|

市场调查报告书

商品编码

1644929

亚太地区智慧清管:市场占有率分析、产业趋势与成长预测(2025-2030 年)Asia-Pacific Intelligent Pigging - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

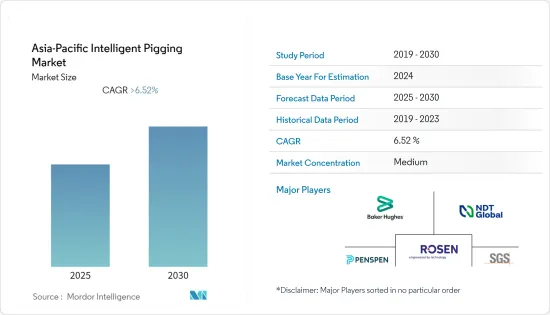

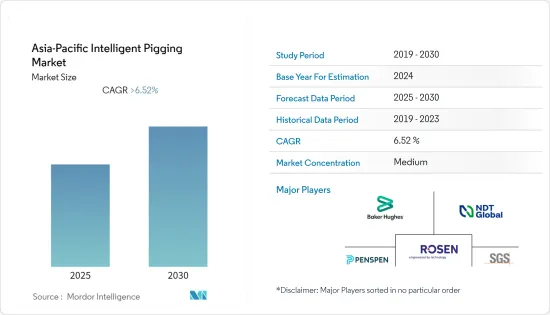

预测期内,亚太地区智慧清管市场预计将以超过 6.52% 的复合年增长率成长。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 短期内,由于亚太地区管道清管服务需求不断增加及石油天然气产量高速成长,智慧清管市场预计将大幅成长。

- 另一方面,智慧清管不能应用于未清管的管道,从而阻碍了市场的成长。

- 该地区,特别是新兴国家的能源消耗增加,是由都市化进程加快推动的。

- 由于即将实施的石油和天然气管道计划,预计中国将占据该市场的最大份额。

亚太地区智慧清管市场趋势

超音波猪有望实现显着成长

- 超音波清管器利用超音波检测管壁厚度的变化。超音波清管器配备有换能器,可垂直于管壁发射讯号并接收来自管道内表面和外表面的讯号。此外,从讯号接收到的迴声可用于测量管道壁的厚度。超音波清管可以对管道中的缺陷深度进行绝对测量,并且可以测量比磁通漏失技术更厚的管道中的金属损失。

- 超音波清管可用于各种尺寸的管道,从 4 英吋到 56 英吋。该技术通常用于液体管道,但在耦合剂的帮助下,它也可以用于气体管道。东亚地区已开发的管道总长度为5.88万公里。截至 2021 年,由于未来计划的需求,该长度预计还会进一步增加。

- 例如,西澳大利亚州将于 2022 年开始建造一条 580 公里长的管道。这条价值 4.6 亿美元的管道可以将珀斯盆地的天然气输送到该州金矿区的资源计划。北部金矿区互联管道将成为西澳大利亚州 2,690 公里天然气管道网路的一部分,预计将大幅增加向内陆的天然气输送量。

- 由于该领域的技术发展,预计超音波领域在不久的将来也将实现成长。例如,2022 年 1 月,总部位于泰国的 Dacon Inspection Technologies 公司对其用于管道的超音波线上检测设备进行了新的改进,提高了检测资料的准确性,并能够检测金属和高密度聚苯乙烯(HDPE) 管道等塑胶等有色金属材料。

- 这些新兴市场的发展有望快速推动该地区的技术市场。

中国可望主导市场

- 中国是亚太地区最大的原油和天然气生产国,2021年分别占该地区原油和天然气总产量的50%和26%。 2021年原油产量为1.9898亿吨,与前一年同期比较成长2.4%,较2020年成长4.0%,较两年平均值成长2.0%。

- 随着能源消耗的增加,该国预计其管道网路将持续成长。截至2022年6月,全国运作中石油管线总长度25,271.3公里,为亚洲国家中最长。未来该国也规划有管道计划,预计网路将进一步扩大。

- 例如,中国西气东输四线计划将于2022年9月动工。该管道将与已完成的3号线和2号线相连,使该系统的年输送能力提高到1000亿立方米以上。天然气管线规划总长3,340公里,起自中国西北部新疆维吾尔自治区吴起县,止于中国西北部宁夏回族自治区中卫。

- 此外,2022年2月,俄罗斯同意一份为期30年的合同,透过新管道向中国供应天然气。由于乌克兰等问题导致莫斯科与西方的关係紧张,莫斯科可能会以欧元付款最近的天然气销售,以加强与北京的能源联盟。垄断俄罗斯天然气管道出口的俄罗斯天然气工业股份公司已同意每年向中国国有能源巨头中国石油天然气集团供应 100 亿立方公尺的天然气。

- 预计此类发展将对中国市场产生比该地区任何其他国家都要显着的推动作用。

亚太地区智慧清管产业概况

亚太地区智慧清管市场适度细分。市场的主要企业(不分先后顺序)包括 Rosen Group、NDT Global Services Ltd、SGA SA、Baker Hughes Company 和 Penspen Limited。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 科技

- 漏磁清管

- 毛细管清管

- 超音波清管

- 应用

- 裂痕和洩漏检测

- 金属损失和腐蚀检测

- 形状测量和弯曲检测

- 管路流体类型

- 油

- 气体

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Rosen Group

- NDT Global Services Ltd.

