|

市场调查报告书

商品编码

1644937

欧洲大型风力发电机-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Large Wind Turbine - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

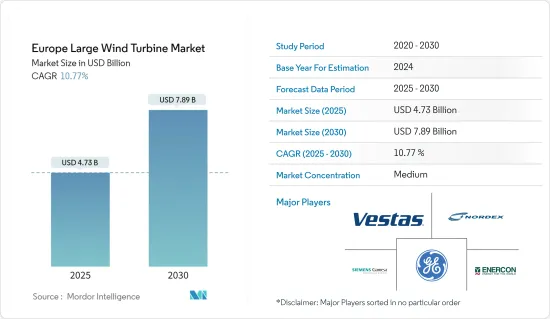

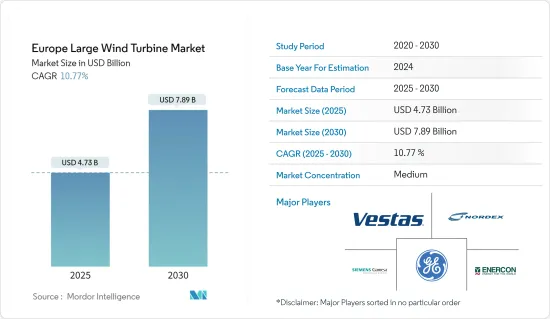

欧洲大型风力发电机市场规模预计在 2025 年为 47.3 亿美元,预计到 2030 年将达到 78.9 亿美元,预测期内(2025-2030 年)的复合年增长率为 10.77%。

关键亮点

- 从中期来看,预计风发电工程投资增加和政府优惠政策等因素将在预测期内推动欧洲大型风力发电机市场的发展。

- 然而,预计在预测期内,替代清洁电力来源(主要是天然气和太阳能光伏)的采用将越来越多地阻碍欧洲大型风力发电机市场的需求。

- 预计预测期内,离岸风力发电计划的发展将为欧洲大型风力发电机市场创造重大机会。

- 近年来,德国一直占据大型风力发电机市场的主导地位。预计预测期内,风发电工程的增加加上政府的措施将推动市场显着成长。

欧洲大型风力发电机市场趋势

陆上市场占据主导地位

- 过去五年来,陆上风电技术不断发展,最大程度地提高了每兆瓦装置容量的发电量并覆盖了更多风速较低的地区。此外,近年来风力发电机毂高度增加,直径增大,风力发电机叶片变得更大。

- 在欧洲,超过81%的新增风电位于陆上,总量约14.05吉瓦。瑞典、德国和土耳其正在建造最多的陆上风电装置容量。 2022年,德国在新建风电场投资方面位居欧洲领先地位。同年,德国投资26亿美元兴建新风发电工程,全部用于陆域风电场。

- 过去的一年,瑞典陆上风电装置数量与前一年同期比较增加了一倍多,创下了风电装置数量的最高纪录。瑞典目前是欧洲陆上风电装置容量最大的国家,新增陆上风电装置容量为2.1吉瓦。

- 2022年7月,瑞典宣布了计划。三家公司将负责计划:西门子歌美飒、Arise 和 Foresight,他们将在瑞典合作进行新计画。

- 瑞典政府计划在2030年将可再生能源在其电力结构中的比例提高到40%。政府宣布将把可再生能源支出从每年 54 亿美元增加到 87 亿美元。这很可能在预测期内促进大型风力发电机转子市场的成长。

- 此外,根据欧洲风能协会预测,到2030年,陆上风力发电将引领欧洲市场需求,实现净零碳排放。根据GWEC统计,陆上风力发电装置容量约占风力发电总量的90%。预计减少碳排放和逐步淘汰传统电力系统的严格政府法规将推动市场发展。

