|

市场调查报告书

商品编码

1645033

德国医药仓储:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Germany Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

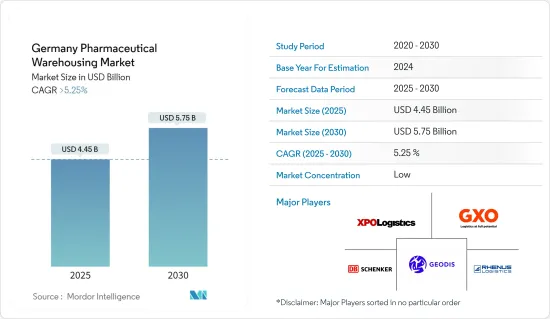

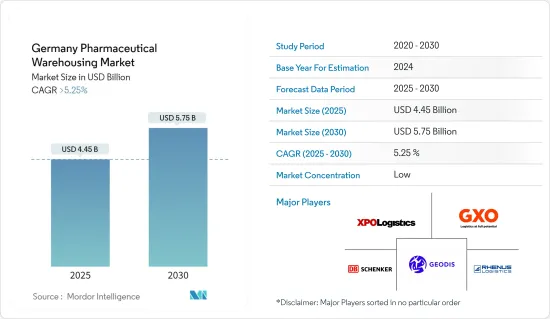

德国医药仓储市场规模在 2025 年估计为 44.5 亿美元,预计到 2030 年将达到 57.5 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5.25%。

德国医药仓储产业在该国医药物流网路中发挥着至关重要的作用。特别是疫苗和生技药品等温度敏感物品的专用仓库的需求激增。 2024年,低温运输市场预计将快速扩张,与前一年同期比较成长率接近6%。根据德国贸易投资署 (GTAI) 的报告,这一增长将包括温控储存和冷藏运输网路等设施。这一增长得益于德国强大的物流基础设施,该基础设施满足国内和国际需求,特别是满足欧盟严格的 GDP 标准所需的设施。

自动化和人工智慧等技术进步正在改变德国的药品储存。机器人和自动化系统的整合不仅使业务更加高效,而且更具成本效益。根据德国物流协会的报告,药品需求的不断增长预计将导致从 2024 年起药品仓库的自动化采用率每年增加 15%。此外,人们正在进行大量投资来提高仓储业务的速度和一致性,主要物流中心正在利用尖端技术为该行业提供更好的服务。

德国医药仓储的监管状况是市场扩张的重要催化剂。政府执行严格的标准,如德国药品法 (Arzneimittelgesetz) 和 GDP 等欧盟法规所规定。这些规定强调药品安全、严密的温度控制和强大的可追溯性。遵守低温运输已成为一项重大挑战,特别是因为预计到 2024 年,对温度敏感的药品将占仓库总容量的 20% 以上。由于对疫苗和生技药品温度控制的要求越来越严格,对此类专业设施的需求预计每年将增加 8%。

德国医药仓储市场趋势

医药仓库采用自动化和人工智慧

医药仓储产业正在经历自动化和人工智慧的采用激增,成为该行业的一个突出趋势。同时,医药供应链日益复杂,对高效能精准营运的需求不断增加,促使德国物流企业大力投资机器人和人工智慧技术。这些进步不仅降低了人事费用,而且还增强了库存管理、订单履行和法规合规性。

现在,许多大型医药仓库使用 AGV 和机械臂进行分类和挑选任务,从而缩短週转时间并提高订单准确性。许多德国领先的医药物流公司已承诺投资旨在优化其仓库的人工智慧系统,特别注重库存追踪和预测性维护。

在德国的医药仓储领域,人工智慧近年来一直在重塑业务。 2024 年 1 月:勃林格殷格翰正在使用机器学习演算法来预测需求、简化库存管理并减少浪费,尤其是对温度敏感的药物。同样,2024 年初,默克公司采用了人工智慧主导的预测分析,透过提供即时库存监控和储存预测来确保遵守药品法规并降低营运费用。这些发展凸显了人工智慧在提高德国医药供应链效率和确保法规遵循方面日益重要的作用。

