|

市场调查报告书

商品编码

1644977

欧洲直接甲醇燃料电池市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Europe Direct Methanol Fuel Cell - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

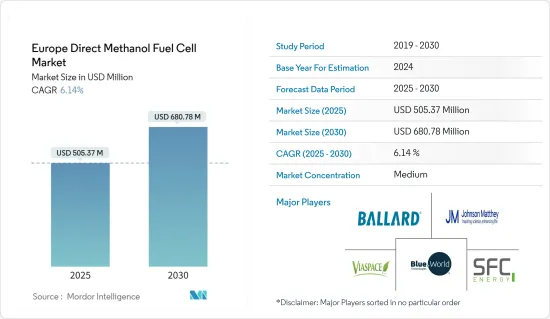

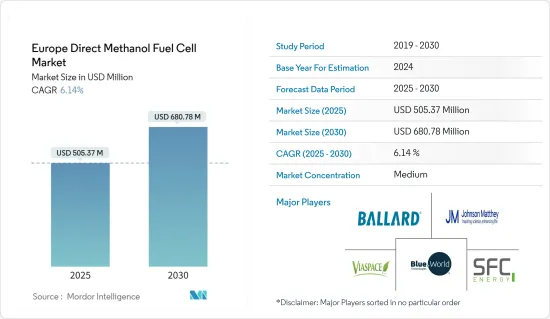

预计 2025 年欧洲直接甲醇燃料电池市场规模为 5.0537 亿美元,到 2030 年将达到 6.8078 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.14%。

主要亮点

- 从中期来看,政府措施和增加的私人投资预计将推动市场成长。

- 另一方面,预测期内锂离子电池价格下跌和基于锂离子电池的应用数量预计增加将阻碍欧洲直接甲醇燃料电池市场的成长。

- 然而,未来对燃料电池的需求可能会在预测期内为欧洲直接甲醇燃料电池市场创造有利的成长机会。

欧洲直接甲醇燃料电池市场趋势

政府措施和私人投资增加

直接甲醇燃料电池市场在过去两年中取得了显着成长,这主要归功于主要市场政府推出的倡议以及私营部门加大的投资支持。

德国拥有欧洲最多的加氢站。截至2022年9月,共有93座加氢站投入运作。接下来是法国,有 21 个地点。

2017年6月,伊莉莎白二世女王提出《自动驾驶与电动车法案》。该法案呼吁增加对燃料电池汽车和氢基础设施的资金投入。自该法案出台以来,该国的氢能和燃料电池产业取得了显着进步。此外,2020 年 2 月,政府宣布为五个以氢气生产为重点的计划提供 3,000 万美元的资金。

在欧洲,市场由 JIVE(氢能汽车联合倡议)主导,其目标是到 2020 年在五个国家部署 139 辆零排放燃料电池公车和加油基础设施。 JIVE 于 2017 年 1 月启动,由燃料电池和氢能联合营业单位(FCH JU) 共同津贴3,400 万美元。该计划联盟包括来自七个国家的22个合作伙伴。

此外,JIVE2将于2018年1月启动,结合JIVE2计划,我们计划在2020年代初在欧洲22个城市部署约300辆燃料电池公车。

此外,2020 年 1 月,由两家交通OEM製造商(燃料电池动力系统和宝马)、一家燃料电池中东和非洲供应商(庄信万丰燃料电池)、一家研究机构(SINTEF)和计划所大学机构(开姆尼茨工业大学和弗莱堡大学 IMTEK)组成的联盟启动了一项提高 PEM 燃料电池功率密度的新计画。

计划的目标是了解中东和非洲汽车应用的新一代 PEM 燃料电池 (膜电极组件) 中的电荷、质量和热传输机制。计划资金为250万美元,将于2020年至2022年运行。

2021年1月,庄信万丰(JM)获得一份价值数百万英镑的新合同,为SFC Energy AG(SFC)供应400,000个直接甲醇MEA(膜电极组件)燃料电池组件,SFC Energy AG(SFC)是固定和移动混合动力解决方案氢能和直接甲醇燃料电池的全球领导者。该合约为期三年多,从2021年2月开始。

