|

市场调查报告书

商品编码

1644843

全球标籤 -市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Global Label - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

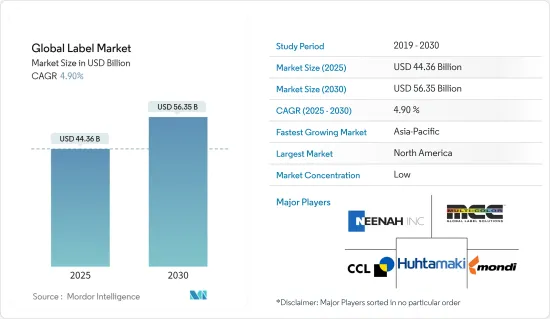

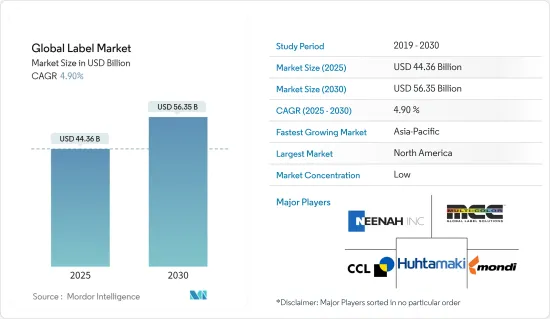

预计 2025 年全球标籤市场规模为 443.6 亿美元,到 2030 年将达到 563.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.9%。

关键亮点

- 标籤对顾客的购买决策有重大影响,在目前市场上各类产品的品牌行销中扮演重要角色。标籤通常由纸、塑胶、织物或其他材料製成,并贴在产品上。此标籤提供一般的产品资讯。

- 标籤透过提供产品识别、成分资讯、警告和建议等功能特性,为食品和消费品包装做出贡献。标籤由于其美观方面,也是品牌推广的重要贡献者。

- 电子商务的兴起推动了对更环保、更有效的包装的需求。因此,客户正在寻找更环保、更有吸引力的选择,例如可回收黏合剂、无底纸标籤和透明基材上的透明薄膜标籤。

- 食品、饮料和製药等主要终端行业对标籤的需求不断增加,预计将增加对标籤的需求。序列化在製药业中日益流行,标籤在製药业的竞争非常激烈。

- 标籤市场的相对稳定是由于COVID-19期间对食品和药品包装的需求增加。同时,COVID-19 疫情导致食品饮料、医疗保健和製造业等各终端用户产业的供应链中断。

标籤市场趋势

食品和饮料终端用户领域可望推动标籤成长

- 标籤预计将在食品和饮料领域实现最大程度的渗透,因为该领域非常重视包装的美学价值。包装可以延长产品的保质期并吸引新客户。

- 食品标籤提供有关产品的有用资讯。其中包括产品名称和说明、净重、日期标记、成分清单、营养资讯面板、过敏警告或过敏原声明、名称和地址以及原产国等资讯。

- 由于食品和饮料行业的兴起,自粘标籤成为一种备受重视的标籤形式。套模标籤直接应用于容器模具上,减少了对实体标籤结构的需求。由于其耐用性、价格实惠、3D装饰潜力和可回收性,这种类型的标籤预计在已开发国家最有发展。

- 在许多发展中地区,随着全球经济的改善,提供各种冷冻食品选择的超级市场和便利商店等现代零售店变得越来越普遍。根据经济合作暨发展组织(OECD)的数据,冷冻食品和包装食品的销售量尤其大幅成长。在德国,客製化包装食品的销量与前一年同期比较成长了56%。

- 根据 Label Insight 和食品行销协会的调查,86% 的顾客对透明度感兴趣。同时,食品购物者将更信任提供全面、易懂的成分资讯的食品製造商和零售商。

亚太地区可望成为成长最快的市场

- 亚太地区是世界上人口最多的地区。随着消费者越来越注重包装,食品和饮料行业对包装的需求也越来越大,对快速、高品质的标籤解决方案的需求也越来越大。由于工业和製造业的不断增长,中国和印度的标籤市场预计将出现正增长。

- 许多亚洲公司都位置于当地,并将机器运往世界各地,从而增加了这些地区的市场利润。例如,AH Industries 在印度、孟加拉、埃及、菲律宾和叙利亚的製药业运作1,000 多台机器。该公司的各种机器,包括湿胶贴标机,广泛应用于製药机械贴标和製药行业的应用。

