|

市场调查报告书

商品编码

1644913

北美油箱保护:市场占有率分析、行业趋势和成长预测(2025-2030 年)North America Tank Protection - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

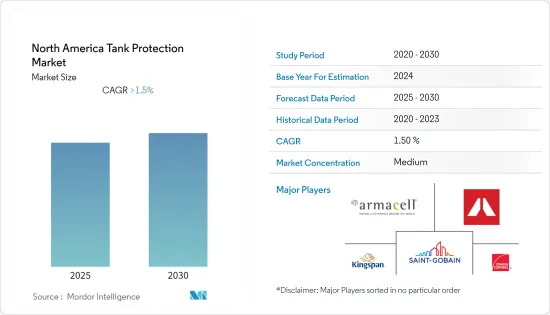

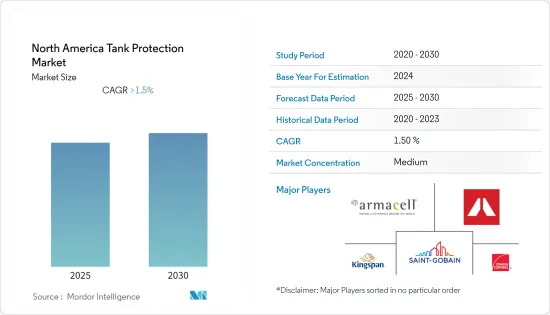

预测期内,北美油箱保护市场预计将以超过 1.5% 的复合年增长率成长。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 由于液化天然气出口的增加(这需要对低温储罐进行特殊考虑)以及由于石油和天然气产量的增加导致储存和运输量的增加,该地区的储罐保护市场预计将在未来几年蓬勃发展。

- 另一方面,北美国家对保护和绝缘材料的严格监管可能会阻碍市场的成长。

- 油箱保护产业的技术进步为市场提供了巨大的机会。例如,喷涂发泡隔热材料(SOFI)是低温储槽的最新发展趋势。

- 由于美国液化天然气出口量和石油天然气产量较高,预计在预测期内将占据市场主导地位。

北美储罐保护市场趋势

聚氨酯(PU)预计将出现强劲成长

- 聚氨酯(PU)泡沫是市场上最常使用的隔热材料。这种材料具有优良的绝缘性能。此外,它还具有透湿性低、吸水率高、机械强度相对较高、密度低等特点,在油箱保护行业中备受推荐。

- 由于液化气体和挥发性有机化合物等货物的储存和运输需要特殊考虑,因此该产品在当前情况下的需求量很大。液化天然气出口量成长是市场的主要驱动力之一。例如,在美国,月度液化天然气出口量在 2021 年达到高峰 3.5 兆立方英尺。

- 此外,加拿大目前提案约18个液化天然气出口终端计划。例如,最受期待的不列颠哥伦比亚省斯阔米甚的Woodfibre LNG计划预计将于2022年开始兴建。该终端投入运作后,预计每年将出口 210 万吨液化天然气。

- 此外,墨西哥目前正在开发的液化天然气出口终端计划预计将进一步提振市场。值得注意的例子包括投资 20 亿美元的 Amigo LNG计划和 Energia Costa Azul计划,后者预计将于 2024 年开始营运。

- 预计这些市场发展将在预测期内推动该地区聚氨酯泡棉市场的发展。

预计美国将主导市场

- 美国目前是全球原油和天然气产量第一大国。美国有五个主要产油州:德克萨斯州、新墨西哥州、北达科他州、阿拉斯加州和科罗拉多,这五个州的原油产量占全国原油总产量的71%。 2021 年海上石油产量约占原油总产量的 15.2%。

- 过去十年(不包括新冠疫情),该国原油产量持续成长,2021年达到日产1,658.5万桶。美国能源资讯署预测,该地区石油价格上涨预计将在未来几年刺激石油产量的进一步成长。创纪录的产量必将对储存槽需求和储罐保护市场产生重大影响。

- 此外,随着美国未来规划的液化天然气工厂计划,预计液化天然气储存槽的需求将进一步增加。例如,里奥格兰德液化天然气计划即将在德克萨斯州布朗斯维尔建立。该厂于 2023 年运作后,年产量将达到 2,700 万吨。

- 另外三个液化天然气出口终端计划计划于 2025 年完工:Golden Pass LNG、Plaquemines LNG 和 Corpus Christi Stage III。到2025年,这三个计划预计将增加约57亿立方英尺/天的液化天然气出口能力。

- 由于这些发展,预计美国将在预测期内占据市场主导地位。

北美坦克保护产业概况

北美油罐保护市场处于适度整合状态。主要企业(不分先后顺序)包括 Rockwool International A/S、Saint Gobain、Owens Corning、Kingspan Group 和 Armacell International SA。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 材料

