|

市场调查报告书

商品编码

1644776

小讯号二极体:全球市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Global Small Signal Diode - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

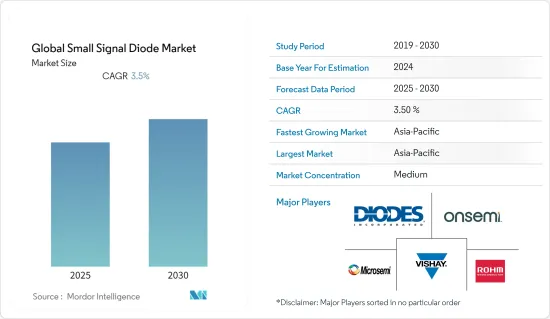

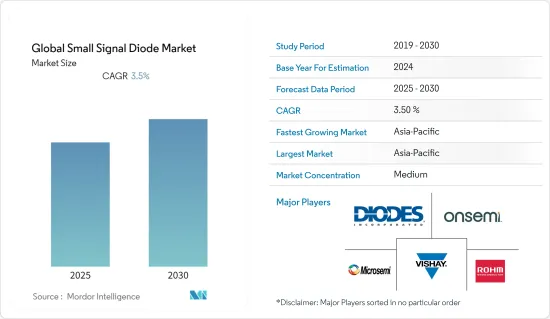

预计预测期内全球小讯号二极体市场的复合年增长率将达到 3.5%。

主要亮点

- 小讯号二极体具有快速的开关速度和快速的恢復时间。许多电子系统使用小讯号二极体。小讯号二极体传输幅度为几伏特、毫伏特甚至微伏特的交流(连续变化)讯号或脉衝。家庭、工业设备、汽车、航空和音乐系统中都存在无线电、音讯、视讯和数位讯号。

- 此外,小讯号二极体还有线端和表面黏着技术(SMT) 类型。小讯号二极体与整流二极体的不同之处在于,它们的结面积较小,这使它们具有无结电容,并且使其在高频下更有用。高速小讯号二极体通常被称为开关二极体。它们比专用电源整流器更小,并且最大反向电压规格更低。

- 与其他功能相比,小讯号二极体通常具有较低的电流承载能力和功率损耗。小讯号二极体可以由硅或锗型半导体材料製造,但二极体的特性会根据所使用的掺杂材料而变化。

- 随着病毒在全球蔓延,全球供应链陷入混乱,隔离期仍不清楚。世界各地许多製造工厂已经关闭。例如,安森美半导体公司在马来西亚、中国、马来西亚和菲律宾等国的大部分製造工厂均根据政府命令关闭,影响了供给能力,并造成了供需缺口。

- 设计小讯号二极体的复杂性可能会阻碍市场的成长。预计製造成本和功能可靠性问题等因素将在未来几年阻碍小讯号二极体市场的成长。

小讯号二极体市场趋势

锗讯号二极体有望占据较大的市场占有率

- 锗二极体在电路中用于仅在一个方向上传导导电讯号。锗二极体比硅二极体有几个优点。与硅二极体相比,锗二极体在电流通过时损失的能量较少。这使其成为中等电流讯号的理想选择,因为高能量损失可能导致讯号被切断。

- 在低讯号环境(侦测从音频到 FM 频率的讯号)和低阶逻辑电路中,锗的低压降非常重要。因此锗二极体在低阶数位电路的应用越来越多。随着人们对锗二极体的兴趣日益浓厚,了解这种材料的基本特性变得至关重要。

- 儘管锗二极体能够破坏电路,但是它的一个很大的优点就是其阈值电压低,因此电压降也低。阈值电压是二极体必须允许电流从阳极流到阴极的电压。这被称为正向电流。除非达到阈值电压,否则二极体就无法通过电流。

- 现代锗二极体是点接触二极体,其线触点是在锗晶片上製作的。额定电流往往以毫安培为单位,大则反向电压低,小则反向电压高。由于这个限制,它们被用作检测目的的小讯号二极体。

亚太地区可望占据主要市场占有率

- 亚太地区由于其蓬勃发展的半导体製造业务而占据了主要的市场占有率。在该地区运营的半导体製造商正在提高生产能力,以满足无晶圆厂供应商日益增长的需求。

- 泰国政府于 2016 年推出了电动车行动计划,以鼓励生产纯电动车和插电式混合动力车,目标是到 2036 年道路上拥有 120 万辆纯电动车和插电式混合动力车。结果,13家公司享受了电动车税收优惠政策。泰国于 2020 年 3 月发布了其电动车蓝图,宣布计划在 2025 年生产 25 万辆电动车并建立东协电动车中心。

