|

市场调查报告书

商品编码

1644965

欧洲空气品质监测-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Air Quality Monitoring - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

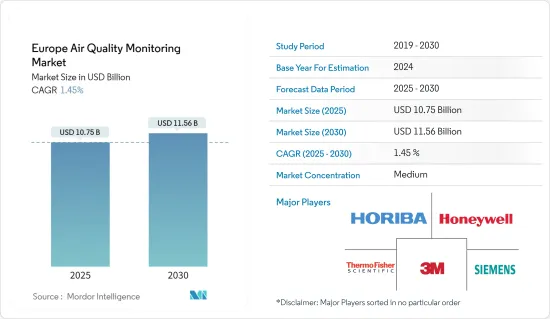

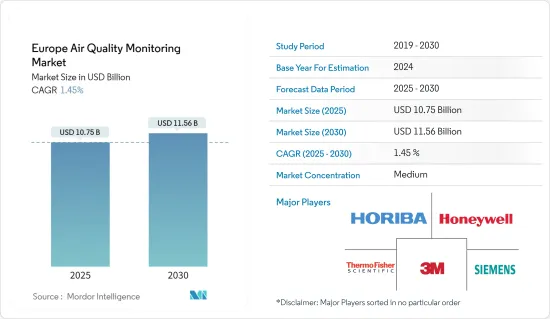

预计2025年欧洲空气品质监测市场规模为107.5亿美元,预计2030年将达到115.6亿美元,预测期内(2025-2030年)的复合年增长率为1.45%。

关键亮点

- 从长远来看,预计预测期内政府对工业和商业运营的严格排放法规将推动市场发展。

- 另一方面,可再生能源产业的不断壮大导致煤炭和天然气发电厂的关闭,预计这将导致全部区域的空气污染水平下降,从而抑制预测期内对空气品质监测设备的需求。

- 预计在预测期内,监测微量污染物水平的监测设备的技术进步将为市场带来巨大的成长机会。

欧洲空气品质监测市场趋势

系列主导市场

- 自动或连续空气品质监测站 (CAAQMS) 可以使用各种分析仪器监测污染物,减少人工错误的机会,以几分钟的时间间隔产生资料,并以最少的人工干预传输资料。这些系统由采样、调节和分析组件以及软体组成,旨在透过分析代表性空气样本提供直接、即时、连续的污染测量。

- 由于它们提供即时测量,这些系统通常安装在空气污染严重的地方,以进行动态空气品质监测。因此,这些系统传统上用于工业设施周围的空气品质监测,以测量工业空气污染物(如 SOx、NOx、COx 和细颗粒物(主要是 PM2.5 和 PM10))的动态水平。大多数连续空气监测计划需要同时监测气象状况。

- 在欧洲等新兴经济体中,空气品质已成为保障社会健康的一个越来越重要的参数。因此,这些国家在建筑和工业建筑中颁布了严格的健康、安全、安保和环境 (HSSE) 法规,从而增加了对室内空气品质监测系统的需求以确保合规。

- 欧洲各地智慧建筑的不断建设,对结合物联网 (IoT) 系统的连续室内空气品质监测系统的需求激增。这些系统可以透过安装在商业空间、办公室、学校等的室内连续空气品质监测系统,动态地提醒业主潜在的空气品质问题。

- 空气污染已成为欧洲日益严重的健康问题。根据欧洲环境署 (EEA) 的数据,超过 90% 的欧盟 (EU) 城市人口所接触的细悬浮微粒水平超过了世界卫生组织 (WHO) 设定的指导水平。此外,接触浓度超过2021年世卫组织指导值的细悬浮微粒导致欧盟27国有超过23万人过早死亡。该地区空气污染的主要来源是能源、交通、家庭、工业和农业活动中石化燃料的燃烧。

- 2022 年,能源产业是欧洲污染最严重的产业,排放量约 37.698 亿吨二氧化碳当量。

- 与其他受到新冠疫情引发的全球经济衰退负面影响的市场不同,空气品质设备和监测市场实现了大幅成长。由于 SARS-2 冠状病毒是一种透过空气传播的病毒,人们担心该病毒会在密闭空间内透过室内病毒污染传播,这导致了先进的抗病毒空气监测和处理系统的开发和部署,以降低传播的可能性。这导致对专门的连续室内空气品质监测系统的需求激增。

英国占很大市场份额

- 2023年4月,英国启动新一轮地方政府空气品质补助金计划,以支持当地社区减少污染空气对民众健康的影响。英格兰各地的地方当局现在可以申请政府 761 万美元的部分资金来实施空气品质改善计划。

- 年度空气品质津贴允许城市製定和实施措施,使企业、学校和社区受益,并减少空气污染对人们健康的影响。自 2010 年以来,该计划已向 500 多个计划颁发了超过 6,719 万美元的奖励。

