|

市场调查报告书

商品编码

1644768

全球射频和微波功率电晶体 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global RF & Microwave Power Transistors - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

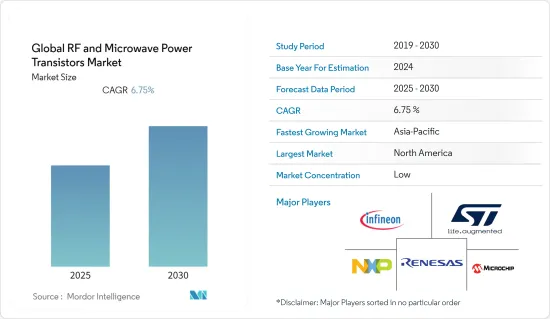

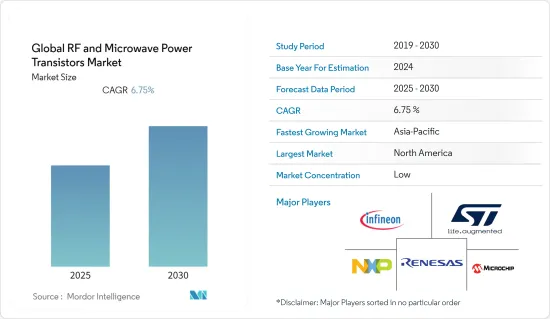

预测期内,全球射频和微波功率电晶体市场预计复合年增长率为 6.75%。

全球 5G 射频和微波功率电晶体市场的关键驱动因素包括需求增加、研发投资增加以及新技术的快速核准。射频和微波功率电晶体可在航太和军事应用中提供高功率讯号的放大和切换。雷达系统、通讯系统、电子战系统和飞弹导引系统都使用它作为发送器或接收器。射频和微波功率电晶体可提高效率,同时减少这些系统的尺寸和重量。

在通讯领域,射频和微波功率电晶体用于放大或切换微波传输的功率。它们还可以控制讯号的方向并用作放大器或振盪器。它们也可以用作开关设备,在电路的不同区域之间传导讯号。射频和微波功率电晶体是微波系统设计的关键组件。

近年来,随着资讯通讯的速度和容量的不断提高,资讯通讯和电力领域中使用的大功率半导体模组的产量以及单位面积上搭载的半导体晶片的数量不断增加,过热问题已成为一大问题。因此,为了实现高热导率和低热膨胀性能,金属-钻石复合材料受到人们的关注。

Good System已达到全球最佳的散热特性,热导率为800W/mK,热膨胀係数为8ppm,可用作56G无线通讯的射频(RF)功率电晶体和绝缘栅双极电晶体高功率绝缘栅双极电晶体(IGBT)的散热材料。

此外,COVID-19 疫情对功率电晶体市场产生了重大影响。全球经济放缓和劳动力短缺导致半导体和电子製造设施停滞。 COVID-19 导致工厂使用率大幅下降、旅行禁令和製造工厂关闭,导致电力传输产业成长放缓。

射频和微波功率电晶体市场趋势

通讯领域可望推动市场发展

爱立信表示,5G将成为史上应用最广泛的行动通讯技术,预计2027年将覆盖全球约75%的人口。

由于资料处理需求的不断增长和消费量的不断增加,5G 设备市场将在未来几年蓬勃发展。为了满足对 5G 设备日益增长的需求,5G 智慧型手机的半导体製造商将看到对 5G 晶片的需求增加。半导体晶片的增加促进了半导体产业的发展,并带动了功率电晶体的需求。

硅基射频氮化镓在 5G 和 6G 基础设施中具有巨大潜力。早期的射频功率放大器以横向扩散金属氧化物半导体 (LDMOS) (PA) 为主,这是一种长期存在的射频功率技术。 GaN 可以为这些 RF PA 提供更好的 RF 特性和比 LDMOS 高得多的输出功率。此外,它可以在硅或碳化硅(SiC)晶片上製造。

2021 年 12 月,Microchip Technology Inc. 在其支援高达 20吉赫(GHz) 频率的氮化镓 (GaN) 射频 (RF) 功率装置产品组合中增加了 MMIC 和分立电晶体。该元件将高功率附加效率 (PAE) 与高线性度相结合,为包括 5G、电子战、卫星通讯、商业和国防雷达系统以及检查设备在内的广泛应用带来新的性能水平。

亚太地区可望创下最快成长

由于东芝公司和三菱电机等大型公司的存在,亚太地区是全球功率电晶体市场成长最快的地区。中国、日本、台湾和韩国是主导半导体製造业并影响市场的少数国家。该地区还拥有巨大的智慧型手机和 5G 技术市场,并且製造业支出正在增加。

