|

市场调查报告书

商品编码

1644966

低温容器-市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Cryogenic Vessels - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

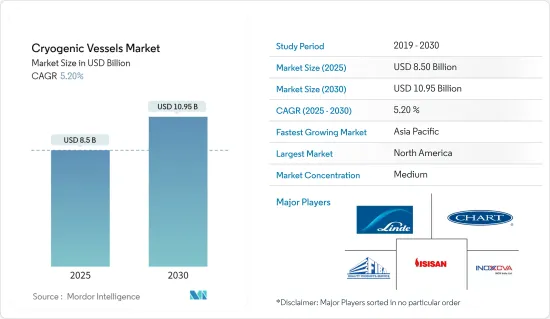

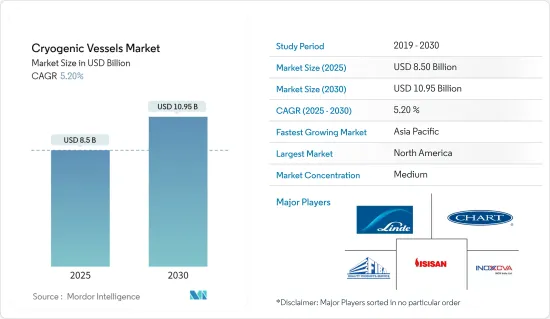

2025 年低温容器市场规模预估为 85 亿美元,预计到 2030 年将达到 109.5 亿美元,预测期内(2025-2030 年)的复合年增长率为 5.2%。

2020 年,新冠疫情对市场产生了负面影响。目前市场已经恢復到疫情前的水准。

关键亮点

- 从中期来看,预计预测期内液化天然气(LNG)需求的增加和医疗系统开发投资的增加将增加对低温容器的需求。

- 另一方面,高昂的营运和维护成本预计会阻碍市场成长。

- 预计,加大对低温能源储存系统开发的技术投资以及氢气作为能源来源的广泛应用将为低温容器市场创造重大机会。

低温容器市场趋势

金属加工产业占市场主导地位

- 低温容器在金属工业中具有重要的应用,因为它们可以在极低的温度下物料输送。这些容器可用多种方式来增强金属加工和製造流程。

- 在金属加工中,低温容器透过循环液态液态氮或其他低温流体来实现极低的温度。这种快速冷却过程提高了金属的硬度、强度和耐磨性。低温处理、低温加工和低温研磨是一些受益于该技术的製程。

- 此外,低温容器在金属加工和焊接作业中发挥重要作用。液态氮和氩等低温气体储存在这些容器中,作为焊接製程的保护气体。透过防止氧化并提供受控环境,这些低温气体可以提高焊接品质。

- 此外,由于都市化、基础设施发展、人口成长和工业扩张,金属产业最近呈现成长趋势,预计在预测期内将继续成长。

- 例如,2022年9月,新日铁公司和安赛乐米塔尔揭露了额外投资计划,以扩大印度的钢铁产能。作为全球最大的钢铁製造商,日本企业将建造和扩大高炉及相关设施。此外,作为扩大策略的一部分,该公司计划收购印度的港口和电力公司。预计这项投资将使粗钢产量从每年 900 万吨增加到 2026 年上半年的 1,500 万吨。

- 根据世界钢铁协会的数据,2022年全球钢铁产量将达18.85026亿吨,占2018年钢铁产量的3%以上。

- 总之,由于先进製造技术的采用增加、对材料性能的要求提高以及製造和焊接操作中对低温气体的需求,金属工业的成长将导致低温容器的使用增加。

- 因此,鑑于上述情况,预计金属产业将占据市场主导地位。

亚太地区成长强劲

- 由于几个关键因素,预计亚太地区对低温容器的需求将增加。其中一个主要驱动因素是能源、化学、电子和医疗保健等各领域的快速工业化。这些行业需要低温流体和低温工艺,预计将推动对储存和运输用低温容器的需求。

- 此外,亚太地区医疗保健和医学研究领域的扩张也促进了低温容器需求的增加。这些容器在储存和运输生物样本、疫苗和其他温度敏感材料方面发挥着至关重要的作用,确保它们在超低温下的完整性。

- 另一个关键因素是该地区注重发展能源和电力基础设施。液化天然气(LNG)终端和仓储设施的大规模投资预计将推动用于储存和运输液化天然气的低温容器的需求激增。

- 例如,2022 年 1 月,马来西亚沙巴州和马来西亚国家石油公司宣布计划建造年产 200 万吨的液化天然气 (LNG) 终端。新工厂计划建在西必丹石油和天然气工业,是马来西亚国家石油公司与沙巴州合作的一部分,旨在扩大向该州工业和商业企业供应清洁能源。

