|

市场调查报告书

商品编码

1644928

南美螺桿压缩机市场占有率分析、行业趋势和成长预测(2025-2030 年)South America Screw Compressor - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

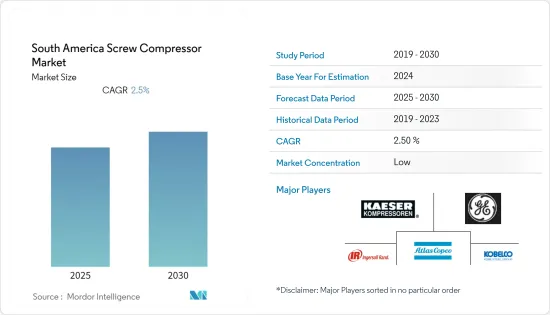

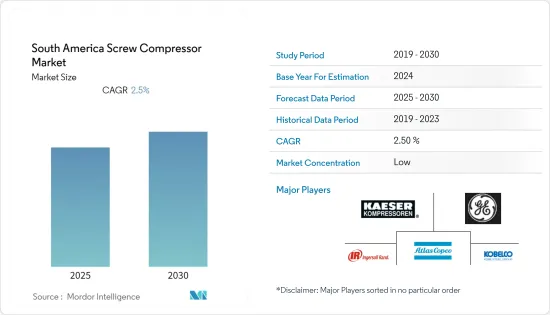

预测期内南美螺桿压缩机市场预计复合年增长率为 2.5%

关键亮点

- 短期内,南美螺桿压缩机市场预计将出现成长,原因是阿根廷和巴西等国家对天然气的需求不断增长,从而推动天然气产量增加以及螺桿压缩机带来的优势,例如维护成本低、压缩比高等。

- 另一方面,螺桿压缩机在高温和缺氧应用中的油污染等方面预计会在不久的将来阻碍市场的发展。

- 螺桿压缩机产业的最新技术趋势为市场发展提供了巨大的机会。例如,现代螺桿压缩机采用全密封设计,非常适合热回收。压缩机能够将其吸收的 100% 电能转换为热能,并且可回收高达 96% 的能量。

- 由于石油、天然气和製造业的成长,预计预测期内巴西将经历加速成长。

南美洲螺桿压缩机市场趋势

石油和天然气产业预计将大幅成长

- 螺桿压缩机在石油和天然气工业中有多种用途,包括作为天然气收集平台的增压器、透过管道输送天然气、石油和气体纯化过程以及石化工业。这些类型的压缩机主要适用于需要长时间保持恆定压力的应用。南美地区天然气生产正在加速,螺桿压缩机的引进也正在加速,尤其是在阿根廷和巴西。

- 2021年,阿根廷天然气产量达386亿立方米,除去新冠疫情的影响,过去五年持续维持上升趋势。螺桿压缩机产业不仅从生产部门获得了推动力,而且从近期的天然气输送计划中也获得了推动力。

- 例如,2021年12月,阿根廷计划在瓦卡穆埃尔塔页岩气地区建造新的天然气管道计划。政府也为此计划提供资金支持,累计约16亿美元。至2023年,该计划将增加约2,400万立方公尺的天然气输送能力。

- 此外,2022 年 7 月,MAN Energy Solutions 获得了 Yinson 的合同,为巴西海上 Jubarte 油田的 FPSO 天然气生产计划提供离心式和螺桿式压缩机组。该合约包括五组离心式压缩机组和两组SKUEL321/CP200螺桿压缩机组。预计天然气生产将于 2024 年开始。

- 由于这些新兴市场的发展,石油和天然气行业可能会引领该地区的螺旋压缩机市场。

巴西:预计将大幅成长

- 由于石油和天然气工业以及製造业(特别是钢铁业和化学製造业)的发展,巴西很可能在螺桿压缩机市场成长方面领先其他南美国家。该国天然气开采计划正在激增,主要是在海上项目,这导致压缩系统的积极采用。

- 根据BP2022年统计报告,2021年巴西天然气产量约243亿立方公尺。过去十年,受天然气需求推动,国内天然气供应大幅增加。许多石油和天然气生产计划正在添加到该国的生产资料中。

- 例如,巴西即将向坎波斯盆地Marlim海上油气天然气田部署FPSO「Anna Nelly」。该FPSO目前正在中国远洋海运长兴船厂建造。该船将配备由马达动力来源的双螺桿压缩机组,用于蒸气回收过程。

- 螺桿压缩机产业的另一个利润丰厚的市场是钢铁业。中国国内对钢铁的需求不断增长,带动了钢铁生产设施的扩建计划。例如,2022年2月,一家全球钢铁製造公司宣布计画投资13亿雷亚尔在巴西里约热内卢进行製造工厂扩建计划。

- 这些新兴市场的发展预计将显着推动巴西螺桿压缩机市场的发展。

南美螺桿压缩机产业概况

南美螺桿压缩机市场比较分散。主要参与企业(不分先后顺序)包括神户製钢所有限公司、阿特拉斯·科普柯 AB Class A、英格索兰公司、通用电气公司和凯撒压缩机公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 类型

- 注油

- 无油

- 应用

- 天然气应用

- 製程气体应用

- 工艺冷冻

- 瓦斯压缩

- 溶解气体应用

- 蒸气回收压缩系统

- 阶段

- 单级

- 多级

- 最终用户产业

- 製造业

- 钢

- 化学

- 其他的

- 石油和天然气

- 矿业

- 建设业

- 其他的

- 製造业

- 地区

- 巴西

- 阿根廷

- 智利

- 其他的

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Kobe Steel Ltd.

- Atlas Copco AB Class A

- Ingersoll Rand Inc.

- General Electric Company

- Kaeser Corporation Inc.

