|

市场调查报告书

商品编码

1644791

非洲智慧卡:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Africa Smart Card - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

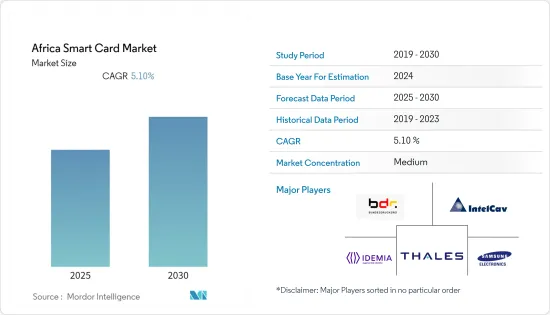

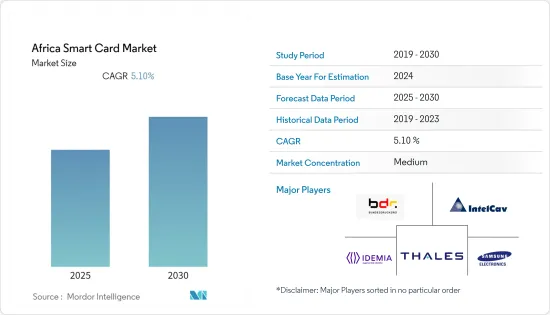

预测期内,非洲智慧卡市场预计将实现 5.1% 的复合年增长率

关键亮点

- 在综合情况下,将引入生物辨识投票系统来检查选民的真实性,减少诈欺和选举舞弊的机会。自从智慧卡技术被引入尼日利亚选举过程以来,它已经被认为提高了选举的公正性。

- 近年来,智慧卡系统在公共和私营部门中得到越来越广泛的应用,尤其是在奈及利亚。该国在国家身分证系统、侦测工资诈欺、确保学生选举的公正性和确保零售付款的努力与非洲大陆其他国家在行动服务、选举和行动银行方面的努力相当。

- 在奈及利亚,生物辨识登记从一个州的薪资核算中剔除了超过 17,000 名幽灵工人。类似的技术也已用于学生选举,证明了向全体民众提供生物辨识支援的 NIN 的可行性。国家身分管理委员会(NIMC)宣布,尼日利亚数位身分计画可在三到五年内实现,预计成本在 4.33 亿美元至 24 亿美元之间。

- 然而,智慧卡在非洲面临的最大问题是其安全水准。为了使智慧卡充分发挥其潜力,它必须能够与多种介面进行互动。但安全也是一个涉及大众对技术认知的问题。由于人们认为他们的卡是安全的,他们可能没有充分意识到他们的卡和他们持有的个人资讯的保护。但他们不知道的是,他们使用智慧卡所获得的所有资讯都会以某种方式在某个地方被收集并进行分析。

- 此外,随着新冠疫情大流行导致的情况迅速变化,智慧卡因其优势,在非洲的各个终端用户产业,尤其是在医疗保健领域得到了越来越广泛的应用。

非洲智慧卡市场趋势

医疗保健和政府部门预计将占据最大的市场占有率

- 非洲正在走向数位化,卫生和政府部门希望消除手工任务并推出用于各种用途的智慧卡。例如,万事达卡最近报告称,南非政府为避免诈欺、重复征收和福利追征,已改用生物识别卡来发放现金福利,导致福利支付减少了20%。

- 2022年1月,南非内政部宣布已开始开发基于生物辨识技术的数位身分证系统NIS,以增强居住在该国的公民和外国人获得各种服务的便利性。这一趋势显示政府部门对智慧卡的需求不断增长。

- 目前,非洲有5个医疗计划正在疫情期间进行。这些计画分别是埃及的CapitalMed医疗城、阿尔及利亚的一家拥有700张床位的医院、象牙海岸共和国的科特迪瓦地区医院、加纳的Komfo Anokey教学医院和尚比亚的一个地区医院计划。医疗保健领域的此类发展预计将推动对医疗记录和用于验证工作人员的智慧卡等的需求。

- 此外,据 Disrupt Africa 称,在疫情期间,该地区的电子医疗正在崛起,预计到 2021年终,该地区将有 55 家电子医疗新兴企业筹集资金。预计这将推动对智慧卡的需求,因为许多医疗保健企业正在与基于智慧卡的电子健康网路合作,以消除对过时且耗时的纸本程式的需求,并增加对低成本互动式患者健康记录的依赖。

南非可望占据最高市场占有率

- 南非是非洲最大的国家之一,被认为是全球新兴的中上收入国家之一。这导致了数位化的提高,该国的银行业正在走向数位转型。预计这将成为该国 IC 卡需求的推动力。

- 机构投资领域的数位转型动能也日益增强。例如,2022 年 2 月,内政部副部长在夸祖鲁-纳塔尔省北部的姆巴兹瓦纳推出了 Matric 智慧身分证。作为该计划的一部分,政府正在该地区选择学校发放智慧ID卡。因此,国内对智慧卡的需求日益增加。

