|

市场调查报告书

商品编码

1644915

南美 AUV -市场占有率分析、行业趋势和成长预测(2025-2030 年)South America AUV - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

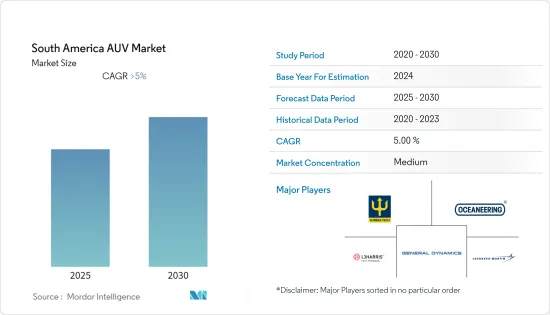

预测期内,南美 AUV 市场预计将以超过 5% 的复合年增长率成长。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 从中期来看,该地区石油和天然气探勘以及深水石油和天然气产量增加等因素可能会推动市场成长。

- 然而,与维护、製造、研发和系统复杂性相关的高成本正在减缓 AUV 的采用,从而抑制市场成长。

- 透过融合人工智慧,无人驾驶船可以执行远距攻击、监视作业、雷区即时通讯、海底攻击、自主导航、勘测等任务。多家公司正在开发具有卓越远距续航能力、智慧性、监控能力和雷区能力的自动驾驶汽车。这些因素预计将为市场提供成长机会。

- 巴西占据市场主导地位,并可能在预测期内实现最高的复合年增长率。成长的关键驱动力是该国用于海上石油探勘的先进 AUV 的采购量不断增加。

南美洲AUV市场趋势

石油和天然气应用占据市场主导地位

- 海上平台是位于近海的石油和天然气生产设施。从历史上看,石油和天然气一般是在地面上生产的。然而,随着陆地上可开采的石化燃料丰富的地区越来越少,海上石油和天然气开发变得越来越重要。 2016年,全球海上油气生产设施数量超过3,000个,预计将持续成长。

- 海上平台拥有众多海底结构,包括管道,因此这些结构的检查和维护至关重要。然而,一些平台位于海平面以下数百米,人类无法潜水和检查。 AUV 克服了这个问题,因为它们没有电线,因此其操作灵活是其最大的优势。为了充分利用这种灵活性,AUV 必须确保其位置感应的准确性。

- AUV 是深海钻井钻机和水深达两英里的管道系统的首选支援系统。可以使用 AUV 来检查、修理和维护这些井和管道系统。

- 天然气田开发对安装水下基础设施的需求不断增加,使得 AUV 在油气产业中几乎不可或缺。该地区在浅水和深水地区不断发现新的油气资源,导致对 AUV 的需求增加。

- 南美洲是世界上已探明石油和天然气蕴藏量最大的国家的所在地。该地区还拥有世界上最大的海上石油和天然气市场之一。巴西、委内瑞拉、阿根廷和哥伦比亚是该地区石油和天然气产业的主要参与者。

- 与世界各地的类似计划相比,南美洲的海上石油和天然气计划具有较低的盈亏平衡价格和具有竞争力的回报期,使其在动盪时期具有韧性。预计到 2023 年,该地区将启动约 30 个海上石油和天然气计划,需要累积约 500 亿美元的待开发区投资。这些计划由国家石油公司(NOC)和大型独立公司营运。

- 根据英国石油公司《世界能源统计评论》,2021年南美洲的石油产量为590.9万桶/日。

- 因此,该地区对深水和海上石油生产活动的投资不断增加,正在推动无人机市场的发展。

巴西占市场主导地位

- 截至 2021 年,巴西是南美洲石油和天然气支出领先的国家。该国海上盐层下油田的石油产量约占总产量的50%,到2020年终这一比例将上升至75%左右。这些海上石油和天然气田产量的不断提高可能会增加该地区对 AUV 的需求。