严格的监管要求,尤其是对疫苗和生技药品等温度敏感产品的要求,是自动化的主要驱动力。人工智慧和自动化透过精确控制储存条件以及即时监控温度和湿度等环境因素,在确保合规性方面发挥关键作用。此外,透过最大限度地减少人为错误,这些技术确保了药品的正确处理和运输。据业内人士透露,由于德国企业越来越多地采用这些先进技术,自动化药品仓库每年的扩张速度达到 15%。随着对高效业务的需求不断增加,预计这一趋势将会持续下去。

药品低温运输物流的成长

低温运输物流正成为德国医药仓储领域的关键趋势。生技药品、疫苗和其他对温度敏感的药物的需求激增,凸显了对专门仓储设施的迫切需求。到2024年,低温运输仓储将占德国医药仓库总容量的20%以上,而该产业正快速成长。这种快速增长的关键驱动因素是疫苗和生技药品数量的增加,这两者都需要严格的温度控制。有些疫苗需要在极低的温度下储存,低至-80°C,但大多数生技药品都保存在2至8°C之间。

这一趋势不仅将持续到 2024 年,而且还将因新生技药品和更多温度敏感产品的推出而得到加强。低温运输物流的扩张受到现行监理环境的极大影响。例如,欧盟的《良好分销规范》和德国的《药品法》要求製药公司确保温度敏感货物的安全储存和运输。

2023年下半年,Kuhne+Nagel将在法兰克福开设新的温控仓库,增强其在德国的低温运输物流能力。该设施将满足对温度敏感药物(特别是疫苗和生技药品)日益增长的需求。此次扩建符合德国对欧盟良好分销规范(GDP)指南的承诺,并确保了这些必需产品的安全储存和运输。这项倡议凸显了德国对加强其在医药物流领域专业知识的重视。

为了满足严格的标准,德国医药仓库营运商正在投资具有即时温度监控和资料记录功能的先进低温运输设施。物流公司正在增加冷藏能力以满足日益增长的需求。

德国医药仓储产业概况

德国的医药仓储市场是一个分散的市场,由全球公司和本地公司混合组成。大部分进出口产品在冷藏运送过程中都需要监控。供应商正在实施各种策略来扩大其市场影响力,包括策略联盟、伙伴关係、併购、地理扩张和产品/服务发布。主要参与者包括 XPO Logistics Inc.、CDS Hackner GmbH、GXO Logistics 和 Wagner Group GmbH。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 製药业越来越重视品质和产品敏感性

- 仓库自动化提高效率和准确性

- 市场限制

- 缺乏高效率的物流支持

- 技术纯熟劳工短缺

- 市场机会

- 政府措施加强药品仓库建设

- 加强医药创新与发展

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 地缘政治与疫情将如何影响市场

第五章 市场区隔

- 按类型

- 低温运输仓库

- 非低温运输仓库

- 按应用

- 药厂

- 药局

- 医院

- 其他的

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Nippon Express

- Bio Pharma Logistics

- Rhenus SE and Co. KG

- ADAllen Pharma

- DB Schenker

- FedEx Corp.

- GEODIS SA

- CEVA Logistics

- Hellmann Worldwide Logistics SE and Co KG

- CDS Hackner GmbH

- Pfenning Logistics

- GXO Logistics

- Wagner Group GmbH

- Kuehne Nagel Management AG

- United Parcel Service Inc.

- XPO Logistics Inc.

- 其他公司

第七章:市场的未来

第 8 章 附录

- 宏观经济指标(GDP分布,依活动划分)

- 经济统计 - 运输及仓储业对经济的贡献

- 对外贸易统计 - 按商品、目的地和原产国分類的进出口数据

The Germany Pharmaceutical Warehousing Market size is estimated at USD 4.45 billion in 2025, and is expected to reach USD 5.75 billion by 2030, at a CAGR of greater than 5.25% during the forecast period (2025-2030).