- 此外,该国交通部门已决定从 2023 年 10 月起逐步淘汰贴合加工驾驶执照并改用智慧卡。据交通部长介绍,智慧卡还可以用于识别证件。这些发展表明该国对智慧卡的需求,并为市场供应商创造了机会。

- 根据南非统计局统计,15至19岁人口为491万,20至24岁人口为473.9万人。随着人口的增加,新执照註册数量预计也会增加。因此,随着10月23日起以智慧卡形式发放许可证,智慧卡製造的需求预计将增加。

非洲智慧卡产业概况

- 2021 年 5 月-SecureID 在奈及利亚拉各斯开设智慧卡工厂。该製造工厂是撒哈拉以南非洲地区第一家获得认证的智慧卡製造厂,也是西非地区唯一的个人化和智慧卡製造厂,是西非大陆六家、全球 80 家个人化和智慧卡製造厂之一。该公司已向金融服务业、通讯、政府、教育、医疗保健和私人公司提供了创新产品。 SecureID 设施为非洲 21 个国家提供服务,并获得了 VISA、Verve 和 MasterCard 等主要商务卡公司的完全认可。该工厂已通过 ISO 9001/2015 认证,可用于智慧卡製造以及信用卡和签帐金融卡的个人化。

- 2021 年 9 月-万事达卡与 Paycode 合作,为居住在偏远地区的非洲人提供生物辨识智慧卡。据这两家公司称,撒哈拉以南非洲地区 57% 的人口仍处于经济排斥状态,30% 的人口仍没有证件。此外,60% 的人口尚未连接到网路。因此,这种智慧卡有望实现国家的现代化,并允许用户在线下和线上使用脸部和手掌识别。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 竞争对手之间的竞争

- 替代品的威胁

- 产业价值链分析

第五章 市场动态

- 市场驱动因素

- 扩大身分和存取控制应用程式中的部署

- 广泛应用于旅行识别和交通运输

- 非接触式付款需求不断成长

- 市场问题

- 隐私和安全问题以及标准化问题

第 6 章 COVID-19 对智慧卡市场的影响(医疗保健、零售和政府的高需求 | 供应方市场动态)

第七章 市场区隔

- 按最终用户产业

- 资讯科技/通讯

- 银行、金融服务和保险(BFSI)

- 政府及医疗

- 其他的

- 按国家

- 南非

- 肯亚

- 非洲其他地区

第八章 竞争格局

- 公司简介

- Gemalto NV(Thales Group)

- IntelCav

- Oberthur Technologies(Sofina)

- Bundesdruckerei

- Giesecke & Devrient GmbH(MC Familiengesellschaft mbH)

- HID Global Corporation

- IDEMIA(Advent International)

- Infineon Technologies AG

- Samsung Electronics Co. Ltd

第九章:市场的未来

简介目录

Product Code: 91095

The Africa Smart Card Market is expected to register a CAGR of 5.1% during the forecast period.

Key Highlights

- In the case of an integral part, a biometric voting system is deployed, which checks the authenticity of voters and reduces the possibility of electoral fraud and irregularities. Smart card technology has been seen to have improved the integrity of elections since its introduction in Nigeria's electoral process.

- The spread of smart card systems in both the public and private sectors, especially in Nigeria, has recently increased in the region. Initiatives for national ID systems, detecting payroll fraud, ensuring student election integrity, and securing retail payments in the country were matched by mobile services, elections, and mobile banking initiatives in other countries on the continent.

- Over 17,000 ghost workers have been eliminated in Nigeria from the payroll of a single state with biometric registration. Similar technology was used for a student election, showing that biometrics-backed NINs can be provided to its entire population. The National Identity Management Commission (NIMC) announced that Nigeria's digital identity plan is achievable within three to five years and is expected to cost between USD 433 million to USD 2.4 billion.

- However, the biggest problem facing smart cards is their level of security in Africa. To reach their full potential, smart cards must be able to interact with a host of interfaces. But there is an issue with security involving the public perception of technology. People might not be aware enough about protecting their card and the personal details it holds because they believe the cards are secure. But they are unaware that all the information taken from the smart cards' use is collected and analyzed somewhere and somehow.

- Moreover, amid the rapidly shifting landscape in the wake of the COVID-19 pandemic, the smart cards in Africa are finding increasing deployment in various end-user industries, especially in the healthcare sectors, owing to the benefits rendered.

Africa Smart Card Market Trends

Healthcare and Government Segment is expected to witness highest Market Share

- The growing digitalization in Africa is driving healthcare and government sectors to eliminate manual procedures and implement smart cards for various purposes. For instance, MasterCard recently reported that the government of South Africa registered a reduction of payout by 20% after switching to biometric cards for the distribution of financial benefits by avoiding fraud, double-dipping, and the collection of benefits posthumously.

