|

市场调查报告书

商品编码

1645034

美国药品仓储:市场占有率分析、行业趋势、统计数据和成长预测(2025-2030 年)US Pharmaceutical Warehousing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

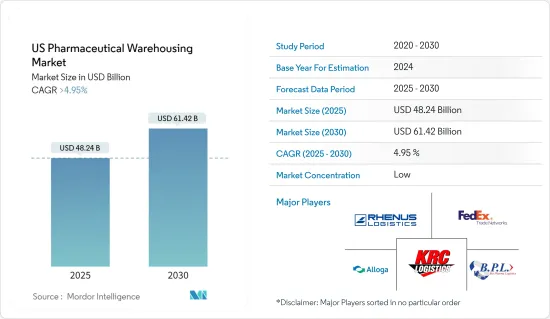

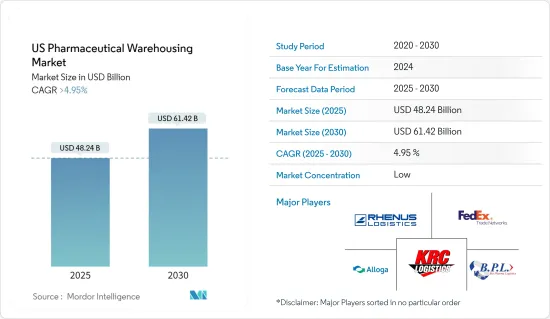

美国医药仓储市场规模预计在 2025 年为 482.4 亿美元,预计到 2030 年将达到 614.2 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 4.95%。

美国製药业以开发突破性药物而闻名,在推动医疗保健产业成长方面发挥关键作用。然而,许多高成本药物的推出导致医疗成本上升,影响私人组织和联邦政府。

作为回应,政策制定者正在积极寻求控制药品价格和减少联邦药品支出的策略。此类支出涵盖一系列活动,从新药研发和测试到产品扩展、安全性和启动临床试验等渐进式创新。

在强大的专科药物管道和越来越多的品牌製造商的支持下,到 2023 年美国医药市场将成长 7.8%,达到 2,325 家公司。

FDA 在 2023 年核准了55 种新药,预示着核准的復苏。这一增长与一些公司在专利到期前为增强其投资组合而进行的策略性收购相吻合。全球疫苗接种运动和持续的治疗需求支撑了该行业强劲的生产和销售。

到 2028 年,药品净支出预计将比 2023 年的水准激增 1,270 亿美元,这主要得益于产量成长。虽然采用技术创新将成为关键驱动力,但它也会受到通常导致价格下降的因素(例如专利到期和立法影响)的限制。

随着加速创新和药物引进的压力越来越大,製药公司正在利用新的机会。科学突破正在推动製造业新一轮创新浪潮,而美国食品药物管理局(FDA)务实的监管立场则加速了这一进程。这次合作加速了救命药物和疗法进入市场。

由于对高效储存和配送解决方案的需求不断增加,美国医药仓储市场也正在经历显着成长。随着製药业的扩张,对确保药品安全合规储存的先进仓储设施的需求变得至关重要。

这些设施配备了最尖端科技,以保持药品处于最佳状态,从而支援整个行业供应链。预计市场将继续保持上升趋势,与製药行业的整体成长趋势保持一致。

美国医药仓储市场趋势

受控物流包装的兴起

由于对温度敏感的药品和疫苗的重要性日益增加,製药公司、医疗机构和物流供应商越来越重视低温运输物流包装。生技药品和某些疫苗的有效性取决于精确温度下的储存和运输。转向受控物流包装对于避免产品劣化至关重要,巩固低温运输包装作为製药行业的重要组成部分的地位。

网路药品订购系统的普及进一步刺激了低温运输物流包装的扩张。随着越来越多的消费者和医疗保健提供者转向线上平台和直接面向患者的运输,对高效温控包装解决方案的需求日益增长。利用低温运输物流进行安全可靠的运送,使供应商能够接触到更广泛的市场,同时保护医药产品的完整性。

