

- Fluor Corporation

- KBR Inc.

- HDR Inc.

- Terracon

- Black & Veatch Holding Company

- Jensen Hughes

- ECS Group of Companies

第八章投资分析

第 9 章:未来趋势

简介目录

Product Code: 91029

The United States Engineering Services Market is expected to register a CAGR of 8.75% during the forecast period.

Key Highlights

- One of the key driving factors of the market is digitalization, which has prompted businesses to demand modern IT solutions such as engineering analytics, the internet of things (IoT), and artificial intelligence (AI) to acquire a competitive advantage and sustain the company's momentum. This is due to the growing use of industrial IoT in various industry verticals, which has resulted in a surge in demand for engineering services to manage the complex connected infrastructure.

- For instance, in May 2022, Aecom stated that its Digital AECOM's PlanEngage platform is available on the Microsoft Azure Marketplace, an online marketplace for buying and selling cloud products certified to run on Azure. Digital AECOM brings together AECOM's global digital-focused consulting services, hosted services products to help customers accelerate their digital journeys and improve project outcomes, and digital technologies to improve its core engineering and design services delivery.

- Further, the government initiatives and significant investments are analyzed to bolster the demand for the engineering services market during the forecast period. For instance, in November 2021, The United States government passed the Bipartisan Infrastructure Act (Infrastructure Investment and Jobs Act), a significant investment in the country's infrastructure and competitiveness. This bipartisan infrastructure bill will repair America's roads, bridges, and rails, increase access to safe drinking water, ensure that every American has high-speed internet, address the climate crisis, advance environmental protection, and invest in populations that have been left behind, too often.

- To solve maintenance and repair backlogs, reduce congestion and emissions at ports and airports, and promote electrification and other low-carbon technologies, the Act invests USD 17 billion in port infrastructure and waterways and USD 25 billion in airports.

- During this time when the COVID-19 pandemic is various crippling industries, in the United States, public construction has been one of the few industries that have been maintained to some extent. Although activity will likely continue in the short-term, in the past, the work halted soon given various factors, including supply chains disruption, shortage of subcontractors and materials, and the termination of contracts to control expenses.

US Engineering Services Market Trends

Civil Engineering Services is Expected to Register a Significant Growth

- Increasing public and private sector expenditures in residential, commercial, healthcare, and educational infrastructure construction projects, alongside government measures to rehabilitate the country's depleted infrastructure, are causing the civil engineering sector to rise substantially.

- According to the American Society of Civil Engineers, if the United States is committed to building a future-proof infrastructure system, it must begin with substantial, long-term, regular investment. To close the USD 2.59 trillion investment gap, meet future needs, and regain global competitive advantage, the country must boost infrastructure investment from 2.5% to 3.5% of GDP in all government and private sectors by 2025.

- In recent years, all federal agencies have emphasized bridge maintenance through investments. Since 2010, 37 states have increased or altered their gas taxes to fund many of these initiatives. Despite rising state funding, overall spending on bridges in the United States remains insufficient.

- According to the Federal Highway Administration's most recent Conditions and Performance Report, the backlog for existing bridge repairs is estimated to be USD 125 billion, and spending on bridge rehabilitation needs to be increased by 58%, from USD 14.4 billion to USD 22.7 billion annually to improve the situation. These factors are analyzed to significantly contribute to the market growth rate during the forecast period.

Construction is Anticipated to Grow at Higher Rate During the Forecast Period

- The total public and private investment in the construction of power, sewage, or water supply infrastructure is represented by the value of utility construction. These developments will necessitate a high level of engineering services to ensure safe and effective operation. During the forecast period, the value of utility construction is expected to expand, creating an opportunity for the industry.

- As stated by the US Census Bureau, construction spending has been estimated at USD 1,744.8 billion in April 2022, up 0.2% from the revised March estimate of USD 1,740.6 billion. The April 2022 value is USD 1,553.5 billion, which is 12.3% higher than the April 2021 estimate. Construction spending was USD 520.8 billion in the first four months of 2022, up 12.4% from USD 463.3 billion in the same time in 2021.

- Therefore the growing investments in the construction sector in the country with the aid by investments through government are analyzed to bolster the market growth rate significantly.

- In April 2022, The Texas Department of Transportation (TxDOT) selected AECOM as the lead engineering firm for the Southeast Connector project, which aims to improve mobility, safety, and transportation options for commuters in the Fort Worth area.

- In May 2022, The City of Austin's Transportation Department (ATD) chose AECOM to continue acting as an engineering consultant, supplementing ATD's existing workforce. AECOM will offer thorough engineering design, evaluation, and coordination with City of Austin transportation officials, led by ATD's objectives to develop an accessible and dependable transportation network that serves the various demands of the community.

US Engineering Services Industry Overview

The United States engineering services market is very competitive because of the presence of many global players such as AECOM, Bechtel Corporation, Flour Corporation, and many others. A significant trend of mergers and alliances of various global engineering firms has been seen over the past decade to increase the market's foothold.

- June 2022 - The Texas Department of Transportation has granted Fluor Corporation a construction contract for the Interstate 35 (I-35) Capital Express South project in Austin, Texas (TxDOT). In the second quarter of 2022, Fluor recorded almost USD 548 million contract value.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing demand due to a growing private investment in large-scale projects and recovery in natural gas and oil prices likely to propel demand from industrial customers

- 5.1.2 Technological advancements have aided in reducing lead time and resource overheads

- 5.2 Market Restraints

- 5.2.1 Market susceptibility to changes in macro-environment as well as regulatory landscape

- 5.3 Comparative Analysis of In-house & Outsourced Engineering Services Industry

- 5.4 Insights on Services offered by Vendors (Trends and developments Product Engineering, Process Engineering, Automation, Asset Management)

6 MARKET SEGMENTATION

- 6.1 By Engineering Disciplines

- 6.1.1 Civil

- 6.1.2 Mechanical

- 6.1.3 Electrical

- 6.1.4 Environmental

- 6.2 By End-user Industry

- 6.2.1 Construction

- 6.2.2 Oil & Gas

- 6.2.3 Manufacturing

- 6.2.4 Utilities

- 6.2.5 Transportation

- 6.2.6 Other End-user Industries

- 6.3 Region

- 6.3.1 West

- 6.3.2 Mid West

- 6.3.3 North East

- 6.3.4 South

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 AECOM

- 7.1.2 Jacobs Engineering Group

- 7.1.3 Bechtel Corporation

- 7.1.4 Fluor Corporation

- 7.1.5 KBR Inc.

- 7.1.6 HDR Inc.

- 7.1.7 Terracon

- 7.1.8 Black & Veatch Holding Company

- 7.1.9 Jensen Hughes

- 7.1.10 ECS Group of Companies

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219