- In January 2022, the Department of Home Affairs announced that South Africa had started developing a biometric-based digital identity system dubbed NIS to enhance access to various services for citizens and foreign nationals residing in the country. Such developments indicate the growing demand for smart cards in the Government sector.

- Africa currently has five projects in health care amid the pandemic. The healthcare projects are CapitalMed Medical City, Egypt, 700 Beds hospital in Algeria, Cote d'Ivoire Regional Hospitals, Ivory Coast, Komfo Anokey Teaching Hospital, Ghana, and Zambia district Hospitals Project. Such developments in the healthcare sector are expected to drive the demand for smart cards to verify medical records and staff, among others.

- Further, amid the pandemic, e-health care in the region is on the rise, and according to to Disrupt Africa, by the end of 2021, the region is expected to have 55 funded e-health startups. This will drive the demand for smart cards as many healthcare firms are associating with smartcard-based e-health networks to eliminate the need for old and slow paper-based procedures and increase the reliance on low-cost interactive patient health records.

South Africa is Expected to Witness Highest Market Share

- South Africa is one of the largest countries in Africa and is considered one of the emerging upper-middle-income economies worldwide. This has given rise to digitalization, and the banking sectors in the country have been progressing toward digital transformations. This is expected to drive the demand for smart cards in the country.

- The institutional sectors have also been gaining momentum for digital transformation. For instance, in February 2022, The Deputy Minister of Home Affairs launched the Matric Smart Id Card in Mbazwana, north of KwaZulu-Natal.As a part of the program, the government chooses schools in the area to issue the Smart ID Cards. Thus indicating the demand for smart cards in the country.

- Further, the transportation sector in the country has decided to eliminate the use of laminated driving licenses and replace it with Smart Card from October 2023. According to the transportation minister, the smart card will also play a role in identifying documents. Such developments indicate the demand for the smart card in the country and create opportunities for the vendors in the market.

- Moreover, according to Statistics South Africa, the total population of individuals aged 15 to 19 years stands at 4,910 thousand, and individuals between the age of 20 to 24 years stand at 4,739 thousand. With the rising population, new license registrations are expected to increase. Therefore with a license issued in the form of a smart card from October 23, the demand for smart card manufacturing is expected to increase.

Africa Smart Card Industry Overview

- May 2021 - SecureID launched its smart card factory in Lagos, Nigeria. The manufacturing facility is poised to be the first certified smartcard manufacturing plant in sub-Saharan Africa, the only personalization plant and a smart card production in West Africa, and one of only six on the continent and one of 80 in the world. The company provided innovative offerings to the financial services sector, telecommunications, government, education, healthcare, and private enterprises. The SecureID facility serves 21 countries across Africa and is fully certified by major commercial card companies such as VISA, Verve, and MasterCard. The facility has an ISO 9001/2015 certification for smart card manufacturing and personalizing credit and debit cards.

- September 2021- Mastercard partnered with Paycode to offer biometric smart cards for Africans living in remote communities. According to the companies, 57% of sub-Saharan Africa remains financially excluded, and 30% remain without identification. Additionally, 60% of the population does not have internet connectivity. Therefore, the smart card is expected to modernize the country and enable users to use face or palm recognitions in both offline and online locations.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness - Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Intensity of Competitive Rivalry

- 4.2.5 Threat of Substitute Products

- 4.3 Industry Value Chain Analysis

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Growing Deployment in Personal Identification and Access Control Application

- 5.1.2 Extensive Use in Travel Identity and Transportation

- 5.1.3 Growing Demand for Contactless Payments

- 5.2 Market Challenges

- 5.2.1 Privacy and Security issues & Standardization Concerns

6 Impact of COVID-19 on the Smart Card Market (High Demand from the Healthcare, Retail and Government Verticals| Supply-side Market Dynamics)

7 MARKET SEGMENTATION

- 7.1 By End-user Industry

- 7.1.1 IT and Telecommunication

- 7.1.2 Banking, Finacial services and Insurance(BFSI)

- 7.1.3 Government and Healthcare

- 7.1.4 Other End-user Industries

- 7.2 By Country

- 7.2.1 South Africa

- 7.2.2 Kenya

- 7.2.3 Rest of Africa

8 COMPETITIVE LANDSCAPE

- 8.1 Company Profiles

- 8.1.1 Gemalto NV (Thales Group)

- 8.1.2 IntelCav

- 8.1.3 Oberthur Technologies (Sofina)

- 8.1.4 Bundesdruckerei

- 8.1.5 Giesecke & Devrient GmbH (MC Familiengesellschaft mbH)

- 8.1.6 HID Global Corporation

- 8.1.7 IDEMIA (Advent International)

- 8.1.8 Infineon Technologies AG

- 8.1.9 Samsung Electronics Co. Ltd

9 FUTURE OF THE MARKET

02-2729-4219

+886-2-2729-4219