|

市场调查报告书

商品编码

1644848

欧洲商业软体市场:份额分析、产业趋势与统计、成长预测(2025-2030 年)Europe Business Software - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

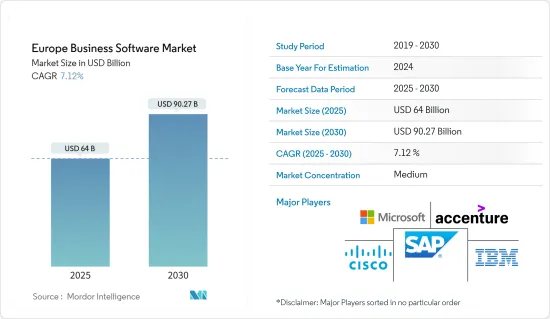

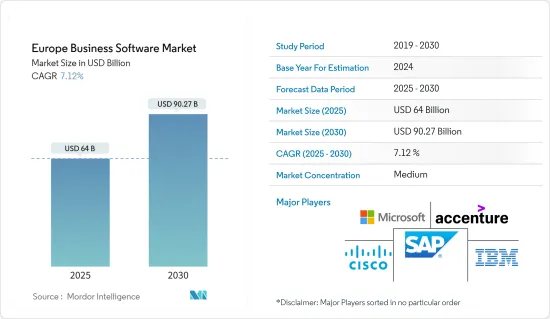

预计 2025 年欧洲商业软体市场规模为 640 亿美元,到 2030 年将达到 902.7 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.12%。

关键亮点

- 数位化和线上资料收集增加了公司对资料分析、消费者评论和业务流程的需求。这项发展推动了对企业软体,尤其是商业智慧(BI)的需求。除了 BI,商业软体部门还包括企业资源规划 (ERP)、客户关係管理 (CRM) 和供应链管理 (SCM) 软体。

- 商业软体驱动并连接整个企业的资料和流程。我们还帮助优化云端运算并改善与客户、供应商、供应商、员工和客户的沟通。

- 此外,人工智慧在职场的日益渗透提高了组织的生产力和效率,从而推动了商业软体市场的发展。人工智慧驱动的任务管理软体可以有效地处理计划、提醒和后续工作,最大限度地减少人工输入的需要。透过确保不出现任何疏漏,它还可以节省许多活动中的人力时间。

- 此外,该企业软体还列出了多种好处,包括透过单一整合平台管理工作流程、无需多个系统、透过自动化流程提高资料品质、减少资料重复,以及允许客户管理员工健康状况并在线上查看资料。

- 全球企业软体公司正在向欧洲投资,导致软体市场的需求增加。例如,2023 年 12 月,总部位于波兰的 Better Software Group 宣布与 Evergent 建立策略合作伙伴关係,以增强数位媒体和娱乐领域的客户体验。这项策略合作伙伴关係为欧洲串流媒体和数位订阅业务带来了卓越的客户关係管理和使用者体验。

- 新冠疫情加速了数位化进程,导致资料收集和资料需求增加。我们还在数位化方面取得了进展,以适应远距工作环境。欧洲正处于云端驱动的数位转型的十字路口。 COVID-19 疫情迫使欧洲企业迅速采用必要的云端迁移。

欧洲商业软体市场的趋势

客户关係管理软体大幅成长

- 软体供应商拥有并维护运行云端基础的CRM 系统的基础设施。 CRM 软体在组织具有网路连线的电脑上运作。 CRM 公司将组织的资料保存在内部并确保其安全。这意味着公司不必花费大量的前期成本来建立储存和保护所有资料所需的基础设施。

- 欧洲商业软体市场正在透过收购和策略联盟不断扩张。例如,2023 年 6 月,云端软体集团宣布与 Midis 集团建立策略合作伙伴关係,以更好地服务其在东欧、中东和非洲的大多数客户。此次合作将使云端软体集团能够利用其客户所需的本地资源来支援他们的变革性技术之旅,并提供进一步扩大其在欧洲以及中东和非洲其他地区影响力所需的规模。

- 2023年5月,Salesforce宣布与埃森哲建立策略伙伴关係,加速将产生人工智慧引入CRM。透过此次合作,两家公司旨在创建一个生成式人工智慧中心,为企业提供扩展所需的技术和专业知识。

- 透过增强机器学习、情绪分析以及利用客户与品牌之间的情感亲和性的能力,云端 CRM 为企业提供了更全面的方法来改善客户体验结果。预计这些考虑将推动本地企业采用云端 CRM。

- 此外,该地区零售和批发服务业的成长预计将为市场带来新的成长机会。零售客户关係管理系统收集和储存客户资讯和资料,例如最近的购买历史、电话号码、相关日期和进一步的联络资讯。根据 SoftClouds CRM 云端调查报告,超过 80% 的企业使用 CRM 系统来自动化销售流程和彙报。

