|

市场调查报告书

商品编码

1644958

亚太地区空气品质监测-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Asia Pacific Air Quality Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

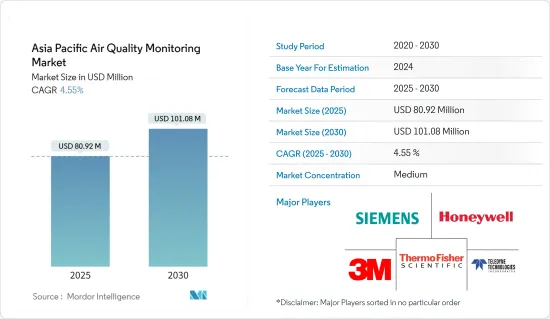

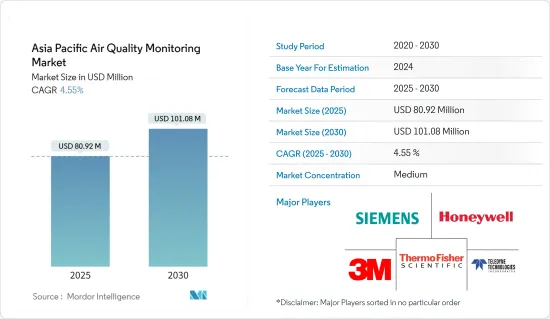

亚太地区空气品质监测 (AQM) 市场规模预计在 2025 年为 8,092 万美元,预计到 2030 年将达到 1.0108 亿美元,预测期内(2025-2030 年)的复合年增长率为 4.55%。

关键亮点

- 从中期来看,人们意识的增强和政府遏制空气污染的倡议预计将推动市场成长。

- 然而,预计空气品质监测系统的高成本将在预测期内阻碍亚太空气品质监测市场的成长。 \

- 预计空气品质监测系统技术的不断进步将在预测期内为亚太地区空气品质监测市场带来有利的成长机会。

亚太地区空气品质监测市场趋势

户外市场将大幅成长

- 室外空气品质监测系统可测量室外空气(即开放空间)中的污染物、空气中的粒状物、湿度和温度的浓度等级。检测 CO2、O3、NO2、SO2、甲醛 (HCHO) 和总挥发性有机化合物 (TVOC) 等污染物的含量。

- 巴基斯坦2022年PM2.5平均浓度为70.9微克/立方公尺(μg/m3),是世界上污染最严重的国家之一。这比印度的平均PM2.5浓度高出近18μg/m3。

- 空气品质监测系统通常由政府在特定州或国家的城市和公共场所部署。这些设备具有防风雨功能,并且必须符合某些环境测试和模拟要求才能获得施工认证。

- 室外监测器进一步分为携带式室外监测器、固定式室外监测器、灰尘和颗粒物监测器以及空气品质管理站。可携式户外监测器由于其操作优势和易于部署而在全球范围内得到最广泛的部署。

- 随着都市化进程的推进和越来越多的人口迁入都市区,都市区的空气污染水平正在上升。预计到2050年,将有25亿人居住在都市区。由于人口密度高,以及工业单位、都市废弃物产生和交通拥堵等多种污染源,迫切需要改善空气品质监测和应变系统。

- 2022 年 4 月,Oizom 宣布已在印度 9 个智慧城市安装了 129 个空气品质监测器。印度政府于 2015 年启动了「100 个智慧城市」计划,Oizom 成为提供强大、准确和紧凑的空气品质监测解决方案的先驱。 Oizom 于 2017 年开始在卡基纳达智慧城安装,并在五年内扩展到瓦拉纳西、甘地讷格尔、苏拉特、伊塔那噶、达万格雷、因帕尔和阿格拉等 8 个城市。

- 因此,预计预测期内此类发展将为户外监测器市场的发展提供动力。

中国主导市场

- 根据《2021年世界空气品质报告》,全球污染最严重的10个国家中有5个位于亚太地区。在污染最严重的20个国家中,有8个位于亚洲和太平洋地区。

- 截至2022年,根据世界空气品质报告,中国人口加权平均PM2.5浓度排名第25位,为30.6μg/m3。根据世界空气品质报告,2022年东亚地区污染最严重的18个区域城市都在中国。据估计,中国每年有一百多人因空气污染而死亡。但现在中国正以创新的解决方案进行反击。

