|

市场调查报告书

商品编码

1644932

欧洲钻井钻机:市场占有率分析、产业趋势和成长预测(2025-2030 年)Europe Drilling Rig - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

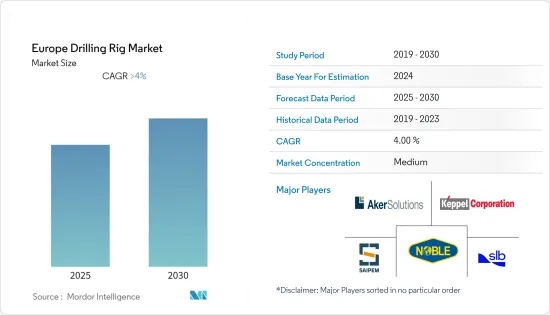

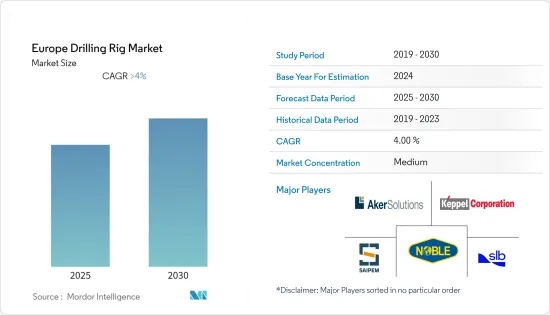

预计预测期内欧洲钻井钻机市场的复合年增长率将超过 4%。

2020 年,市场受到了 COVID-19 的不利影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 从中期来看,预计对石油和天然气探勘和生产的投资增加将推动市场成长。

- 另一方面,预测期内原油和天然气价格的波动预计将阻碍欧洲钻井钻机市场的成长。

- 预计预测期内欧洲海上探勘和生产将为欧洲钻井钻机市场提供有利的成长机会。

- 挪威在市场中占据主导地位,并可能在预测期内实现最高的复合年增长率。这一增长归因于投资的增加以及政府为满足欧洲能源需求而采取的支持措施。

欧洲钻井钻机市场趋势

海上业务实现显着成长

- 欧洲大部分石油和天然气产量来自海上蕴藏量。大部分产量来自北海地区,其中大部分石油来自英国和挪威。预计海上活动的增加将推动欧洲钻井钻机市场的需求。

- 截至 2022 年 1 月,欧洲共有 32 座海上钻机。由于英国在浅水区发现了一些油田,并且进行了一系列油田开发,浅水投资导致 2020 年对钻井钻机的需求增加。

- 2022年1月,马士基钻井公司与丹麦道达尔能源勘探与生产公司签署合同,使用高效自升式自升式钻井马士基伸臂号在丹麦北海提供修井服务。该合约预计于2022年7月开始,为期21个月。

- 此外,2021年6月,挪威石油和能源部宣布了第25轮边境地区许可证授予结果,授予七家公司在挪威大陆架总合四个生产许可证的所有权。其中三张许可证位于巴伦支海新开放的区域,一张位于挪威海。

- 成熟的海上油田也为海上旋转钻井市场创造了机会。随着石油公司将注意力转向挪威大陆棚(NCS)更成熟的区域,挪威计划将将近海的探勘量增加一倍。此外,随着浅水油田的成熟,安哥拉的深水油田产量也将增加。因此,预计在预测期内,对成熟油田产量成长的关注将推动海上钻井钻机服务的需求。

- 因此,鑑于上述情况,预计预测期内欧洲钻井钻机市场的海上部分将显着成长。

挪威占据市场主导地位

- 截至 2021 年,挪威是仅次于俄罗斯和卡达的世界第三大天然气出口国。该国满足了欧盟和英国20-25%的天然气需求。挪威大陆棚生产的石油和天然气几乎全部用于出口,石油和天然气占挪威商品出口总额的一半以上。这使得石油和天然气成为挪威经济最重要的出口商品。

