|

市场调查报告书

商品编码

1644814

中东和非洲即时付款:市场占有率分析、行业趋势、统计数据、成长预测(2025-2030 年)Middle East and Africa Real Time Payments - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

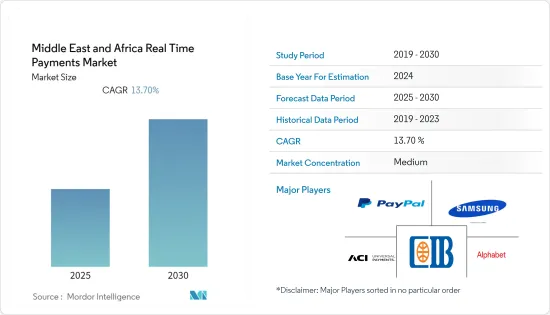

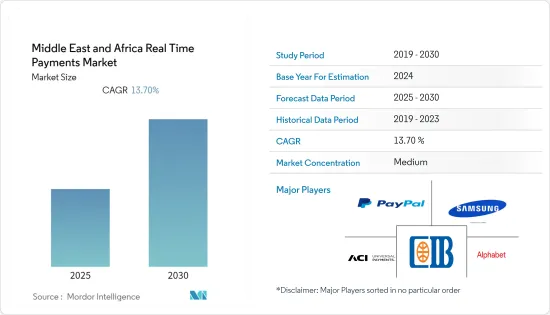

预测期内,中东和非洲的即时付款市场预计将以 13.7% 的复合年增长率成长。

关键亮点

- 付款系统供应商Checkout.com于2020年12月发布的一项针对阿联酋、沙乌地阿拉伯、埃及、巴林、约旦、卡达、科威特和巴基斯坦的5,000多名消费者的调查发现,47%的消费者可能会在未来12个月内更频繁地网路购物。但

- 中东和非洲的数位付款市场正在迅速成长,许多市场参与企业提供一系列服务。尤其是阿拉伯联合大公国,行动付款服务的数量正在迅速增加。

- 根据万事达卡最新的区域报告《无现金之旅》,63%的零售商表示,采用数位付款增加了商店流量,并使销售额提高了 68%。此外,该地区正透过 Pay it 等付款方式实现行动金融服务的转型,阿联酋所有知名品牌均可使用此支付方式,包括 Sharafdg、Emax、Jumbo、Bodyshop、Babyshop、Cineroyal、Novo Cinemas 和 Joyalukkas。

- 随着南非人越来越多地网路购物,数位钱包供应商正在与金融科技合作伙伴开发虚拟付款解决方案。此外,Telkom 还与 Mastercard、Nedbank 和领先的金融科技合作伙伴 Ukheshe Technologies 合作推出了虚拟储值卡。

- 在新冠肺炎疫情期间,中东消费者采用了即时付款方式。由于许多银行和电子商务网站为客户提供即时付款的便利,该地区的即时付款使用量激增。

中东和非洲的即时付款市场趋势

智慧型手机普及率上升推动市场成长

- 随着越来越多的通讯业者推出价格实惠的智慧型手机并增加融资选择以及行动宽频普及率的提高,该地区的智慧型手机普及率继续快速增长。未来五年,该地区智慧型手机连线数预计将增加约2亿,到2025年终将达到5.65亿,普及率约80%。

- 根据万事达卡最近的一项调查,未来中东地区的数位付款将快速成长,超过70%的消费者愿意使用行动电话付款。向行动端的转变预计将带来巨大的经济效益。

- 此外,即时付款服务为消费者和企业带来了一系列好处。用户通常透过行动应用程式存取这些付款系统,这样他们就可以向透过行动电话号码而不是银行帐户详细资讯识别的收款人汇款。此类服务可以满足那些想要快速简单地网路购物以及使用行动电话向朋友和实体零售商付款的消费者的需求。有了这些选择,消费者不再需要携带现金或卡片。

- 例如,沙乌地阿拉伯一家电信业者推出了一款名为「STC Pay」的数位钱包应用程式。

- 此外,2021年10月,摩洛哥通讯业者宣布已完成5G前导测试,并将很快部署自己的5G网络,以加速该地区整个社会的数位转型。

阿联酋占有最大市场占有率

- 随着数位付款变得越来越普及,预计该地区会有更多企业和消费者采用这些付款。即时付款服务为消费者和企业带来许多好处。用户通常透过行动应用程式存取这些即时付款系统,从而可以向透过行动电话号码而不是银行帐户详细资讯识别的收款人汇款。

- 企业还可以透过将即时付款与数位发票选项和支付请求功能相结合来简化 B2B 交易。这些选项可确保企业将相关资料附加到付款中,从而可能加快对帐速度。交易速度的提升也能帮助企业更好地管理流动性。

