|

市场调查报告书

商品编码

1644783

欧洲楼梯升降机 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Europe Stair Lift - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

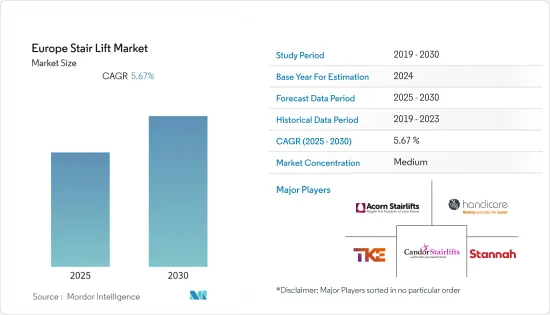

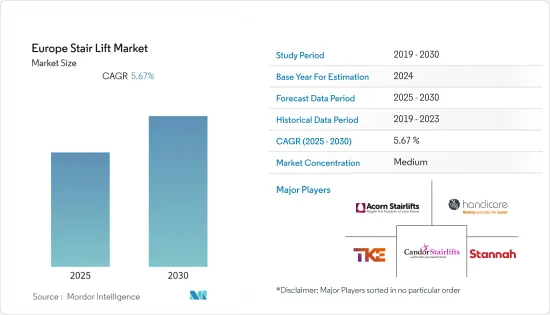

预计预测期内欧洲楼梯升降机市场的复合年增长率将达到 5.67%。

人口老化、流动性和安全挑战等因素推动了过去几年楼梯升降机市场的成长。楼梯升降机是一种沿着附在楼梯上的导轨或轨道移动的座椅。引擎位于座椅底座内,通常由位于座椅底座内的电池控制。

关键亮点

- 由于受伤人数和残障人士老年人的数量不断增加,预计市场将快速成长。老年人和残障人士由于身体状况不佳,爬楼梯很困难。目前,大多数设施(例如医院和老人安养院)使用的最佳选择是楼梯升降机。

- 此外,根据欧盟统计局的数据,到2022年,欧盟超过五分之一(21.1%)的人口将年龄超过65岁,到2022年1月1日,欧盟人口平均年龄将升至44.4岁。

- 这些设备使用方便,为人们提供了有效的交通方式。近年来,楼梯升降机已成为老年人和行动不便人士的热门选择。楼梯升降机本质上是一种由引擎驱动的轨道轮椅。楼梯升降机采用「小齿轮和齿条」技术设计,使轮椅使用者和行动不便的人更容易上下楼梯和阶梯。

- 此外,随着技术的进步,供应商正在寻求帮助老年人和残障人士过上更独立的生活。越来越多现代辅助器具的推出,如带有集成轮椅支架的楼梯升降机和可适合任何自订楼梯结构的曲线楼梯升降机,正在推动该地区的楼梯升降机市场的发展。

- 然而,高昂的安装成本和安装后服务是阻碍该地区楼梯升降机市场成长的挑战。此外,由于安装不正确而导致受伤和故障的潜在风险也是该市场最终用户面临的挑战之一。

欧洲楼梯升降椅市场的趋势

住宅市场占据主要市场占有率

- 住宅领域预计将占据相当大的市场占有率,这主要是因为老年人群体偏好能够让他们在家中保持独立生活的产品。此外,楼梯升降机可以灵活地安装在几乎任何楼梯上,这也推动了市场的成长。

- 在住宅领域,坐式楼梯升降机的需求量很大,因为与站立式楼梯升降机相比,坐式楼梯升降机更具成本效益。这一数量的增长主要是由于最终用户遭遇越来越多的肌肉骨骼问题,例如由于老龄化导致的骨骼密度下降、不健康的生活方式和对不健康食物的依赖增加,这些问题影响他们的身体和自由活动的能力,导致骨关节炎等疾病,并增加受伤时骨折的几率。

- 根据英国风湿病学会的调查,骨关节炎是最常见的关节炎类型,估计影响整个欧洲超过 4000 万人。骨关节炎是全世界成长最快的残疾原因。随着欧洲预期寿命的增加和肥胖程度的上升,预计骨关节炎将成为第四大致残原因。

- 2019年至2034年间,75岁以上男性和女性的数量预计将分别增加42%以上和29%以上。

- 此外,法国政府将于2022年10月宣布一项新的无障碍计划,为安装楼梯升降机、加宽门框以方便轮椅通行等住宅维修提供津贴。法国政府已实施多项计画来帮助维修住宅,使其更适合老年人居住,但最近宣布的「MaPrimeAdapt」计画旨在简化这项流程。

- 此外,日益增长的健康问题和各种疾病/残疾的增加可能会增加整个全部区域对楼梯升降机的需求。此外,住宅领域对楼梯升降机的需求也在不断增长,因为它方便了人们在家中(人们大部分时间都待在家里)的移动。