- 2021年挪威天然气产量达1,167亿标准立方米,与前一年同期比较增加0.4%。

- 2021年总合发现18个新油田,其中北海12个,挪威海3个,巴伦支海3个。初步估计已发现石油总储量为8500万立方米。最重要的发现是挪威海的 6507/4-2 S(Dvalin Nord)、北海的 31/2-22 S(Blasto)、25/8-20 S 和 25/8-20 B(Prince/King)。所有这些发现都发生在海上,需要钻井钻机等海底生产系统,这可能会推动市场成长。

- 石油和天然气领域的投资约占挪威生产资本支出的五分之一。据挪威石油天然气协会称,2020年将在勘探、油田开发、运输基础设施和陆上设施方面进行大量投资。到2021年,不包括勘探在内的总投资将达到约1,470亿挪威克朗。

- 2021 年有四个新油田开始生产:北海的 Martin Linge、Duva 和 Solveig,以及挪威海的 A Erfugl Nord。 2021年10月,Ime油田重新开发后恢復生产。截至 2021 年 12 月,共有 6 个油田正在开发中:北海 4 个,挪威海 1 个,巴伦支海总合。

- 凭藉如此丰富的资源和石油和天然气活动,挪威的海上石油和天然气产业预计将进一步成长,从而推动该国在预测期内对欧洲钻井钻机的需求。

欧洲钻井钻机产业概况

欧洲钻井钻机市场中等细分化。市场的主要企业(不分先后顺序)包括 Saipem SpA、Noble Corporation PLC、斯伦贝谢有限公司、Aker Solutions ASA 和吉宝企业有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

第六章 类型

- 顶升

- 半潜式

- 钻井船

- 其他的

第 7 章 部署位置

- 陆上

- 海上

第 8 章 用途

- 石油和天然气

- 矿业

- 其他的

第九章 区域

- 英国

- 挪威

- 荷兰

- 德国

- 欧洲其他地区

第十章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Saipem SpA

- Noble Corporation PLC

- Schlumberger Limited

- Aker Solutions ASA

- Keppel Corporation Limited

- Worldwide Oilfield Machine

- Shengji Group

- Dril-Quip Inc.

- Maersk Drilling AS

- Seadrill Ltd

第十一章 市场机会与未来趋势

简介目录

Product Code: 93201

The Europe Drilling Rig Market is expected to register a CAGR of greater than 4% during the forecast period.

The market was negatively impacted by COVID-19 in 2020. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, increasing investments in oil and gas exploration and production are expected to drive the market's growth.

- On the other hand, volatile crude oil and gas prices are expected to hamper the growth of the Europe drilling rig market during the forecast period.

- Nevertheless, Europe's offshore exploration and production are expected are likely to create lucrative growth opportunities for the Europe drilling rig market in the forecast period.

- Norway dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments, coupled with supportive government policies to meet the energy demand in the Europe region.

Europe Drilling Rig Market Trends

Offshore Segment to Witness Significant Growth

- The majority of oil and gas production in Europe comes from offshore reserves. Most of the production is from the North Sea region, and most of the oil comes from the United Kingdom and Norway. The increasing offshore activities are expected to drive the demand for the European drilling rig market.

- As of January 2022, Europe accounted for 32 offshore rigs. With investment in shallow water resulting in few discoveries and various field developments in the shallow water areas in the United Kingdom, the demand for drilling rigs increased in 2020.

- In January 2022, Maersk Drilling was awarded a contract with TotalEnergies E&P Denmark, which will employ the high-efficiency jack-up rig Maersk Reacher for well intervention services in the Danish North Sea. The contract is expected to commence in July 2022, with a duration of 21 months.

- Further, In June 2021, the Norwegian Ministry of Petroleum and Energy announced awards in the 25th licensing round in frontier areas, granting seven companies ownership interests in a total of four production licenses on the Norwegian Shelf. Three licenses are placed in the newly opened area in the Barents Sea, while one is in the Norwegian Sea.

