|

市场调查报告书

商品编码

1644775

全球光开关市场:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Optical Switches - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

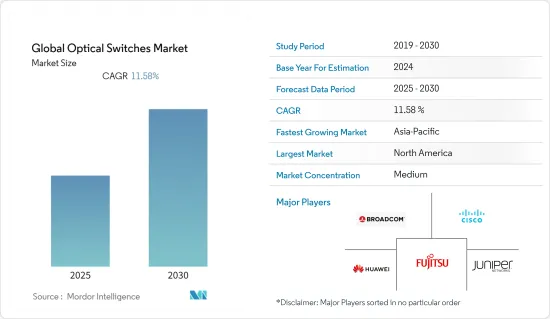

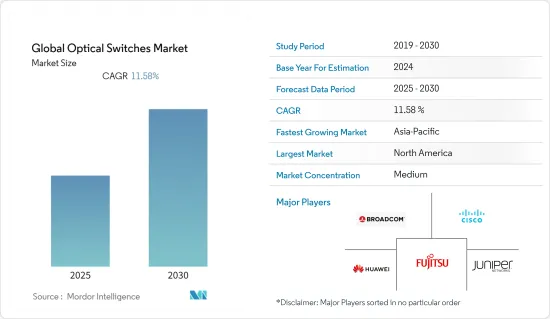

预测期内,全球光开关市场预计将实现 11.58% 的复合年增长率

关键亮点

- 光开关促进的能耗降低以及高频宽和资料传输需求激增等因素预计将推动全球光开关市场的发展。

- 推动市场发展的主要因素之一是许多行业自动化程度的提高。光交换机部署在高速网路中,需要大型交换器来处理大量流量。它也广泛应用于外部调变、网路监视器、光交叉连接器光加取多工器(OADM)和光纤元件测试。

- 它们也用于光纤通讯网路中的恢復、波长路由、光纤管理以及在光纤发生故障时进行切换保护,以便在发生问题之前将讯号切换到另一根光纤。再加上技术的不断进步,这一趋势正在推动着产业向前发展。

- 近年来光元件的流行趋势和光纤通讯的快速发展推动了全球光开关市场的大幅成长。资料流量的增加和云端运算的采用正在推动市场成长。 5G的广泛应用和资料中心的需求不断增长是影响光开关市场成长的两个主要因素。此外,由于重点转向数位转型,该行业正在成长。

- 预算限制和高成本正在阻碍光开关市场的发展。此外,由于生产设施停滞以及对电子和半导体产品的需求增加,COVID-19 疫情也对电子产业产生了影响。主要影响是欧洲大规模工业停工和中国零件出口停止,限制了对光开关的需求。

光开关市场趋势

预计 IT 和电信业在预测期内将呈现最高成长率。

- 交换器在任何通讯网路中都发挥着至关重要的作用。在装置之间传输资料时,交换器存在于连接到网路的装置中,用于改变资料传输的路径。透过快速重新路由传输并仅将资料传送到相关设备,可以减少网路上的总负载。

- 光讯号无需转换成电讯号,即可沿着指定的通讯路径传播。因此,可以在不损害高速光纤通讯优势的情况下传输讯号。在通讯中,光开关是一种可以选择性地将光纤或光积体电路(IOC)中的讯号从一个电路切换到另一个电路的开关。

- 分析认为,为满足消费者需求,产品创新的大幅成长将拉动市场成长率。例如,Tejas Networks宣布推出TJ1600S/I,这是专为5G、云端和宽频网路设计的最大的分解式多Terabit分组光纤交换器。

- 诺基亚最近宣布推出用于5G Cloud RAN的新型分组光纤交换器。新型交换器系列透过透明地支援现有和新兴的空中介面标准,统一了 4G 和 5G 网路的行动传输。

- 此外,到 2023 年,预计全球 70% 以上的人口将能够使用行动连线。据思科系统公司称,全球行动用户预计将从 2018 年的 51 亿(占人口的 66%)增长到 2023 年的 57 亿(占人口的 71%)。随着 5G 的出现,预计预测期内资料中心的需求将会增加。到2023年,5G设备和连接预计将达到全球行动装置和连接的10%。

亚太地区可望实现强劲成长

- 通讯技术的不断进步是亚太光开关市场成长的主要动力。该地区的通讯网路营运商正在为所有通讯应用部署光纤,包括城际、城内、FTTx 和行动蜂窝系统。除企业外,中国政府部门也在部署光纤系统以支援电网、高速公路、铁路、管道、机场、资料中心和许多其他应用,推动市场成长。

