|

市场调查报告书

商品编码

1644919

西班牙的叶轮:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)Spain Rotor Blade - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

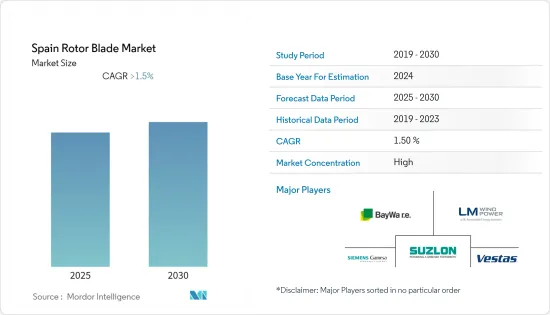

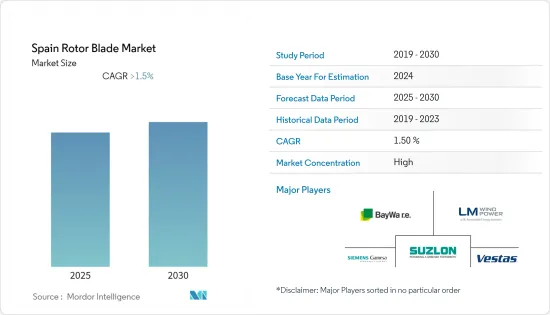

预测期内,西班牙叶轮市场预计将以超过 1.5% 的复合年增长率成长

关键亮点

- 短期内,由于西班牙政府大力推动风力发电,预计叶轮市场将蓬勃发展。

- 另一方面,国内叶轮产业较为薄弱,国内製造商数量很少,预计将阻碍市场成长。

- 叶轮产业的技术发展为市场创造了充足的机会。例如,欧洲航太中心——德国航太中心(Deutsches Zentrum fur Luft-und Raumfahrt)目前正在进行计划,为风力发电行业引进更大、更轻的叶轮。

西班牙叶轮市场的趋势

海上部门预计将经历显着成长

- 西班牙的风力发电产业经历了令人瞩目的成长,形成了主导的可再生能源组合。截至 2021 年,该能源来源发电量约为 62.4 TWh,是所有可再生能源中发电量最高的。风电在该国的发电结构中排名第二。

- 由于西班牙位于水域广布的位置,且技术进步提高了离岸风力发电电场的营运可行性,因此,随着公共和私人计划国离岸风力发电离岸风力发电的投资即将到来,离岸风电行业预计将在不断发展的市场中实现显着增长。

- 2021年12月,西班牙政府核准了首个离岸风蓝图,设定了2030年在西班牙海域安装约3GW离岸风力发电的目标。西班牙港口和造船厂已经在离岸风力发电链中发挥重要作用。

- 此外,2022 年 9 月,Simply Blue Group、Proes Consultores 和 FF New Energy Ventures 的合资企业 IberBlue Wind 宣布计划在西班牙和葡萄牙开发浮体式海上风电场。他们致力于成为伊比利亚半岛离岸风力发电市场的主要参与企业之一。

- 预计此类发展将加速该国离岸风力发电领域的成长,从而推动对叶轮的需求。

即将启动的风发电工程将推动市场

- 就风电在发电结构中的占比而言,西班牙是世界第五大国家,仅次于中国、美国、德国和印度。截至 2021 年,该国拥有约 21,500风力发电机,比 2020 年的数字增加 10%。 2021年风电装置容量2807万千瓦。

- 西班牙政府制定了一系列雄心勃勃的计划,以大幅提高该国的风力发电能力。例如,政府的《国家能源与气候综合计画》(PNIEC)要求每年安装至少 2.2 吉瓦的风电,以实现 2030 年风电达到 50 吉瓦的关键目标。为了实现这一目标,该国已经规划了许多计划。

- 2022年6月,西班牙能源公司Greenalia SA宣布了在西班牙加利西亚地区建造50兆瓦风电场的新计画。 Rodacio风发电工程投资3,970万美元,将安装12风力发电机,容量为4.2兆瓦,轮毂高度为107米,转子直径为150米。

- 此外,2022 年 9 月,风电巨头 Vestas A/S 赢得了 Estudios Proyectos Pradamap(Grupo Vapat)的合同,在西班牙卡斯蒂利亚和莱昂的巴利亚多利德建设一个新的风电场。该风电场的发电量为 104 兆瓦,配备 23 台 V150-4.5 兆瓦风力发电机。