Germany's pharmaceutical warehousing industry plays a pivotal role in the nation's pharmaceutical logistics network. The demand for specialized warehouses, particularly for temperature-sensitive items like vaccines and biologics, has surged. In 2024, the cold chain market is expanding swiftly, with an average year-on-year growth rate nearing 6%. This growth encompasses facilities like temperature-controlled storage units and refrigerated transportation networks, as highlighted in a report by Germany Trade & Invest (GTAI). This growth is bolstered by Germany's robust logistics infrastructure, which caters to both domestic and international demands, especially with facilities meeting stringent EU GDP standards.

Technological advancements, including automation and artificial intelligence, are transforming pharmaceutical storage in Germany. The integration of robotics and automated systems not only boosts operational efficiency but also enhances cost-effectiveness. The German Logistics Association reports that, in response to increasing demand for medicines, pharmaceutical warehouses are projected to see a 15% annual rise in automation adoption, beginning in 2024. Furthermore, significant investments are being channeled to enhance the speed and consistency of warehouse operations, with major logistics centers leveraging state-of-the-art technologies to better cater to the sector.

Germany's regulatory landscape for pharmaceutical warehousing is a crucial catalyst for market expansion. The government enforces stringent standards, as delineated in the German Medicines Act (Arzneimittelgesetz) and EU regulations like GDP. These regulations emphasize the safety of pharmaceutical products, meticulous temperature control, and robust traceability. Cold chain compliance poses a significant challenge, especially with temperature-sensitive pharmaceuticals projected to occupy over 20% of total warehouse capacity by 2024. Given the heightened temperature control mandates for vaccines and biologics, the demand for such specialized facilities is anticipated to grow by 8% annually.

Germany Pharmaceutical Warehousing Market Trends

Adoption of Automation and AI in Pharmaceutical Warehousing

The pharmaceutical warehouse sector witnessed a significant surge in the adoption of automation and AI, marking it as a prominent trend in the industry. At the same time, the rising intricacies of pharmaceutical supply chains, coupled with a heightened demand for efficient and precise operations, are prompting German logistics firms to invest heavily in robotics and AI technologies. These advancements not only curtail labor costs but also enhance stock management, order fulfillment, and adherence to regulations.

Many leading pharmaceutical warehouses now utilize AGVs and robotic arms for sorting and picking tasks, leading to quicker turnaround times and heightened order accuracy. Numerous major pharmaceutical logistics firms in Germany have pledged investments in AI systems aimed at warehouse optimization, particularly emphasizing inventory tracking and predictive maintenance.

In Germany's pharmaceutical warehousing sector, AI has been reshaping operations in recent years. In January 2024, Boehringer Ingelheim harnessed machine learning algorithms to forecast demand, streamline inventory management, and curtail wastage, especially for temperature-sensitive medications. Likewise, in early 2024, Merck KGaA employed AI-driven predictive analytics for immediate stock oversight and storage predictions, guaranteeing adherence to pharmaceutical regulations and cutting down operational expenses. These developments highlight AI's expanding influence in boosting efficiency and ensuring regulatory compliance in Germany's pharmaceutical supply chain.

Stringent regulatory requirements, especially concerning temperature-sensitive products like vaccines and biologics, significantly drive the push for automation. AI and automation play a pivotal role in ensuring compliance by providing precise control over storage conditions and real-time monitoring of environmental factors such as temperature and humidity. Moreover, by minimizing human error, these technologies ensure the proper handling and transportation of medications. Industry sources indicate that automated pharmaceutical warehouses are expanding at an annual rate of 15%, driven by the increasing adoption of these advanced technologies by German firms. Given the escalating demand for high-efficiency operations, this trend is expected to persist.