- 此外,由于能源需求的增加,近年来该地区的天然气消费量一直在上升。根据《BP世界能源统计年鑑2022》预测,2021年天然气消费量为9,183亿立方米,较2020年成长6.2%,2011年至2021年年平均成长率为4%。

- 总之,由于工业化的快速发展、医学研究领域的不断扩大、能源和电力基础设施的发展、航太和国防应用的增长以及对技术进步和研究的重视,预计亚太地区对低温容器的需求将会增加。

低温产业概况

全球低温容器市场正走向半固体。该市场的一些主要企业(不分先后顺序)包括 Linde plc、Chart Industries Inc、Inox India Ltd、Isisan AS 和 FIBA Technologies Inc。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 液化天然气(LNG)需求不断成长

- 限制因素

- 运作维护成本高

- 驱动程式

- 供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁产品/服务

- 竞争对手之间的竞争

第五章 市场区隔

- 应用

- 贮存

- 运输

- 最终用户产业

- 能源产出

- 金工

- 医疗

- 饮食

- 其他的

- 低温液体

- LNG

- 液态氮

- 液态氧

- 液态氢

- 其他低温液体

- 原料

- 钢

- 镍合金

- 铝合金

- 其他的

- 2028 年市场规模与需求预测(按地区)

- 北美洲

- 美国

- 加拿大

- 北美其他地区

- 欧洲

- 德国

- 法国

- 英国

- 俄罗斯

- 欧洲其他地区

- 亚太地区

- 中国

- 印度

- 澳洲

- 日本

- 马来西亚

- 其他亚太地区

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 奈及利亚

- 南非

- 其他中东和非洲地区

- 南美洲

- 巴西

- 阿根廷

- 智利

- 南美洲其他地区

- 北美洲

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Linde PLC

- Air Water Inc

- Chart Industries Inc

- Cryofab Inc

- Cryolor

- FIBA Technologies, Inc.

- INOX India Ltd.

- ISISAN AS

- Wessington Cryogenics

- Gardner Cryogenic

第七章 市场机会与未来趋势

- 加大对低温能源储存系统开发的技术投资

The Cryogenic Vessels Market size is estimated at USD 8.50 billion in 2025, and is expected to reach USD 10.95 billion by 2030, at a CAGR of 5.2% during the forecast period (2025-2030).

COVID-19 negatively impacted the market in 2020. Presently, the market has reached pre-pandemic levels.

Key Highlights

- Over the medium term, the increasing demand for liquefied natural gas (LNG) and increasing investments in developing healthcare systems are expected to increase the demand for cryogenic vessels during the forecasted period.

- On the other hand, high operations and maintenance costs are expected to hinder market growth.

- Nevertheless, the increasing technological investments in cryogenic energy storage system development and the increasing deployment of hydrogen as an energy source are expected to create huge opportunities for the cryogenic vessel market.

Cryogenic Vessels Market Trends

Metal Processing Industry To Dominate The Market

- Cryogenic vessels have significant applications in the metal industry due to their ability to handle and store materials at extremely low temperatures. These vessels are utilized in various ways to enhance metal processing and manufacturing processes.

- In metalworking, cryogenic vessels are used to achieve ultra-low temperatures by circulating liquid nitrogen or other cryogenic fluids. This rapid cooling process improves metals' hardness, strength, and wear resistance. Cryogenic treatment, cryogenic machining, and cryogenic grinding are some of the processes that benefit from this technique.

- Furthermore, cryogenic vessels play a significant role in metal fabrication and welding operations. Cryogenic gases, such as liquid nitrogen or argon, are stored in these vessels as shielding gases during welding processes. By preventing oxidation and providing a controlled environment, these cryogenic gases enhance the quality of welds.

- Furthermore, the metal industry has observed growth in recent years and is expected to continue during the forecasted period due to urbanization, infrastructure development, population growth, and industrial expansion.

- For instance, in September 2022, Nippon Steel Corp. and ArcelorMittal revealed their plans to make an additional investment to expand steel production capacity in India. The Japanese company, the largest steelmaker globally, will construct and expand blast furnaces and associated facilities. Additionally, they are anticipated to acquire port and electric power companies in India as part of their expansion strategy. With this investment, the annual production of crude steel is projected to rise from 9 million tons to 15 million tons by the first half of 2026.

- According to the World Steel Association, in 2022, 188,5026 thousand tons of steel were produced globally, which was more than 3% of the steel production in 2018.

- In summary, the growth of the metal industry is likely to increase the utilization of cryogenic vessels due to the expanding adoption of advanced manufacturing techniques, the demand for improved material performance, and the need for cryogenic gases in fabrication and welding operations.