- 截至 2022 年 6 月,该国近海区域运作约 7 个活跃钻机,陆上区域共有 3 个活跃钻井平台。截至 2021 年,浮式生产储油卸油设备(FPSO)、钻井船、半潜式钻井船和浮体式货运设施(FSO) 等浮体式资产占该国运作中海上平台的 80% 以上。这显示海上浮体式资产在巴西上游石油和天然气产业占据主导地位。

- 根据2022年统计局的数据,2021年巴西海上原油产量为10.2834亿桶,陆上原油产量为3,203万桶。

- 预计巴西将在海上石油和天然气产业从动盪的 2020 年復苏中发挥重要作用,尤其是在浮体式生产市场。预计到 2025 年,该国将部署约 18 艘 FPSO。 2021年5月,巴西石油公司共预审合格12个EPC(工程、采购和施工)集团参与P-80 FPSO的竞标。

- 巴西石油公司计划在 2022 年至 2026 年期间投资约 680 亿美元。其中,84%将用于石油和天然气的勘探和生产(E&P)。在总勘探与生产资本支出(570 亿美元)中,约 67% 将分配给盐层下地层。这表明,巴西上游石油和天然气行业,尤其是海上石油和天然气资产,预计将在预测期内获得大量投资。

- 2021 年 12 月,作为与未公开客户签订的合约的一部分,挪威海洋勘测承包商 Argeo 将向巴西石油和天然气行业提供自主水下航行器 (AUV) 服务。该计划预计最早于 2022 年第一季开始,并有可能延长。

- 因此,国家石油生产活动对先进 AUV 的采购不断增加,正在推动无人机市场的发展。

南美洲AUV产业概况

南美 AUV 市场呈现细分化。主要参与企业(不分先后顺序)包括 Subsea Tech、Oceaneering International Inc.、通用动力公司、L3Harris Technologies 和洛克希德马丁公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 应用

- 石油和天然气

- 防御

- 商业探勘

- 其他的

- 地区

- 巴西

- 阿根廷

- 哥伦比亚

- 南美洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Subsea Tech

- Oceaneering International, Inc.

- General Dynamics Corporation

- L3Harris Technologies

- Lockheed Martin Corporation

- Mitsubishi Heavy Industries, Ltd.

- Fugro NV

- Boeing Co

- Kongsberg Maritime

- Teledyne Technologies

第七章 市场机会与未来趋势

简介目录

Product Code: 92901

The South America AUV Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, factors like increasing oil & gas exploration and deep-water offshore oil & gas production in the region may drive the market growth.

- On the other hand, the high costs associated with maintenance, manufacturing, research and development, and system complexity are causing the slow adoption of AUVs, which restrains the market growth.

- Nevertheless, by integrating artificial intelligence, unmanned vehicles can conduct long-range attacks, surveillance operations, and minefields in real-time communication, undersea strikes, autonomous navigation, and surveys. Several companies are developing autonomous vehicles with excellent long-range endurance, intelligence, surveillance, and minefield capabilities. These factors are expected to provide growth opportunities in the market.

- Brazil dominates the market and is also likely to witness the highest CAGR during the forecast period. The growth is mainly driven by the increased procurement of advanced AUVs for offshore oil exploration in the country.

South America AUV Market Trends

Oil & Gas Application to Dominate the Market

- An offshore platform is an oil and gas production facility that is located offshore. Historically, oil and gas were generally produced on the ground. Nonetheless, offshore oil and gas development has become increasingly important since there are fewer fossil fuel-rich sites that can be accessed from the ground. The number of offshore oil and gas production facilities in the world was more than 3,000 in 2016, which is expected to increase.

- As offshore platforms have a large number of subsea structures, such as pipelines, inspection and maintenance of these structures are of utmost importance. However, it is impossible for humans to dive and inspect some platforms because they are installed in water depths of hundreds of meters. Because AUVs do not have wires, they can overcome this problem, which is why their operation flexibility is their greatest advantage. It is crucial for AUVs to ensure the accuracy of position sensing in order to take advantage of this flexibility.

- AUVs are the preferred support system for deepwater drilling rigs and pipeline systems that can operate at depths of two miles. These wells and pipeline systems can be inspected, repaired, and maintained using AUVs.