因此,预计未来几年政府措施和不断增加的私人投资将推动欧洲直接甲醇燃料电池市场的发展。

德国占据市场主导地位

德国正在推进燃料电池电动公车的引进,同时减少该国的温室气体排放。地区交通管理局 Regionalverkehr Koln 获得政府 790 万美元拨款,购买 30 辆 FCEB 和两座加氢站 (HRS)。该国还计划在 2030年终部署 1,000 个充电站。预计此类倡议将在未来几年极大地推动该地区燃料电池的部署。

根据氢能委员会的统计,2020 年欧洲道路上持有1,300 辆燃料电池电动车 (FCEV)。预计到 2030 年这数字可能会超过 400 万。

德国政府于2020年6月核准的《国家氢能战略》旨在透过氢能能源产出承担减少排放的全球责任,主要目的是提高氢能的竞争力,降低成本,并将氢能确立为替代能源载体。

该策略还旨在透过以可再生能源取代目前的化石能源生产,将氢气作为工业永续性的原料,并支持研究和合格人员的培训,以便在2030年系统地应用工业规模的解决方案。

2021年7月,SFC Energy AG宣布推出下一代氢燃料电池解决方案。 EFOY 氢燃料电池 2.5 电源解决方案结合了可靠、强大、环保的发电方式以及最高的连接性和易用性。

因此,由于德国政府推出的各种倡议,预计预测期内欧洲将主导直接甲醇燃料电池市场。

欧洲直接甲醇燃料电池产业概况

欧洲直接甲醇燃料电池市场适度整合。市场的主要企业(不分先后顺序)包括 Blue World Technologies ApS、Johnson Matthey、SFC Energy AG、Viaspace Inc. 和 Ballard Power Systems Inc.

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 2028 年市场规模与需求预测(美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 政府措施和私人投资增加

- 限制因素

- 锂离子电池价格下跌

- 驱动程式

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 地区

- 英国

- 法国

- 义大利

- 德国

- 其他欧洲国家

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Blue World Technologies ApS

- Johnson Matthey

- SFC Energy AG

- Viaspace Inc.

- Ballard Power Systems Inc.

- MeOH Power, Inc.

- Oorja Protonics Inc.

- Horizon Fuel Cell Technologies

- TreadStone Technologies, Inc.

- Fujikura Ltd.

第七章 市场机会与未来趋势

- 创造本地燃料电池需求的未来目标

The Europe Direct Methanol Fuel Cell Market size is estimated at USD 505.37 million in 2025, and is expected to reach USD 680.78 million by 2030, at a CAGR of 6.14% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, government initiatives and increasing private investments are expected to drive the market's growth.

- On the other hand, declining lithium-ion battery prices and an increase in lithium-ion battery-based applications are expected to hamper the growth of Europe's direct methanol fuel cell market during the forecast period.

- Nevertheless, future targets creating fuel cell demand will likely create lucrative growth opportunities for the Europe direct methanol fuel cell market in the forecast period.

Europe Direct Methanol Fuel Cell Market Trends

Government Initiatives and Increasing Private Investments

The direct methanol fuel cell market witnessed significant growth in the last two years, mainly due to the introduction of government initiatives in key markets and increasing investment support from the private sector.

Germany has the most significant number of hydrogen fuel stations in Europe. As of September 2022, 93 operational hydrogen refueling stations were in the country. This was followed by France, with 21 such stations.

In June 2017, Queen Elizabeth II announced the introduction of the 'Automated and Electric Vehicles Bill.' The bill called for greater funding for fuel cell vehicles and hydrogen infrastructure. After the bill's introduction, the country's hydrogen and fuel cell industry has seen impressive developments. Furthermore, in February 2020, the government announced USD 30 million in funding for five projects focused on hydrogen production.

In Europe, the market is driven by the JIVE (Joint Initiative for Hydrogen Vehicles), which seeks to deploy 139 new zero-emission fuel cell buses and refueling infrastructure across five countries by 2020. The JIVE started in January 2017 and is co-funded by USD 34 million grant from the Fuel Cells and Hydrogen Joint Undertaking (FCH JU). The project consortium involves 22 partners from seven countries.