- 电子商务的普及正在迅速增长,与现金付款相比,数位付款由于其便利性和安全性更高,在该地区的应用也越来越广泛。随着越来越多的消费者透过电子商务购物,消费者似乎也开始接受数位付款。这是因为,顾客担心透过实体货币感染新冠病毒,而不愿在线下商店购物。

- 该地区跨境运营,因此需要更顺畅、更便宜、更快捷的付款流程。因此,在该地区推出此类即时付款系统可能会增加并促进市场成长。

中东和非洲即时付款产业概况

中东和北非即时付款市场集中度较高,由少数几家主要企业主导,包括 Paypal Holdings Inc.、Alphabet Inc.、ACI Worldwide Inc.、三星电子公司和 CIB Bank。这些占据突出市场份额的大公司正致力于扩大海外基本客群。

- 2022 年 4 月 - 根据其数位策略,摩洛哥计划透过鼓励对通讯领域的直接投资,在非洲大陆建立数位技术领域的主导枢纽。

- 2021 年 6 月-南非有线和无线通讯业者Telkom 推出了一款虚拟卡,可供其数位钱包 Telkom Pay 用户在 WhatsApp 上使用,并与万事达卡、莱利银行和领先的金融科技支援合作伙伴 Ukheshe Technologies 合作推出了虚拟储值卡。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

- 国内付款环境的演变

- 与日本无现金交易扩张相关的主要市场趋势

- COVID-19 对该国付款市场的影响

第五章 市场动态

- 市场驱动因素

- 智慧型手机的普及

- 减少对传统银行业务的依赖

- 提高便利性

- 市场问题

- 付款诈骗

- 对现金的依赖

- 市场机会

- 政府鼓励数位付款成长的政策预计将推动大众即时付款的成长

- 数位付款产业的关键法规和标准

- 全球监管状况

- 可能成为监管障碍的经营模式

- 随着商业环境的变化而有发展空间

- 关键用案例和使用案例分析

- 现实世界付款交易占比及主要国家交易量及金额区域分析

- 主要国家地区实际付款交易与非现金交易比例及交易量分析

第六章 市场细分

- 依付款类型

- P2P

- P2B

- 按国家

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 肯亚

- 奈及利亚

- 其他中东和非洲地区

第七章 竞争格局

- 公司简介

- Paypal Holdings Inc.

- Samsung Corporation

- ACI Worldwide Inc.

- CIB Bank

- Alphabet Inc.

- Apple Inc.

- Fiserve Inc.

- Fawry

- Mastercard Inc.

- VISA Inc.

- Saudi Digital Payment Company

- Denarii Cash

第八章投资分析

第九章:未来市场展望

简介目录

Product Code: 91141

The Middle East and Africa Real Time Payments Market is expected to register a CAGR of 13.7% during the forecast period.

Key Highlights

- A study published by Checkout.com, a payment systems provider, in December 2020, which surveyed over 5000 consumers in the UAE, Saudi Arabia, Egypt, Bahrain, Jordan, Qatar, Kuwait, and Pakistan, found that 47% of consumers are likely to shop online more frequently over the next year. However,

- The Middle East and Africa region is witnessing a burgeoning digital payment market with many market players offering various services. The United Arab Emirates (UAE), in particular, has observed a boom in the number of available mobile payment services.

- Mastercard's recent report in the region "The Cashless Journey" stated that 63% of the retailers claimed an increase in foot traffic with a 68% increase in revenue with the acceptance of digital payments. Further, in the region, mobile financial services' transformation has been witnessed through payment methods such as Pay it, which is accepted across all the big brands in the UAE like Sharafdg, Emax, Jumbo, and Bodyshop, Babyshop, Cineroyal, Novo Cinemas, Joyalukkas.

- With the rise in online shopping among South Africans, digital wallet providers are developing virtual payment solutions with fintech partners. Further, Telkom collaborated with Mastercard, Nedbank, and leading fintech enablement partner Ukheshe Technologies to launch this virtual prepaid card.

- During the Covid -19 pandemic, consumers over the Middle East have adopted real-time payment methods. Many banks and E-commerce websites have offered customers the convenience of using real-time payment methods, which has resulted in an upsurge in using Real-time payments in the region.

MEA Real Time Payments Market Trends

Increased Smartphone Penetration to Drive the Market Growth

- Smartphone adoption in the region continues to grow rapidly as many operators introduce affordable smartphones with more financing options, leading to increased mobile broadband adoption. Over the next five years, there would be about 200 million additional smartphone connections in the region, taking the total to 565 million by the end of 2025, at an adoption rate of almost 80%.

- A recent survey from MasterCard indicates that digital payments in the Middle East will increase rapidly with over 70% and stating that consumers were willing to use mobile phones to make payments. The shift to mobile will be causing a tremendous economic impact.

- Additionally, immediate payment services provide various benefits to consumers and businesses alike. Users can often access such payment systems through mobile apps that allow them to send money to recipients identified by their mobile phone numbers rather than their bank account details. Such services can satisfy consumers who want fast, easy ways to shop online as well as those who use their mobile phones to pay for friends or brick-and-mortar retailers. Such options can spare consumers from carrying cash or cards.

