|

市场调查报告书

商品编码

1644988

亚太潜水泵:市场占有率分析、行业趋势和成长预测(2025-2030 年)Asia Pacific Submersible Pump - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

价格

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

简介目录

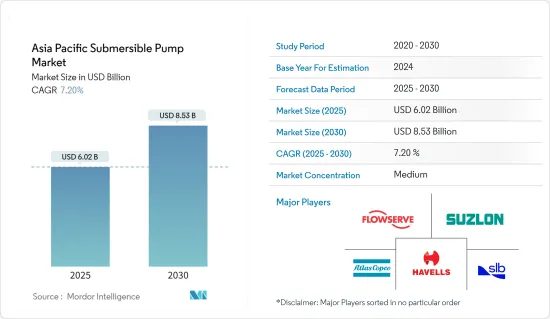

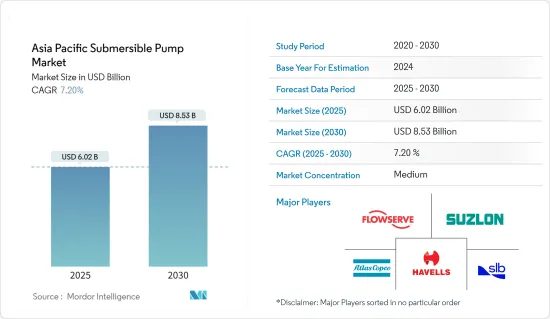

预计 2025 年亚太潜水泵市场规模为 60.2 亿美元,预计到 2030 年将达到 85.3 亿美元,预测期内(2025-2030 年)的复合年增长率为 7.2%。

关键亮点

- 从中期来看,预计终端用户产业的投资增加将推动市场成长。

- 然而,预计高昂的维护和营业成本以及波动的石油和天然气价格将在预测期内阻碍亚太潜水泵市场的成长。

- 在预测期内,现有老化基础设施的维修和升级以及新技术的创新可能会为亚太地区潜水泵市场创造丰厚的成长机会。

- 中国占据市场主导地位,并可能在预测期内实现最高的复合年增长率。这一增长可归因于终端用户行业的投资增加和政府的支持性政策。

亚太潜水泵市场趋势

石油和天然气产业预计需求旺盛

- 在石油和天然气上游产业,潜水泵用于将废弃的钻井泥浆移入和移出蕴藏量坑,透过人工举升最大限度地提高石油和天然气产量,并处理生产污水。

- 过去几年,潜水泵的需求一直不稳定,主要原因是受产业不景气的影响。然而,原油价格的回升和低损益平衡价格正在推动预测期内市场的生产活动。

- 2022年,中国将生产7.99艾焦耳,成为亚太地区最大的天然气生产国。同年,澳洲生产了约 5.5 艾焦耳的天然气,成为该地区第二大生产国。

- 亚太地区石油和天然气产业取得了一系列进展,包括生产效率提高和新油田的推出,导致2021年天然气产量与前一年同期比较增加了1.6%。此外,预计未来几年单位营运成本将会下降。

- 2021年6月,中海油深水天然气田开始投产1,000万立方公尺/日的产能。该天然气田也称为陵水17-2气田,位于中国南海海平面以下1500公尺。该天然气田每年可供应30亿立方公尺天然气,约相当于中国天然气需求的1%。

- 2021年9月,中海油宣布在渤海湾发现垦利10-2油田。垦利10-2油田位于渤海湾南部莱州湾凹陷,平均水深约50英尺。

- 截至 2022 年,印度共有 77 座钻机运作。由于油田老化和缺乏重大发现,该国的石油产量近十年来一直在下降。国营和私营公司都在製定投资计划,以提高旧油田的采收率。

- 因此,基于上述因素和计划,预计预测期内石油和天然气行业对亚太潜水泵市场的需求将大幅增加。

中国主导市场

- 中国已成为全球製造业成长的重要推手。该国在采矿业和建筑业中处于领先地位,并且在石油和天然气领域也处于领先参与企业。儘管受到新冠肺炎疫情影响,但该国工业部门自 2020 年 4 月以来仍实现 3% 以上的增长,并在 2021 年 1 月达到历史最高的 35.1%。根据中国国家统计局统计,2021年中国工业生产与前一年同期比较成长9.6%。

- 2022年中国原油产量约2.04亿吨。原油产量与前一年同期比较成长2.5%。

- 中国重点扩大这些都市区地区所需的基础设施,预计将对未来几年潜水泵的需求产生正面影响。预计潜水泵市场将受到石油和天然气、污水处理、采矿和建筑以及其他行业的成长所推动。

- 中国的工业活动正在成长,这推动了对原油、化学品和其他商品的需求。预计2019年至2025年间,中国将占亚太地区原油精製能力成长的大部分。预计到2025年,中国将占该地区精製能扩张总量的26.8%。这可能会增加该地区对潜水泵市场的需求。

