|

市场调查报告书

商品编码

1644771

日本设施管理:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Japan Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

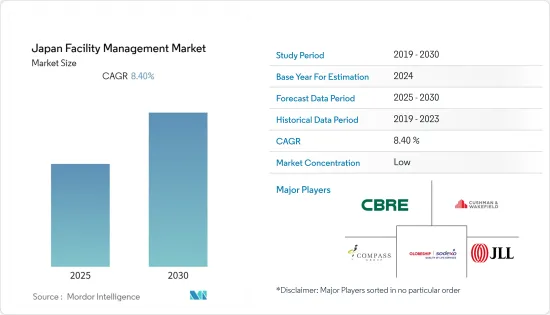

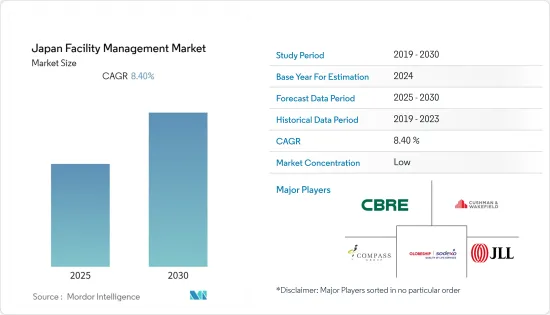

预计预测期内日本设施管理市场的复合年增长率将达到 8.4%。

日本增加基础建设支出被认为是 FM 市场成长的主要驱动力之一。此外,对优化流程和提高能源效率的日益关注也是设施管理市场发展的主要驱动力。

此外,房地产、製造业、零售业和公共部门是该国基础设施成长较快的行业领域。上述行业构成了设施管理解决方案的主要最终用户,因为将营运设施的资料与其他业务应用程式整合的需求日益增加。

该地区的设施管理行业由跨洲和跨国界的大型供应商提供的综合合约推动,而较小的本地参与者则专注于单一合约和单一服务解决方案。但考虑到全部区域正在发生的动态,以新的方式利用设施管理和企业房地产的机会越来越多。

设施管理 (FM) 包括管理组织的建筑物、基础设施以及组织内职场环境的整体和谐的管理方法和技术。该系统使组织的服务标准化并简化了流程。过去十年,该地区运营的几家服务供应商一直致力于扩大其影响力,以利用日益增长的设施管理需求,特别是考虑到最近外包非核心业务的趋势。此外,考虑到日本的整体趋势,日本以创新方式利用设施管理和企业房地产的机会正在增加。

日本已采取多项措施吸引投资和游客,以帮助该国从新冠肺炎疫情的影响中恢復过来。国际货币基金组织(IMF)将日本2022年经济成长率预测上调至2.4%。

日本设施管理市场趋势

综合FM显示出强劲的成长率

随着多个行业从使用单一的 FM 外包模式转向能够大规模满足所有客户核心需求的整合服务模式,市场正在发生模式转移。此外,随着新技术改变组织的工作方式,整合性机构管理已成为智慧建筑和职场环境的关键。

对于各种供应商而言,IFM 已被用于简化和高效的工作和任务管理。与独立的相关人员和多次监督所有任务相比,这个概念主要减少了需要管理的合约、团队和资源的数量,并提供了所有管理相关任务的单一、整合的视图。

IFM 为您提供更高的视觉性,帮助您有效地管理团队、降低营运成本、更快地回应请求、减少员工停工时间并专注于整体情况。与 IFM 服务提供者合作还可以更轻鬆地跨多个站点和服务实施大规模变更。

日本市场的趋势是从单一服务转向捆绑服务,再转向整合性机构管理方法。这将增加所提供的服务范围并延长合约期限,提高附加价值,提高品质并促进规模经济。对于需要专业知识的外包服务的需求也不断增加。

此外,不同的供应商正在透过各种合约扩大业务。例如,2022年4月,日本管材株式会社签署股份转让协议,收购JTB Asset Management 40%的股份。

商务用终端用户部分预计将占很大份额

商业部门是日本设施管理市场中占有较大份额的主要部门之一。预计日本在新冠疫情后 GDP 的强劲成长将对受访市场产生正面影响。商业领域的成长归因于日本快速的基础设施发展以及对饭店、零售店、购物中心和办公大楼的需求不断增长。

商业部门涵盖提供商业服务的办公大楼,例如製造商、IT 和通讯、金融和保险、房地产和其他服务供应商的公司办公室。日本各地 IT 产业的兴起可能会推动商业产业以及设施管理服务的进一步扩张。