- 因此,预计预测期内该地区的此类发展将支持大型风力发电机市场。

德国占据市场主导地位

- 德国是风力发电领域的大国。离岸风力发电电场的兴起,由于其风速比陆上风电场更快,创造了一个利润丰厚的市场。因此,离岸风力发电预计将实现大幅成长。

- 此外,德国政府、沿海国家和输电系统营运商(TSO)已就扩大北海和波罗的海上风电开发的联合计划达成一致,将该国的海上装机容量目标提高到2030年的20GW。这将推动大型风力发电机市场的成长。

- 根据欧洲风能协会(WindEurope)的数据,截至 2021 年,欧洲风电装置容量为 236 吉瓦。德国继续拥有最大的装置容量,其次是西班牙、英国、法国和瑞典。

- 截至年终年底,德国陆上风力发电机总数将达28,443台。此外,2022 年将安装 551 台新的陆上风力发电机,容量为 2.4 吉瓦。陆域风电总设备容量5816千万瓦。

- 2022年,欧盟风电发电量总合419.5兆瓦时。这比与前一年同期比较增长了约 8.4%。德国是欧盟成员国中风力发电量最多的国家,当年风力发电量约125兆瓦瓦。

- 2022年6月,德国议会通过了新的陆域风电法i.WindLandG,目标从2025年起每年开发10吉瓦的大型陆上风电场。这是德国所谓「復活节包装」的一部分,将再生能源扩张是最高公共利益的原则纳入法典。

- 因此,考虑到以上几点,德国很可能在预测期内占据市场主导地位。

欧洲大型风力发电机产业概况

欧洲大型风力发电机市场是半分割的。沼气市场的主要企业(不分先后顺序)包括 Vestas Wind Systems A/S、Nordex SE、Siemens Gamesa Renewable Energy SA、Enercon GmbH 和通用电气公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2029年的市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 加大对风发电工程的投资

- 政府优惠政策

- 限制因素

- 越来越多采用替代清洁电力来源

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 部署位置

- 土地

- 海上

- 地区

- 德国

- 法国

- 西班牙

- 北欧的

- 土耳其

- 俄罗斯

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Vestas Wind Systems A/S

- Nordex SE

- Siemens Gamesa Renewable Energy SA

- Enercon GmbH

- General Electric Company

- Suzlon Energy Limited

- Vensys Energy AG

- Xinjiang Goldwind Science & Technology Co., Ltd.

- JSC NovaWind

- Envision Energy

- Market Player Ranking

第七章 市场机会与未来趋势

- 海上风力发电迅猛增长

简介目录

Product Code: 93219

The Europe Large Wind Turbine Market size is estimated at USD 4.73 billion in 2025, and is expected to reach USD 7.89 billion by 2030, at a CAGR of 10.77% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, factors such as increasing investments in wind power projects and favorable government policies are anticipated to drive the Europe large wind turbine market during the forecast period.

- On the other hand, the growing adoption of alternate sources of clean power generation, mainly natural gas power and solar power is expected to hamper the demand for the Europe large wind turbine market during the forecast period.

- Nevertheless, the offoshore wind energy projects development are expected to create considerable opportunities for the Europe large wind turbine market during the forecast period.

- Germany is expected to dominate the large turbine wind market in recent years. It is expected to witness significant market growth in the forecast period due to the increasing wind energy projects coupled with the government's policies.

Europe Large Wind Turbine Market Trends

Onshore Segment to Dominate the Market

- Onshore wind energy power generation technology has evolved over the last five years to maximize electricity produced per megawatt capacity installed and to cover more sites with lower wind speeds. Besides this, in recent years, wind turbines have become more extensive with taller hub heights, broader diameters, and larger wind turbine blades.

- In Europe, over 81% of the new wind installations were the onshore wind, with around 14.05 GW. Sweden, Germany, and Turkey are building the most onshore wind installations. In 2022, Germany was the European leader in terms of investment in new wind farms. That year, Germany invested USD 2.6 billion in new wind projects, all of which went toward onshore wind installations.

- During the past year, Sweden has seen a record number of wind installations as onshore installations have more than doubled year-over-year. Sweden now has the most onshore wind capacity in Europe, with 2.1 GW of new onshore installations.

