|

市场调查报告书

商品编码

1644921

亚太地区海上起重机:市场占有率分析、产业趋势和成长预测(2025-2030 年)Asia-Pacific Offshore Crane - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

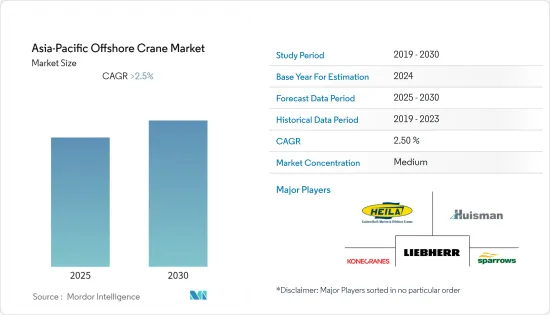

预测期内,亚太地区海上起重机市场预计将以超过 2.5% 的复合年增长率成长。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已恢復至疫情前的水准。

主要亮点

- 短期内,亚太地区海上探勘和生产活动的扩大以及海上可再生能源生产的上升势头是导致亚太海上起重机市场成长的因素。

- 同时,预计操作海上起重机的熟练劳动力短缺将在不久的将来阻碍市场发展。

- 然而,电动和遥控起重机的引入等技术进步正在创造一些加速市场成长的机会。

- 由于中国海上石油和天然气以及海上可再生能源产业的持续发展,预计中国将实现显着成长。

亚太地区海上起重机市场趋势

预计石油和天然气产业将主导市场

- 石油和天然气产业使用海上起重机进行各种作业,包括组装、修理和供应石油和天然气生产系统。性能、尺寸和容量可根据您的个人化需求量身定制。海上起重机是用于海上石油和天然气开采的石油钻井平台的重要组成部分。它们用于提升钻桿和套管、从船上起吊维护设备以及许多其他日常任务。

- 2021年亚太地区原油产量为733.5万桶/日,较过去5年下降。因此,亚洲各国政府和私人投资者开始考虑新的海上石油和天然气生产计划,以满足日益增长的能源需求。

- 例如,油气产业资深企业英国石油公司于2022年6月与印尼政府签署了一份为期30年的产品分成合约(PSC),在印尼两个海上区块进行勘探和生产。

- 此外,印度政府于2022年10月通知了26个海上油气区块和16个煤层气区块,以进行油气天然气田勘探和开发的国际竞标。这些区块占地约 223,000 平方公里,是近年来此类区块最大的公开招标之一。

- 预计这些发展将在未来几年推动该地区石油和海上天然气起重机市场的发展。

中国可望主导市场

- 过去十年,中国计划在海上能源领域取得重大发展,重点是离岸风电产业和上游石油和天然气产业。根据世界离岸风电论坛报道,中国是世界离岸风电产业的领导者。 2022 年前六个月,约有 6,759 兆瓦的离岸风力发电投入使用,截至 2022 年,累积离岸风力发电容量达到 2,490 万千瓦。

- 截至 2021 年,风力发电占该国可再生能源发电的很大一部分,达到 655.6 TWh。由于该国计划建造许多新的离岸风力发电计划以在 2050 年实现碳中和,预计这一数字将会增加。

- 例如,2022年10月,广东省潮州市在其五年计画中规划了43.3吉瓦新建的离岸风力发电。该市声称,一旦 2025 年运作,该离岸风力发电的发电量将相当于挪威所有发电厂的总发电量。

- 此外,该国的海上石油和天然气产业一直在持续成长。 2022年11月,中国海洋石油总公司(中海油)预测,未来几年中国海上原油和天然气产量可能会成长。该公司预计明年海上原油产量将增加5.4%至5,760万吨,占原油总增量的80%左右。

- 预计此类发展将在不久的将来推动该国海上起重机市场的发展。

亚太地区海上起重机产业概况

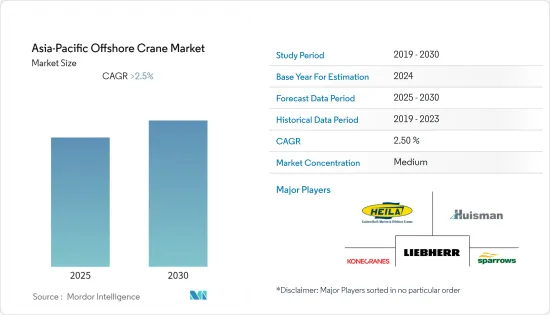

亚太地区海上起重机市场中等分散。主要企业(不分先后顺序)包括 Leibherr Group、Heila Cranes SpA、Huisman Equipment BV、Sparrows Offshore Group Limited 和 Konecranes。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 板式海洋起重机

- 折臂起重机

- 伸缩臂起重机

- 桁架臂起重机

- 变幅起重机

- 其他的

- 起重能力

- 0~500MT

- 500~2,000MT

- 2000~5,000MT

- 超过 5,000 吨

- 应用

- 石油和天然气

- 海洋

- 可再生能源

- 其他用途

- 地区

- 中国

- 印度

- 日本

- 印尼

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Liebherr Group

- Heila Cranes SpA

- Huisman Equipment BV

- Sparrows Offshore Group Limited

- Konecranes

- Haoyo Group

- Robinson Equipment Limited

- Tytan Marine Inc.