- 一些城市从 20 世纪 70 年代开始监测空气质量,并在 20 世纪 80 年代推出了第一个国家监测系统。 2000年,国家开始采用以NO2、PM10、SO2监测资料为基础的日空气污染指数(API)来评估42个城市的空气品质。

- 近年来,中国政府显着提高了空气品质监测覆盖率。 2012年至2020年间,中国各地的联邦空气监测站数量从661个增加到1800个。除此之外,地方政府也管理和资助了数千个空气监测站。

- 近年来,中国空气污染问题受到广泛关注,空气品质监测成为关注的焦点。近年来,中国空气品质监测产业的发展速度超出了预期。

- 然而,这项技术主要集中在最需要它的都市区。随着公众兴趣和监管机构对改善空气品质的关注度不断提高,预计中国空气品质监测市场在预测期内将呈现积极的前景。

亚太地区空气品质监测产业概况

亚太地区空气品质监测市场本质上是半地方性的。市场的主要企业(不分先后顺序)包括西门子股份公司、赛默飞世尔科技公司、3M公司、霍尼韦尔国际公司和Teledyne Technologies公司。

2022年2月,霍尼韦尔推出了室内空气品质(IAQ)监测器。该监测器向建筑物业主和营运商发出潜在问题的警报,使他们能够主动改善室内空气质量,从而降低传播空气污染物的风险。这款小型触控萤幕设备是印度製造的产品,可测量相对湿度、温度和室内空气污染物等关键的室内空气品质参数。 IAQ 指数是根据测量结果列出的。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 意识提升并宣传政府政策和非政府措施以遏制空气污染

- 限制因素

- 空气品质监测系统高成本

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 产品类型

- 室内监控

- 户外监视器

- 取样方法

- 连续的

- 手动的

- 间歇性

- 污染物类型

- 化学污染物

- 物理污染物

- 生物污染物

- 最终用户

- 住宅和商业

- 发电

- 石油化工

- 其他的

- 地区

- 中国

- 印度

- 日本

- 新加坡

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Siemens AG

- Thermo Fisher Scientific Inc.

- Horiba Ltd

- Emerson Electric Co.

- 3M Co.

- Honeywell International Inc.

- Teledyne Technologies Inc.

- TSI Inc.

- Merck KGaA

- Agilent Technologies Inc.

- Aeroqual Limited

第七章 市场机会与未来趋势

- 空气品质监测系统的技术进步日益

The Asia Pacific Air Quality Monitoring Market size is estimated at USD 80.92 million in 2025, and is expected to reach USD 101.08 million by 2030, at a CAGR of 4.55% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing awareness and favorable government policies and non-government initiatives for curbing air pollution are expected to drive the market's growth.

- On the other hand, the high costs of air quality monitoring systems are expected to hamper the growth of the Asia Pacific air quality monitoring market during the forecast period. \

- Nevertheless, increasing technological advancements in air quality monitoring systems will likely create lucrative growth opportunities for the Asia Pacific air quality monitoring market in the forecast period.

Asia Pacific Air Quality Monitoring Market Trends

Outdoor Segment to Witness Significant Growth

- The outdoor air quality monitoring systems measure the concentration levels of pollutants, suspended particles, humidity, and temperature in outside air, i.e., in open spaces. They detect the levels of pollutants like CO2, O3, NO2, SO2, formaldehyde (HCHO), total volatile organic compounds (TVOC), etc.

- Pakistan had an average PM2.5 concentration of 70.9 micrograms per cubic meter of air (µg/m3) in 2022, making it one of the most polluted country in the world. This was almost 18 µg/m3 more than the average PM2.5 concentrations in India.

- Air quality monitoring systems are majorly deployed by the respective governments in cities and public spaces of a particular state or country. These devices are weather-resistant and must meet certain environmental tests and simulations to be confided by some building certifications.

- The outdoor monitors are further segmented into portable outdoor monitors, fixed outdoor monitors, dust and particulate monitors, and AQM stations. Portable outdoor monitors are the most widely deployed globally due to their operational advantage and easy deployment.