Growth in Cold Chain Logistics for Pharmaceuticals

Cold chain logistics emerges as a pivotal trend in Germany's pharmaceutical storage landscape. The surging demand for biologic pharmaceuticals, vaccines, and other temperature-sensitive medications underscores the urgent need for specialized cold storage facilities. By 2024, cold chain storage has claimed over 20% of Germany's total pharmaceutical warehouse capacity, with the sector witnessing rapid growth. This surge is predominantly fueled by the increasing volume of vaccines and biologics, both of which demand stringent temperature controls. While certain vaccines necessitate storage at a frigid -80°C, the majority of biologics are maintained within a 2 to 8°C range.

The urgency for these facilities was amplified by the pressing demands of COVID-19 vaccine distribution, a trend that has not only persisted into 2024 but has also been bolstered by the introduction of new biologics and even more temperature-sensitive products. The expansion of cold chain logistics is heavily influenced by the prevailing regulatory landscape. For instance, both the European Union's Good Distribution Practice standards and Germany's Arzneimittelgesetz mandate that pharmaceutical companies ensure the safe storage and transport of temperature-sensitive goods.

In late 2023, Kuehne + Nagel strengthened its cold chain logistics capabilities in Germany by opening a new temperature-controlled warehouse in Frankfurt. This facility addresses the rising demand for temperature-sensitive pharmaceuticals, notably vaccines and biologics. The expansion aligns with Germany's commitment to the EU Good Distribution Practice (GDP) guidelines, ensuring the secure storage and transportation of these essential products. This initiative highlights Germany's focus on bolstering its pharmaceutical logistics expertise.

German pharmaceutical warehouse providers are investing in advanced cold chain facilities with real-time temperature monitoring and data recording to meet stringent standards. Logistics companies are increasing cold storage capacities to meet rising demand.

Germany Pharmaceutical Warehousing Industry Overview

The Germany Pharmaceutical Warehousing market is fragmented in nature, with a mix of global and local players. Most of the imports and exports products need to be monitored in refrigerated transports. Vendors are implementing various strategies, such as strategic alliances, partnerships, mergers and acquisitions, geographical expansion, and product/service launches, to enhance their presence in the market. Major players include XPO Logistics Inc., CDS Hackner GmbH, GXO Logistics, and Wagner Group GmbH.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Increased focus on quality and product sensitivity in the pharma industry

- 4.2.2 Automation at warehouses to increase efficiency and accuracy

- 4.3 Market Restraints

- 4.3.1 Lack of efficient logistics support

- 4.3.2 Shortage of skilled labor

- 4.4 Market Opportunities

- 4.4.1 Rise in government initiatives to enhance Pharmaceutical Warehousing

- 4.4.2 Increasing Pharmaceutical product innovation and Development

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Type

- 5.1.1 Cold Chain Warehouse

- 5.1.2 Non-Cold Chain Warehouse

- 5.2 By Application

- 5.2.1 Pharmaceutical Factory

- 5.2.2 Pharmacy

- 5.2.3 Hospital

- 5.2.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Nippon Express

- 6.2.2 Bio Pharma Logistics

- 6.2.3 Rhenus SE and Co. KG

- 6.2.4 ADAllen Pharma

- 6.2.5 DB Schenker

- 6.2.6 FedEx Corp.

- 6.2.7 GEODIS SA

- 6.2.8 CEVA Logistics

- 6.2.9 Hellmann Worldwide Logistics SE and Co KG

- 6.2.10 CDS Hackner GmbH

- 6.2.11 Pfenning Logistics

- 6.2.12 GXO Logistics

- 6.2.13 Wagner Group GmbH

- 6.2.14 Kuehne Nagel Management AG

- 6.2.15 United Parcel Service Inc.

- 6.2.16 XPO Logistics Inc.*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, by Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 External Trade Statistics - Exports and Imports by Product and by Country of Destination/Origin