英国可望占据主要市场占有率

- 英国占据市场主导地位。这是由于人口平均年龄上升以及政府对老年人面临的问题给予大力支持等因素所造成的。根据英国的一项研究,每年从楼梯上摔下来会导致约 29 万人严重受伤,并有 500 多人死亡。根据圣乔治大学医院 NHS 基金会信託的数据,在英国安装楼梯升降机的平均成本英国3,369 英镑(4,103.80 美元)。这些因素导致对楼梯升降机的需求增加。

- 由于人们对包容性设计认识的不断提高、法规的加强以及对公共运输、医院和医疗机构中楼梯升降机等基础设施领域的投资,近几十年来已规划了许多改善残障人士的措施。

- 此外,政府也努力让残障人士的生活更轻鬆。例如,2022年6月,英国政府宣布就一项政策启动咨询,该政策要求房东对残障人士租户家外的公共空间进行变更。这些变化包括安装楼梯升降机、扶手和坡道。

欧洲楼梯升降机产业概况

欧洲楼梯升降机市场是半刚性的,主要参与者包括 Handicare Group AB、Stannah Lifts Holdings Ltd、Acorn Mobility Services Ltd、Thyssenkrupp Elevator AG 和 Candor Care Limited。市场参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

2022 年 11 月,英国楼梯升降机、家用电梯和平台升降机供应商 Access BDD 将在 2022 年 Rehacare 展会上展示其 HomeGlide 楼梯升降机和市场领先的 Flow X。该款楼梯升降机计划于 2023 年 4 月在欧洲市场上市。

2022 年 8 月,蒂森克虏伯电梯股份公司推出了新型楼梯升降机 S100。 S100 楼梯升降机结合了 S200 楼梯升降机的大量最尖端科技,为客户提供了一系列满足其移动需求的选择。 S100 楼梯升降机具有广泛的安全功能,包括扶手侦测,可确保除非扶手完全折迭起来,否则楼梯升降机不会移动。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 分析主要宏观经济趋势对市场的影响

第五章 市场动态

- 市场驱动因素

- 老化速度加快,残障人士人数增加

- 市场限制

- 安装成本高,后製服务也较高

第六章 市场细分

- 搭乘铁路方向

- 直线

- 曲线

- 按使用者导向

- 就座

- 常设

- 融合的

- 按安装位置

- 室内的

- 户外的

- 按应用

- 住宅

- 医疗

- 其他的

- 按国家

- 英国

- 法国

- 德国

- 欧洲其他地区

第七章 竞争格局

- 公司简介

- Handicare Group AB

- Stannah Lifts Holdings Ltd.

- Acorn Mobility Services Ltd.

- Thyssenkrupp Elevator AG

- Candor Care Limited

- Mobility Stairlift Ltd

- Bespoke Stairlifts Limited

- StayHome Stairlift Ltd.

- Ableworld (UK) Ltd

- Weigl Liftsysteme DE GmbH

- Anglian Lifts Ltd

- Dolphin Mobility

- Platinum Stairlifts

第八章投资分析

第九章:市场的未来

The Europe Stair Lift Market is expected to register a CAGR of 5.67% during the forecast period.

Factors like the aging population and mobility and safety challenges have driven the stairlift market growth in the past few years. A stairlift is a seat moving along a rail or track attached to a stairway. An engine inside the seat's foundation is generally controlled by a battery inside the seat's foundation.

Key Highlights

- The market is expected to grow rapidly due to the increased number of injured people and the increasing number of disabilities among senior adults. Because of their physical condition, senior adults and people with disabilities struggle to climb stairs. Nowadays, the best option, adopted by most institutions such as hospitals and nursing homes, is a stair lift.

- Moreover, as per Eurostat, in 2022, more than one-fifth (21.1%) of the EU population was aged 65 and above, and the median age of the EU's population increased to 44.4 years on 1st January 2022.

- These devices are simple to use and provide people with effective mobility solutions. Stairlifts have become a popular choice for older people and people with limited mobility in recent years. A stair lift is essentially an engine-driven wheelchair on rails. They are designed to work on the 'pinion and racks' technology, allowing wheelchair-bound individuals or people with portability issues to easily use flights of stairs and steps.

- Furthermore, with recent technological advancements, vendors are trying to help the elderly and disabled population lead independent lives. There has been a rise in the launch of modern aids such as stairlift with integrated wheelchair support and curved stairlift that fits into any custom stairway structure, which in turn is boosting the stairlift market in the region.

- However, high installation costs and post-installation services are some of the challenges hindering the growth of the stairlift market in the region. Also, the potential risk of injury and faulty mechanisms due to incorrect installation is one of the challenges faced by the end-users in the market.

Europe Stair Lift Market Trends

Residential Segment to Hold a Significant Market Share

- The residential segment is expected to hold a significant market share, majorly owing to the preference of the elderly population towards products that would allow them to remain independent in their homes. Also, the flexibility of stairlifts installed nearly on any staircase elevates the market's growth.