- Therefore, per the above-mentioned points, the metal industry is expected to dominate the market.

Asia-Pacific to Witness Significant Growth

- Due to several significant factors, the Asia-Pacific region is poised to experience increased demand for cryogenic vessels. One key driver is the region's rapid industrialization across various sectors, including energy, chemicals, electronics, and healthcare. As these industries require cryogenic fluids and processes, the demand for cryogenic vessels for storage and transportation is expected to rise.

- Furthermore, Asia-Pacific's expanding healthcare and medical research sectors contribute to the increased need for cryogenic vessels. These vessels play a vital role in storing and transporting biological samples, vaccines, and other temperature-sensitive materials, ensuring their integrity at ultra-low temperatures.

- Another key factor is the region's focus on energy and power infrastructure development. With significant investments in liquefied natural gas (LNG) terminals and storage facilities, the demand for cryogenic vessels for LNG storage and transportation is expected to surge.

- For instance, in January 2022, the Malaysian State of Sabah and Petronas announced plans for a two million metric tons per year (mmt) liquefied natural gas (LNG) terminal. The new facility planned for the Sipitang Oil and Gas Industrial Park is part of Petronas' collaboration with the state to expand Sabah's distribution of cleaner energy to industrial and commercial businesses.

- Furthermore, due to increasing energy demand, natural gas consumption in the region has been on the rise in recent years. According to the BP statistical review of world energy 2022, natural gas consumption in 2021 was 918.3 bcm, an increase of 6.2% compared to 2020 and a 4% annual growth rate between 2011 and 2021.

- In summary, the Asia-Pacific region is anticipated to see an increase in demand for cryogenic vessels due to its rapid industrialization, expanding healthcare and medical research sectors, energy and power infrastructure development, growth in aerospace and defense applications, as well as its focus on technological advancements and research.

Cryogenic Vessels Industry Overview

The global cryogenic vessels market is semi-consolidated. Some key players in this market (in no particular order) include Linde plc, Chart Industries Inc, Inox India Ltd, Isisan AS, and FIBA Technologies Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecasts in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Increasing Demand for Liquefied Natural Gas (LNG)

- 4.5.2 Restraints

- 4.5.2.1 High Operational and Maintenance Costs

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Industry Attractiveness - Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitutes Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Application

- 5.1.1 Storage

- 5.1.2 Transport

- 5.2 End-User Industry

- 5.2.1 Energy Generation

- 5.2.2 Metal Processing

- 5.2.3 Healthcare

- 5.2.4 Food and Beverages

- 5.2.5 Other End-User Industries

- 5.3 Cryogenic Liquid

- 5.3.1 LNG

- 5.3.2 Liquid Nitrogen

- 5.3.3 Liquid Oxygen

- 5.3.4 Liquid Hydrogen

- 5.3.5 Other Cryogenic Liquids

- 5.4 Raw Material

- 5.4.1 Steel

- 5.4.2 Nickel Alloy

- 5.4.3 Aluminum Alloy

- 5.4.4 Other Raw Materials

- 5.5 Geography [Market Size and Demand Forecast till 2028 (for regions only)]

- 5.5.1 North America

- 5.5.1.1 United States

- 5.5.1.2 Canada

- 5.5.1.3 Rest of North America

- 5.5.2 Europe

- 5.5.2.1 Germany

- 5.5.2.2 France

- 5.5.2.3 United Kingdom

- 5.5.2.4 Russia

- 5.5.2.5 Rest of Europe

- 5.5.3 Asia-Pacific

- 5.5.3.1 China

- 5.5.3.2 India

- 5.5.3.3 Australia

- 5.5.3.4 Japan

- 5.5.3.5 Malaysia

- 5.5.3.6 Rest of Asia-Pacific

- 5.5.4 Middle East and Africa

- 5.5.4.1 Saudi Arabia

- 5.5.4.2 UAE

- 5.5.4.3 Nigeria

- 5.5.4.4 South Africa

- 5.5.4.5 Rest of Middle East and Africa

- 5.5.5 South America

- 5.5.5.1 Brazil

- 5.5.5.2 Argentina

- 5.5.5.3 Chile

- 5.5.5.4 Rest of South America

- 5.5.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Linde PLC

- 6.3.2 Air Water Inc

- 6.3.3 Chart Industries Inc

- 6.3.4 Cryofab Inc

- 6.3.5 Cryolor

- 6.3.6 FIBA Technologies, Inc.

- 6.3.7 INOX India Ltd.

- 6.3.8 ISISAN A.S

- 6.3.9 Wessington Cryogenics

- 6.3.10 Gardner Cryogenic

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Increasing Technological Investments in Cryogenic Energy Storage System Development