- 5G 网路的快速推出,加上设备中物联网 (IoT) 应用的不断增多,例如驾驶辅助和智慧交通的车对车 (V2X)通讯,预计将增加对小讯号二极体的需求。

- 此外,2022 年 6 月,东芝电子扩大了与 Farnell 的合作,Farnell 是一家全球电气元件分销商,在亚太地区以 element14 的名义进行交易。此次合作将使 Farnell 能够更好地储备更多东芝产品并更好地支持东芝的客户供应链。 Farnell 的产品组合将包括更多东芝设备,到 2023 年总合1,000 种。东芝的小讯号二极体和电晶体很受关注。

- 日本政府的目标是到 2050 年,日本销售的所有新车都是电动或混合动力汽车。日本政府的目标是到2050年,国内销售的所有新车均为电动或混合动力汽车汽车,併计划向私营企业提供补贴,以加速电动车电池和马达的开发。在日本,政府为电动车购买者提供补贴,导致电动车充电站数量增加,从而支持了越来越多的电动车。预计这将推动汽车产业对小讯号二极体的需求。

小讯号二极体产业概况

全球小讯号二极体市场竞争适中,有许多地区和全球参与者。主要参与者包括 Vishay Intertechnology, Inc、On Semiconductor Corporation、Diodes Incorporated、Microsemi Corporation 和 ROHM。

- 2022 年 2 月 - 智慧电源和感测器解决方案供应商安森美半导体 (ON Semiconductor) 正在采用晶圆厂升级 (fab-liter) 製造方法,透过提高毛利率来实现长期财务成功。

- 2021 年 10 月 - Vishay Intertechnology, Inc. 宣布推出采用超小型 DFN1006-2A 塑胶封装且具有可润湿侧面的新型表面黏着技术超小讯号二极体。 40 V BAS40L 萧特基二极体和 100 V BAS16L 开关二极体符合 AEC-Q101核准,旨在在汽车和工业应用中节省空间并提高热性能。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 波特五力分析

- 供应商的议价能力

- 买家的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 汽车技术中小讯号二极体的采用日益增多

- 小讯号二极体在家用电子电器应用的使用日益增多

- 市场挑战

- 製造过程的复杂性

第六章 市场细分

- 依产品类型

- 锗讯号二极体

- 硅讯号二极体

- 其他的

- 按最终用户产业

- 车

- 家电

- 产业

- 其他最终用户产业

- 按地区

- 北美洲

- 欧洲

- 亚太地区

- 拉丁美洲

- 中东和非洲

第七章 竞争格局

- 公司简介

- Diodes Incorporated

- On Semiconductor Corporation

- Microsemi Corporation

- Vishay Intertechnology, Inc

- ROHM Co., Ltd.

- Taiwan Semiconductor

- TT Electronics Plc

- STMicroelectronics

- Infineon Technologies AG

- Diotec Semiconductor AG

第八章投资分析

第九章:市场的未来

简介目录

Product Code: 91068

The Global Small Signal Diode Market is expected to register a CAGR of 3.5% during the forecast period.

Key Highlights

- The small-signal diode has a high switching speed with a fast recovery time. Many electronic systems use small signal diodes, which are AC (continuously changing) signals or pulses with amplitudes of a few volts, millivolts, or even microvolts. Radio, audio, video, and digital signals are employed in the household, industrial equipment, automobile, aeronautic, and musical systems.

- Further, small signal diodes are available in wire-ended and surface mount (SMT) configurations. They differ from rectifier diodes and have smaller junction areas, resulting in junction-less capacitance, making them more useful at higher frequencies. Small signal diodes with high speeds are often known as switching diodes. They are smaller and have lower maximum reverse voltage specifications than dedicated power rectifiers.

- Signal diodes often have a low current carrying capacity and power dissipation compared to their other capabilities. The Small Signal Diode can be manufactured using Silicon or Germanium type semiconductor material, although the diode's characteristics vary based on the doping material used.

- The global supply chains are disrupted as the virus spreads worldwide, and there is still uncertainty over quarantine durations. Many manufacturing factories were shut down across the world. For instance, most of the company's manufacturing facilities, On semi, were shut down due to government mandates in countries like Malaysia, China, Malaysia, and the Philippines, which impacted its ability to supply products to its clients and created a gap in demand and supply.

- The complexity associated with the design of small signal diodes can hinder the market's growth. Factors such as the manufacturing cost and functional reliability issues are expected to hinder the market's growth for the small signal diode in the coming years.

Small Signal Diode Market Trends

Germanium Signal Diodes Expected to Witness Significant Market Share

- Germanium diodes are used in electrical circuits and conduct electrical signals in only one direction. A germanium diode has some advantages over a silicone diode. Compared to a silicone diode, a germanium diode loses less energy as the current travels through. This makes it an ideal alternative for signals created by modest currents where a considerable energy loss could cause the signal to be disrupted.