- 随着人工智慧、5G、物联网、虚拟实境等技术的快速发展和这些新技术的商业性应用,资料处理和资讯互动的需求日益增加,将加速国内资料中心的建设,引发行业爆发式增长。据 Cloud Scene 称,资料中心的主要市场包括中国、日本、澳洲、印度和新加坡。

- 该地区的大量研究进一步促进了市场成长率。 2022年1月,日本产业技术综合研究所(AIST)展示了131,072埠的光交换网路有可能实现全球最大的总光交换容量1.25亿Gbps。这相当于每秒传输超过 60 万张蓝光碟的资料。

- 使用AIST生产的最大容量为3232埠的光开关,进行了将宽频光讯号透过同一光开关传输9次的循环传输实验。此外,我们统计研究了光开关中串扰的行为,并开发了最大化光开关连接埠数量的综合理论。该成果满足了下一代资料和超级电脑对光开关的要求,该技术将为大容量、低延迟的下一代资讯基础设施的发展做出贡献。

光开关产业概况

由于有许多大大小小的公司在多个国家开展业务,因此光开关市场竞争较为激烈。市场集中度适中,正走向细分阶段。主要企业正在采用产品创新和伙伴关係等策略来扩大其影响力并保持竞争优势。我们将介绍一些最近的市场发展趋势。

- 2022 年 2 月-着名的网路数位转型解决方案供应商富士通与光传输和网路存取解决方案供应商Ekinops 建立合作伙伴关係。富士通正在将 Ekinops 的下一代 OTN 紧凑型模组化交换器纳入其 FUJITSU 1FINITY 开放光纤网路连结产品组合,为服务供应商提供更多选择和灵活性。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 购买者/消费者的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 价值链/供应链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 数位化的进步

- 5G 的普及和资料中心需求的增加

- 市场限制

- 光开关成本高

第六章 市场细分

- 按类型

- 电光开关

- 声光开关

- 基于微机电系统的开关

- 磁光开关

- 其他的

- 最终用户产业

- 政府和国防

- 资讯科技和电讯

- BFSI

- 製造业

- 其他的

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Broadcom Inc.

- Cisco Systems Inc

- Huawei Technologies Co., Ltd.

- Fujitsu Ltd

- Nokia Corporation

- Juniper Networks

- NTT Advanced Technology Corporation

- Furukawa Electric Co. Ltd.

- Keysight Technologies Inc.

- Agiltron Inc.

第八章投资分析

第 9 章:未来趋势

简介目录

Product Code: 91065

The Global Optical Switches Market is expected to register a CAGR of 11.58% during the forecast period.

Key Highlights

- Factors such as reduced energy consumption facilitated by optical switches and a surge in demand for high bandwidth & data transmission rates are expected to propel the global optical switches market forward.

- One of the primary factors driving the market is the rising automation in many industry verticals. Optical switches are deployed in high-speed networks, where large switches are needed to handle significant traffic. They are also widely used in external modulators, network monitors, optical cross-connects (OXCs), optical add-drop multiplexers (OADM), and fiber optic component testing.

- They are also used for restoration, wavelength routing, and fiber management in fiber communication networks and for switching protection as they allow signals to be switched to another fiber before an issue emerges when a fiber fails. This, coupled with increasing technical improvements, is propelling the industry forward.

- With the growing investments in optical devices and the fast development of optical communication in recent years, the global optical switches market has seen significant growth. Increasing data traffic and adopting cloud computing are driving the market growth. The widespread implementation of 5G and the rise in demand for data centers are two major factors influencing the growth of the optical switches market. Furthermore, the industry is growing due to a shift in focus on digital transformation.

- Budget constraints and high costs hamper the optical switches market. Further, the COVID-19 pandemic has impacted the electronics industry since production facilities have stagnated, resulting in increased demand for electronics and semiconductor products. Its main effects are a significant industrial halt in Europe and a halt in Chinese parts exports, limiting the demand for optical switches.

Optical Switches Market Trends

IT and Telecom is Analyzed to Grow at Highest Rate During the Forecast Period

- Switches play a crucial role in any communication network. When transporting data between devices, switches are present inside network-linked devices and are used to change data transmission paths. The total load on the network can be decreased by swiftly altering the transmission path and transmitting data only to relevant devices.