- Mature offshore fields also create opportunities for the rotary drilling market in the offshore segment. In Norway, oil companies plan to nearly double exploration drilling offshore Norway to focus on more mature areas of the Norwegian Continental Shelf (NCS). Moreover, Angola's deepwater production is also set to ramp up as its shallow-water sector matures. Therefore, focusing on increasing production from mature fields, the offshore segment's demand for drilling rig services is expected to be driven during the forecast period.

- Therefore, due to the above points, the offshore segment is expected to witness significant growth in the Europe drilling rig market during the forecast period.

Norway to Dominate the Market

- As of 2021, Norway is the world's third-largest exporter of natural gas, behind Russia and Qatar. The country has supplied 20-25% of the European Union and the United Kingdom's gas demand. Nearly all oil and gas produced on the Norwegian shelf are exported and combined, due to which Oil and gas exceed half of the total value of Norwegian exports of goods. This makes oil and gas the most important export commodities in the Norwegian economy.

- In 2021, Norway's natural gas production amounted to 116,700 million standard cubic meters, up by 0.4 percent compared to the previous year.

- A total of 18 new oil discoveries were made in 2021, out of which 12 of them were in the North Sea, 3 in the Norwegian Sea, and 3 in the Barents Sea. The discoveries have a preliminary total estimate of 85 million standard cubic meters of recoverable oil equivalents. The most significant discoveries are 6507/4-2 S (Dvalin Nord) in the Norwegian Sea, 31/2-22 S (Blasto), 25/8-20 S, and 25/8-20 B (Prince/King) in the North Sea. These discoveries are likely to promulgate the growth of the market since all the discoveries were made offshore, which require subsea production systems, such as drilling rigs.

- Investments in the oil and gas sector are responsible for about one-fifth of the country's productive capital investments. As per the Norwegian Oil and Gas Association, significant investments were made in exploration, field development, transport infrastructure, and onshore facilities in 2020. Also, in 2021 the investments, excluding exploration, totaled around NOK 147 billion.

- Four new fields came onstream in 2021: Martin Linge, Duva, Solveig in the North Sea, and AErfugl Nord in the Norwegian Sea. In October 2021, production from Yme started again after a field redevelopment. As of December 2021, six field developments were ongoing: four in the North Sea, one in the Norwegian Sea, and one in the Barents Sea.

- With such enormous resources and oil and gas activities, Norway's offshore oil and gas industry is likely to grow further, driving the demand for Europe drilling rigs in the country during the forecast period.

Europe Drilling Rig Industry Overview

The Europe drilling rig market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Saipem SpA, Noble Corporation PLC, Schlumberger Limited, Aker Solutions ASA, and Keppel Corporation Limited.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

6 Type

- 6.1 Jackup

- 6.2 Semi-submersible

- 6.3 Drillship

- 6.4 Other Types

7 Location of Deployment

- 7.1 Onshore

- 7.2 Offshore

8 Application

- 8.1 Oil and Gas

- 8.2 Mining

- 8.3 Others

9 Geography

- 9.1 United Kingdom

- 9.2 Norway

- 9.3 Netherlands

- 9.4 Germany

- 9.5 Rest of Europe

10 COMPETITIVE LANDSCAPE

- 10.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 10.2 Strategies Adopted by Leading Players

- 10.3 Company Profiles

- 10.3.1 Saipem SpA

- 10.3.2 Noble Corporation PLC

- 10.3.3 Schlumberger Limited

- 10.3.4 Aker Solutions ASA

- 10.3.5 Keppel Corporation Limited

- 10.3.6 Worldwide Oilfield Machine

- 10.3.7 Shengji Group

- 10.3.8 Dril-Quip Inc.

- 10.3.9 Maersk Drilling AS

- 10.3.10 Seadrill Ltd

11 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219