- 此外,在欧洲,非金融经济领域营运的所有公司中有三分之一活跃于此领域,主要代表服务于当地市场的中小型零售商和批发商。

- 根据经合组织公布的统计数据,葡萄牙、土耳其和波兰零售额增幅最高,分别为13.3%、10.2%和10.1%。预计这些地区的零售额成长将推动对 CRM 的需求并在预测期内支持市场成长。

预计德国市场将大幅成长

- 数位化和IT安全是欧洲的关键问题,公司和组织正在从传统的内部部署软体迁移到更安全、更有效率且更易于连接的云端解决方案。随着越来越多的中小型企业发现基于云端基础的ERP 系统能够实现手动和劳动密集流程的自动化,德国向云端技术的转变预计将继续加速。

- 德国的ERP市场又与时俱进。尤其是 SAP,它将其软体即服务 (SaaS) 和 AI 产品视为加强其在欧洲市场主导地位的下一步。事实上,透过采用 S/4HANA 和 SAP Leonardo 平台,SAP 已准备好充分利用未来的市场趋势。此外,新兴企业和专门从事巨量资料应用的新创公司Altiscale等。

- 这家企业软体公司正致力于透过收购扩大在德国市场的影响力。例如,2023年1月,Visma宣布收购柏林软体公司H&H和BuchhaltungsButler,进军德国市场。 Visma 是一家欧洲业务关键型云端基础软体供应商,为中小型企业和公共部门提供薪资、会计和人力资源等领域的 ERP 解决方案。

- 此外,德国的IT和软体产业是世界上最具创新性的产业之一,因此被认为是利润丰厚的市场。最近的发展包括政府激励和支持计划、低利率以及对数位服务的迫切需求,这些都在德国经济的各个领域创造了巨大的需求,进一步推动了市场成长。

- 此外,随着数位化和云端技术继续影响全球企业,德国企业,尤其是中小企业,正专注于数位化商务策略,其中云端服务(最好是混合云端服务)在其成功中发挥着至关重要的作用。

- 此外,根据 bitkom.org 的数据,2022 年德国软体产业的销售额为 355 亿欧元(38.58 亿美元)。这与前一年同期比较增加了约 30 亿欧元(30 亿美元)。过去十年,软体产业收入稳定成长。

欧洲商业软体产业概况

欧洲商业软体市场主要由全球性和地区性公司组成,竞争相对较弱。这些市场参与企业拥有相当大的市场占有率,并致力于在全球扩大基本客群。为了在预测期内获得竞争优势,这些公司正在投资研发、策略伙伴关係以及其他有机和无机成长方法,以带来创新解决方案。

- 2023 年 10 月,Leidos 推出了其最新的企业软体平台 ProSight。 ProSight 透过集中式安全管理系统为机场和商业组织提供高风险网路基地台。 ProSight 整合了先前与查核点不相容的系统和技术,包括安全筛检设备、威胁侦测演算法和其他第三方资料。

- 2023 年 9 月,OneStream Software 和毕马威宣布建立策略伙伴关係,以克服组织复杂性并推动法国的财务转型。此次伙伴关係将利用 CPM OneStream 的整合云端运算软体等技术,以及领先的商业咨询服务供应商毕马威的专业知识,支援从计划交付到行销和策略业务合作等活动。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态

- 市场概况

- 市场驱动因素

- 中小企业需求不断成长

- 转向整合解决方案推动需求

- 基于云端和网路的进步

- 市场问题

- 市场机会

- 产业吸引力波特五力分析

- 购买者/消费者的议价能力

- 供应商的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 新冠肺炎疫情及其他宏观经济因素对市场的影响

- 向远端/混合工作模式的转变及其在加速软体采用中的作用

- 区域采用驱动因素以及疫情前后情景

- 商业软体的最新趋势和创新

第 5 章。

- 依软体类型

- ERP 软体

- CRM 软体

- BI 软体

- 供应链软体

- 按部署

- 云

- 本地

- 按行业

- BFSI

- 医疗

- 公共部门

- 零售

- 运输

- 製造业

- 其他产业(电讯、国防等)

- 按国家

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 波兰

- 比荷卢

- 罗马尼亚

- 捷克共和国

- 匈牙利

- 欧洲其他地区

- 按软体类型细分(最终调查包括 CRM、ERP、BI、SCM)

第六章 竞争格局

- 十大 ERP 供应商分析(主要供应商的相对市场份额)- SWOT、策略、最新发展

- 十大 CRM 供应商分析(主要供应商的相对市场份额)

- 领先的 BI 软体供应商分析,包括其核心竞争力分析

- 主要SCM供应商分析(包括其核心竞争力分析)

第七章投资分析

- 近期併购

- 最受欢迎的策略

- 差距分析

第八章 市场展望

The Europe Business Software Market size is estimated at USD 64.00 billion in 2025, and is expected to reach USD 90.27 billion by 2030, at a CAGR of 7.12% during the forecast period (2025-2030).