- Optical signals can be routed along a specified communication path without being converted into an electrical signal. As a result, signals can be sent without affecting the benefits of high-speed optical communications. An optical switch in telecommunications is a switch that allows signals in optical fibers or integrated optical circuits (IOCs) to be switched from one circuit to another selectively.

- The significant growth in product innovations to meet consumer demand is analyzed to boost the market growth rate. For instance, Tejas Networks has announced the launch of the TJ1600S/I, the largest disaggregated multi-terabit packet-optical switch designed for 5G, cloud, and broadband networks.

- Nokia has recently launched new packet-optical switches for 5G Cloud RAN. The new switch family unifies mobile transport for 4G and 5G networks by transparently supporting existing and new radio interface standards.

- Furthermore, over 70% of the global population is expected to have access to mobile connectivity by 2023. According to Cisco Systems, the global mobile subscribers are expected to increase from 5.1 billion (or 66% of the population) in 2018 to 5.7 billion (or 71% of the population) by 2023. With the advent of 5G, the demand for data centers is expected to increase over the forecast period. By 2023, 5G devices and connections are expected to reach 10% of the global mobile device and connections.

Asia-Pacific is Expected to Register the Significant Growth Rate

- The constant advancements in communication technologies are the primary drivers of optical switches market growth in the Asia-Pacific. The region telecom network operators have installed fiber in the full range of telecom applications - inter-city, intra-city, FTTx, and mobile cellular systems. Apart from enterprises, the Chinese government authorities also install fiber systems to support the electric power grid, highways, railways, pipelines, airports, data centers, and many other applications, driving the market growth.

- With the rapid development of AI, 5G, the Internet of Things, virtual reality, and the commercial application of these new technologies, the demand for data processing and information interaction is growing, which would speed up the construction of data centers in the country and lead to the explosive growth of the industry. According to Cloud Scene, some of the top markets in data centers include China, Japan, Australia, India, and Singapore.

- The significant research in the region is further contributing to the market growth rate. In January 2022, the National Institute of Advanced Industrial Science and Technology (AIST), Japan, demonstrated that a 131,072 port optical switch network may attain the world's biggest total optical switch capacity of 125 million Gbps. This is equivalent to the ability to send data from 600,000 or more Blu-ray discs per second.

- A circular transmission experiment was conducted using the greatest 3232 port optical switch produced by AIST, in which a wideband optical signal was transferred nine times over the same optical switch. In addition, the behavior of crosstalk in the optical switch was statistically investigated, and a comprehensive theory for maximizing the number of optical switch ports was developed. These results meet the optical switch requirements of next-generation data centers and supercomputers, and this technology will contribute to high-capacity, low-latency next-generation information infrastructure.

Optical Switches Industry Overview

The optical switches market is moderately competitive, owing to many large and small players operating in multiple countries. The market appears to be moderately concentrated, moving towards the fragmented stage. Major players adopt strategies like product innovation and partnerships to expand their reach and stay ahead of the competition. Some of the recent developments in the market are:

- February 2022 - Fujitsu, a prominent network digital transformation solutions provider, partnered with Ekinops, an optical transport and network access solutions producer. Fujitsu will incorporate Ekinops' next-generation OTN compact modular switches into its Fujitsu 1FINITY open optical networking portfolio, giving service providers even more options and flexibility.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Value Chain / Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Adoption of Digitalization

- 5.1.2 Widespread Implementation of 5G and Increase in Demand for Data Centers

- 5.2 Market Restraints

- 5.2.1 High Costs of Optical Switches

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Electro-optic Switching

- 6.1.2 Acoustic-Optic switching

- 6.1.3 Mems-based Switching

- 6.1.4 Magneto-Optic Switching

- 6.1.5 Others

- 6.2 End-User Industry

- 6.2.1 Government and Defense

- 6.2.2 IT and Telecom

- 6.2.3 BFSI

- 6.2.4 Manufacturing

- 6.2.5 Others

- 6.3 Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Broadcom Inc.

- 7.1.2 Cisco Systems Inc

- 7.1.3 Huawei Technologies Co., Ltd.

- 7.1.4 Fujitsu Ltd

- 7.1.5 Nokia Corporation

- 7.1.6 Juniper Networks

- 7.1.7 NTT Advanced Technology Corporation

- 7.1.8 Furukawa Electric Co. Ltd.

- 7.1.9 Keysight Technologies Inc.

- 7.1.10 Agiltron Inc.

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219