|

市场调查报告书

商品编码

1644891

德国网路安全:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Germany Cybersecurity - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

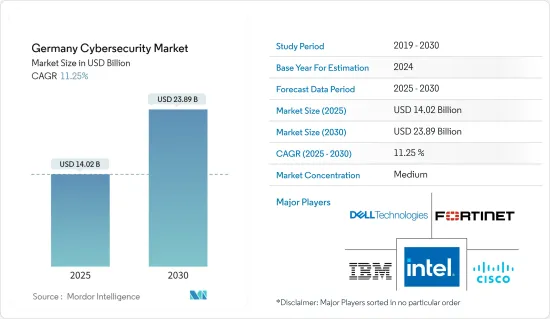

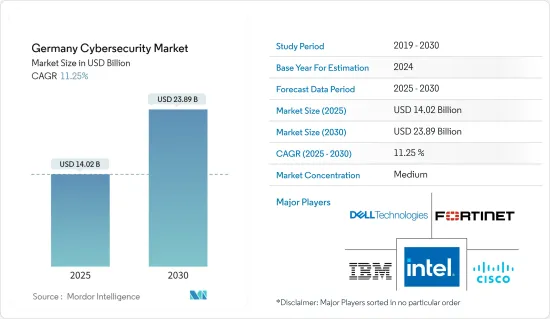

预计 2025 年德国网路安全市场规模为 140.2 亿美元,到 2030 年将达到 238.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 11.25%。

由于电子商务平台的兴起、智慧型装置的广泛使用以及云端解决方案的部署而导致的网路攻击数量的增加是推动市场成长的因素。随着智慧和物联网技术设备的使用增加,网路威胁预计将持续演变。因此,预计企业将采用和部署先进的网路安全解决方案来侦测、最小化和减轻网路攻击的风险,从而推动市场成长。

主要亮点

- 预计政府采取的各种措施和主要企业采取的策略将推动市场发展。德国拥有强大且多样化的网路安全生态系统,拥有许多专门从事网路安全的成熟公司、新兴企业、研究机构和大学。该国政府的政策尤其支持,推出了国家网路安全战略和网路安全法等措施。

- 该地区网路攻击数量的增加预计将推动对网路安全解决方案的需求。例如,根据联邦资讯安全局发布的《2022年德国IT安全状况》,消费者的整体兴趣水准与过去三年相比略有上升。约29%的受访者表示,他们曾遭受网路犯罪。前几年这个比例是25%。四分之一的受访者曾经历过网路购物诈骗(25%)、第三方存取他们的线上帐户(25%)和恶意软体感染(24%)。与网路购物诈骗(2021 年:19%)相比,第三方存取网路帐户(2021 年:31%)和恶意软体感染(2021 年:29%)的数字与前一年相比有所下降。去年,只有 19% 的受访者成为网路钓鱼的受害者。

- 解决与第三方供应商风险、託管安全服务提供者(MSSP)的变化以及向云端优先策略的转变等趋势相关的风险对于网路安全市场至关重要。随着公司越来越依赖外部供应商提供各种服务和技术,相关风险也随之增加。

- 过去几年里,安全系统使得攻击者更难取得关键资料。因此,一般用户对网路安全的警觉性越来越高。几年前有效的解决方案现在不再适用。为了识别网路攻击并从中恢復,组织需要多种资源并且必须做好充分的准备。在许多情况下,组织可能需要完全停止业务几天才能从违规或攻击中恢復过来。如果计划不周和基础设施不完善,事故发生后恢復所需的时间可能会更长。

- 网路攻击者将 COVID-19 疫情视为机会,利用在家工作员工的漏洞来加强犯罪活动。在后疫情时代,网路安全的需求日益增加,因为计划实施业务永续营运计划(BCP)的企业数月来一直致力于在隔离条件下业务的同时加强网路安全,包括资讯安全监控和响应。因此,随着对数位化和可扩展IT基础设施的需求不断增加,所研究的市场正在快速成长。

德国网路安全市场的趋势

资料安全领域可望占据主要市场占有率

- 在德国,《资料保护法》已经生效,迫使企业实施资料安全解决方案,并提高资料安全意识的重要性。

- 德国企业领域的工业自动化和资料收益趋势加剧了终端用户资料隐私侵犯和财务损失的风险,从而推动了该国对资料安全解决方案的需求。

- 例如,2023年11月,德国联邦资讯安全局发布报告指出,德国的网路威胁显着增加,占德国经济约80%的中小企业被认为面临极高的勒索软体攻击风险。

- 因此,预计未来几年各组织将大力投资资料安全解决方案。这主要是因为需要保护和确保多个环境中的敏感资讯安全、遵守监管要求并简化操作复杂性。根据 DLA Piper 的数据,截至 2023 年 1 月,报告的个人资料外洩事件最多的国家是荷兰,总合。其次是德国,个人资讯外洩报告超过7.6万起。