- With the increasing urbanization and more people moving to urban areas, the air pollution levels in urban areas have increased. It is estimated that by 2050, 2.5 billion more people will live in urban areas. The high population density and diverse pollution sources like industrial facilities, municipal waste generation, and transport congestion lead to an urge for better air quality monitoring and addressal systems.

- In April 2022, Oizom stated that the company installed 129 air quality monitors across nine smart cities in India. The Government launched the 100 Smart Cities program in 2015, for which Oizom has pioneered in providing robust, accurate, and compact solutions for air quality monitoring. Oizom initiated its installation in Kakinada Smart City in 2017 and eventually expanded to eight other cities over five years, such as Varanasi, Gandhinagar, Surat, Itanagar, Davangere, Imphal, and Agra.

- Therefore, owing to such developments are expected to give a thrust to the outdoor monitor segment of the market during the forecast period.

China to Dominate the Market

- According to the World Air Quality Report 2021, among the top 10 most polluted countries in the world, five were from the Asia-Pacific region. Among the top 20 polluted countries, eight were from the region.

- As of 2022, China stands at 25th position with an average of 30.6 µg/m3 PM2.5 concentration weighted by population according to the World Air Quality Report. According to the world air quality report, in 2022, the 18 most polluted regional cities in East Asia were from China. Over a million people are estimated to die annually from air pollution in China. However, currently, the country is fighting back with innovative solutions.

- China has a long history of using air quality monitoring systems; the country started monitoring air quality in a few cities in the 1970s and set up an initial national monitoring system in the 1980s. In 2000, the daily Air Pollution Index (API) based on NO2, PM10, and SO2 monitoring data was introduced in the country to assess air quality in 42 cities.

- In recent years, the Government of China has significantly improved air quality monitor coverage. The number of federal air monitoring stations across China increased from 661 to 1,800 between 2012 and 2020. This is in addition to thousands of air monitoring stations being managed and funded by the local governments.

- In recent years, air quality monitoring has drawn attention due to the extensive concerns regarding air pollution in China. China's air quality monitoring industry has grown faster than expected in recent years.

- However, this technology has been concentrated mainly in urban where it is most required. As public interest and regulatory bodies focus on improving air quality, the Chinese air quality monitoring market is expected to have a positive outlook during the forecast period.

Asia Pacific Air Quality Monitoring Industry Overview

The Asia Pacific air quality monitoring market is semi-consolidated in nature. Some of the major players in the market (in no particular order) include Siemens AG, Thermo Fisher Scientific Inc., 3M Co., Honeywell International Inc., and Teledyne Technologies Inc., among others.

In February 2022, Honeywell launched its Indoor Air Quality (IAQ) monitor, which forewarns building owners and operators of potential issues to proactively enhance indoor air quality, thereby potentially reducing the risk of transmitting airborne contaminants. A Make in India product, the compact, touchscreen-enabled device measures key IAQ parameters, including relative humidity, temperature, and indoor air pollutants. It provides an IAQ index based on the readings.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Awareness and Favorable Government Policies and Non-government Initiatives for Curbing Air Pollution

- 4.5.2 Restraints

- 4.5.2.1 High Costs of Air Quality Monitoring Systems

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Product Type

- 5.1.1 Indoor Monitor

- 5.1.2 Outdoor Monitor

- 5.2 Sampling Method

- 5.2.1 Continuous

- 5.2.2 Manual

- 5.2.3 Intermittent

- 5.3 Pollutant Type

- 5.3.1 Chemical Pollutants

- 5.3.2 Physical Pollutants

- 5.3.3 Biological Pollutants

- 5.4 End User

- 5.4.1 Residential and Commercial

- 5.4.2 Power Generation

- 5.4.3 Petrochemicals

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 Singapore

- 5.5.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Siemens AG

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Horiba Ltd

- 6.3.4 Emerson Electric Co.

- 6.3.5 3M Co.

- 6.3.6 Honeywell International Inc.

- 6.3.7 Teledyne Technologies Inc.

- 6.3.8 TSI Inc.

- 6.3.9 Merck KGaA

- 6.3.10 Agilent Technologies Inc.

- 6.3.11 Aeroqual Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Advancements in Air Quality Monitoring Systems