- In July 2022, a project was announced in Sweden to build a new 277 MW wind farm starting in 2025. Three companies will be in charge of the project; Siemens Gamesa, Arise and Foresight are likely to collaborate on a new project in Sweden.

- Sweden government has planned to increase the share of renewable energy in the power mix to 40% by 2030. The government announced an increase in the expenditure on renewables, from USD 5.4 billion to USD 8.7 billion annually. This, in turn, is likely to aid the growth of the large wind turbine rotor market during the forecast period.

- Furthermore, according to WindEurope, onshore wind energy will lead the market demand in the European region to achieve net-zero carbon emissions by 2030. According to GWEC, onshore wind energy capacity takes around 90% of the total wind energy. The strict government regulations to reduce carbon emissions and phase out conventional power systems are expected to drive the market.

- Thus, such developments in the region are expected to support the large wind turbine market during the forecast period.

Germany to Dominate the Market

- Germany is rich in wind power generation. Growing wind power plants in the offshore area are becoming a lucrative market due to higher wind speed in comparison to onshore wind. Thus, offshore wind-based electricity generation is expected to witness significant growth.

- Also, the German government, coastal states, and transmission system operators (TSOs) have agreed on a joint plan to expand offshore wind development in the North and Baltic Seas and lift the country's offshore installed capacity target to 20 GW by 2030. This in turn culminates in the growth of the large wind turbine rotor market.

- According to WindEurope, as of 2021, 236 GW of wind energy capacity is installed in Europe. Germany continues to have the largest installed capacity, followed by Spain, the United Kingdom, France, and Sweden.

- At the end of the year 2022, there were a total of 28,443 onshore wind turbines in Germany. Also, 551 new onshore wind turbines with a capacity of 2.4 GW were newly installed in the year 2022. The total installed capacity of onshore wind energy is 58.106 GW.

- The amount of electricity generated from wind power in the European Union (EU) totaled 419.5 terawatt hours in 2022. This was an increase of about 8.4 percent in comparison to the previous year. Among EU member states, Germany produced the most electricity from wind power, generating nearly 125 terawatt hours that same year..

- In June 2022, the German Parliament adopted a new Onshore Wind Law, i.e., WindLandG, which aims to develop onshore wind-based power plants by a massive 10 GW a year starting from 2025. It's part of Germany's "Easter Package" of measures that enshrines the principle that the expansion of renewables is a matter of overriding public interest.

- Therefore considering the above-mentioned points, Germany is likely to dominate the market during the forecast period.

Europe Large Wind Turbine Industry Overview

Europe Large Wind Turbine Market is semi fragmented. Some of the key players in the biogas market (not in particular order) include Vestas Wind Systems A/S, Nordex SE, Siemens Gamesa Renewable Energy S.A., Enercon GmbH, and General Electric Company, among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2029

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 The Increasing Investments in Wind Power Projects

- 4.5.1.2 Favorable Government Policies

- 4.5.2 Restraints

- 4.5.2.1 The Growing Adoption of Alternate Sources of Clean Power Generation

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Location of Deployment

- 5.1.1 Onshore

- 5.1.2 Offshore

- 5.2 Geography

- 5.2.1 Germany

- 5.2.2 France

- 5.2.3 Spain

- 5.2.4 NORDIC

- 5.2.5 Turkey

- 5.2.6 Russia

- 5.2.7 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Vestas Wind Systems A/S

- 6.3.2 Nordex SE

- 6.3.3 Siemens Gamesa Renewable Energy S.A

- 6.3.4 Enercon GmbH

- 6.3.5 General Electric Company

- 6.3.6 Suzlon Energy Limited

- 6.3.7 Vensys Energy AG

- 6.3.8 Xinjiang Goldwind Science & Technology Co., Ltd.

- 6.3.9 JSC NovaWind

- 6.3.10 Envision Energy

- 6.4 Market Player Ranking

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 The Aggressive Growth of Offshore Wind Energy

02-2729-4219

+886-2-2729-4219