随着各种电子产品不断转移到中国,日本、韩国和中国的半导体消费成长速度快于该地区其他国家。此外,亚洲是全球五大家用电子电器产业的所在地,预测期内该全部区域的半导体应用具有巨大潜力。

根据10个政府部门于2021年7月发布的三年计划,中国计划在2023年终拥有5.6亿5G移动客户,大型工业企业中高速无线技术的普及率将达到35%。 5G在各产业的应用,对推动经济社会数位化、网路化、智慧化具有重要意义。

在政府的支持下,台湾的半导体市场也在成长。 2021年4月,国家发展基金宣布,台湾企业计划在2021年至2025年期间投资1,070亿美元用于半导体产业的成长。政府也透过资金和人才招聘计画支持新半导体技术的发展。

射频和微波功率电晶体产业概况

由于安森美半导体公司、瑞萨电子公司、英飞凌科技股份公司、德州仪器公司、恩智浦半导体公司、意法半导体公司、三菱电机公司、凌力尔特系统公司和东芝公司等主要参与者的存在,射频和微波功率电晶体市场竞争激烈。

2022 年 5 月-义法半导体和 MACOM Technology Solutions Holdings Inc. 宣布成功生产高频硅基氮化镓 (RF GaN-on-Si) 原型。继这项成功成果之后,ST 和 MACOM 打算继续并加强合作。

2021 年 7 月-意法半导体 (STMicroelectronics) 增加了多种产品,扩展了其 STPOWER 系列 RF LDMOS 功率电晶体。为各种工业和商业应用中的射频功率放大器 (PA) 开发了三种产品系列的电晶体。该公司的 RF LDMOS 元件结合了短传导通道长度和高击穿电压,可提供高效率和低热阻,同时设计用于承受高 RF 功率。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 5G 等先进通讯技术的发展

- 对连网型设备的需求不断增加

- 市场限制

- 由于温度、频率反向阻断能力等造成的操作限制。

第六章 市场细分

- 按类型

- LDMOS

- GaN

- GaAs

- 其他 (GaN-on-Si)

- 按应用

- 通讯

- 工业的

- 航太和国防

- 其他(科学、医学)

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Infineon Technologies AG

- Renesas Electronics Corporation

- NXP Semiconductors NV

- Texas Instruments Inc.

- STMicroelectronics NV

- Linear Integrated Systems Inc.

- Mitsubishi Electric Corporation

- Toshiba Corporation

- Onsemi Corporation

- Microchip Technology Inc.

第八章投资分析

第 9 章:未来趋势

The Global RF & Microwave Power Transistors Market is expected to register a CAGR of 6.75% during the forecast period.

The major drivers of the Global RF/Microwave Power Transistor for 5G market include rising demand, increased investment in research & development, and rapid approval of new technologies. The RF microwave power transistor amplifies or switches high-power signals in aerospace and the military. Radar systems, communication systems, electronic warfare systems, and missile guidance systems all employ it as a transmitter or receiver. The RF microwave power transistor increases efficiency while reducing size and weight in these systems.

In communication, the RF Microwave Power Transistor is used to amplify or switch the power of microwave transmission. It can also be used to control the signal's direction and as an amplifier or oscillator. It can also be used as a switching device to direct signals between different areas of a circuit. The RF Microwave Power Transistor is an important component in microwave system design.

Due to the recent increase in information speed and capacity, the output of high-power semiconductor modules used in information communication and power fields as well as the number of semiconductor chips mounted per unit area, are increasing, and overheating has emerged as an important issue. In order to produce high thermal conductivity and low thermal expansion characteristics, metal-diamond composite materials are attracting attention.

The Good System has managed to produce the world's best heat dissipation attributes, with 800W/mK-class thermal conductivity and 8PPM thermal expansion coefficient, as a heat dissipation material for radiofrequency (RF) power transistors for 56G wireless communication and high-power insulated-gate bipolar transistors (IGBT) for electric vehicles.

Further, the covid-19 pandemic significantly impacted the market for power transistors. Due to the slowdown and lack of workforce availability around the world, semiconductor and electronic manufacturing facilities came to a standstill. COVID-19 resulted in a major and sustained dip in factory utilization, travel prohibitions, and production site closures, resulting in a slowdown in the power transmission industry's growth.

RF & Microwave Power Transistor Market Trends

Communication Sector is Expected to Boost the Market

As stated by Ericsson, 5G is anticipated to be the most widely deployed mobile communication technology in history, covering roughly 75% of the global population by 2027.