- There is a significant demand for the seated stairlift within the residential segment due to its cost-effectiveness compared to standing stairlift counterparts. This rise in numbers is majorly due to end-users growing musculoskeletal problems like decreasing bone density due to aging, unhealthy lifestyle, and increasing dependency on unhealthy foods, giving rise to diseases like Osteoarthritis, which impacts the body and ability of a person to move freely because of increased chances of fractures in case of any injury.

- As per the British Society of Rheumatology study, Osteoarthritis is the most common type of arthritis, is estimated to affect more than 40 million people across Europe, and has a lifetime risk of 45 percent for knee (Osteoarthritis) OA and 25 percent for hip (OA. OA is the fastest-growing cause of disability worldwide. With increased life expectancy and rising levels of obesity across Europe, Osteoarthritis is predicted to become the fourth leading cause of disability.

- As the number of men and women aged 75 years and above is expected to increase by more than 42 percent and 29 percent, respectively, between 2019 and 2034, it is projected that the annual number of osteoporotic fractures will likely increase by approximately +24.8 percent in that period, reaching 5.34 million annual fragility fractures.

- Furthermore, the French government announced a new accessibility program in October 2022 that offers grants for home improvements like installing a stair lift or enlarging a doorframe to accommodate wheelchair access. While the French government has several programs to help with home renovations to make them more accessible for elderly people, the recently announced "MaPrimeAdapt" program aims to streamline the process.

- Moreover, the rising health concerns and the growth in various diseases/disabilities will augment the demand for stairlifts across the region. Also, to ease mobility in the home, where people spend most of their time, the need for stairlifts is higher in the residential segment.

United Kingdom is Expected to Hold Significant Market Share

- The United Kingdom held a dominant market share in the market. This is owing to factors such as an increase in the population's average age and critical government support for the problems faced by the elderly. According to a study conducted in the United Kingdom, approximately 290,000 people are seriously injured, and over 500 people die each year as a result of a fall on the stairs. According to St George's University Hospitals NHS Foundation Trust United Kingdom, the average installation cost of stairlifts in the UK is GBP 3,369 (USD 4103.80). Such factors have given a boost to raise the demand for stairlifts.

- Many improvements have been planned in accessibility for disabled people in recent decades, aided by increased awareness of inclusive design, tightened regulations, and investment in infrastructural segments like stairlift deployment at public transport and stairlifts at hospitals and medical institutions.

- Moreover, the government is also trying to ease the lives of people with disabilities. For instance, in June 2022, the UK Government announced the launch of a consultation on a policy as per which landlords will be obliged to make changes to communal spaces outside disabled tenants' homes. The changes would be to communal areas of rented and leasehold homes and include installing stairlifts, handrails, and ramps.

Europe Stair Lift Industry Overview

The European stairlift market is semi consolidated, with the presence of major players like Handicare Group AB, Stannah Lifts Holdings Ltd, Acorn Mobility Services Ltd, Thyssenkrupp Elevator AG, and Candor Care Limited. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In November 2022, Access BDD, a UK supplier of stairlifts, home lifts, and platform lifts, showcased its HomeGlide stairlift alongside its market-leading Flow X in Rehacare 2022. These stairlifts are targeted to launch in April 2023 across the European market.

In August 2022, Thyssenkrupp Elevator AG launched its new stairlift S100, which combined the extensive state-of-the-art technology of its multiple counterparts, the S200 stairlift, thereby providing customers with options that fit their mobility needs. The S100 stairlift has extensive safety features such as armrest detection, ensuring that the stairlift will not move unless the armrest is fully folded.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact Analysis of Key Macro Economic Trends on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Rising proportion of aged people and growing disability among individuals

- 5.2 Market Restraints

- 5.2.1 High installation cost and post installation services

6 MARKET SEGMENTATION

- 6.1 By Rail Orientation

- 6.1.1 Straight

- 6.1.2 Curved

- 6.2 By User Orientation

- 6.2.1 Seated

- 6.2.2 Standing

- 6.2.3 Integrated

- 6.3 By Installation

- 6.3.1 Indoor

- 6.3.2 Outdoor

- 6.4 By Application

- 6.4.1 Residential

- 6.4.2 Healthcare

- 6.4.3 Other Applications

- 6.5 By Country

- 6.5.1 United Kingdom

- 6.5.2 France

- 6.5.3 Germany

- 6.5.4 Rest of Europe

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Handicare Group AB

- 7.1.2 Stannah Lifts Holdings Ltd.

- 7.1.3 Acorn Mobility Services Ltd.

- 7.1.4 Thyssenkrupp Elevator AG

- 7.1.5 Candor Care Limited

- 7.1.6 Mobility Stairlift Ltd

- 7.1.7 Bespoke Stairlifts Limited

- 7.1.8 StayHome Stairlift Ltd.

- 7.1.9 Ableworld (UK) Ltd

- 7.1.10 Weigl Liftsysteme DE GmbH

- 7.1.11 Anglian Lifts Ltd

- 7.1.12 Dolphin Mobility

- 7.1.13 Platinum Stairlifts