|

市场调查报告书

商品编码

1645036

新加坡化学物流:市场占有率分析、产业趋势与统计、成长预测(2025-2030 年)Singapore Chemical Logistics - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

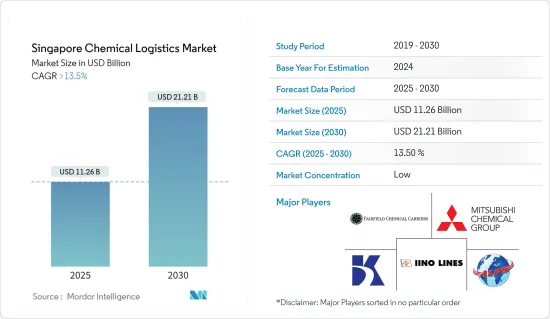

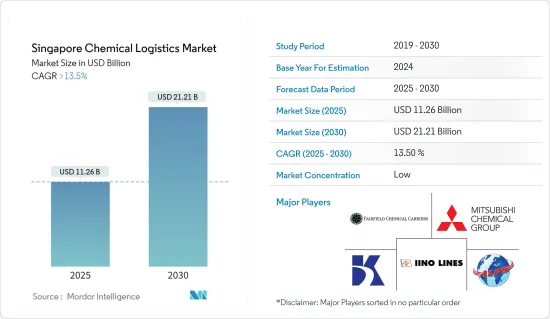

新加坡化学品物流市场规模预计在 2025 年为 112.6 亿美元,预计到 2030 年将达到 212.1 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 13.5%。

主要亮点

- 新加坡是世界领先的能源和化学中心,拥有强大的精製、烯烃生产、化学品製造、商业和创新能力。它是100多家国际化学公司的主要基地。裕廊岛是新加坡石化、特种化学品和精製业务的主要枢纽。客户和供应商透过高度整合的基础设施紧密联繫在一起,这些基础设施实际上是透过栅栏传输的。这个综合生态系统还包括公共事业和物流服务供应商,将为企业产生节省成本的生产协同效应。裕廊岛累计投资额已超过372.7亿美元。随着全球工业朝向定製配方和环保配方发展,新加坡被定位为永续、高效的化学品製造中心。

- 建造新的化学品仓库或仓储设施是一项资本密集型工程,需要遵守各种标准和批准。此外,仓库需要大量的营运和维修成本。对仓储解决方案日益增长的需求吸引了对该领域的各种投资。然而,有效率、有效地管理仓库是一项关键义务。实用有效的仓储和仓储设施所需的一些基本要素是适当的财务模型、需求图和基础设施评估。製造和建立仓库所涉及的现金是不可逆的,因此偿还投资所需的时间很长。因此,预计建立和营运仓库以及管理库存损失的高成本将限制预测期内的市场成长。

- 儘管新加坡远离欧洲金融危机,但其化学工业却直接受到世界事件的影响。它与石油和天然气行业的密切联繫使其受到原材料价格、贸易紧张局势和消费者行为变化的影响。儘管遭遇疫情,或者可能正因为疫情,GBR 今年采访的几乎所有公司都报告了 2022 年第一季的稳健成长,并在 2021 年创下了创纪录的成长。但未来并不确定,取决于化学公司如何将成本转嫁至价值链的下一个环节,并最终转嫁给客户。

- 与大宗化学品相比,高性能化学品更能转嫁成本并产生更高的利润,而大宗化学品更直接受到原料和能源价格上涨的影响。原料短缺,加上持续的物流限制,给特种化学品行业的公司带来了严重的问题,导致订单延迟和某些产品的长期积压。新加坡产业正受到当前市场因素以及亚太地区非常有利的人口基本面的影响。该行业高度重视营养问题,使新加坡成为应对粮食安全和粮食永续性挑战的中心。