- SGA SA

- Baker Hughes Company

- Penspen Limited

- Dtaic Inspection Equipment(Suzhou)Co Ltd.

- Dacon Inspection Technologies

- Panorama Oil & Gas Sdn Bhd

- Romstar Sdn Bhd.

- NDTS India(P)Limited

第七章 市场机会与未来趋势

简介目录

Product Code: 93194

The Asia-Pacific Intelligent Pigging Market is expected to register a CAGR of greater than 6.52% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Currently, the market has reached pre-pandemic levels.

Key Highlights

- Over the short term, the Asia-Pacific intelligent pigging market is expected to register significant growth due to the increasing demand for pipeline pigging services in the region and the high growth of oil and gas production.

- On the other hand, intelligent pigging is not applicable to unpigged pipelines, which impedes the market growth.

- Nevertheless, the growing energy consumption in the region, distinctly in developing countries, is propelled by the advancing steps of urbanization.

- Due to the upcoming oil and gas pipeline projects, China is predicted to have the highest share in the market studied.

APAC Intelligent Pigging Market Trends

Ultrasonic Pigs Expected to Witness Significant Growth

- An ultrasonic pig uses ultrasounds to detect the thickness changes in the pipe wall. Ultrasonic pigs are equipped with a transducer, which perpendicularly transmits signals to the pipe wall surface and receives signals from both the pipeline's internal and external surfaces. Furthermore, the echo received from the signals can be used to determine the pipeline wall's thickness. Ultrasonic pigs provide an absolute measurement of defect depth in the pipe and can measure metal losses in much thicker pipes than is possible with magnetic flux leakage technology.

- Ultrasonic pigs can be used in a wide range of pipeline sizes, ranging from 4 inches up to 56 inches. The technology is generally used for liquid pipelines but can also be used for gas pipelines with the help of a couplant. The pipelines developed in the East-Asian region are 58,800km in length. As of 2021, the length is expected to extend even more due to the demand in upcoming projects.

- For example, in 2022, the construction of the 580 kilometers pipeline in Western Australia started. The USD 460 million worth of pipelines may transport natural gas from the Perth basin to resources projects in the state's Goldfield. The Northern Goldfield Interconnect is expected to be a part of the 2,690-km gas pipeline network in Western Australia and significantly increase the volume of gas transported inland.

- The ultrasonic segment is also expected to grow in the near future due to the technological developments made in the sector. As an example, in January 2022, Dacon Inspection Technologies, the Thailand-based company, made new advancements in the ultrasonic in-line inspection fleet used for pipelines, which increases the inspection data accuracy as well as the inspection of non-ferrous materials such as metals and plastics like High-Density Poly Ethylene (HDPE) pipelines.

- Such developments are expected to drive the technology market in the region in a fast-paced manner.

China Expected to Dominate the Market

- China is the largest crude oil and natural gas producer in the Asia-Pacific region and accounted for around 50% and 26% of the total crude oil and natural gas production in the region in 2021. In 2021, 198.98 million tons of crude oil were produced, an increase of 2.4% over the previous year, a rise of 4.0% over 2020, and an average increase of 2.0% over the two years.

- The country envisaged consistent growth in the pipeline network established due to the increasing energy consumption. The total length of the operational oil pipelines in the country was recorded as 25,271.3 km as of June 2022, the highest among all the Asian countries. The network is bound to grow more due to the upcoming pipeline projects in the country.

- For instance, the construction of the No.4 pipeline of China's West-to-East transmission project started in September 2022. The pipeline was designed to lift the annual carrying capacity of the system to more than 100 billion cubic meters (bcm) after linking with the completed No.3 and No.2 pipelines. The No.4 gas pipeline is expected to be 3,340km long, from Wuqiacounty in Northwest China's Xinjiang Uygur Autonomous Region to Zhongwei in Northwest China's Ningxia Hui Autonomous Region.

- In addition, in February 2022, Russia agreed to a 30-year contract to supply gas to China via a new pipeline. It may settle the recent gas sales in Euros, bolstering an energy alliance with Beijing amid Moscow's strained ties with the West over Ukraine and other issues. Gazprom, which has a monopoly on Russian gas exports by pipeline, agreed to supply Chinese state energy major CNPC with 10 billion cubic meters of gas annually.

- Such developments are expected to visibly steer the market in China more than any other country in the region.

APAC Intelligent Pigging Industry Overview

The Asia-Pacific intelligent pigging market is moderately fragmented. Some of the key players in the market (in no particular order) include Rosen Group, NDT Global Services Ltd, SGA SA, Baker Hughes Company, and Penspen Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Technology

- 5.1.1 Magnetic Flux Leakage Pigs

- 5.1.2 Capiller Pigs

- 5.1.3 Ultrasonic Pigs

- 5.2 Application

- 5.2.1 Crack & Leakage Detection

- 5.2.2 Metal Loss/ Corrosion Detection

- 5.2.3 Geometry Measurement & Bend Detection

- 5.3 Pipeline Fluid Type

- 5.3.1 Oil

- 5.3.2 Gas

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Rosen Group

- 6.3.2 NDT Global Services Ltd.

- 6.3.3 SGA SA

- 6.3.4 Baker Hughes Company

- 6.3.5 Penspen Limited

- 6.3.6 Dtaic Inspection Equipment (Suzhou) Co Ltd.

- 6.3.7 Dacon Inspection Technologies

- 6.3.8 Panorama Oil & Gas Sdn Bhd

- 6.3.9 Romstar Sdn Bhd.

- 6.3.10 NDTS India (P) Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219