- Deyuan Marine

- Weihua Crane Machinery

第七章 市场机会与未来趋势

简介目录

Product Code: 93165

The Asia-Pacific Offshore Crane Market is expected to register a CAGR of greater than 2.5% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently. The market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the growing offshore exploration and production activities in the region and increasing momentum towards offshore renewable energy production are the factors that can lead to growth in the Asia-Pacific offshore crane market.

- On the other hand, the lack of skilled manpower to operate offshore cranes is expected to hinder the market in the near future.

- Nevertheless, technological advancements like the introduction of electric and remote-controlled cranes create several opportunities for accelerated growth of the market.

- China is expected to witness significant growth due to the consistent developments in the region's offshore oil and gas and offshore renewable energy sectors.

APAC Offshore Crane Market Trends

Oil and Gas Segment Expected to Dominate the Market

- The oil and gas industry deploys offshore cranes for various tasks like assembling, repairing, and supplying oil and gas production systems. The performance, size, and capacity are set according to individual requirements. The offshore cranes are an integral part of an oil rig employed for offshore oil and gas extraction. They are used for daily operations like lifting drill pipes and casing, lifting maintenance equipment from the ships, and many more day-to-day operations.

- The crude oil production in the Asia-Pacific region was recorded as 7,335 thousand barrels per day in 2021, a downtrend in the last five years. Thus, the governments and private investors of Asian countries have started contemplating new offshore oil and gas production projects to meet the growing energy demand.

- For example, in June 2022, the oil and gas industry veteran British Petroleum signed a 30-year PSC (Production Sharing Contract) with the Indonesian government to conduct exploration and production in two offshore blocks in Indonesia.

- Additionally, in October 2022, the Indian government notified 26 offshore oil and gas blocks and 16 coal bed methane blocks for international bidding to explore and develop oil and gas fields. These cover an area of approximately 223,000 square kilometers (sq. km), constituting one of the largest such offerings in recent times.

- Such developments are expected to drive the region's oil and offshore gas cranes market in the coming years.

China Expected to Dominate the Market

- China has envisaged considerable developments in the offshore energy sector in the last decade, mainly in the offshore wind industry and oil and upstream gas sector. According to the World Forum Offshore Wind, China tops the world in the offshore wind industry. It commissioned around 6,759 MW of offshore wind capacity during the first six months of 2022, and the cumulative offshore wind capacity in the country stood at 24.9 GW as of 2022.

- In the renewable power generation mix of the country, wind energy occupies the major share of 655.6 TWh as of 2021. The value is expected to increase as the country has planned many new offshore wind projects to reach carbon neutrality by 2050.

- For example, in October 2022, the city of Chaozhou in the Guangdong province planned a new offshore wind farm with a capacity of 43.3 GW as part of its five-year plan. The city claims that once operational in 2025, the offshore wind farm will be able to produce as much power as Norway's power plants can produce altogether.

- Additionally, the country's offshore oil and gas sector is growing consistently. In November 2022, CNOOC (China National Offshore Oil Corporation) predicted that China's offshore crude and natural gas production is likely to witness augmented growth in the coming years. They believe that the offshore crude output will rise by 5.4% to 57.6 million metric tons in the next year, accounting for around 80% of the total crude increment.

- Such developments are forecasted to drive the offshore cranes market in the country in the near future.

APAC Offshore Crane Industry Overview

The Asia-Pacific Offshore Crane market is moderately fragmanted. Some of the key players (in no particular order) include Leibherr Group, Heila Cranes SpA, Huisman Equipment B.V, Sparrows Offshore Group Limited, and Konecranes.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Board Offshore Cranes

- 5.1.2 Knuckle Boom Crane

- 5.1.3 Telescopic Boom Crane

- 5.1.4 Lattice Boom Crane

- 5.1.5 Luffing Crane

- 5.1.6 Others

- 5.2 Lifting Capacity

- 5.2.1 0-500MT

- 5.2.2 500-2000MT

- 5.2.3 2000-5000MT

- 5.2.4 Above 5000MT

- 5.3 Application

- 5.3.1 Oil & Gas

- 5.3.2 Marine

- 5.3.3 Renewable Energy

- 5.3.4 Other Applications

- 5.4 Geography

- 5.4.1 China

- 5.4.2 India

- 5.4.3 Japan

- 5.4.4 Indonesia

- 5.4.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Liebherr Group

- 6.3.2 Heila Cranes SpA

- 6.3.3 Huisman Equipment B.V

- 6.3.4 Sparrows Offshore Group Limited

- 6.3.5 Konecranes

- 6.3.6 Haoyo Group

- 6.3.7 Robinson Equipment Limited

- 6.3.8 Tytan Marine Inc.

- 6.3.9 Deyuan Marine

- 6.3.10 Weihua Crane Machinery

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219