|

市场调查报告书

商品编码

1644916

美国精製石油产品:市场占有率分析、产业趋势、成长预测(2025-2030 年)United States Refined Petroleum Products - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

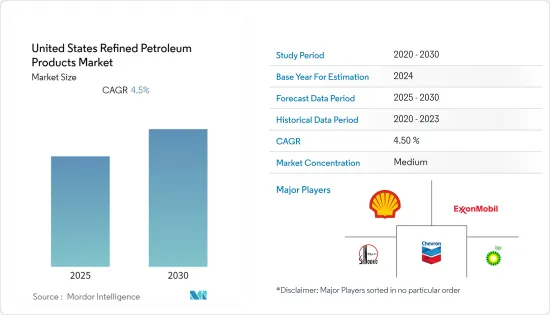

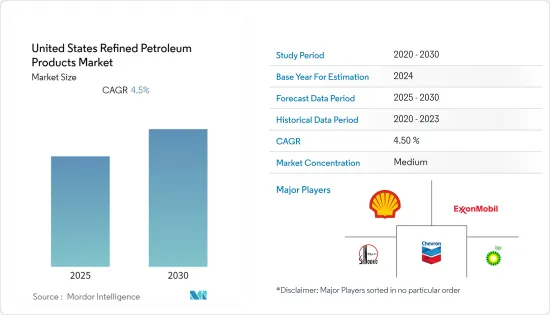

预计预测期内美国精製石油产品市场复合年增长率将达到 4.5%。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从长远来看,市场预计将受到许多因素的影响,例如极高的电力需求(燃料主导的电力产业可以轻鬆满足这一需求)和航运业的稳定成长(刺激对船用燃料的需求)。

- 另一方面,可再生能源的不断扩大应用是阻碍市场成长的主要因素。

- 向清洁燃料和液化石油气的转变已成为低收入家庭必不可少的能源。因此,预计市场研究将会出现大量机会。

美国精製石油产品市场趋势

航空燃料使用量大幅增加

- 美国是航空燃油产业最大的市场之一,过去几年航空业净利持续增加。根据美国运输部的数据,2021 年美国最大的航空公司运送了 6.324 亿名乘客,高于 2020 年的 3.479 亿名乘客。

- 商业航空业占美国航空燃料市场的很大份额。美国国土面积广阔,航空出游相对于其他交通方式来说相对便捷,使得航空出行成为美国流行的交通方式。

- 过去几十年来,航空业变得更加高效,美国航空公司的燃油效率(基于收入吨英里)在 1978 年至 2021 年间提高了 135% 以上。

- 此外,美国航空公司使用的大部分航空燃料是喷射机燃料,一种以石油为基础的煤油燃料。喷射机燃料是一种精製石油产品,其价格受全球原油价格的影响很大。截至 2021 年,航空燃料成本已达到每加仑 1.98 美元。

- 此外,2022年5月,美国运输部部运输统计局(BTS)公布了3月份美国航空公司的燃油成本及消费量,显示美国定期航班使用了13.8亿加仑燃油,比2022年2月(11.4亿加仑)增长20.3%,比疫情前减少9.8%。

- 鑑于上述情况,预计预测期内航空燃料的使用量将持续增加,并主导美国精製石油产品市场。

可再生燃料需求成长阻碍市场发展

- 美国是航空业和可再生航空燃料的最大市场之一。美国生质能源技术办公室(BETO)和能源部(DOE)在能源效率和可再生能源部(EERE)的支持下,正在努力增加可持续燃料的采用。

- 2021 年,美国生质柴油总产量达到约 16 亿加仑。生物柴油旨在用作标准柴油引擎的燃料,可以单独使用或与石油混合使用。

- 2022 年 1 月,美国环保署 (EPA) 宣布了 RFS 计划下 2022 年纤维素生质燃料、先进生质燃料和可再生燃料的总体数量要求拟议。在此基础上,2022年的可再生燃料标准定为360亿加仑,与前一年同期比较增加30亿加仑。

- 2022年3月,Aemetis Inc.宣布已与澳洲航空有限公司签署合同,自2025年起供应2,000万公升可再生燃料混合航空燃料。混合燃料将在加州的一家工厂生产,主要用于为两国之间运营的波音和空中巴士飞机提供燃料。这可能会阻碍该国精製石油产品的使用。

- 此外,美国联邦航空管理局于2021年9月启动CLEEN计画第三阶段,向航空引擎製造商提供1亿美元资金,用于开发降低排放气体和燃料消耗的技术。

- 此外,2022 年 1 月,空中巴士公司宣布已开始在美国的工厂生产飞机。该工厂生产的所有飞机都将使用可再生航空燃料和传统喷射机燃料的混合燃料。空中巴士采取此措施符合其 2035 年打造零排放飞机的目标。

- 鑑于上述情况,预计预测期内对可再生燃料的需求不断增长将抑制美国精製石油产品市场的发展。

美国精製石油产品产业概况

美国精製石油产品市场中等分化。市场的主要企业包括(不分先后顺序):荷兰皇家壳牌、埃克森美孚、中国石油化学股份有限公司、英国石油公司和雪佛龙公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至 2027 年美国精製石油产品市场(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 最新趋势和发展

- 市场动态

- 驱动程式

- 限制因素

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 汽车燃料

- 船用燃料

- 航空燃料

- 液化石油气(LPG)

- 其他燃料

- 地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Royal Dutch Shell

- Exxon Mobil Corporation

- China Petroleum & Chemical Corporation

- BP PLC

- Chevron Corporation

第七章 市场机会与未来趋势

简介目录

Product Code: 92903

The United States Refined Petroleum Products Market is expected to register a CAGR of 4.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has reached pre-pandemic levels.