The 5G enabled devices market is analyzed to grow rapidly in the coming years, owing to rising data processing requirements and increased consumption. To accommodate the growing demand for 5G enabled devices, semiconductor manufacturers for 5G enabled smartphones will experience increased demand for 5G chips. The rise in semiconductor chips will help to advance the semiconductor industry, boosting demand for power transistors.

For 5G and 6G infrastructure, RF GaN-on-Silicon has significant potential. Early-generation RF power amplifiers were dominated by the long-term incumbent RF power technology, laterally-diffused metal-oxide-semiconductor (LDMOS) (PAs). GaN can provide improved RF characteristics and much higher output power for these RF PAs than LDMOS. Additionally, it can be made on silicon or silicon-carbide (SiC) wafers.

In December 2021, Microchip Technology Inc. added additional MMICs and discrete transistors to its Gallium Nitride (GaN) Radio Frequency (RF) power device portfolio, spanning frequencies up to 20 gigahertz (GHz). The devices combine high power-added efficiency (PAE) and high linearity to achieve new levels of performance in a wide range of applications, including 5G, electronic warfare, satellite communications, commercial and defense radar systems, and test equipment.

Asia-Pacific is Expected to Register the Fastest Growth Rate

Asia-Pacific is the fastest-growing area in the global power transistors market due to the presence of large businesses such as Toshiba Corporation and Mitsubishi Electric Corporation. China, Japan, Taiwan, and South Korea are among a few countries that dominate the semiconductor manufacturing industry, thereby impacting the market. The region also has a significant market for smartphones and 5G technologies and an increase in manufacturing expenditures.

Due to the continued transfer of various electronic equipment to China, semiconductor consumption in Japan, South Korea, and China is fast increasing in comparison to other nations in the area. Furthermore, Asia is home to the world's top five consumer electronics sectors, presenting huge prospects for semiconductor adoption across the region in the forecast period.

According to a three-year plan released in July 2021 by ten government entities, China planned to have 560 million 5G mobile customers by the end of 2023 and a 35 percent penetration rate of the fast wireless technology among large industrial firms. It stated that the use of 5G in various industries is significant in driving the digital, networked, and intelligent transformation of the economy and society.

The semiconductor market in Taiwan is also growing due to support from the government. In April 2021, the National development fund announced that between 2021 and 2025, companies of Taiwan planned USD 107 billion investment for the semiconductor industry's growth. The government is also assisting in developing new semiconductor technologies with funding support as well as talent recruitment programs.

RF & Microwave Power Transistor Industry Overview

The RF and Microwave Power Transistors Market is a highly competitive market due to the presence of significant players such as Onsemi Corporation, Renesas Electronics Corporation, Infineon Technologies AG, Texas Instruments Inc., NXP Semiconductors N.V., STMicroelectronics N.V., Mitsubishi Electric Corporation, Linear Integrated Systems Inc. and Toshiba Corporation.

May 2022 - STMicroelectronics and MACOM Technology Solutions Holdings Inc. announced that radio-frequency Gallium-Nitride-on-Si (RF GaN-on-Si) prototypes had been successfully produced. ST and MACOM will continue to collaborate and strengthen the relationship as a result of this accomplishment.

July 2021 - STMicroelectronics expanded the STPOWER family of RF LDMOS Power Transistors with a number of additional products. Three product series of transistors have been developed for RF power amplifiers (PAs) in a variety of industrial and commercial applications. The company's RF LDMOS devices combine a short conduction-channel length with a high breakdown voltage, offering high efficiency and low thermal resistance while being packed to withstand high RF power.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Buyers/Consumers

- 4.2.2 Bargaining Power of Suppliers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing advanced communication technologies such as 5G

- 5.1.2 Rise in demand for connected devices

- 5.2 Market Restraints

- 5.2.1 Limitations in Operations due to constraints like temperature, frequency reverse blocking capacity, etc

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 LDMOS

- 6.1.2 GaN

- 6.1.3 GaAs

- 6.1.4 Others(GaN-on-Si)

- 6.2 By Application

- 6.2.1 Communication

- 6.2.2 Industrial

- 6.2.3 Aerospace and Defense

- 6.2.4 Others (Scientific, medical)

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Infineon Technologies AG

- 7.1.2 Renesas Electronics Corporation

- 7.1.3 NXP Semiconductors N.V.

- 7.1.4 Texas Instruments Inc.

- 7.1.5 STMicroelectronics N.V.

- 7.1.6 Linear Integrated Systems Inc.

- 7.1.7 Mitsubishi Electric Corporation

- 7.1.8 Toshiba Corporation

- 7.1.9 Onsemi Corporation

- 7.1.10 Microchip Technology Inc.