- 在亚太地区,中国和印度尤其占据市场主导地位。在整个全部区域,COVID-19 的影响因国家而异。包装和标籤产业的製造和生产仅在包装对 GDP 贡献显着的某些国家/地区发挥作用。

- 这里也是三大区域产业协会——印度商会联合会 (FICCI)、全印度食品加工商协会和美印战略伙伴关係论坛 (USISPF)——以及百事可乐和可口可乐等主要饮料公司的所在地。雀巢、亿滋等公司呼吁政府将食品和饮料製造视为“基本服务”,并免除隔离限制,继续生产。

标籤行业概况

全球标籤市场呈现分割状态,导致供应商之间的竞争加剧。市场上不断有新进入者向标籤市场提供产品。这些新进入者迫使现有企业专注于产品创新以获得竞争优势。此外,公司正在推出新产品来扩大客户群。

- 2021 年 4 月 - Neenah, Inc. 耐用标籤解决方案系列中的九种认证生物基产品已获得美国农业部 (USDA) 认证。透过此项第三方认证,一系列 DISPERSA、ENDURA 和 PREVAIL 耐用标籤和纸板产品现在可以带有独特的 USDA 标籤,突出其 68-99% 的生物基含量。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 波特五力分析

- 新进入者的威胁

- 消费者议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争强度

- 供应链分析

- COVID-19 市场影响评估

第五章 市场动态

- 市场驱动因素

- 预计回收离型纸的问题以及实现直接数位印刷的能力将推动需求。

- 能够适应任何尺寸或形状,同时仍提供您所需的保护

- 市场问题

- 饮料业对立式袋的需求不断增长,整个回收过程也日益复杂

第六章 市场细分

- 按类型

- 感压标籤

- 按印刷工艺

- 胶印

- 柔版印刷

- 凹版印刷

- 其他模拟印刷工艺

- 数位印刷

- 依产品类型

- 衬垫

- 无衬垫

- VIP

- 主要的

- 功能与安全性

- 晋升

- 最终用户产业

- 饮食

- 製药和医疗

- 其他的

- 收缩和弹力套筒标籤

- 按类型

- 收缩套标

- 拉伸套

- 按材质

- PVC

- PET

- PE

- OPP & OPS

- 其他材料(PO、PLA等)

- 最终用户产业

- 饮食

- 製药和医疗

- 其他的

- 套模标籤

- 湿胶标籤

- 热转印标籤

- 按材质

- 纸

- 聚酯纤维

- PP

- 其他的

- 最终用户产业

- 饮食

- 製药和医疗

- 其他的

- 环绕式标籤

- 感压标籤

- 地区

- 北美洲

- 欧洲

- 亚太地区

- 中东和非洲

- 拉丁美洲

第七章 竞争格局

- 公司简介

- Neenah, Inc

- Multi-Color Corporation

- Mondi

- Huhtamaki Group

- CCL Industries, LLC

- Constantia Flexibles Group GmbH

- Avery Dennison

- UPM Raflatc

- Lintec

- Bemis Company

- Berry Global

- Klockner Pentaplast

- Taghleef Industries Inc.

- Fort Dearborn Company

- Fort Dearborn

- CPC Packaging

- Royal Sens Group

- 3M Company

- Lintec Corporation

- Fuji Seal International, Inc.

- WestRock Company

- Vintech Polymers Private Limited

- KRIS FLEXIPACKS PVT. LTD.

- GTPL

- Leading Edge labels & Packaging

第八章投资分析

第 9 章:未来趋势

简介目录

Product Code: 91312

The Global Label Market size is estimated at USD 44.36 billion in 2025, and is expected to reach USD 56.35 billion by 2030, at a CAGR of 4.9% during the forecast period (2025-2030).

Key Highlights

- Labels have a considerable impact on customer purchasing decisions and play a vital part in brand marketing of the various products currently available on the market. Labels are often made of paper, plastic, cloth, or other material attached to a product. Labels contain general product information.

- Labels contribute to the packaging of food and consumer goods by giving functional qualities such as product identification, ingredient information, warning signs, and cautionary alerts, among other things. Labels are also important contributors to brand promotion because of their aesthetic aspect.