Key Highlights

- Digitalization and online data collection have increased companies' requirements for data analysis, consumer reviews, and business processes. This development is driving demand for enterprise software, particularly business intelligence BI. In addition to BI, the business software area also includes software for Enterprise Resource Planning ERP, Customer Relationship Management (CRM), and Supply Chain Management (SCM).

- Business Software facilitates and connects data and processes across the enterprise. It also aids in cloud computing optimization and improves communication with clients, vendors, suppliers, employees, and customers.

- Furthermore, the Business software market is driven by the increasing penetration of artificial intelligence in the workplace to improve organizational productivity and efficiency. Task management with artificial intelligence Software can handle timetables, reminders, and follow-ups effectively and minimize the need for human inputs. They may also save humans time on numerous activities by ensuring nothing is overlooked.

- Moreover, enterprise software offers a variety of benefits, such as managing workflows through a single integrated platform, eliminating the need for multiple systems, improving data quality and reducing data duplication through automated processes, and enabling customers to manage employee health and view data online.

- Global Enterprise Software companies invest in Europe, which results in a rise in demand for the software market. For instance, in December 2023, Better Software Group, based in Poland, announced a strategic partnership with Evergent to enhance customer experiences across the digital media and entertainment landscape. The strategic partnership will deliver superior customer relationship management and user experiences for European streaming and digital subscription businesses.

- The COVID-19 pandemic accelerated digitalization, resulting in increased data collection and the need to analyze the data collected. It also increased digitalization to cope with the remote working environment. Europe is at a crossroads in its digital transition with the cloud. The COVID-19 pandemic compelled European businesses to adopt essential cloud migration quickly.

Europe Business Software Market Trends

Customer Relationship Management Software Show Significant Growth in the Market

- The software provider owns and maintains the infrastructure to run a cloud-based CRM system. CRM software is run on computers by organizations using an internet connection. CRM companies keep and secure the organization's data on their premises. This prevents enterprises from incurring large upfront fees for creating the infrastructure required to store and safeguard all that data.

- The Business Software Market in Europe is expanding through acquisitions and strategic collaborations. For instance, in June 2023, Cloud Software Group announced a strategic partnership with Midis Group to better serve its customers in most of Eastern Europe, the Middle East, and Africa. The partnership will enable the Cloud Software Group to tap into local resources needed by customers in order to support their transformative technology journey and scale necessary for further expansion of its reach across Europe and other regions.

- In May 2023, Salesforce announced a strategic partnership with Accenture to accelerate the adoption of generative artificial intelligence for CRM. Through this collaboration, both companies aim to create a generative AI hub that provides companies with the technology and expertise they need to scale.

- Cloud CRM enables enterprises to take a more holistic approach that improves customer experience outcomes through enhanced machine learning, sentiment analysis, and the ability to harness the emotional affinity between customers and the brand. Such considerations are expected to drive the use of Cloud CRM for regional businesses.

- Furthermore, the growing retail and wholesale services sector in the region will create new growth opportunities for the market. The Retail Customer Relations Management System collects and stores the customer's information and profiles, including their most recent purchase, telephone number, relevant dates, and further contact details. More than 80% of businesses use CRM systems for sales process automation and reporting, according to the CRM Cloud Survey Report from SoftClouds.

- Moreover, in Europe, one-third of all enterprises operating within the non-financial economy are active in the sector, representing mainly small to medium-sized retailers and wholesalers that serve local markets.

- According to stats published by the OECD, Portugal, Turkiye, and Poland had the highest rise in retail sales volume at 13.3, 10.2, and 10.1 percent, respectively. Such an increase in the region's retail sales will drive the demand for CRM and support the market growth during the projected timeline.

Germany is Expected to Witness Significant Growth in the Market

- With digitalization and IT security high on the European agenda, companies and organizations are increasingly moving from traditional on-premise software to more secure, efficient, and easy-to-connect cloud solutions. The transition to cloud technology in Germany is expected to continue to accelerate as more and more small and medium-sized businesses discover the benefits of cloud-based ERP systems for automating manual and labor-intensive processes.

