|

市场调查报告书

商品编码

1644941

亚太电池管理系统 -市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Battery Management System - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

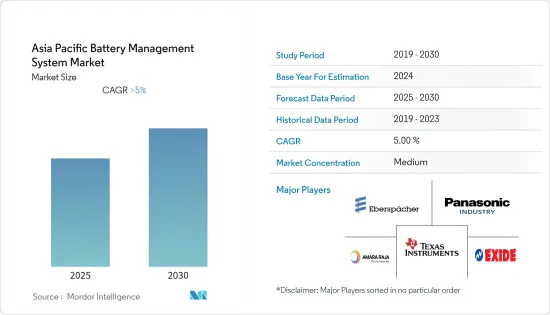

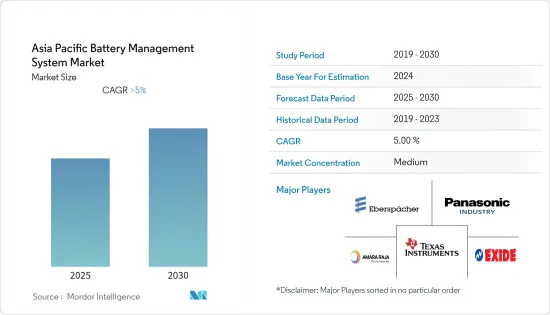

预计预测期内亚太地区电池管理系统市场复合年增长率将超过 5%。

市场受到了 COVID-19 的不利影响。目前市场已恢復至疫情前的水准。

关键亮点

- 从中期来看,电动车的日益普及、对强大充电基础设施的需求以及对提高电池能源效率的关注也有望推动所研究市场的成长。

- 然而,现成或标准电池管理系统的技术限制是市场的主要限制因素之一。

- 电池管理系统的技术进步具有降低复杂性、提高效率和增强可靠性等优点,预计将在预测期内提供成长机会。

- 中国占据市场主导地位,并可能在预测期内实现最高的复合年增长率。这一成长的推动因素包括电动车销售飙升、政府大力减少温室气体排放以及电池充电基础设施的发展。

亚太地区电池管理系统市场趋势

运输领域预计将主导市场

- 此前,只有内燃机汽车(ICE)才被使用。然而,人们对环境问题的日益担忧正在导致技术转向电动车(EV)。因此,内燃机汽车领域没有电池管理系统的市场。

- 2021年,中国是亚洲销售电动车最多的国家,电动车销量超过333万辆,而纽西兰2021年销售了约10,300辆电动车。

- 锂离子电池系统为插电混合动力汽车汽车和电动车提供动力。锂离子电池具有高能量密度、快速充电能力和高放电功率,是唯一能够满足OEM对车辆续航里程和充电时间要求的技术。铅基牵引电池比能量低、重量大,在全混合动力汽车和电动车上使用不具竞争力。

- 此外,中国是全球製造电动车电池的热点地区。中国目前拥有 93 座超级工厂,预计到 2030 年将达到 130 座左右。因此,预计该国对电池管理系统的需求将会增加。

- 此外,印度各邦政府正在采取多项倡议在该国推广电动车。例如,德里政府推出了一项电动车计划,为每千瓦时电池和每辆电动车提供奖励。例如,该州为每千瓦时电池容量提供约 120 美元的奖励,或为每辆电动车提供约 1,850 美元的奖励。该计划的主要目标是促进电动和混合动力汽车在印度汽车市场的普及。

- 因此,由于上述因素,预测期内运输业很可能主导电池管理系统市场。

中国主导市场

- 预测期内,中国很可能成为重要的电池管理系统市场。由于中国电动车市场的快速成长,预计将实现显着成长。

- 在中国,市场主要受到电动车部署的增加、都市化导致的家用电子电器需求高以及电力购买力平价上升的推动。

- 中国是最大的电动车市场,预计 2021 年电动车销量将超过 333 万辆,仍将是全球最大的电动车市场。 2021年中国将占全球电动车销量的近40%。

- 此前,外国汽车製造商必须面临25%的进口关税,或在中国设厂的股权比例不得超过50%。 2022年1月,乘用车50%投资限制放宽。中国也废除了一项限制外国公司在该国设立两家以上生产同类汽车的合资企业的法律。

- 随着国内电动车产业目前蓬勃发展,中国政府将在2022年将电动车补贴削减30%,并在年终前取消补贴。计划中的补贴削减旨在使製造商减少对政府资金开发新技术和新车型的依赖。

- 2022年5月,层级汽车零件製造商Endurance Technologies Limited以4,000万美元收购了ION Energy旗下的电池管理系统(BMS)业务Maxwell Energy Services。收购后,Maxwell计划将研发团队扩大至250人以上,并推出针对电动车和能源储存系统的新产品。电池管理系统是一种监控电池充电状态、健康和安全的电子系统。这项收购正值印度发生一系列电动两轮车起火事件之际,电动车製造商正受到越来越严格的审查。

- 因此,上述因素被认为是该国电池管理系统的主要驱动因素,预计将在预测期内推动市场成长。

亚太电池管理系统产业概况

亚太地区电池管理系统市场适度细分。市场的主要企业(不分先后顺序)包括 Exide Industries Limited、Amara Raja Batteries Ltd.、 Panasonic 工业、Texas Instruments Incorporated 和 Eberspaecher Vecture Inc.

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2027 年市场规模及需求预测(十亿美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 应用

- 固定式

- 可携式的

- 运输

- 地区

- 中国

- 印度

- 日本

- 新加坡

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Exide Industries Limited

- Amara Raja Batteries Ltd.