- 这笔资金将优先用于解决颗粒物问题的计划,提高公众对空气污染影响的认识,并帮助地方政府将氮氧化物 (NO2) 和其他污染物的含量降低到法定基准值以下。因此,政府的此类措施可能会在预测期内增加对空气品质监测系统的需求。

- 英国环境署运营的约 300 个监测站遍布全英国,负责监测空气质量,这些监测站组成网络,使用特定方法收集特定类型的信息。每个网路测量的污染物和所采用的方法取决于网路建立的原因和资料的使用方式。

- 2022 年,能源产业是英国污染最严重的产业之一,排放量约 3.446 亿吨二氧化碳当量。最着名的监测污染物浓度的网路称为自动化城乡网路(AURN),它每小时几乎即时报告资料。

- 英国拥有严格的指导方针和广泛的监控网络,预计这些因素将在预测期内推动市场成长。

欧洲空气品质监测产业概况

欧洲空气品质监测市场正在变得半固体。市场的主要企业(不分先后顺序)包括霍尼韦尔国际公司、堀场製作所有限公司、3M、赛默飞世尔科技和西门子股份公司。

2022 年 9 月,霍尼韦尔推出了整合预警烟雾侦测和先进室内空气品质 (IAQ) 监测的解决方案,以推动安全健康的建筑发展。 Vesda Air 解决方案基于旗舰产品 Vesda-E 系列吸气式烟雾侦测器开发,在一个盒子中整合了五个 IAQ 感测器。在生命安全、财产保护或室内空气品质问题变得严重之前发现它们,您可以使您的建筑物更加安全。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第二章调查方法

第三章执行摘要

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 政府对工业和商业运作的排放法规非常严格

- 限制因素

- 可再生能源产业需求不断成长

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第五章 市场区隔

- 产品类型

- 室内监控

- 户外监视器

- 取样方法

- 连续的

- 手动的

- 间歇性

- 按最终用户

- 住宅和商业

- 发电

- 石油化工

- 其他的

- 按地区

- 英国

- 德国

- 法国

- 义大利

- 西班牙

- 欧洲其他地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- Companies Profiles

- Siemens AG

- Thermo Fisher Scientific Inc.

- Horiba Ltd

- Emerson Electric Co.

- 3M Co.

- Honeywell International Inc.

- Teledyne Technologies Inc.

- TSI Inc.

- Merck KGaA

- Agilent Technologies Inc.

- Aeroqual Limited

第七章 市场机会与未来趋势

- 监测微量污染物水准的监测设备技术进步

The Europe Air Quality Monitoring Market size is estimated at USD 10.75 billion in 2025, and is expected to reach USD 11.56 billion by 2030, at a CAGR of 1.45% during the forecast period (2025-2030).

Key Highlights

- Over the long term, strict government-mandated emission norms in industrial and commercial operations are expected to drive the market during the forecast period.

- On the flip side, the growing impetus to the renewable energy industry leading to a closure of coal and natural gas-fired power plants is expected to result in a decrease in air pollution levels across the region, restraining the demand for air quality monitoring devices during the forecast period.

- Nevertheless, technological advancements in monitoring equipment to monitor levels of trace contaminants are expected to be a significant growth opportunity for the market during the forecast period.

Europe Air Quality Monitoring Market Trends

Continuous Type to dominate the market

- Automatic or continuous ambient air quality monitoring stations (CAAQMS) can monitor pollutants using different analyzers, reducing the chances of manual error, generating data at time intervals of minutes, and transmitting the data while minimizing manual intervention. These systems comprise sampling, conditioning, and analytical components and software designed to provide direct, real-time, continuous pollution measurements by analyzing representative sample(s) of air.

- Due to their real-time measurement capabilities, these systems are typically installed at places with a high level of air pollution for dynamic air quality monitoring. Therefore, these systems have been traditionally used for air quality monitoring around industrial facilities to measure the dynamic levels of industrial air pollutants such as SOx, NOx, COx, and particulates (mostly PM2.5 and PM10). Most continuous air monitoring programs require simultaneous monitoring of meteorological conditions because these parameters influence local and regional air quality.

- In developed economies like those in Europe, air quality has become an increasingly significant parameter for safeguarding social health. Hence, these countries have enacted strict Health, Safety, Security, and Environment (HSSE) regulations in building and industrial construction, which, in turn, has led to the growth in demand for indoor air quality monitoring systems to ensure compliance.

- The rise in the construction of smart buildings across Europe has led to a surge in demand for continuous indoor air quality monitoring systems coupled with Internet of Things (IoT) systems. These systems can dynamically alert the owners about prospective air quality issues, with indoor continuous air quality monitoring systems installed in commercial spaces, offices, and schools.