- The ERP market is once again evolving with the times in the country. SAP, in particular, sees Software-as-a-Service and AI products as the next step in strengthening its stranglehold in European markets. Indeed, with the introduction of its S/4HANA and SAP Leonardo platforms, SAP has properly positioned itself to capitalize on future market trends. This is in addition to its aggressive acquisition strategy, including Gigya, a consumer profile and identity management company, and Altiscale, a start-up focused on big data applications.

- Enterprise software companies are focusing on expanding their presence in the German market by making Acquisitions. For instance, in January 2023, Visma announced it entered the German market by acquiring Berlin-based software companies H&H and BuchhaltungsButler. Visma is a European provider of business-critical cloud-based software for SMEs and the public sector, offering ERP solutions for areas such as payroll, accounting, and human resources.

- Moreover, the German IT and software industry is considered one of the most innovative in the world and, therefore, a very lucrative market. Due to recent events, government incentives and support programs, low interest rates, and the urgent need for digital services have created enormous demand in all areas of the German economy, which will further drive the market growth.

- Furthermore, as digitalization and cloud technologies continue to impact global business, German organizations, especially SMEs, are focusing on digital business strategies, with cloud services, preferably hybrid cloud services, playing an essential role in their success.

- Moreover, according to bitkom.org, in 2022, the German software industry generated EUR 35.5 billion (USD 38.58) in revenue. This was an increase of about EUR 3 billion (USD 3 billion) compared to the year before. The income of the software industry over the past ten years has been growing steadily.

Europe Business Software Industry Overview

Europe Business Software Market is moderately competitive, with significant global and regional companies. These industry participants have a sizable market share and are focused on extending their client base globally. To gain a competitive advantage over the forecast period, these firms are spending on R&D to bring innovative solutions, strategic partnerships, and other organic & inorganic growth methods.

- In October 2023, Leidos announced to launch ProSight, its newest enterprise software platform. ProSight provides airports and commercial organizations with high risk access points with a centralized security management system. ProSight brings together systems and technologies such as security screening equipment, threat detection algorithms or other third party data which were traditionally incompatible at the check points.

- In September 2023, OneStream Software and KPMG announced strategic partnership to help organizations conquer complexity and drive finance transformation in France. The partnership will support activities ranging from project implementation to marketing and strategic business collaboration, using KPMG's expertise as the leading provider of consulting services for businesses and technology including CPM OneStream's unified cloud computing software.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions & Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growing Demand from SMEs

- 4.2.2 Move Towards Integrated Solutions Expected to Drive Demand

- 4.2.3 Cloud & Networking-Based Advancements

- 4.3 Market Challenges

- 4.4 Market Opportunities

- 4.5 Industry Attractiveness Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Buyers/Consumers

- 4.5.2 Bargaining Power of Suppliers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Impact of COVID-19 Aftereffects and Other Macroeconomic Factors on the Market

- 4.6.1 Move Towards Remote/Hybrid Working and Their Role in Driving Adoption of Software

- 4.6.2 Regional Drivers for Adoption & Pre vs Post-Pandemic Scenarios

- 4.7 Recent trends and innovations in Business Software

5 EUROPE BUSINESS SOFTWARE MARKET SEGMENTATION (Trends, revenue for the period of 2022-2027 & Market Outlook)

- 5.1 By Software Type

- 5.1.1 ERP Software

- 5.1.2 CRM Software

- 5.1.3 BI Software

- 5.1.4 Supply chain Software

- 5.2 By Deployment

- 5.2.1 Cloud

- 5.2.2 On-Premise

- 5.3 By End-User Vertical

- 5.3.1 BFSI

- 5.3.2 Healthcare

- 5.3.3 Public & Institutions

- 5.3.4 Retail

- 5.3.5 Transportation

- 5.3.6 Manufacturing

- 5.3.7 Other End-User Verticals (Telecom, Defense, etc.)

- 5.4 By Country

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Poland

- 5.4.7 Benelux

- 5.4.8 Romania

- 5.4.9 Czech Republic

- 5.4.10 Hungary

- 5.4.11 Rest of Europe

- 5.4.12 Further Breakdown by Software Type (CRM, ERP, BI & SCM to be included in the final study)

6 COMPETITIVE LANDSCAPE

- 6.1 Analysis of Top 10 ERP Vendors (with relative shares for major vendors) - SWOT, Strategies & Recent Developments

- 6.2 Analysis of Top 10 CRM Vendors (with relative shares for major vendors)

- 6.3 Analysis of Major BI Software Vendors (with coverage on their core competencies)

- 6.4 Analysis of Major SCM Vendors (with coverage on their core competencies)

7 INVESTMENT ANALYSIS

- 7.1 Recent Mergers & Acquisitions

- 7.2 Most Adopted Strategies

- 7.3 Gap Analysis

- 7.4 Analyst View