Key Highlights

- Over the long term, factors such as extremely high power demand, which can be immediately met by the fuel-driven power sector, and demand for marine fuels due to the steadily growing shipping industry are expected to drive the market.

- On the other hand, the growing adoption of renewable power sources is a major restraint hindering the market growth.

- Nevertheless, the transition to cleaner fuels and also LPG becomes critical to household energy in low-income communities. Therefore, it is expected to create ample opportunities for the market studied.

US Refined Petroleum Products Market Trends

Aviation Fuel Usage to Grow Significantly

- The United States is one of the largest markets for the aviation fuel industry, and it has witnessed a continuous increase in the net profit in the aviation industry in the past few years. According to the United States Department of Transportation, in 2021, the country's largest airlines carried 632.4 million passengers, a significant increase from 347.9 million passengers in 2020.

- The commercial aviation industry holds the major share of the aviation fuel market in the United States. Due to the country's vast landscape and relative ease of air travel compared to other forms of transport in the United States, airplanes are a popular mode of transportation in the country.

- The aviation industry has become more efficient in recent decades, with the US airlines improving their fuel efficiency (on a revenue ton mile basis) by more than 135% between 1978 and 2021.

- Also, the vast majority of airline fuel used by US airlines is jet fuel, which is a kerosene-based fuel derived from petroleum. Being a refined petroleum product, the price of jet fuel is greatly affected by the global price of crude oil. As of 2021, the cost of airline fuel reached USD 1.98 per gallon.

- Moreover, in May 2022, the Department of Transportation's Bureau of Transportation Statistics (BTS) released the March Fuel Cost and Consumption numbers of the US airlines, indicating that the US scheduled service airlines used 1.38 billion gallons of fuel, 20.3% more fuel than in February 2022 (1.14B gallons) and 9.8% less than in pre-pandemic days.

- Owing to the above points, the growing usage of aviation fuel is expected to dominate the US refined petroleum products market during the forecast period.

Growing Demand for Renewable Based Fuel to Restrain the Market

- The United States is one of the largest markets for both the aviation industry and renewable aviation fuel. The Bio-Energy Technologies Office (BETO) of the United States and the Department of Energy (DOE), supported by Energy Efficiency and Renewable Energy (EERE), are making efforts to expand the adoption of sustainable fuel.

- In 2021, the total volume of biodiesel production in the United States amounted to some 1.6 billion gallons. Biodiesel is intended to be used in standard diesel engines as a standalone fuel or blended with petroleum.

- In January 2022, the Environmental Protection Agency (EPA) issued proposed volume requirements, under the RFS program, for cellulosic biofuel, advanced biofuel, and total renewable fuel for 2022. Under this, the renewable fuel standard for 2022 was set at 36 billion gallons, an increment of over 3 billion gallons over the previous year.

- In March 2022, Aemetis Inc. announced that it had made an agreement with Qantas Airways Limited to supply 20 million liters of blended renewable aviation fuel from 2025. The blended fuel is expected to be produced at a facility in California and primarily be used to power Boeing and Airbus planes operated between the countries. This, in turn, may hinder the usage of refined petroleum products across the country.

- Also, in September 2021, the United States Federal Aviation Administration launched the third phase of the CLEEN program, through which USD 100 million have been awarded to aircraft and engine manufacturers to develop technologies to reduce emissions and fuel consumption, which may adversely affect the growth in the usage of refined petroleum products.

- Moreover, in January 2022, Airbus SE announced that it had commenced manufacturing aircraft from its US-based facility. All the aircraft manufactured at the location are expected to operate on a blend of renewable aviation fuel and conventional jet fuel. Airbus SE has taken this initiative in line with its goal of manufacturing zero-carbon-emitting aircraft by 2035.

- Owing to the above points, growing demand for renewable-based fuel is expected to restrain the United States refined petroleum products market during the forecast period.

US Refined Petroleum Products Industry Overview

The US refined petroleum products market is moderately fragmented in nature. Some of the key players in the market include (in no particular order) Royal Dutch Shell, Exxon Mobil Corporation, China Petroleum & Chemical Corporation, BP PLC, and Chevron Corporation.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 United States Refined Petroleum Products Market in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Recent Trends and Developments

- 4.6 Market Dynamics

- 4.6.1 Drivers

- 4.6.2 Restraints

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Automotive Fuels

- 5.1.2 Marine Fuels

- 5.1.3 Aviation Fuels

- 5.1.4 Liquefied Petroleum Gas (LPG)

- 5.1.5 Other Fuel Types

- 5.2 Geography

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers & Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Royal Dutch Shell

- 6.3.2 Exxon Mobil Corporation

- 6.3.3 China Petroleum & Chemical Corporation

- 6.3.4 BP PLC

- 6.3.5 Chevron Corporation

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219