- 这些发展将对西班牙叶轮市场产生直接影响。

西班牙叶轮产业概况

西班牙叶轮市场高度整合。市场的主要企业(不分先后顺序)包括西门子歌美飒再生能源公司、维斯塔斯风力系统公司、BayWa RE AG、LM Wind Power 和苏司兰能源有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(百万美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- PESTLE分析

第五章 市场区隔

- 部署位置

- 陆上

- 海上

- 刀片材质

- 碳纤维

- 玻璃纤维

- 其他的

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 市场占有率分析

- 公司简介

- Siemens Gamesa Renewable Energy SA

- Vestas Wind Systems A/S

- BayWa RE AG

- LM Wind Power

- Suzlon Energy Limited

第七章 市场机会与未来趋势

简介目录

Product Code: 93136

The Spain Rotor Blade Market is expected to register a CAGR of greater than 1.5% during the forecast period.

Key Highlights

- Over the short term, the Spain rotor blade market is expected to bloom due to the government's efforts to promote wind power generation in the country.

- On the other hand, a fragile domestic rotor blade industry with very less indigenous manufacturers is expected to hamper the market growth.

- Nevertheless, the technological developments happening in the rotor blade industry create ample opportunities for the market. As an example, Deutsches Zentrum fur Luft-und Raumfahrt, an Aerospace Center in Europe, is currently working on a project to introduce larger and lighter rotor blades for the wind power industry.

Spain Rotor Blade Market Trends

Offshore Segment Expected to Witness Significant Growth

- Spain has witnessed remarkable growth in the wind power generation sector, concluding into a value that dominates the renewable portfolio. As of 2021, the energy source generates around 62.4TWh of electricity, the highest generation among all renewables. The wind power source ranks second in the country's electricity generation mix.

- The offshore wind power sector is anticipated to witness significant growth in the evolving scene due to the upcoming public and private offshore wind power project investments in the country, allured by the location of the country, blessed with huge water bodies around, and technological developments to increase the operational feasibility of the offshore wind power plants.

- In December 2021, the Spanish government approved its first Offshore Wind Roadmap, which sets the target of installing around 3GW of offshore wind power in Spanish waters by 2030. Ports and shipyards across Spain already play a key role in the supply chain for offshore wind.

- Further, in September 2022, IberBlue Wind, a joint venture made by Simply Blue Group, Proes Consultores, and FF New Energy Ventures, made plans for the development of floating offshore wind farms in Spain and Portugal. They have committed to become one of the leading players in the offshore wind market off the Iberian Peninsula.

- Owing to such developments, the offshore wind segment is forecasted to grow at a faster rate in the country, driving the demand for rotor blades.

Upcoming Wind Power Projects Expected to Drive the Market

- Spain is the fifth largest country in the world in terms of the high share of wind power in the electricity generation mix, after China, the United States, Germany, and India. As of 2021, the country has around 21,500 wind turbines, 10% more than the value in 2020. The wind power installed capacity in the country was recorded as 28.07GW in the year 2021.

- The Spanish government has many ambitious plans to see a huge growth in the wind power capacity in the country. For example, the Integrated National Plan of Energy and Climate (PNIEC) fabricated by the government requires the installation of at least 2.2GW of wind power per year to reach the significant goal of 50GW of wind power by 2030. The country has planned many projects to achieve the target.

- In June 2022, Greenalia SA, the Spanish energy player, announced new plans to construct a new 50MW wind farm in Galicia, Spain. The Rodacio wind project is planned with an investment of USD39.7 million and will include 12 wind turbines with a 4.2MW capacity, a hub height of 107 meters, and 150 meters in rotor diameter.

- Additionally, in September 2022, Vestas A/S, the leading wind energy player, clinched a new contract from Estudios Proyectos Pradamap (Grupo Vapat) to build a new wind park in Valladolid, Castilla y Leon, Spain. The wind park, with a capacity of 104MW, includes the installation of 23 V150-4.5MW wind turbines.

- Such developments will have a direct influence on the rotor blade market in the country.

Spain Rotor Blade Industry Overview

The Spain Rotor Blade market is highly consolidated. Some of the key players in the market (in no particular order) include Siemens Gamesa Renewable Energy SA, Vestas Wind Systems A/S, BayWa R.E AG, LM Wind Power, and Suzlon Energy Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD million, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 PESTLE Analysis

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Blade Material

- 5.2.1 Carbon fiber

- 5.2.2 Glass Fiber

- 5.2.3 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Market Share Analysis

- 6.4 Company Profiles

- 6.4.1 Siemens Gamesa Renewable Energy SA

- 6.4.2 Vestas Wind Systems A/S

- 6.4.3 BayWa R.E AG

- 6.4.4 LM Wind Power

- 6.4.5 Suzlon Energy Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219