- With the rise of e-commerce, there is a greater demand for more environmentally friendly and effective packaging. This encourages customers to seek more environmentally friendly and appealing options, such as recyclable adhesives, liner-free labels, and clear film labels on clear substrates.

- The increased need for labels from major end-use industries such as food and beverages and the pharmaceutical business is projected to increase demand for labels. Pharmaceutical businesses are increasingly serializing, giving the label a significant competitive advantage in the pharmaceutical industry.

- The label market has remained relatively stable because of the growing need for food and pharmaceutical packaging during COVID-19. The COVID-19 epidemic, on the other hand, caused supply chain disruptions in a variety of end-user industries, including food and beverage, healthcare, and manufacturing.

Label Market Trends

Food and Beverage End-User Segment is Expected to Drive Growth of Labels

- Labeling is expected to exhibit maximum adoption in the food and beverage industry due to the importance of the aesthetic value of packaging in the food and beverage sector. Packaging extends the product's shelf life and attracts new customers.

- Food label carries useful information about a product. It provides information like the name and description of the product, Net weight, Date mark, Ingredient list, Nutrition information panel, Allergy warning or Allergen declaration, Name and address, and Country of origin.

- Glue-applied labels are the highly rated form of label due to the rise of the food and beverage industry. In-mold labeling is carried out directly on the container's mold, reducing the need for a physical label structure. Because of its durability, affordability, 3D decorating potential, and recycling, this kind is predicted to develop the most in developed countries.

- In numerous growing regions, modern retail trade outlets such as supermarkets and convenience shops that sell a more significant choice of frozen food goods are becoming more prevalent as global economies improve. Frozen and packaged food items, in particular, have expanded considerably, according to the Organisation for Economic Co-operation and Development (OECD). In Germany 56% increase in customized packaged food sales year over year.

- According to Label Insight and the Food Marketing Institute, 86 percent of customers are concerned about transparency. At the same time, grocery shopping would place more faith in food producers and retailers that give comprehensive, easy-to-understand ingredient information.

Asia Pacific is Expected to be the Fastest Growing Market

- The Asia-Pacific region has the largest population in the world. As consumer awareness of packaging grows, so does the demand for packaging in the food and beverage industry and the need for fast and high-quality labeling solutions. Increased growth in the industrial and manufacturing sectors is expected to lead to positive growth in China and India's label market.

- Many Asian companies are located locally, shipping their machines to other parts of the world, helping to increase market profits in these parts of the world. For example, A.H. Industries operates more than 1000 machines in the pharmaceutical industry in India, Bangladesh, Egypt, the Philippines, and Syria. Their wide range of machines, such as wet adhesive labeling machines, are widely used to label pharmaceutical machines and have applications in the pharmaceutical industry.

- In the Asia-Pacific region, China and India, in particular, dominate the market. Throughout the region, the impact of COVID 19 varies from country to country. The manufacturing and production of the packaging and labeling industry work only in certain countries where packaging contributes significantly to GDP.

- In addition, three major regional industry groups such as the Federation of Indian Chamber of Commerce (FICCI), the All Indian Food Processors Association, the US India Strategic Partnership Forum (USISPF), and major beverage makers such as PepsiCo, Coca-Cola. Nestle, Mondelez, and others consider the food and beverage manufacturing sector an "essential service" and call on the government to exempt lockdown restrictions from continuing production.

Label Industry Overview

Global Label Market is fragmented, with inetnse competition among the vendors. The market has been witnessing continuous new entrants offering in Label Market. Due to these new entrants, exsisting companies are focusing on making product innovations to gain competitive advantage. Also, the companies are launching new product to interset their customer base.