2023年11月,Cryopak Eco GelTM推出了低温运输物流领域的突破性解决方案,为传统冷媒提供了一种永续的、环保的替代品。白皮书深入探讨了该产品的显着属性,包括 FDA核准、生物分解性和可回收性,强调了其在不同行业中推动永续实践的潜力。

因此,美国医药仓储市场对受控物流包装的需求正在显着增加。此举体现了业界对维持产品功效和满足对温度敏感药物和疫苗日益增长的需求的承诺。 Cryopak Eco GelTM 等先进低温运输解决方案的采用进一步推动了这一成长,凸显了市场向更永续、更可靠的包装实践的转变。

医院和诊所发展加快

美国拥有约 6,120 家医院,包括学术医疗中心和教学医院,拥有各种各样的非联邦短期医疗设施。这些医院在美国各地的药品消费中发挥着至关重要的作用。美国有 6,200 多所医院和 400 个医疗系统发挥至关重要的作用,并对医疗保健的提供产生了重大影响。

作为急性和专科护理的主要提供者,这些组织决定了药品采购和使用的趋势。医疗机构的强烈需求表明医疗保健领域将继续进行合作和策略性倡议,以改善患者治疗效果并简化业务。

在美国,有 31,748 家诊所提供医疗保健框架,包括医疗、心理健康和妇女服务。这些诊所不仅提供全面的医疗服务,也加强了该国对优质医疗保健的奉献精神。

德克萨斯州拥有 4,661 家诊所,凸显了其强大的医疗保健基础设施。包括华盛顿州、密苏里州和明尼苏达州在内的其他州也强调了满足居民医疗需求的承诺。此次扩建凸显了日益增长的医疗服务需求以及该诊所在整个医疗保健体系中的战略重要性。

美国医院和诊所数量的不断增加对医药仓储市场产生了重大影响。随着这些医疗设施的扩大,对高效能药品储存和分销解决方案的需求也日益增长。

这项发展凸显了医药仓库在支持医疗保健基础设施、确保及时安全地运送药品以满足全国各地医院和诊所日益增长的需求方面的重要作用。

美国药品仓储产业概况

美国药品仓储市场竞争激烈,既有多家大型企业,也有中小型公司。一些主要参与者将透过扩大其地理影响力、增强其服务产品以及投资新技术和自动化来保持相关性。

主要参与者包括 Alloga、BioPharma Logisics、Rhenus SE and Co.KG、ADAllen Pharma、WH BOWKER LTD、Pulleyn Transport Ltd、TIBA、Schenker AG、CEVA Logistics 和 DACHSER Group SE and Co.KG。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查结果

- 调查前提

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 製药业的成长

- 温控储存需求不断成长

- 市场限制

- FDA 对药品仓库的严格规定

- 市场机会

- 政府推出新措施加强医药仓库

- 电子商务日益普及

- 价值链/供应链分析

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 地缘政治与疫情将如何影响市场

第五章 市场区隔

- 按服务类型

- 贮存

- 分配

- 库存管理

- 包装

- 其他的

- 按模式

- 低温运输仓库

- 非低温运输仓库

- 按最终用户

- 製药公司

- 医院和诊所

- 研究和政府组织

- 其他的

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Alloga

- Bio Pharma Logistics

- Rhenus SE and Co. KG

- ADAllen Pharma

- DB Schenker

- FedEx Corp.

- GEODIS SA

- CEVA Logistics

- Hellmann Worldwide Logistics SE and Co KG

- KRC Logistics

- Kuehne Nagel Management AG

- United Parcel Service Inc.

- XPO Logistics Inc.*

- 其他公司

第七章:市场的未来

第 8 章 附录

- 宏观经济指标(GDP分布,依活动划分)

- 经济统计 - 运输及仓储业对经济的贡献

- 相关药品进出口统计

The US Pharmaceutical Warehousing Market size is estimated at USD 48.24 billion in 2025, and is expected to reach USD 61.42 billion by 2030, at a CAGR of greater than 4.95% during the forecast period (2025-2030).