例如,日本的通讯业者正专注于5G部署,这可能会为该地区的设施管理产业创造巨大的商机。例如,2022年4月,Softbank Corporation借款约2.82亿美元用于开发5G基地台,旨在进一步加强其在日本的5G网路。Softbank Corporation表示,计画到2022年3月底,5G网路覆盖日本90%的人口。

此外,日本占日本商业领域开发计划的大多数。此外,牛津大学研究人员的研究显示,2021年7月举行的东京奥运将需要154亿日圆的巨额投资,成为史上最昂贵的夏季奥运。

东京奥运会让建设产业受益,新建了 7 个场馆,包括耗资 30 亿美元的 68,000 个座位的国家体育场,另有 25 个设施正在进行维修。此外,日本正从新冠疫情期间商业建筑停顿中迅速復苏,推动受调查市场的成长。

日本设施管理产业概况

日本的设施管理市场高度分散,不同规模的许多参与者竞争激烈。随着企业不断投资以抵消其策略上正在经历的当前经济放缓,预计该市场将出现大量的併购和联盟。

2022 年 1 月-世邦魏理仕集团增强了其饭店相关资产的经纪服务。 CBRE Hotels 运用其在饭店和旅馆方面的专业知识,为饭店相关资产的买卖提供从策略制定到交易完成的全面解决方案。

2021 年 9 月 - Cushman & Wakefield 部署 Matterport 的 3D虚拟工具,以实现一流的房产估价并增强房产行销。该虚拟工具以该公司去年与 matterport 签署的全球协议为基础,为客户提供其场所 3D 扫描的承包解决方案。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- COVID-19 对市场的影响

第五章 市场动态

- 市场驱动因素

- 更重视外包非核心活动

- 商业地产领域稳定成长

- 强调绿色实践和安全意识

- 市场挑战/限制

- 监管和法律变化

第六章 市场细分

- 按设施管理

- 内部设施管理

- 外包设施管理

- 单调频

- 捆绑 FM

- 整合调频

- 按服务

- 硬体维修

- 软调频

- 按最终用户

- 商业设施

- 设施

- 公共/基础设施

- 工业的

- 其他最终用户

第七章 竞争格局

- 公司简介

- Globeship Sodexo

- JLL Japan

- Compass Group,Inc

- CBRE Group Japan

- Cushman & Wakefield

- RISE Corp. Tokyo

- Nippon Kanzai Co

- ISS World

- Aramark Facilities Services

- G4S Facilities Management

- Compass Group

第八章投资分析

第九章:市场的未来

The Japan Facility Management Market is expected to register a CAGR of 8.4% during the forecast period.

The increased spending on the infrastructural aspect in Japan can be cited as one of the major drivers of the growth of the FM market. Moreover, the increasing focus on optimization processes and energy efficiency improvements are the main driving forces for the development of the facility management market.

Along with this, real estate, manufacturing, retail, and the public sector are a few industry verticals that have witnessed high infrastructural growth in the country. These verticals mentioned above constitute the primary end users of facility management solutions, owing to the growing need for integrating data from operational facilities into other business applications.

The region's facility management industry operates with integrated contracts provided by significant vendors across continents and borders, and small local players focus on single contracts and single-service solutions. However, there are increasing opportunities to leverage facility management and corporate real estate in new ways, given the dynamics occurring across the region.

Facility management (FM) includes management methods and techniques for building management, infrastructure management for an organization, and overall harmonization of the work environment in an organization. This system standardizes services and streamlines processes for an organization. Across the last decade, several service vendors operating in the region have been focused on expanding their presence to leverage the increasing demand for facility management, especially with the recent trend favoring the outsourcing of non-core operations. Further, Japan has been witnessing increased opportunities to leverage facility management and corporate real estate in innovative ways, given the dynamics across the country.

Japan has adopted several efforts to attract investment and visitors to aid the country's recovery from the impacts of the Covid-19 epidemic. The International Monetary Fund upped the country's economic growth forecast for 2022 to 2.4%, citing Japan's reaction to the COVID-19 epidemic.

Japan Facility Management Market Trends

Integrated FM to exhibit a significant growth rate

There is a paradigm shift in the market as multiple industries are transforming from utilizing a single FM outsourcing type of model to an integrated services model that can meet all customers' core needs on a large scale. In addition, with newer technology transforming the way organizations work, integrated facility management has become the key to smart buildings and work environments.