- Panasonic Industry Co., Ltd.

- Texas Instruments Incorporated

- Elithion Inc.

- Sensata Technologies, Inc.

- LION Smart GmbH

- Eberspaecher Vecture Inc.

- Leclanche SA

- Contemporary Amperex Technology Co. Limited

- Kolsite Group

第七章 市场机会与未来趋势

The Asia Pacific Battery Management System Market is expected to register a CAGR of greater than 5% during the forecast period.

The market was negatively impacted by COVID-19. Presently the market has now reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing adoption of electric vehicles, the need for robust charging infrastructure, and the focus on increasing the energy efficiency of batteries are also expected to drive the growth of the market studied.

- On the other hand, technological limitation on off-the-shelf battery management systems or standard battery management systems is one of the major restraints for the market.

- Nevertheless, technological advancements in battery management systems with advantages, such as reduced complexity, better efficiency, and improved reliability, are expected to provide growth opportunities in the forecast period.

- China dominates the market and is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the rapid rise in sales of electric vehicles, extensive efforts of the governments to reduce greenhouse gas emissions, and the development of battery charging infrastructure.

APAC Battery Management System Market Trends

Transportation Segment Expected to Dominate the Market

- Vehicles with internal combustion engines (ICE) were the only types used earlier. However, technology has been shifting toward electric vehicles (EVs) due to growing environmental concerns. Therefore, due to these reasons, battery management systems do not have any market in the ICE sector.

- In 2021, China experienced the most electric vehicle sales in Asia, with over 3.33 million electric cars sold, and about 10.3 thousand electric vehicles were sold in New Zealand in 2021.

- Lithium-ion battery systems propel plug-in hybrid and electric vehicles. Due to their high energy density, fast recharge capability, and high discharge power, lithium-ion batteries are the only available technology that meets OEM requirements for the vehicle driving range and charging time. The lead-based traction batteries are not competitive for use in full hybrid electric vehicles or electric vehicles because of their lower specific energy and higher weight.

- Additionally, China is the global hotspot for electric vehicle battery manufacturing. There are 93 Giga factories in China, and the country is projected to have around 130 by 2030; the country is expected to dominate the market during the forecast period. This, in turn, is expected to create tremendous demand scope for battery management systems in the country.

- Furthermore, the Indian state government has taken several initiatives to promote electric vehicles in the country. For instance, the Delhi government has an EV policy that provides incentives per Kwh of battery and per EV. For instance, the state provides about USD 120 as incentives per KWh battery capacity and about USD 1,850 incentives per EV. The main objective of such a scheme is to promote faster adoption of electric and hybrid vehicles in the Indian automotive market.

- Hence, based on the factors mentioned above, the transportation segment is likely to dominate the battery management systems market during the forecast period.

China to Dominate the Market

- China will likely be a significant battery management system market during the forecast period. China is expected to witness substantial growth due to the rapid growth in the electric vehicle market.

- In China, the market studied is mainly driven by the increasing deployment of electric vehicles and high demand for consumer electronics with urbanization and increasing power purchase parity.

- China is the largest market for electric vehicles (EVs), with over 3.33 million EVs sold during 2021, and it is expected to remain the world's largest electric car market. China accounted for almost 40% of global electric car sales in 2021.

- Earlier the foreign automakers faced a 25% import tariff, or they were required to build a factory in China with a cap of 50% ownership. In January 2022, the 50% ownership rule was relaxed for passenger cars. The laws restricting a foreign company from establishing more than two joint ventures producing similar vehicles in the country were also removed.

- The Government of China is likely to cut subsidies on electric vehicles by 30% in 2022 and eliminate it by the end of the year, as the electric vehicle industry in the country is now thriving. The planned subsidy cut is aimed at reducing manufacturers' reliance on government funds for developing new technologies and vehicles.

- In May 2022, Endurance Technologies Limited, a Tier-1 automotive component manufacturer, acquired ION Energy's Battery Management System (BMS) business unit Maxwell Energy Services for USD 40 million. After the acquisition, Maxwell is expected to increase its R&D team to more than 250 engineers and launch new products for electric vehicles and energy storage systems. The battery management system is an electronic system that monitors a battery's state of charge and health to ensure safety. The acquisition also comes amid increasing scrutiny on EV makers after electric two-wheelers catch fire across India.

- Therefore, the above-stated factors can be considered the major driving factors for battery management systems in the country, where the market is expected to grow during the forecast period.

APAC Battery Management System Industry Overview

The Asia Pacific battery management system market is moderately fragmented in nature. Some of the major players in the market (in no particular order) include Exide Industries Limited, Amara Raja Batteries Ltd., Panasonic Industry Co., Ltd., Texas Instruments Incorporated, and Eberspaecher Vecture Inc.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD billion, till 2027

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Stationary

- 5.1.2 Portable

- 5.1.3 Transportation

- 5.2 Geography

- 5.2.1 China

- 5.2.2 India

- 5.2.3 Japan

- 5.2.4 Singapore

- 5.2.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Exide Industries Limited

- 6.3.2 Amara Raja Batteries Ltd.

- 6.3.3 Panasonic Industry Co., Ltd.

- 6.3.4 Texas Instruments Incorporated

- 6.3.5 Elithion Inc.

- 6.3.6 Sensata Technologies, Inc.

- 6.3.7 LION Smart GmbH

- 6.3.8 Eberspaecher Vecture Inc.

- 6.3.9 Leclanche SA

- 6.3.10 Contemporary Amperex Technology Co. Limited

- 6.3.11 Kolsite Group