|

市场调查报告书

商品编码

1644787

拉丁美洲设施管理:市场占有率分析、行业趋势和成长预测(2025-2030 年)Latin America Facility Management - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

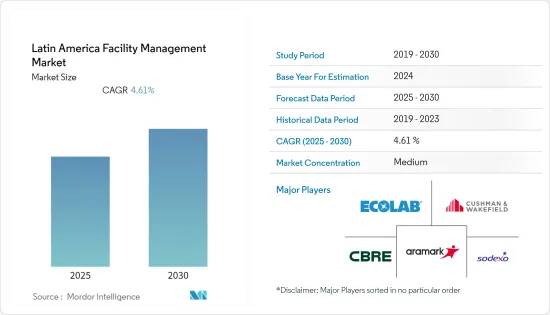

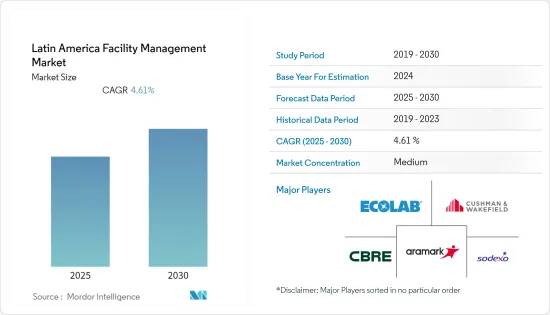

预计预测期内拉丁美洲的设施管理市场将实现 4.61% 的复合年增长率。

设施管理包括影响组织生产力和效率的几个因素。新的管理系统标准与行业最佳实践保持一致,将成为全部区域制定和推广有效的策略、战术性和营运 FM 原则的基准。

关键亮点

- 在拉丁美洲,巴西、墨西哥等主要国家的商业机构数量正在增加。商业机构的兴起需要先进的管理设施来提供适当的工作文化。因此,为确保安心和良好的职场环境而设立的安全、维护、清洁等管理设施必须在公司内部进行或外包。

- 近年来,基础设施已成为向民众提供医疗保健的关键要素。这导致该地区对发展卫生基础设施的投资增加。医疗保健机构正在大力投资设施以提供先进的医疗服务。

- BIM 是一种代表设施功能和物理方面的模型,在建筑物资讯资源的结构化交换中发挥关键作用。近年来,随着许多国际组织和政府在整个建筑生命週期中推广 BIM,对建筑资讯模型 (BIM) 的需求不断增加。

- 随着 IT 和 OT 系统不断整合,公司评估其 OT 环境中的潜在网路风险并采取措施加强其安全态势比以往任何时候都更加重要。随着威胁情势发生巨大变化,设施经理可以提供宝贵的内部建议,制定和实施严密的网路安全计画来保护关键的 OT 系统。

- 在后疫情时代,市场受到多种因素的影响,公司和企业比以往任何时候都更加关注客户和员工的福祉。提供更好的就业能力和客户体验将推动服务供应商采用 3D 列印、人工智慧和机器学习等新技术。

拉丁美洲设施管理市场趋势

预计商业终端用户领域将占据主要市场占有率

- 商业房地产涵盖由商业服务机构建造或占用的办公大楼,例如IT和通讯、製造商和其他服务供应商的公司办公室。提供必要的设备、配件以及商业建筑装饰和管理日益重要,推动了拉丁美洲商业部门市场的发展。

- 商业空间需要物业会计、租赁、合约管理、采购管理等多项服务,这需要聘请专业人员。由于这些因素,商业部门在市场上有进一步的成长机会,预计这一趋势将在整个预测期内持续下去。

- 此外,商业部门还涵盖提供商业服务的办公大楼,例如製造业、IT 和通讯、金融和保险业、房地产和其他服务供应商的企业办公室。服务分为房地产、清洁、保全、餐饮、支援、环境管理等。其中,由于对租赁物业广告和物业管理和维护服务的需求不断增加,房地产类别的需求旺盛。

- 预计各国 IT 产业的兴起将带动商业不动产和设施管理服务的扩张。例如,通讯业者正专注于在该地区部署5G,为该地区的设施管理产业创造了庞大的商机。据5G Americas称,截至2023年6月,拉丁美洲和加勒比海地区已部署28张5G网路。巴西和智利各有四个网路使用这种新一代技术。

巴西可望占据较大市场占有率

- 巴西正在成为技术发展和人口变化的中心。该地区正在吸引国际投资者利用其不断发展的科技生态系统。作为全球营运公司全球扩张计画的一部分,各种新工厂正在落脚巴西,利用当地政府提供的经济效益和整体投资组合。网路普及率和 5G 等未来技术的其他因素表明资料基础设施的增加可能会推动市场的发展。根据GSMA预测,到2025年,巴西将成为拉丁美洲5G行动连线数占最大的国家,5G行动连线数将占该国总行动连线的20%。