- 中国的目标是提高页岩气等非传统资源的国内产量。预计到2035年,中国页岩气产量将达2,800亿立方公尺左右。因此,预计增加页岩气产量的计画将在未来几年创造机会。

- 2021 年 2 月,中国海洋石油总公司(中海油)宣布资本支出总额为 139.1 亿美元至 154.6 亿美元,目标产量为 5.45 亿至 5.55 亿桶油当量(Mboe)。

- 2021年3月,中石化宣布将投资92.8亿美元用于上游探勘,重点开发中国西南地区的页岩气和在沿海地区建造液化天然气(LNG)终端。

- 因此,基于这些发展,预计中国将在预测期内主导亚太潜水泵市场。

亚太潜水泵产业概况

亚太地区潜水泵市场规模减少了一半。市场的主要企业(不分先后顺序)包括斯伦贝谢有限公司、苏尔寿股份公司、福斯公司、阿特拉斯·科普柯公司和 Havells India 有限公司。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究范围

- 市场定义

- 调查前提

第 2 章执行摘要

第三章调查方法

第四章 市场概况

- 介绍

- 至2028年市场规模及需求预测(单位:美元)

- 最新趋势和发展

- 政府法规和政策

- 市场动态

- 驱动程式

- 限制因素

- 供应链分析

- 波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

第五章 市场区隔

- 类型

- 井深潜水泵

- 露天井潜水泵

- 无堵塞潜水泵

- 驱动器类型

- 追踪

- 电的

- 油压

- 其他的

- 头

- 少于50米

- 50~100 m

- 超过100米

- 最终用户

- 用水和污水

- 石油和天然气

- 采矿和建设业

- 其他的

- 地区

- 中国

- 印度

- 日本

- 韩国

- 其他亚太地区

第六章 竞争格局

- 併购、合资、合作与协议

- 主要企业策略

- 公司简介

- Baker Hughes Co.

- Schlumberger Limited

- Halliburton Co.

- Weir Group PLC

- Sulzer AG

- Flowserve Corporation

- Atlas Copco AB

- Crompton Greaves Consumer Electricals Limited

- Havells India Ltd.

- Falcon Pumps Pvt. Ltd.

- Shimge Pump Industry Group Co., Ltd.

第七章 市场机会与未来趋势

简介目录

Product Code: 5000238

The Asia Pacific Submersible Pump Market size is estimated at USD 6.02 billion in 2025, and is expected to reach USD 8.53 billion by 2030, at a CAGR of 7.2% during the forecast period (2025-2030).

Key Highlights

- Over the medium term, increasing investments in end-user industries are expected to drive the market's growth.

- On the other hand, high maintenance and operation costs and volatility in oil and gas prices are expected to hamper the Asia-Pacific submersible pump market growth during the forecast period.

- Nevertheless, retrofitting, upgrading aging, existing infrastructure, and new technology innovations will likely create lucrative growth opportunities for the Asia-Pacific submersible pump market in the forecast period.

- China dominates the market, and it is also likely to witness the highest CAGR during the forecast period. This growth is attributed to the increasing investments and supportive government policies in the end-user industries.

Asia Pacific Submersible Pump Market Trends

Oil and Gas Industry to Witness Significant Demand

- In the oil and gas upstream industry, submersible pumps are used to move spent drilling mud in and out of the reserve pits, maximizing oil and gas production through the artificial lift and treating the produced wastewater.

- The demand for submersible pumps has been volatile in the past few years, mainly due to the downturn in the industry. However, the recovery in crude oil price and the low breakeven price drive the production activity in the market during the forecast period.

- In the year 2022, China was the largest producer of natural gas in the Asia-Pacific region with a production of 7.99 exajoules. In the same year, Australia produced around 5.5 exajoules of natural gas, making it the second biggest producer in the region.

- The oil and gas industry in the Asia Pacific region has witnessed numerous developments, such as production efficiency improvements and new fields startup, the natural gas production increased by 1.6% in 2021 compared to the previous year. Also, unit operating costs are expected to decline in the coming years.

- In June 2021, CNOOC's deepwater gas field commenced production capacity of 10 million cubic meters daily. The gas field, also named Lingshui 17-2, sits 1,500 meters below the sea surface in the South China Sea. The field will be able to supply 3 billion cubic meters of gas a year, or roughly 1% of China's gas demand.

- In September 2021, CNOOC Limited announced the discovery of Kenli 10-2 oilfield in Bohai Bay. The Kenli 10-2 oilfield is located in Laizhou Bay Sag in Southern Bohai Bay, with an average water depth of about 50 feet.

- As of 2022, India has 77 active rigs. The country's oil production has been falling for almost a decade due to aging fields and the absence of major discoveries. Both state-owned and private players have been working on investment plans to raise recovery from older fields.

- Therefore, based on the factors and projects mentioned above, the oil and gas industry is expected to witness significant demand for the submersible pump market in the Asia Pacific over the forecast period.