- Man Energy Solutions

- Burckhardt Compression AG

- Zhejiang Kaishan Compressor Co.,Ltd.

- Quincy Compressor LLC

- Shandong Sollant Machinery Manufacturing Co., Ltd.

第七章 市场机会与未来趋势

简介目录

Product Code: 93188

The South America Screw Compressor Market is expected to register a CAGR of 2.5% during the forecast period.

Key Highlights

- Over the short term, the South America screw compressor market is expected to have an augmented growth due to the growing natural gas demand in countries like Argentina and Brazil, which has led to the growth in natural gas production and the advantages associated with screw compressors like low maintenance costs, high compression ratio, etc.

- On the other hand, the aspects like oil contamination when screw compressors are applied in hot and sour applications are expected to impede the market in the near future.

- Nevertheless, the technological developments that cropped up in the screw compressor industry recently present a golden opportunity for the growth of the market. As an example, the modern screw compressors have a fully-enclosed design that makes them suitable for heat recovery. They can convert 100% of the drawn electrical energy into heat and up to 96% of this energy can be recovered.

- Brazil is expected to have a faster growth during the forecast period due to the growth in the oil and gas and manufacturing industries.

South America Screw Compressor Market Trends

Oil and Gas Industry Expected to Witness Significant Growth

- The screw compressors are used in the oil and gas industry for various applications like boosters for gas gathering platforms, gas transportation via pipelines, oil and gas refining processes, and the petrochemical industry. These types of compressors are preferred in the industry, mainly for applications where constant pressure is required for longer periods. The South American region has witnessed an acceleration in natural gas production, especially in countries like Argentina and Brazil which have ramped up the deployment of screw compressors.

- The natural gas production in Argentina was recorded as 38.6 billion cubic meters in the year 2021, a continuous uptrend in the last five years, except for the Covid effect. The screw compressor industry did not get the vibes from the production segment only but also from the gas transportation projects in the recent picture.

- As an example, Argentina planned a new gas pipeline project in the Vaca Muerta shale gas region in December 2021. The country's government has also financially aided the project by earmarking around USD1.6 billion for the project. The project will add around 24 million cubic meters of gas transportation capacity by 2023.

- Further, in July 2022, MAN Energy Solutions bagged a contract from Yinson to supply centrifugal and screw compressor trains for the FPSO-based gas production project at the Jubarte field, offshore Brazil. The agreement included the supply of five centrifugal compressor trains and two SKUEL321/CP200 screw compressor trains for the project. The gas production is expected to get started in 2024.

- Such kind of developments is likely to see the oil and gas industry spearheading the screw compressor market in the region.

Brazil Expected to Witness Significant Growth

- Brazil is likely to take over other countries in South America in the screw compressors market growth due to the developing oil and gas industry and manufacturing sector, particularly steelmaking and chemical manufacturing. The country has witnessed an upsurge in gas extraction projects, mainly in the offshore segment, which has resulted in the aggressive deployment of compression systems.

- According to BP Statistical Report 2022, the natural gas production in Brazil was around 24.3 billion cubic meters in 2021. The indigenous gas supply has largely increased in the last decade due to the fuelled natural gas demand. A number of oil and gas production projects are still on the way to be added to the national production data.

- For example, Brazil is anticipating the deployment of an FPSO, Anna Nery, very soon at the Marlim offshore oil and gas field in the Campos Basin. The FPSO is currently under-construction at the Cosco Changxing shipyard, China. The vessel will include double screw compressor trains aboard, which will be powered by electric motors and will be used for the vapor recovery process.

- The other lucrative market for the screw compressor industry is the steel manufacturing industry. The country has witnessed a growth in the domestic steel demand, leading to expansion projects at the manufacturing facilities. For instance, in February 2022, the global steel manufacturing corporation announced plans to pursue a manufacturing unit expansion project in Rio de Janeiro, Brazil, with an investment of BRL 1.3 billion.

- Such developments are expected to drive the screw compressor market in Brazil substantially.

South America Screw Compressor Industry Overview

The South America screw compressor market is fragmanted. Some of the major players (in no particular order) include Kobe Steel Ltd., Atlas Copco AB Class A, Ingersoll Rand Inc., General Electric Company, and Kaeser Compressor Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Oil-Injected

- 5.1.2 Oil-Free

- 5.2 Application

- 5.2.1 Natural Gas Applications

- 5.2.2 Process Gas Applications

- 5.2.3 Process Refrigeration

- 5.2.4 Fuel Gas Compression

- 5.2.5 Solution Gas Applications

- 5.2.6 Vapor Recovery Compression Systems

- 5.3 Stage

- 5.3.1 Single-Stage

- 5.3.2 Multi-Stage

- 5.4 End-User Industry

- 5.4.1 Manufacturing

- 5.4.1.1 Steel

- 5.4.1.2 Chemical

- 5.4.1.3 Others

- 5.4.2 Oil and Gas Industry

- 5.4.3 Mining

- 5.4.4 Construction

- 5.4.5 Others

- 5.4.1 Manufacturing

- 5.5 Geography

- 5.5.1 Brazil

- 5.5.2 Argentina

- 5.5.3 Chile

- 5.5.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Kobe Steel Ltd.

- 6.3.2 Atlas Copco AB Class A

- 6.3.3 Ingersoll Rand Inc.

- 6.3.4 General Electric Company

- 6.3.5 Kaeser Corporation Inc.

- 6.3.6 Man Energy Solutions

- 6.3.7 Burckhardt Compression AG

- 6.3.8 Zhejiang Kaishan Compressor Co.,Ltd.

- 6.3.9 Quincy Compressor LLC

- 6.3.10 Shandong Sollant Machinery Manufacturing Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219