- 2030年「数位十年」目标等欧洲商业环境数位转型措施推动了数位经济的崛起,这也增加了该地区的电子资料量和资料外洩的风险。

- 例如,2023年10月,欧盟委员会发布了首份「数位十年」状况报告,介绍了实现数位转型以加强数位主权、有弹性和有竞争力的欧盟的进展,并确认了对资料安全解决方案的需求,以保护德国的数位基础设施免受网路攻击。

IT 和通讯终端用户领域预计将占据市场占有率

- 资讯科技 (IT) 和通讯对于企业、政府和组织至关重要。随着我们对互联网、云端运算和数位通讯的依赖日益增加,强大的网路安全措施的需求变得至关重要。 IT 和电讯终端用户构成了全球网路安全市场的重要组成部分,他们力求保护自己的敏感资料、网路和通讯免受不断演变的网路威胁。

- 德国是一个已开发经济体,拥有强大的行动电话网路。例如,通讯业巨头德国电信最近指出,99% 的德国人可以使用 LTE 服务。相比之下,目前已有 92% 的家庭可以存取该营运商的 5G 网路。根据德国电信介绍,其利用3.6GHz频段在德国境内2,000多个地点提供5G服务。

- 2023 年 12 月,Whalebone 与 O2 Telefonica 在德国签署了新的伙伴关係关係。这将使 O2 Telefonica 客户能够利用名为 Aura 的网路安全解决方案。此举增强了 Whalebone 作为通讯业网路安全领导者和客户盟友的地位。

- 根据欧洲5G观察站的数据,截至2023年,德国将成为欧盟成员国中拥有5G基地台最多的国家,安装的基地台约为90,000个。

- 网路安全市场的 IT 和电讯终端用户部分对市场成长做出了重大贡献,因为网路威胁的频率和复杂性不断增加,对 IT 和电讯基础设施构成了重大风险,而且云端部署、企业合作和收购成为关注焦点。此外,预计全球网路安全市场的 IT 和电讯终端用户将继续投资于创新解决方案。随着技术的进步,主动实施先进的网路安全措施预计将成为维护全球 IT 和通讯业务的完整性和安全性的关键。

德国网路安全产业概况

德国网路安全市场半固体,主要参与者包括 IBM 公司、思科系统公司、戴尔科技公司、Fortinet 公司和英特尔安全公司(英特尔公司)。市场参与者正在采取合作和收购等策略来加强其产品供应并获得永续的竞争优势。

- 2023 年 10 月,IBM 将推出一项新的 AI 驱动的託管侦测和回应服务,该服务能够自动升级或关闭高达 85% 的警报,从而帮助缩短客户的安全回应时间。全新威胁侦测和回应服务 (TDR) 提供全天候调查、监控和自动修復客户混合云环境中所有相关技术的安全警报的功能,包括现有的安全工具和投资、云端、本地和操作技术(OT)。

- 2023 年 10 月,McAfee Corp. 推出具有 AI 保护功能和新功能的产品系列,以帮助消费者保护他们的线上隐私和身分。 McAfee 的产品系列包括创新的安全功能,例如 McAfee Next-gen Threat Protection 和 McAfee Scam Protection,它们利用先进的 AI 来对抗日益增长的 AI 威胁,并为消费者及其家人提供自动化的安全保护。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 宏观经济因素如何影响市场

第五章 市场动态

- 市场驱动因素

- 数位化和对可扩展IT基础设施日益增长的需求

- 需要因应各种趋势带来的风险,包括第三方供应商风险、MSSP 的发展以及云端优先策略的采用

- 市场限制

- 网路安全专家短缺

- 高度依赖传统身分验证方法且缺乏准备

- 趋势分析

- 组织利用人工智慧加强其网路安全策略

- 由于转向云端基础的交付模式,云端安全将呈指数级增长

第六章 市场细分

- 按服务

- 安全类型

- 云端安全

- 资料安全

- 身分和存取管理

- 网路安全

- 消费者安全

- 基础设施保护

- 其他类型

- 按服务

- 安全类型

- 按部署

- 云

- 本地

- 按最终用户

- BFSI

- 卫生保健

- 製造业

- 政府和国防

- 资讯科技/通讯

- 其他最终用户

第七章 竞争格局

- 公司简介

- IBM Corporation

- Cisco Systems Inc.

- Dell Technologies Inc.

- Fortinet Inc.

- Intel Security(Intel Corporation)

- F5 Networks Inc.

- AVG Technologies

- FireEye Inc.