Further, JIVE2 started in January 2018, and on a combined basis, the JIVE2 projects are expected to deploy around 300 fuel cell buses in 22 cities across Europe by the early 2020s.

Moreover, a new project in January 2020 to improve the power density of PEM fuel cells was taken up by the consortium consisting of two transport OEMs (Fuel Cell Powertrain and BMW), a fuel cell MEA supplier (Johnson Matthey Fuel Cells), one research institute (SINTEF) and two university institutes (Chemnitz University of Technology and IMTEK at the University of Freiburg).

The project's objective consists of understanding the charge, mass, and heat transport mechanism in new generation PEM fuel cell MEA (Membrane Electrode Assemblies) for automotive applications. The project has funding of USD 2.5 million and will run from 2020-2022.

In January 2021, Johnson Matthey (JM), has won a new multi-million-pound agreement to provide 400,000 Direct Methanol MEA (Membrane Electrode Assemblies) fuel cell components to SFC Energy AG (SFC), a global leader of hydrogen and direct methanol fuel cells for stationary and mobile hybrid power solutions. The agreement is considered from February 2021 for a duration of over three years.

Therefore, government initiatives and increasing private investments are expected to drive the Europe direct methanol fuel cell market in the coming years.

Germany to Dominate the Market

Germany is promoting the deployment of fuel cell electric buses in conformation while reducing the GHG emission in the country. The regional transport authority, Regionalverkehr Koln, was awarded USD 7.9 million by the government to purchase 30 FCEBs and two hydrogen refueling stations (HRS). The country also aims to promote the deployment of 1000 stations by the end of 2030. Such initiatives are expected to significantly support the deployment of fuel cells in the region in the coming years.

As per Hydrogen Council statistics, there were about 1,300 fuel cell electric vehicles (FCEVs) in the European fleet in 2020. Projections indicate that this number could exceed four million units by 2030.

Germany's National Hydrogen Strategy, which the government approved in June 2020, aims to assume global responsibility for reducing emissions through energy generation from hydrogen, primarily by making hydrogen competitive, pushing cost reductions, and establishing hydrogen as an alternative energy carrier.

The strategy also aims to establish hydrogen as a raw material for industry sustainability by switching current production based on fossil energies to renewable energies while supporting research and training qualified personnel to get industrial-scale solutions to application maturity by 2030 systematically.

In July 2021, SFC Energy AG announced the launch of the next generation of its hydrogen fuel cell solution. The EFOY Hydrogen Fuel Cell, 2.5 power solution, combines a reliable, robust, and environmentally friendly form of power generation with the highest possible connectivity and ease of use.

Therefore, with various government initiatives launched by Germany, Europe is expected to dominate the direct methanol fuel cell market during the forecast period.

Europe Direct Methanol Fuel Cell Industry Overview

The Europe Direct Methanol Fuel Cell Market is moderately consolidated in nature. Some of the major players in the market (in no particular order) include Blue World Technologies ApS, Johnson Matthey, SFC Energy AG, Viaspace Inc., and Ballard Power Systems Inc., among others.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.1.1 Government Initiatives and Increasing Private Investments

- 4.5.2 Restraints

- 4.5.2.1 Declining Lithium-ion Battery Prices

- 4.5.1 Drivers

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Geography

- 5.1.1 United Kingdom

- 5.1.2 France

- 5.1.3 Italy

- 5.1.4 Germany

- 5.1.5 Rest of Europe

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Blue World Technologies ApS

- 6.3.2 Johnson Matthey

- 6.3.3 SFC Energy AG

- 6.3.4 Viaspace Inc.

- 6.3.5 Ballard Power Systems Inc.

- 6.3.6 MeOH Power, Inc.

- 6.3.7 Oorja Protonics Inc.

- 6.3.8 Horizon Fuel Cell Technologies

- 6.3.9 TreadStone Technologies, Inc.

- 6.3.10 Fujikura Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

- 7.1 Future Targets Creating Fuel Cell Demand in the Region