- For instance, Saudi Arabia's telecommunications company launched a digital wallet app, STC Pay, which allows people to send money to other users and pay restaurants and stores digitally.

- Further, in October 2021, Morocco's telecommunication operators announced that they had completed pilot tests for 5G and soon will deploy its own 5G network and seeks to accelerate the region's whole-of-society digital transformation.

United Arab Emirates to hold largest Market share

- As digital payment options continue to grow in popularity, an increasing number of businesses and consumers are expected to adopt these payments in the region. Immediate payment services can confer a multitude of benefits to consumers and businesses. Users can often access such real-time-payment systems via mobile apps that allow them to send money to recipients identified by their mobile phone numbers rather than their bank account details, whereas 71% of UAE consumers are already using digital methods to make payments in stores.

- Businesses also have the opportunity to streamline B2B transactions by pairing real-time payments with digital invoicing options and request-to-pay features. These options could help companies ensure that their payments are attached to relevant data, leading to swifter reconciliation. Accelerated transaction speeds can also help firms better manage liquidity.

- The adoption of E-commerce has been proliferating, which favors the use of digital payments in the region due to the increased convenience and security compared to that when using cash. Consumers also appear to be receptive to the usage of digital payments, as many shoppers turn to e-commerce for their purchasing needs. As Customers were reluctant to purchase from offline stores due to fear of contracting COVID-19 through physical money.

- As the region is operating cross-border, it requires smoother, cheaper, and quicker payment processes. Hence, launching such a real-time payment system in the region is likely to increase and drive market growth.

MEA Real Time Payments Industry Overview

The Middle East & North Africa, the Real-Time payments market is moderately concentrated and dominated by a few major players like Paypal Holdings Inc., Alphabet Inc., ACI Worldwide Inc., Samsung Electronics Inc., and CIB Bank. These major players, with a prominent share in the market, are focusing on expanding their customer base across foreign countries.

- April 2022 - Maroc, as per its Digital strategy, is planning to establish a leading hub in the field of digital technologies on the African continent by encouraging foreign investments directly in the telecommunications sector, So it can easily accelerate the transformation of digital society.

- June 2021 - South African wireline and wireless telecommunications provider Telkom introduced a virtual card for use on WhatsApp for its digital wallet, Telkom Pay, users and has collaborated with Mastercard, Nedbank, and leading fintech enablement partner Ukheshe Technologies to launch this virtual prepaid card.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Attractiveness-Porter's Five Forces Analysis

- 4.2.1 Bargaining Power of Suppliers

- 4.2.2 Bargaining Power of Buyers/Consumers

- 4.2.3 Threat of New Entrants

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Evolution of the payments landscape in the country

- 4.4 Key market trends pertaining to the growth of cashless transaction in the country

- 4.5 Impact of COVID-19 on the payments market in the country

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increased Smartphone Penetration

- 5.1.2 Falling Reliance on Traditional Banking

- 5.1.3 Ease of Convenience

- 5.2 Market Challenges

- 5.2.1 Payment Fraud

- 5.2.2 Existing Dependence on Cash

- 5.3 Market Opportunities

- 5.3.1 Government Policies Encouraging the Growth of Digital Paymentis expected to aid the growth of Real Time Payment methods amongst commoners

- 5.4 Key Regulations and Standards in the Digital Payments Industry

- 5.4.1 Regulatory Landscape Across the World

- 5.4.2 Business Models with Potential Regulatory Roadblocks

- 5.4.3 Scope for Development in Lieu of Evolving Business Landscape

- 5.5 Analysis of major case studies and use-cases

- 5.6 Analysis of Real Payments Transactions as a share of all Transactions with a regional breakdown of key countries by volume and transacted value

- 5.7 Analysis of Real Payments Transactions as a share of Non-Cash Transactions with a regional breakdown of key countries by volumes

6 MARKET SEGMENTATION

- 6.1 By Type of Payment

- 6.1.1 P2P

- 6.1.2 P2B

- 6.2 By Country

- 6.2.1 Saudi Arabia

- 6.2.2 United Arab Emirates

- 6.2.3 Kenya

- 6.2.4 Nigeria

- 6.2.5 Rest of Middle-East and Africa

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Paypal Holdings Inc.

- 7.1.2 Samsung Corporation

- 7.1.3 ACI Worldwide Inc.

- 7.1.4 CIB Bank

- 7.1.5 Alphabet Inc.

- 7.1.6 Apple Inc.

- 7.1.7 Fiserve Inc.

- 7.1.8 Fawry

- 7.1.9 Mastercard Inc.

- 7.1.10 VISA Inc.

- 7.1.11 Saudi Digital Payment Company

- 7.1.12 Denarii Cash

8 INVESTMENT ANALYSIS

9 FUTURE OUTLOOK OF THE MARKET

02-2729-4219

+886-2-2729-4219