- Due to the rise in the installation of underwater infrastructure for oil and gas field development, AUVs have become almost indispensable in the oil and gas industry. There have been a number of new oil and gas discoveries in the region, both shallow and deepwater, which has resulted in an increase in AUVs demand.

- South America is home to some of the largest countries in the world in terms of proven oil and gas reserves. The region also hosts one of the largest offshore oil and gas markets in the world. Brazil, Venezuela, Argentina, and Colombia are the major countries in the region's oil and gas industry.

- Offshore oil and gas projects in South America have lower breakeven prices and competitive payback times in comparison to similar projects all over the world, which makes them more resilient in the current turbulent times. Around 30 offshore oil and gas projects are expected to start across the region by 2023, which requires a cumulative greenfield investment of around USD 50 billion. These projects are operated by a mix of national oil companies (NOCs) and major independent companies.

- According to the bp Statistical Review of World Energy, in 2021, South America produced 5909 thousand barrels per day of oil.

- Hence, increasing investments in deepwater and offshore oil production activities in the region are driving the UAV market.

Brazil to Dominate the Market

- As of 2021, Brazil is the major country in South America in terms of oil and gas expenditure. The country's offshore pre-salt oil fields pumped around 50% of the total oil output, and this share increased to approximately 75% by the end of 2020. This increasing production of offshore oil and gas fields can increase the demand for AUVs in the region.

- As of June 2022, there are around seven active rigs operating in the offshore areas and three active rigs in the onshore areas of the country. As of 2021, floating assets such as floating production storage and offloading (FPSO), drillships, semi-submersibles, and floating storage and offloading (FSO) accounted for more than 80% of the active offshore platforms in the country. This, in turn, indicates the dominance of offshore floating assets in Brazil's upstream oil and gas industry.

- According to Anuario Estatiastico 2022, in 2021, Brazil produced 1028.34 million barrels of offshore crude oil and 32.03 million barrels of onshore crude oil.

- Brazil is expected to play a major role in the offshore oil and gas industry's recovery from a tumultuous 2020, especially in the floating production market. The country is expected to deploy around 18 FPSOs by 2025. In May 2021, a total of 12 engineering, procurement, and construction (EPC) groups were pre-qualified by Petrobras to bid for the P-80 FPSOs

- Petrobras has plans to invest around USD 68 billion for the period 2022 to 2026. Of this total investment, 84% is allocated to the exploration and production (E&P) of oil and natural gas. Of the total E&P CAPEX (USD 57 billion), around 67% will be allocated to pre-salt assets. This indicates that the upstream oil & gas sector, especially the offshore oil & gas assets in Brazil, is expected to witness significant investment during the forecast period.

- In December 2021, as part of its agreement with an undisclosed client, a Norwegian marine survey contractor, Argeo, is expected to provide autonomous underwater vehicle (AUV) services to the Brazilian oil and gas industry. The project is scheduled to commence early in the first quarter of 2022 and may be extended.

- Hence, increasing procurement of advanced AUVs for oil production activities in the country is driving the UAV market.

South America AUV Industry Overview

The South American AUV market is fragmented. Some major players (in no particular order) include Subsea Tech, Oceaneering International Inc., General Dynamics Corporation, L3Harris Technologies, and Lockheed Martin Corporation, among other companies.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Oil & Gas

- 5.1.2 Defense

- 5.1.3 Commercial Exploration

- 5.1.4 Other Applications

- 5.2 Geography

- 5.2.1 Brazil

- 5.2.2 Argentina

- 5.2.3 Columbia

- 5.2.4 Rest of South America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Subsea Tech

- 6.3.2 Oceaneering International, Inc.

- 6.3.3 General Dynamics Corporation

- 6.3.4 L3Harris Technologies

- 6.3.5 Lockheed Martin Corporation

- 6.3.6 Mitsubishi Heavy Industries, Ltd.

- 6.3.7 Fugro N.V

- 6.3.8 Boeing Co

- 6.3.9 Kongsberg Maritime

- 6.3.10 Teledyne Technologies

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219