China to Dominate the Market

- China has been an essential factor in the growth of the manufacturing sector worldwide. The country is the leader in the mining and construction industries and is a top oil and gas player. Despite the outbreak of COVID-19, the industrial sector in the country has been registering a growth of over 3% since April 2020, reaching an all-time high of 35.1% in January 2021. As per the National Bureau of Statistics of China, in 2021, China's industrial production increased by 9.6% compared to the previous year.

- In 2022, Crude oil production in China was approximately 204 million tons. Crude oil production has witnessed a 2.5% increase compared to the previous year.

- China is committed to expanding the infrastructure required for these urban and rural areas, which is expected to positively impact the demand for submersible pumps in the coming years. The submersible pump market is expected to be driven by growth in oil and gas, wastewater treatment, mining and construction, and other industries.

- China is witnessing an increase in industrial activities, thereby inducing growth in demand for crude oil and chemicals, among others. China is expected to account for significant crude oil refining capacity growth between 2019 and 2025 in Asia-Pacific (APAC). The country is expected to account for 26.8% of the total refining expansion capacity in the region by 2025. This will likely contribute to the region's market demand for submersible pumps.

- China targets to boost domestic production of unconventional sources like shale gas. It is also estimated that China's shale gas production may reach around 280 billion cubic meters (bcm) by 2035. Thus, the plans to boost its shale gas production are expected to create an opportunity in the coming years.

- In February 2021, CNOOC announced total capital expenditure in the range of USD 13.91 billion to USD 15.46 billion, with targeted net production of 545-555 million barrels of oil equivalent (Mboe).

- In March 2021, Sinopec announced to invest USD 9.28 billion in upstream exploration, focusing on shale gas development in southwest China and the construction of liquefied natural gas (LNG) terminals in coastal areas.

- Therefore, based on such developments, China is expected to dominate the Asia Pacific submersible pump market during the forecast period.

Asia Pacific Submersible Pump Industry Overview

The Asia-Pacific submersible pump market is semi-fragmented. Some of the major players in the market (in no particular order) include Schlumberger Limited, Sulzer AG, Flowserve Corporation, Atlas Copco AB, and Havells India Ltd.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Scope of the Study

- 1.2 Market Definition

- 1.3 Study Assumptions

2 EXECUTIVE SUMMARY

3 RESEARCH METHODOLOGY

4 MARKET OVERVIEW

- 4.1 Introduction

- 4.2 Market Size and Demand Forecast in USD, till 2028

- 4.3 Recent Trends and Developments

- 4.4 Government Policies and Regulations

- 4.5 Market Dynamics

- 4.5.1 Drivers

- 4.5.2 Restraints

- 4.6 Supply Chain Analysis

- 4.7 Porter's Five Forces Analysis

- 4.7.1 Bargaining Power of Suppliers

- 4.7.2 Bargaining Power of Consumers

- 4.7.3 Threat of New Entrants

- 4.7.4 Threat of Substitute Products and Services

- 4.7.5 Intensity of Competitive Rivalry

5 MARKET SEGMENTATION

- 5.1 Type

- 5.1.1 Borewell Submersible Pump

- 5.1.2 Openwell Submersible Pump

- 5.1.3 Non-clog Submersible Pump

- 5.2 Drive Type

- 5.2.1 Truck

- 5.2.2 Electric

- 5.2.3 Hydraulic

- 5.2.4 Other Drive Types

- 5.3 Head

- 5.3.1 Below 50 m

- 5.3.2 Between 50 m to 100 m

- 5.3.3 Above 100 m

- 5.4 End User

- 5.4.1 Water and Wastewater

- 5.4.2 Oil and Gas Industry

- 5.4.3 Mining and Construction Industry

- 5.4.4 Other End Users

- 5.5 Geography

- 5.5.1 China

- 5.5.2 India

- 5.5.3 Japan

- 5.5.4 South Korea

- 5.5.5 Rest of Asia-Pacific

6 COMPETITIVE LANDSCAPE

- 6.1 Mergers and Acquisitions, Joint Ventures, Collaborations, and Agreements

- 6.2 Strategies Adopted by Leading Players

- 6.3 Company Profiles

- 6.3.1 Baker Hughes Co.

- 6.3.2 Schlumberger Limited

- 6.3.3 Halliburton Co.

- 6.3.4 Weir Group PLC

- 6.3.5 Sulzer AG

- 6.3.6 Flowserve Corporation

- 6.3.7 Atlas Copco AB

- 6.3.8 Crompton Greaves Consumer Electricals Limited

- 6.3.9 Havells India Ltd.

- 6.3.10 Falcon Pumps Pvt. Ltd.

- 6.3.11 Shimge Pump Industry Group Co., Ltd.

7 MARKET OPPORTUNITIES AND FUTURE TRENDS

02-2729-4219

+886-2-2729-4219