- Fujitsu

第八章投资分析

第九章:市场的未来

The Germany Cybersecurity Market size is estimated at USD 14.02 billion in 2025, and is expected to reach USD 23.89 billion by 2030, at a CAGR of 11.25% during the forecast period (2025-2030).

The rising number of cyberattacks with the emergence of e-commerce platforms, the proliferation of smart devices, and the deployment of cloud solutions are some factors driving the market's growth. Cyber threats are expected to evolve with the increase in the usage of devices with intelligent and IoT technologies. As such, firms are expected to adopt and deploy progressive cyber security solutions to detect, minimize, and mitigate the risk of cyber-attacks, thereby driving the market's growth.

Key Highlights

- Various government initiatives and strategies adopted by major players are expected to drive the market. Germany has a strong and diversified cybersecurity ecosystem, with a wide spectrum of established enterprises, startups, research organizations, and universities dedicated to cybersecurity. The country's government policy is particularly supportive, with efforts such as the National Cybersecurity Strategy and the Cybersecurity Act.

- The rise in the number of cyberattacks in the region is expected to drive the demand for cybersecurity solutions. For instance, the State of IT Security in Germany in 2022 by the Federal Office of Information Security states that consumers' general level of concern has recently risen slightly compared to the past three years. About 29% of the respondents stated that they had already been victims of crime on the internet. In previous years, the figure was 25%. In each case, a quarter of the respondents had experienced fraud when shopping online (25%), third-party access to an online account (25%), and infection with malware (24%). In contrast to online shopping fraud (2021: 19%), the figures for being affected by third-party access to an online account (2021: 31%) or infection with malware (2021: 29%) have decreased compared to the previous year. Only 19% of respondents were affected by phishing in the last year.

- Addressing risks associated with trends like third-party vendor risks, changes in managed security service providers (MSSPs), and a shift toward a cloud-first strategy is pivotal in the cybersecurity market. As businesses increasingly rely on external vendors for various services and technologies, the associated risks also rise.

- Over the past few years, security systems have made it difficult for an attacker to reach critical data. As a result, ordinary users are increasingly wary of the security of the internet. Solutions that may have worked a few years ago are irrelevant now. To identify and recover from cyberattacks, organizations need several resources and must be highly prepared. In many cases, to recover from a breach or attack, the organization may need to shut down its operations for days altogether. In case of poor planning and inadequate infrastructure, the time to recover from an incident may be considerably high.

- Cyberattackers saw the COVID-19 pandemic as a possibility to step up their criminal initiatives by exploiting the vulnerability of employees working from home. In the post-pandemic era, the need for cybersecurity increased as enterprises planning to execute months-long business continuity plans (BCP), including information security monitoring and response while operating under quarantine conditions, focused on enhancing cybersecurity. Thus, the market studied is growing rapidly with the increasing demand for digitalization and scalable IT infrastructure.

Germany Cyber Security Market Trends

Data Security Segment is Expected to Hold Significant Market Share

- The growth of Germany's data protection law has forced enterprises to adopt data security solutions to become operational in the country, which shows the increasing importance of data security awareness.

- Industrial automation and data monetization trends in Germany's enterprise segments are fueling the risk of data privacy breaches and financial losses for end-users, which is driving the demand for data security solutions in the country.

- For instance, in November 2023, the German Federal Office for Information Security published a report stating that Germany has been experiencing a significant increase in cyber threats, with the risk of ransomware attacks considered exceptionally high among SMEs, which account for approximately 80% of the German economy.

- Therefore, organizations are expected to actively invest in data security solutions in the coming years largely due to the need to protect and safeguard their sensitive information across multiple environments, meet regulatory compliance, and simplify operational complexity. According to DLA Piper, the maximum number of personal data breaches as of January 2023 were reported in the Netherlands, a total of approximately 117,434. Germany ranked next, with more than 76,000 personal data breach notifications.

- The emergence of the digital economy in European initiatives for digital transformations of the business landscape of the region, including the Digital Decade targets for 2030, has raised the number of electronic data in the area, which has raised the risk of data breaching.

- For instance, in October 2023, the European Commission published the first report on the State of the Digital Decade, showing the progress toward achieving the digital transformation to empower a digitally sovereign, resilient, and competitive European Union, supporting the demand for data security solutions to protect the digital infrastructures from cyberattacks in Germany.

IT and Telecommunication End-user Segment is Expected to Hold Significant Market Share

- Information technology (IT) and telecommunications are vital in businesses, government agencies, and organizations. The need for robust cybersecurity measures has become crucial with the increasing reliance on interconnected networks, cloud computing, and digital communication. IT and telecom end-users form a substantial portion of the global cybersecurity market as they seek to protect their sensitive data, networks, and communications from evolving cyber threats.