- 巴西设施管理市场的发展受到跨国和本地公司等商业机构增加、技术整合不断加强、效率提高和外国直接投资增加的推动。这导致该国对设施管理服务的需求不断增长。

- 根据世界银行和联合国贸易和发展会议(UNCTAD)的数据,巴西是继美国之后西半球第二大经济体。

- 此外,随着全球化的兴起,该国的基础设施差距明显。这就是巴西走向私有化的原因。各国政府正在投资向私人公司提供特许经营的项目,将私营部门利益可以透过提高效率来最佳管理的资产私有化。

- 预计该国的社会和人口变化也将对设施管理市场产生正面影响。截至 2022 年初,该国 6.7% 的人口年龄在 64 岁或以上,预计未来几十年将大幅增加。预计这将增加该国对医疗保健服务的需求,从而增加该国对设施管理的需求。预计不断增加的外国直接投资、全球化以及绿色节能建筑的兴起将有利于该国的设施管理市场。

拉丁美洲设施管理产业概况

拉丁美洲设施管理市场是半独立的,主要企业包括 CBRE Group, Inc.、Cushman &Wakefield plc、Sodexo, Inc.、Ecolab Inc. 和 Aramark Corporation。市场参与企业正在采取联盟和收购等策略来增强其产品供应并获得可持续的竞争优势。

2022年12月,索迪斯与利乐将其全球协议再续约五年。索迪斯与国际食品加工包装解决方案公司利乐续签了五年合同,涵盖全球综合设施管理 (IFM) 服务。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- COVID-19 对设施管理产业的影响

第五章 市场动态

- 市场驱动因素

- 加大卫生基础建设及卫生设施建设投入

- 商业建筑的建筑资讯模型 (BIM) 要求与日俱增

- 市场限制

- 资料外洩和安全威胁日益增多

第六章 市场细分

- 按类型

- 公司设施管理

- 外包设施管理

- 单调频

- 捆绑 FM

- 整合调频

- 按服务

- 硬体维修

- 软调频

- 按最终用户

- 商业

- 设施

- 公共/基础设施

- 工业的

- 其他的

- 按地区

- 巴西

- 墨西哥

- 阿根廷

第七章 竞争格局

- 公司简介

- CBRE Group, Inc.

- Cushman & Wakefield plc

- Sodexo, Inc.

- Ecolab Inc.

- Aramark Corporation

- Jones Lang LaSalle IP, Inc.

- ISS A/S

- Tecma Group of Companies

- G4S Brazil(Allied Universal Company)

第八章投资分析

第 9 章:未来趋势

The Latin America Facility Management Market is expected to register a CAGR of 4.61% during the forecast period.

Facility management consists of multiple factors that influence the productivity and efficiency of organizations. The new management system standard, conforming with the best industry practices, constitutes a benchmark for developing and driving effective strategic, tactical, and operational FM principles across the Region.

Key Highlights

- Latin America has witnessed a rise in the count of commercial establishments in significant countries, including Brazil and Mexico. The increase in commercial buildings needs advanced management facilities to provide a decent work culture. Thus, it requires in-house or outsourced management facilities like security, maintenance, cleanliness, etc., to ensure peace of mind and a favorable work environment.

- In recent times, infrastructure has become a crucial element in providing healthcare to the public. Hence, there has been an increased investment in developing healthcare infrastructure in the Region. Healthcare organizations are significantly investing in facilities to deliver advanced healthcare services.

- BIM is a model that illustrates a facility's functional and physical aspects and plays a vital role in the structured exchange of informational resources about the building, making BIM a crucial decision-making guideline. The demand for Building Information Modelling (BIM) has recently increased as many international organizations and governments promote BIM in the building life cycle.

- The need for enterprises to evaluate possible cyber risks across their OT environments and take action to strengthen their security posture is more than ever as IT and OT systems continue to converge. Facility managers may offer crucial insider advice in developing and implementing a diligent cybersecurity plan to safeguard important OT systems as the threat landscape changes alarmingly.

- The market is influenced by various factors in the post-pandemic world, with corporate and businesses focusing more on customer and employee well-being than ever. Providing better employability and customer experience pushes the service providers to incorporate new technologies like 3D printing, artificial intelligence, and machine learning.