For Various Vendors, IFM has been away for streamlined and efficient work and task management. The concept has primarily resulted in fewer contracts, teams, and resources to juggle and a single integrated view of all the management-related tasks, in comparison with overseeing each independent stakeholder and every task multiple times.

IFM offers increased visibility that leads to effective management of teams, reduced operation costs, quicker responses to requests, less downtime for employees, and a greater focus on the bigger picture. Implementing large changes across multiple sites and services is also much easier using an IFM service provider.

The trends in the Japanese market are for a progression from single services to bundled services and further toward the integrated facilities management approach. This offers a broad scope of services provided and longer-term contracts, which adds value and drives better quality and economies of scale. Also, this is increasing the demand for outsourced services, where specialist expertise is required.

Moreover, various market vendors are expanding their business operations through various contracts. For instance, in April 2022, NIPPON KANZAI Co. entered into a share transfer agreement to acquire 40% of the shares of JTB Asset Management Co. Ltd.

Commercial End User Sector is expected to hold major share

The commercial segment is one of the prominent segments that contributes a good share in the facility management market in Japan. Japan's resilient GDP growth after the COVID-19 pandemic is expected to positively influence the studied market. The growth of the commercial segment is attributed to the rapid infrastructural development and rising demand for hotels, retail outlets, malls, and office buildings in the country.

The commercial sector covers office buildings occupied by business services, such as corporate offices of manufacturers, IT and telecommunication, finance and insurance, property, and other service providers. The rise in the IT sector across Japan will allow more expansion in the commercial sector along with facility management services.

For instance, the telecom players are focusing on 5G deployments in Japan, which will create significant opportunities for the region's facilities management sector. For instance, in April 2022, Softbank borrowed around USD 282 million to develop 5G base stations, aiming to further strengthen its 5G network in japan. As per Softbank, it will cover 90% of the Japanese population with a 5G network at the end of March 2022.

Moreover, Japan accounts for most of the development projects being undertaken in the country's commercial sector. Moreover, the Tokyo Olympics held in july 2021 saw a massive investment of 15.4 billion, making it the most expensive summer game ever, per a study from University of Oxford researchers.

The construction industry benefitted from the Tokyo olympics as many developments were made, including the 68,000-capacity national stadium and seven other venues for the olympic, costing USD 3 billion, and 25 other facilities were renovated. Further, the country is rapidly recovering from the construction halt of the commercial sector during the COVID-19 pandemic driving the growth of the studied market.

Japan Facility Management Industry Overview

The Japanese Facility Management market is highly fragmented as it is a highly competitive market with the presence of several players of different sizes. This market is expected to experience a number of mergers, acquisitions, and partnerships as companies continue to invest in offsetting the present slowdowns that they are experiencing strategically.

January 2022 - CBRE Group has strengthened its brokerage services for hotel-related assets. With expertise in hotels and ryokans, CBRE Hotels provides comprehensive solutions for selling and purchasing hospitality assets, strategy developments, and closing.

September 2021 - Cushman and Wakefield introduced matterport's 3D virtualization tools for first-class property evaluation and enhanced property marketing. This virtualization tool is based on a global contract that the company signed last year with matterport, which gives the customer a turnkey solution for 3D scanning of the managed facilities.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption And Market Defination

- 1.2 Scope of the study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power Of Suppliers

- 4.2.2 Bargaining Power Of Buyers

- 4.2.3 Threat Of New Entrants

- 4.2.4 Threat Of Substitutes

- 4.2.5 Intensity Of Competitive Rivalry

- 4.3 Impact Of Covid-19 On The Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Emphasis on Outsourcing of Non-core Operations

- 5.1.2 Steady Growth in Commercial Real Estate Sector

- 5.1.3 Strong Emphasis on Green Practices and Safety Awareness

- 5.2 Market Challenges/Restraints

- 5.2.1 Regulatory & Legal Changes

6 MARKET SEGMENTATION

- 6.1 By Fcaility Management

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Management

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offering

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Globeship Sodexo

- 7.1.2 JLL Japan

- 7.1.3 Compass Group,Inc

- 7.1.4 CBRE Group Japan

- 7.1.5 Cushman & Wakefield

- 7.1.6 RISE Corp. Tokyo

- 7.1.7 Nippon Kanzai Co

- 7.1.8 ISS World

- 7.1.9 Aramark Facilities Services

- 7.1.10 G4S Facilities Management

- 7.1.11 Compass Group