- Germany is a developed economy with significant connectivity through mobile phones. For instance, Deutsche Telekom, one of the prominent players in the telecom industry, recently noted that 99% of Germans have access to LTE service. In comparison, 92% of homes can now access the carrier's 5G network. Deutsche Telekom said it offers 5G services in over 2,000 places across Germany using 3.6 GHz frequencies.

- In December 2023, Whalebone and O2 Telefonica entered a new partnership in Germany. It will give O2 Telefonica customers a cybersecurity solution called Aura. This move will strengthen Whalebone as a leader in the telecommunications industry's cybersecurity space and an ally of its customers.

- According to the European 5G Observatory, as of 2023, Germany had the most 5G base stations among EU (European Union) member states, with approximately 90,000 base stations installed.

- The IT and telecom end-user segment in the cybersecurity market significantly contributed to the market's growth, owing to the rising frequency and complexity of cyber threats posing significant risks to IT and telecom infrastructures, gaining prominence in cloud deployment, corporate partnerships, and acquisitions. Furthermore, IT and telecom end-users in the global cybersecurity market are expected to continue investing in innovative solutions. As technology advances, the proactive adoption of advanced cybersecurity measures is expected to be essential for maintaining the integrity and security of global IT and telecom operations.

Germany Cyber Security Industry Overview

The German cybersecurity market is semi-consolidated with the presence of major players like IBM Corporation, Cisco Systems Inc., Dell Technologies Inc., Fortinet Inc., and Intel Security (Intel Corporation). Players in the market are adopting strategies such as partnerships and acquisitions to enhance their product offerings and gain sustainable competitive advantage.

- October 2023: IBM launched the managed detection and response service offerings with new AI technologies, including the ability to automatically escalate or close up to 85% of alerts, assisting in accelerating security response timelines for clients. The new Threat Detection and Response Services (TDR) provide 24x7 investigation, monitoring, and automated remediation of security alerts from all relevant technologies across the client's hybrid cloud environments, including existing security tools and investments, and cloud, on-premise, and operational technologies (OT).

- October 2023: McAfee Corp. launched a product lineup with AI-powered protection and new features to help consumers safeguard their privacy and identity online. McAfee's portfolio of products includes innovative safety features, such as McAfee Next-gen Threat Protection and McAfee Scam Protection, that utilize advanced AI to combat the rise in AI threats and provide automated layers of security for consumers and their families.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Industry Value Chain Analysis

- 4.3 Industry Attractiveness - Porter's Five Forces Analysis

- 4.3.1 Threat of New Entrants

- 4.3.2 Bargaining Power of Buyers

- 4.3.3 Bargaining Power of Suppliers

- 4.3.4 Threat of Substitutes

- 4.3.5 Intensity of Competitive Rivalry

- 4.4 Impact of Macroeconomic Factos on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Demand for Digitalization and Scalable IT Infrastructure

- 5.1.2 Need to Tackle Risks from Various Trends, such as Third-party Vendor Risks, the Evolution of MSSPs, and Adoption of Cloud-first Strategy

- 5.2 Market Restraints

- 5.2.1 Lack of Cybersecurity Professionals

- 5.2.2 High Reliance on Traditional Authentication Methods and Low Preparedness

- 5.3 Trends Analysis

- 5.3.1 Organizations Leveraging AI to Enhance their Cybersecurity Strategy

- 5.3.2 Exponential Growth to be Witnessed in Cloud Security owing to Shift toward Cloud-based Delivery Model

6 MARKET SEGMENTATION

- 6.1 By Offering

- 6.1.1 Security Type

- 6.1.1.1 Cloud Security

- 6.1.1.2 Data Security

- 6.1.1.3 Identity Access Management

- 6.1.1.4 Network Security

- 6.1.1.5 Consumer Security

- 6.1.1.6 Infrastructure Protection

- 6.1.1.7 Other Types

- 6.1.2 Services

- 6.1.1 Security Type

- 6.2 By Deployment

- 6.2.1 Cloud

- 6.2.2 On-premise

- 6.3 By End User

- 6.3.1 BFSI

- 6.3.2 Healthcare

- 6.3.3 Manufacturing

- 6.3.4 Government & Defense

- 6.3.5 IT and Telecommunication

- 6.3.6 Other End Users

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 IBM Corporation

- 7.1.2 Cisco Systems Inc.

- 7.1.3 Dell Technologies Inc.

- 7.1.4 Fortinet Inc.

- 7.1.5 Intel Security (Intel Corporation)

- 7.1.6 F5 Networks Inc.

- 7.1.7 AVG Technologies

- 7.1.8 FireEye Inc.

- 7.1.9 Fujitsu