Latin America Facility Management Market Trends

Commercial End User Segment is Expected to Hold Significant Market Share

- The commercial entities cover office buildings constructed or occupied by business services, such as corporate offices of IT and communication, manufacturers, and other service providers. Due to the provision of necessary fitments, interiors, and commercial buildings, decoration and management have gained significant importance, driving Latin America's commercial sector market.

- Commercial spaces require property accounting, renting, contract management, procurement management, and several other services, so hiring professionals becomes necessary. Due to such factors, the commercial category has further growth opportunities in the market, and the trend is likely to continue throughout the forecast period.

- Moreover, the commercial sector covers office buildings occupied by business services, such as corporate offices of manufacturers, IT and telecommunication, finance and insurance, property, and other service providers. The services are categorized into property, cleaning, security, catering, support, environmental management, etc. Among these, the property category has high demand due to the increased requirement for advertising rental properties and asset management and maintenance services.

- The rise in the IT sector across various countries will allow more commercial and facility management services expansion. For instance, the telecom players focus on 5G deployments in the region, creating significant opportunities for the region's facilities management sector. According to 5G Americas, as of June 2023, 28 5G networks were deployed in Latin America and the Caribbean. Brazil and Chile accounted for four networks of this next-generation technology each.

Brazil is Expected to Hold Significant Market Share

- Brazil is becoming a hub for development in technology and other demographical changes. The region is attracting international investors to leverage the developing technological ecosystem. Various new facilities as a plan for global expansion by globally-operational companies are entering Brazil to utilize the economic benefits offered by the local government and overall portfolio for investments. The increase in data infrastructure, indicated by internet penetration and other factors to welcome future technologies like 5G, will encourage the market. According to GSMA, By 2025, Brazil was expected to have the maximum share of 5G mobile connections in Latin America, with the technology accounting for 20 percent of total mobile connections in the country.

- The Brazilian facility management market is driven by increased commercial establishments such as MNCs and local corporations, rising technological integration, increased efficiency, and rising FDI investments. This has increased the demand for facility management services in the country.

- According to the World Bank, Brazil was the second-largest economy in the Western Hemisphere, behind the United States, according to the United Nations Conference on Trade and Development (UNCTAD).

- Further, the country witnessed a significant infrastructure gap with increased globalization. Due to this, Brazil is undergoing widespread privatization. The government invests in programs to provide concessions to private companies and privatizes assets that private sector interests can best manage through improved efficiencies.

- Social and demographic changes in the country are also expected to affect the facility management market positively. At the beginning of 2022, 6.7% of the country's population was above the age of 64, which is expected to increase significantly in the following decades. This is expected to drive the demand for healthcare services in the country, which increases the demand for facility management in the country. The increase in FDI, globalization, and growth in green or energy-efficient buildings are anticipated to benefit the facilities management market in the country.

Latin America Facility Management Industry Overview

The Latin America Facility Management Market is semiconsolidated, with major players like CBRE Group, Inc., Cushman & Wakefield plc, Sodexo, Inc., Ecolab Inc., and Aramark Corporation. Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

In December 2022, Sodexo and Tetra Pak extended their global agreement for a five-year contract renewal. Sodexo has renewed its five-year agreement with Tetra Pak, an international food processing and packaging solutions company, to provide global integrated facilities management (IFM) services.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Impact of COVID-19 on the Facility Management Industry

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Investments in Healthcare Infrastructure and the Construction of Healthcare Facilities

- 5.1.2 Requirement of Building Information Modeling (BIM) in Commercial Buildings Addresses the Growth

- 5.2 Market Restraints

- 5.2.1 Increased instances of Data Breaches and Security Threats

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Inhouse Facility Management

- 6.1.2 Outsourced Facility Mangement

- 6.1.2.1 Single FM

- 6.1.2.2 Bundled FM

- 6.1.2.3 Integrated FM

- 6.2 By Offerings

- 6.2.1 Hard FM

- 6.2.2 Soft FM

- 6.3 By End User

- 6.3.1 Commercial

- 6.3.2 Institutional

- 6.3.3 Public/Infrastructure

- 6.3.4 Industrial

- 6.3.5 Others End Users

- 6.4 By Geography

- 6.4.1 Brazil

- 6.4.2 Mexico

- 6.4.3 Argentina

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 CBRE Group, Inc.

- 7.1.2 Cushman & Wakefield plc

- 7.1.3 Sodexo, Inc.

- 7.1.4 Ecolab Inc.

- 7.1.5 Aramark Corporation

- 7.1.6 Jones Lang LaSalle IP, Inc.

- 7.1.7 ISS A/S

- 7.1.8 Tecma Group of Companies

- 7.1.9 G4S Brazil (Allied Universal Company)