The U.S. pharmaceutical industry, celebrated for its groundbreaking drug developments, plays a pivotal role in propelling the healthcare sector's growth. However, the introduction of many high-priced medications has led to surging healthcare costs, impacting both private entities and the federal government.

In response, policymakers are actively seeking strategies to curtail drug prices and diminish federal drug-related expenditures. These expenditures span a spectrum of activities, from the discovery and testing of novel drugs to incremental innovations like product extensions and clinical testing for safety and marketing.

Bolstered by a strong pipeline of specialty drugs and a rising count of brand-name manufacturers, the U.S. pharmaceutical market witnessed a 7.8% growth, reaching 2,325 businesses in 2023.

The FDA granted approvals to 55 new drugs in 2023, signaling a resurgence in approvals. This uptick coincides with strategic acquisitions by companies aiming to bolster their portfolios in anticipation of patent expirations. The sector's robust output and sales are buoyed by a global vaccination drive and a consistent demand for medical treatments.

By 2028, net spending on medicines is projected to surge by USD 127 billion from 2023 levels, driven primarily by volume growth. While the adoption of innovations will be a key growth driver, it will be tempered by factors like patent expirations and legislative impacts, which typically lead to lower prices.

Amidst pressures to hasten innovation and drug introductions, pharmaceutical manufacturers are capitalizing on emerging opportunities. Scientific breakthroughs are ushering in a fresh wave of innovations in manufacturing, a momentum further bolstered by the U.S. Food and Drug Administration's (FDA) pragmatic regulatory stance. This collaboration is expediting the market entry of lifesaving medicines and therapeutics.

The United States pharmaceutical warehousing market is also experiencing significant growth, driven by the increasing demand for efficient storage and distribution solutions. As the pharmaceutical industry expands, the need for advanced warehousing facilities that ensure the safe and compliant storage of drugs becomes paramount.

These facilities are equipped with state-of-the-art technology to maintain optimal conditions for pharmaceuticals, thereby supporting the industry's overall supply chain. The market is expected to continue its upward trajectory, aligning with the broader growth trends in the pharmaceutical sector.

US Pharmaceutical Warehousing Market Trends

Increase in Controlled Logistics Packaging

Pharmaceutical companies, healthcare facilities, and logistics providers are increasingly prioritizing cold chain logistics packaging due to a heightened emphasis on temperature-sensitive medications and vaccines. The efficacy of biologics and certain vaccines hinges on their storage and transportation at precise temperatures. This pivot towards controlled logistics packaging is vital to avert product degradation, solidifying cold chain packaging as an essential component of the pharmaceutical industry.

The surge in online medication ordering systems has further fueled the expansion of cold chain logistics packaging. With a growing number of consumers and healthcare providers turning to online platforms and direct-to-patient deliveries, the need for efficient temperature-controlled packaging solutions has escalated. By leveraging cold chain logistics for safe and reliable deliveries, providers can tap into a wider market while safeguarding the integrity of pharmaceutical products.

In November 2023, Cryopak Eco GelTM introduced a groundbreaking solution in cold chain logistics, presenting a sustainable and eco-friendly alternative to conventional refrigerants. This white paper delves into the product's standout attributes, including FDA approval, biodegradability, and recyclability, and underscores its potential to propel sustainable practices across diverse industries.

As a result, the United States pharmaceutical warehousing market has seen a significant increase in controlled logistics packaging. This trend reflects the industry's commitment to maintaining product efficacy and meeting the growing demand for temperature-sensitive medications and vaccines. The adoption of advanced cold chain solutions like Cryopak Eco GelTM further supports this growth, highlighting the market's shift towards more sustainable and reliable packaging methods.

The Rise in Development of Hospitals and Clinics

With around 6,120 hospitals, including academic medical centers and teaching hospitals, the U.S. boasts a diverse array of nonfederal, short-term facilities. These hospitals play a pivotal role in the nation's pharmaceutical consumption. Over 6,200 hospitals and 400 health systems across the country are key players, significantly influencing healthcare delivery.