- 聚氨酯

- 岩绒

- 玻璃纤维

- 泡棉玻璃

- 其他的

- 应用

- 贮存

- 运输

- 地区

- 美国

- 加拿大

- 墨西哥

第六章 竞争格局

- 併购、合资、合作、协议

- 主要企业策略

- 公司简介

- Rockwool International A/S

- Owens Corning

- Saint Gobain

- Kingspan Group

- Armacell International SA

- Cabot Corporation

- Johns Manville

- Knauf Insulation

- BASF SE

- Covestro AG

第七章 市场机会与未来趋势

简介目录

Product Code: 92899

The North America Tank Protection Market is expected to register a CAGR of greater than 1.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- The tank protection market in the region is projected to prosper in the coming years due to increasing LNG exports that need special care in the cryogenic tanks and the growing oil and gas production in the country, leading to more storage and transportation.

- On the other hand, the stringent regulations for the material used for protection or insulation in North American countries can impede the market growth.

- Nevertheless, the technological advancements in the tank protection industry create tremendous opportunities for the market. As an example, spray-on foam insulation (SOFI) has been developed recently for use on cryogenic tanks.

- The United States is expected to dominate the market during the forecast period due to high LNG exports and oil and gas production.

North America Tank Protection Market Trends

Polyurethane (PU) Expected to Witness Significant Growth

- Polyurethane (PU) foam is the most commercially available insulation material. The material possesses good thermal insulating properties. Moreover, other features like low moisture-vapor permeability, high resistance to water absorption, relatively high mechanical strength, and low density make the material highly recommended in the tank protection industry.

- The product is in high demand in the current scenario due to the special care taken for storing and transporting commodities like liquid gases, volatile organic compounds, etc. The increase in LNG exports is one of the factors strongly driving the market. For example, in the United States, the monthly LNG exports peaked at 3.5 tcf in 2021.

- Moreover, around 18 LNG export terminal projects in Canada have been proposed in the current scenario. For example, the most awaited Woodfibre LNG project, located in Squamish, British Columbia, is about to get a construction kickstart in 2022. The terminal is expected to export 2.1 MTPA of LNG after the commissioning.

- Furthermore, the LNG export terminal projects in the under-development phase in Mexico are predicted to bolster the market even more. Some of the best examples include the Amigo LNG project, with a USD2 billion investment, and the Energia Costa Azul project, which is anticipated to start operations in 2024.

- Such developments are forecasted to drive the polyurethane foam material market in the region during the forecast period.

United States Expected to Dominate the Market

- The United States is currently at the top position in crude oil and natural gas production at the global level. The country has five major oil-producing states that account for 71% of the total crude oil production in the country, Texas, New Mexico, North Dakota, Alaska, and Colorado. The offshore segment constituted around 15.2% of the total crude oil production in 2021.

- The country has witnessed continuous growth in crude oil production in the last decade (except for COVID-19), reaching 16,585 thousand barrels per day in 2021. The production is expected to get spurred even more in the coming years, as expected by the Energy Information Administration, due to the rising oil prices in the region. The record production levels may inevitably have a huge impact on the demand for storage tanks and the tank protection market.

- The demand for LNG storage tanks is also projected to escalate even more in the United States due to the upcoming LNG plant projects. For example, the Rio Grande LNG project is expected to be established in Brownsville, Texas. The plant will be able to produce 27 million tpy once operational in the year 2023.

- Furthermore, the country is anticipating three more additional LNG export terminal projects by 2025, the Golden Pass LNG, Plaquemines LNG, and Corpus Christi Stage III. The three projects may add around 5.7 bcf/d of LNG export capacity by 2025.

- Owing to such developments, the United States is expected to dominate the market during the forecast period.

North America Tank Protection Industry Overview

The North American tank protection market is moderately consolidated. Some of the key players (in no particular order) include Rockwool International A/S, Saint Gobain, Owens Corning, Kingspan Group, and Armacell International SA.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Material

- 5.1.1 Polyurethane

- 5.1.2 Rockwool

- 5.1.3 Fiberglass

- 5.1.4 Cellular Glass

- 5.1.5 Other Materials

- 5.2 Application

- 5.2.1 Storage

- 5.2.2 Transportation

- 5.3 Geography

- 5.3.1 United States

- 5.3.2 Canada

- 5.3.3 Mexico

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Rockwool International A/S

- 6.3.2 Owens Corning

- 6.3.3 Saint Gobain

- 6.3.4 Kingspan Group

- 6.3.5 Armacell International SA

- 6.3.6 Cabot Corporation

- 6.3.7 Johns Manville

- 6.3.8 Knauf Insulation

- 6.3.9 BASF SE

- 6.3.10 Covestro AG

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219