- Air pollution is a growing health concern in Europe. According to the European Environmental Agency (EEA), more than 90% of the urban population in the European Union (EU) were exposed to fine particulate matter levels above the guideline level set by the World Health Organization (WHO). Further, exposure to concentrations of fine particulate matter above the 2021 WHO guideline resulted in more than 230,000 premature deaths in the EU-27 region. The region's primary sources of air pollution come from burning fossil fuels in energy, transport, households, and industrial and agricultural activities.

- In 2022, the energy sector was the most polluting in Europe, emitting roughly 3769.8 million tonnes of carbon dioxide equivalents of carbon dioxide.

- Unlike other markets that were negatively impacted due to the global recession triggered by the COVID-19 pandemic, the air quality equipment and monitoring markets have grown considerably. As the SARS-2 coronavirus is an airborne virus, concerns about infections caused by indoor viral pollution in constrained spaces have led to the developing and deploying advanced anti-viral air monitoring and treatment systems to reduce the chances of contagion. This has led to explosive growth in demand for specialized continuous indoor air quality monitoring systems.

United Kingdom to have a Significant share in the market

- The United Kingdom is widely recognized for having one of the most comprehensive air quality monitoring programs in the European Union. in April 2023, A new round of Air Quality Grants for local administrations was opened to aid communities and lessen the impact of polluted air on people's health in the United Kingdom. Local administrations across England can now apply for a share of USD 7.61 million of the government budget to provide projects to enhance air quality.

- The annual Air Quality Grant permits councils to develop and execute measures to benefit businesses, schools, and communities and lessen the impact of air pollution on people's health. Since 2010, more than USD 67.19 million has been awarded across more than five hundred projects through the scheme.

- The budget will be prioritized towards projects that tackle particulate matter, enhance public understanding of the effects of air pollution, and help local authorities bring down levels of nitrogen oxide (NO2) and other pollutants below legal limits. Thus, such initiatives by the government are likely to increase demand for air quality monitoring systems during the forecast period.

- Around 300 environment agency-managed monitoring sites across the United Kingdom monitor air quality, and these are organized into networks that gather a particular kind of information using a particular method. The pollutants measured and the method used by each network depends upon the reason for setting up the network and what the data are to be used for.

- In 2022, the energy sector was one of the most polluting in the United Kingdom, emitting roughly 344.6 million tonnes of carbon dioxide equivalents of carbon dioxide. The network that monitors concentrations of the most well-known pollutants is called the Automatic Urban and Rural Network (AURN), which reports data hourly in near real-time.

- The United Kingdom has strict guidelines and a widespread monitoring network, and these factors are expected to drive the market's growth during the forecast period.

Europe Air Quality Monitoring Industry Overview

The Europe air quality monitoring market is semi-consolidated. Some of the key players in the market (in no particular order) include Honeywell International Inc., Horiba Ltd., 3M Company, Thermo Fisher Scientific Inc., and Siemens AG, among others.

In September 2022, Honeywell launched a solution that integrates early warning smoke detection with progressive indoor air quality (IAQ) monitoring, advancing its efforts to develop secure and healthful buildings. Created on the flagship Vesda-E line of aspirating smoke detectors, the Vesda Air solution has an individual five-in-one IAQ sensor within a single box. It can help enhance building safety by determinating life safety, asset protection, or IAQ issues before they escalate into problems.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Strict Government-Mandated Emission Norms in Industrial and Commercial Operations

- 4.5.2 Restraints

- 4.5.2.1 Growing Impetus to the Renewable Energy industry

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGEMENTATION

- 5.1 Product Type

- 5.1.1 Indoor monitor

- 5.1.2 Outdoor Monitor

- 5.2 Sampling Method

- 5.2.1 Continuous

- 5.2.2 Manual

- 5.2.3 Intermittent

- 5.3 By End-user

- 5.3.1 Residential and Commercial

- 5.3.2 Power Generation

- 5.3.3 Petrochemicals

- 5.3.4 Other End Users

- 5.4 By Geography

- 5.4.1 United Kingdom

- 5.4.2 Germany

- 5.4.3 France

- 5.4.4 Italy

- 5.4.5 Spain

- 5.4.6 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Companies Profiles

- 6.3.1 Siemens AG

- 6.3.2 Thermo Fisher Scientific Inc.

- 6.3.3 Horiba Ltd

- 6.3.4 Emerson Electric Co.

- 6.3.5 3M Co.

- 6.3.6 Honeywell International Inc.

- 6.3.7 Teledyne Technologies Inc.

- 6.3.8 TSI Inc.

- 6.3.9 Merck KGaA

- 6.3.10 Agilent Technologies Inc.

- 6.3.11 Aeroqual Limited

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Technological Advancements in Monitoring Equipment to Monitor Levels of Trace Contaminants