- In low signal environments (signal detection from audio to FM frequencies) and low-level logic circuits, germanium's smaller voltage drop becomes crucial. As a result, low-level digital circuits are increasingly using germanium diodes. With the rising interest in germanium diodes, it became essential to understand the basic features of the material.

- One significant benefit of germanium diodes, which could be a disruptive force for a circuit, is that they have lower threshold voltages and, as a result, fewer voltage drops. The threshold voltage is the voltage at which the diode must conduct current from anode to cathode. This is referred to as forwarding current. The diode cannot conduct current unless the threshold voltage is met.

- Modern germanium diodes are point contact diodes with a wire contact made of a germanium wafer. The current rating is often in the milliamp range, with a low inverse and high reverse voltage. They are used as small-signal diodes for detection because of this limitation.

Asia-Pacific Expected to Witness Significant Market Share

- Asia-Pacific holds a prominent market share due to a significant number of regional semiconductor manufacturing operations. The pure-play manufacturers operating in the region are increasing their production capacity to cater to the growing demand from fabless vendors.

- The Thai government launched an EV action plan in 2016 to encourage the production of BEVs and PHEVs to have 1.2 million such vehicles on the road by 2036. As a result, 13 companies have benefited from preferential tax treatment for electric vehicles. Thailand announced an EV roadmap in March 2020 to produce 250,000 EVs by 2025 and establish an ASEAN EV hub, which will drive market growth.

- The rapid deployment of 5G networks, coupled with the increasing Internet of Things (IoT) applications for devices, such as assisted driving and vehicle-to-everything (V2X) communication for smart transport, is expected to increase the demand for small signal diodes.

- Further, in June 2022, Toshiba Electronics extended its collaboration with Farnell, a global distributor of electrical components traded as element14 in the Asia Pacific. Farnell will stock more Toshiba products in larger numbers due to this partnership, enhancing support of Toshiba's client supply chain. Farnell's portfolio contains more of Toshiba's devices, totaling 1,000 by 2023. Toshiba's compact signal diodes and transistors will be highlighted.

- The Japanese government aims to ensure that all new cars sold in Japan be electric or hybrid vehicles by 2050. The country plans to subsidize the private sector to accelerate the development of batteries and motors for electricity-powered vehicles. Japan witnessed an increase in EV charging stations to support the rising number of EVs because of the introduction of government subsidies for EV buyers. This is expected to drive the small signal diode demand in the automotive industry.

Small Signal Diode Industry Overview

The Global Small Signal Diode Market is moderately competitive, with many regional and global players. Key players include Vishay Intertechnology, Inc, On Semiconductor Corporation, Diodes Incorporated, Microsemi Corporation, and ROHM CO., LTD.

- February 2022 - Onsemi, a provider of intelligent power and sensor solutions, adopted a fab-liter manufacturing approach to achieve long-term financial success by increasing gross margins.

- October 2021 - Vishay Intertechnology, Inc. announced the availability of new surface-mount tiny signal diodes in the ultra-compact DFN1006-2A plastic package with wettable flanks. The 40 V BAS40L Schottky and 100 V BAS16L switching diodes are AEC-Q101 approved and designed to conserve space and improve thermal performance in automotive and industrial applications.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumption and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitutes

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Assessment of COVID-19 Impact on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Adoption of Small Signal Diodes in Vehicle Technologies

- 5.1.2 Rising Usage of Small Signal Diodes in Consumer Electronics Applications

- 5.2 Market Challenges

- 5.2.1 Complexity in the Manufacturing Process

6 MARKET SEGMENTATION

- 6.1 By Product Type

- 6.1.1 Germanium Signal Diodes

- 6.1.2 Silicon Signal Diodes

- 6.1.3 Other

- 6.2 By End-User Industry

- 6.2.1 Automotive

- 6.2.2 Consumer Electronics

- 6.2.3 Industrial

- 6.2.4 Other End-user Industries

- 6.3 By Geography

- 6.3.1 North America

- 6.3.2 Europe

- 6.3.3 Asia-Pacific

- 6.3.4 Latin America

- 6.3.5 Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Diodes Incorporated

- 7.1.2 On Semiconductor Corporation

- 7.1.3 Microsemi Corporation

- 7.1.4 Vishay Intertechnology, Inc

- 7.1.5 ROHM Co., Ltd.

- 7.1.6 Taiwan Semiconductor

- 7.1.7 TT Electronics Plc

- 7.1.8 STMicroelectronics

- 7.1.9 Infineon Technologies AG

- 7.1.10 Diotec Semiconductor AG

8 INVESTMENT ANALYSIS

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219