As primary providers of acute and specialized care, these institutions shape trends in pharmaceutical procurement and usage. Their strong demand signals ongoing collaborations and strategic moves within the healthcare sector, all aimed at boosting patient outcomes and streamlining operations.

In the U.S., 31,748 clinics, spanning medical, mental health, and women's health services, are integral to the healthcare framework. These clinics not only deliver comprehensive medical care but also reinforce the nation's dedication to healthcare excellence.

Texas tops the list with 4,661 clinics, highlighting its robust healthcare infrastructure, while California closely follows with 4,584. Other states like Washington, Missouri, and Minnesota also stand out, emphasizing their commitment to meeting the healthcare needs of their residents. This expansion underscores the rising demand for medical services and the strategic significance of clinics in the broader healthcare delivery system.

The rise in the development of hospitals and clinics in the United States has significantly impacted the pharmaceutical warehousing market. As these healthcare facilities expand, the demand for efficient pharmaceutical storage and distribution solutions has grown.

This trend highlights the critical role of pharmaceutical warehousing in supporting the healthcare infrastructure, ensuring timely and safe delivery of medications to meet the increasing needs of hospitals and clinics nationwide.

US Pharmaceutical Warehousing Industry Overview

The United States Pharmaceutical Warehousing Market is a highly competitive market with the presence of several large players as well as small and medium-sized companies. Some of the key players are focusing on expanding their geographic presence, enhancing their service offerings, and investing in new technologies and automation to remain in the market.

Some of the major players are Alloga, BioPharma Logisics, Rhenus SE and Co. KG, ADAllen Pharma, WH BOWKER LTD, Pulleyn Transport Ltd, TIBA, Schenker AG, CEVA Logistics and DACHSER Group SE and Co. KG.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Deliverables

- 1.2 Study Assumptions

- 1.3 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS AND DYNAMICS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Growth of the pharmaceutical industry

- 4.2.2 Increasing demand for temperature-controlled storage

- 4.3 Market Restraints

- 4.3.1 Stringent FDA rules & regulations towards Pharmaceutical Warehousing

- 4.4 Market Opportunities

- 4.4.1 Rise in government initiatives to enhance Pharmaceutical Warehousing

- 4.4.2 Growing popularity of e-commerce

- 4.5 Value Chain / Supply Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Bargaining Power of Suppliers

- 4.6.2 Bargaining Power of Buyers/Consumers

- 4.6.3 Threat of New Entrants

- 4.6.4 Threat of Substitute Products

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Impact of Geopolitics and Pandemic on the Market

5 MARKET SEGMENTATION

- 5.1 By Service Type

- 5.1.1 Storage

- 5.1.2 Distribution

- 5.1.3 Inventory Management

- 5.1.4 Packaging

- 5.1.5 Others

- 5.2 By Mode

- 5.2.1 Cold Chain Warehouse

- 5.2.2 Non-Cold Chain Warehouse

- 5.3 By End User

- 5.3.1 Pharmaceutical Companies

- 5.3.2 Hospital and Clinics

- 5.3.3 Research Institiutes and Government Agencies

- 5.3.4 Others

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Alloga

- 6.2.2 Bio Pharma Logistics

- 6.2.3 Rhenus SE and Co. KG

- 6.2.4 ADAllen Pharma

- 6.2.5 DB Schenker

- 6.2.6 FedEx Corp.

- 6.2.7 GEODIS SA

- 6.2.8 CEVA Logistics

- 6.2.9 Hellmann Worldwide Logistics SE and Co KG

- 6.2.10 KRC Logistics

- 6.2.11 Kuehne Nagel Management AG

- 6.2.12 United Parcel Service Inc.

- 6.2.13 XPO Logistics Inc.*

- 6.3 Other Companies

7 FUTURE OF THE MARKET

8 APPENDIX

- 8.1 Macroeconomic Indicators (GDP Distribution, By Activity)

- 8.2 Economic Statistics - Transport and Storage Sector Contribution to Economy

- 8.3 Export and Import Statistics of Related Pharmaceutical Products