- April 2021 - Neenah, Inc. achieved nine verified U.S. Department of Agriculture (USDA) Certified Biobased Products in the durable label solutions lineup as further evidence of its commitment to sustainability efforts. With this third-party verification, various DISPERSA, ENDURA, and PREVAIL durable label and board products have earned the ability to display a unique USDA label highlighting their biobased content ranging from 68-99%.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definitions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Porters Five Force Analysis

- 4.2.1 Threat of New Entrants

- 4.2.2 Bargaining Power of Consumers

- 4.2.3 Bargaining Power of Suppliers

- 4.2.4 Threat of Substitute Products

- 4.2.5 Intensity of Competitive Rivalry

- 4.3 Supply Chain Analysis

- 4.4 Assessment of the Impact of COVID -19 on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 The issues related to recycling of release liners and the ability to enable direct digital printing is expected to spur demand

- 5.1.2 Ability to conform to any size and shape, and yet provide the necessary protection

- 5.2 Market Challenges

- 5.2.1 Growing demand for stand-up pouches in the beverage sector and elaborate nature of the overall recycling process

6 MARKET SEGMENTATION

- 6.1 By Type

- 6.1.1 Pressure-Sensitive Label

- 6.1.1.1 By Print Process

- 6.1.1.1.1 Offset Printing

- 6.1.1.1.2 Flexography Printing

- 6.1.1.1.3 Gravure

- 6.1.1.1.4 Other Analog Printing Process

- 6.1.1.1.5 Digital Printing

- 6.1.1.2 By Product Type

- 6.1.1.2.1 Liner

- 6.1.1.2.2 Linerless

- 6.1.1.2.3 VIP

- 6.1.1.2.4 Prime

- 6.1.1.2.5 Functional & Security

- 6.1.1.2.6 Promotional

- 6.1.1.3 End-User Industry

- 6.1.1.3.1 Food & Beverages

- 6.1.1.3.2 Pharmaceutical & Healthcare

- 6.1.1.3.3 Other End-Users

- 6.1.2 Shrink & Stretch Sleeve Label

- 6.1.2.1 By Type

- 6.1.2.1.1 Shrink Sleeve

- 6.1.2.1.2 Stretch Sleeve

- 6.1.2.2 By Material

- 6.1.2.2.1 PVC

- 6.1.2.2.2 PET

- 6.1.2.2.3 PE

- 6.1.2.2.4 OPP & OPS

- 6.1.2.2.5 Other Materials (PO, PLA, etc.)

- 6.1.2.3 End-User Industry

- 6.1.2.3.1 Food & Beverages

- 6.1.2.3.2 Pharmaceutical & Healthcare

- 6.1.2.3.3 Other End-Users

- 6.1.3 In-Mold Label

- 6.1.4 Wet Glue Label

- 6.1.5 Thermal Transfer Label

- 6.1.5.1 By Material

- 6.1.5.1.1 Paper

- 6.1.5.1.2 Polyester

- 6.1.5.1.3 PP

- 6.1.5.1.4 Other Materials

- 6.1.5.2 End-User Industry

- 6.1.5.2.1 Food & Beverages

- 6.1.5.2.2 Pharmaceutical & Healthcare

- 6.1.5.2.3 Other End-Users

- 6.1.6 Wrap Around Label

- 6.1.1 Pressure-Sensitive Label

- 6.2 Geography

- 6.2.1 North America

- 6.2.2 Europe

- 6.2.3 Asia-Pacific

- 6.2.4 Middle East & Africa

- 6.2.5 Latin America

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 Neenah, Inc

- 7.1.2 Multi-Color Corporation

- 7.1.3 Mondi

- 7.1.4 Huhtamaki Group

- 7.1.5 CCL Industries, LLC

- 7.1.6 Constantia Flexibles Group GmbH

- 7.1.7 Avery Dennison

- 7.1.8 UPM Raflatc

- 7.1.9 Lintec

- 7.1.10 Bemis Company

- 7.1.11 Berry Global

- 7.1.12 Klockner Pentaplast

- 7.1.13 Taghleef Industries Inc.

- 7.1.14 Fort Dearborn Company

- 7.1.15 Fort Dearborn

- 7.1.16 CPC Packaging

- 7.1.17 Royal Sens Group

- 7.1.18 3M Company

- 7.1.19 Lintec Corporation

- 7.1.20 Fuji Seal International, Inc.

- 7.1.21 WestRock Company

- 7.1.22 Vintech Polymers Private Limited

- 7.1.23 KRIS FLEXIPACKS PVT. LTD.

- 7.1.24 GTPL

- 7.1.25 Leading Edge labels & Packaging

8 INVESTMENTS ANALYSIS

9 FUTURE TRENDS

02-2729-4219

+886-2-2729-4219