新加坡化学品物流市场趋势

化学品产量上升推动市场

- 週三公布的政府统计数据显示,由于特种化学品和石化行业产量下降,新加坡 3 月份化学品整体产量较去年同期下降 11.8%。经济发展局(EDB)在声明中表示,2023 年 3 月石化产量与去年同期相比下降了 20.3%,原因是「市场需求疲软和工厂维护中断」。由于矿物油和食品添加剂产量下降,当月特种产业产量下降了 6.5%。与 2022 年同期相比,2023 年 1 月至 3 月包括石油在内的化学丛集总产量年减 13.1%。新加坡2023年2月整体工业生产年减9.7%,但2023年3月下降4.2%,降幅较小。

- 新加坡的化学工业与食品、可再生能源和专用生物基材料等其他产业越来越难以区分。最大的化学和石油公司也是氢等新能源的最大投资者,他们的研究实验室正在开发碳捕获和封存以及先进分子回收的尖端创新。人们、工程师、化学家、工人和管理人员在不同行业之间的流动比以往任何时候都更加自由,而生物聚合物、生物表面活性剂和生质燃料竞争与食品成分相同的原材料。它们透过与食品原料相同的数位管道进行商业化。化学工业的命运与石油和天然气产业密不可分。

- 天然气衰退引发的能源危机提醒人们,一个乐意承诺摆脱石化燃料的社会还没准备好摆脱碳源。通货膨胀持续的事实表明,汽油价格(甚至更少的供应量)对全球经济的影响有多密切。持续上升的通膨压力,以及各国央行大幅收紧货币政策,导致已开发经济体的情况愈发复杂。由于持续的景气衰退和持续的高通膨,包括汽车和建筑业在内的消费品和关键客户行业对化学品的需求可能会大幅下降。

物流服务与基础建设投资推动市场

- 由于设备采用率的不断提高,未来几年新加坡电子商务市场每笔交易的平均订单价值可能会上升。随着技术的进步,供应链的透明度、安全性和成本效益可望提高。此外,多式联运、物流园区和港口等物流基础设施的发展可能会在未来几年创造机会。食品和大宗商品原料进出口的增加是刺激新加坡第三方物流市场扩张的主要原因。国际航运商会估计,每年透过船舶运输的货物约为110亿吨。由于全球化,世界贸易大幅成长。机械和运输设备以及石油是新加坡的主要进口产品,而精炼石油产品是其最大的出口产品。中国、美国、印尼、马来西亚和日本是其最重要的贸易伙伴。

- 市场的波动使製造商难以掌控其供应业务。这就是第三方物流变得越来越重要的原因。此外,国际市场的成长可能进一步帮助该行业。随着企业越来越多地将第三方物流视为进出口商品的经济高效的选择,预计第三方物流利用市场将在预测期内显着增长。由于持续的劳动力短缺和供应链问题,第三方物流公司正在采用自动化和机器人技术来简化整个生命週期的业务。同时,资料主导的订购、仓储和运输技术也被用于增强消费者、品牌和物流服务提供者之间的可见性和沟通。因此,随着物流的应用日益广泛,新加坡的第三方物流市场预计将显着成长。

新加坡化工物流行业概况

新加坡的化学品物流市场高度分散,拥有大量本地、地区和全球参与者。主要参与者包括 ALPS Global Logistics、Koyo Kaiun、Iino Singapore Pte Ltd、Fairfield Chemical Carriers 和 MCL Logistics Asia Pte Ltd。近年来,该行业出现了许多创新和数位化趋势,例如巨量资料分析和物联网技术的采用,这些趋势进一步推动了化学物流行业的成长。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 调查前提条件

- 研究范围

第二章调查方法

- 分析方法

- 研究阶段

第三章执行摘要

第四章 市场动态

- 当前市场状况

- 市场概况

- 市场动态

- 驱动程式

- 石化产品需求不断成长推动市场

- 投资增加推动市场

- 限制因素

- 营运成本高

- 机会

- 技术创新

- 驱动程式

- 价值链/供应链分析

- 波特五力分析

- 供应商的议价能力

- 购买者/消费者的议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争强度

- 产业创新

- 政府吸引产业投资的倡议

- 3PL 市场洞察(市场规模和预测)

- COVID-19 对产业的影响

第五章 市场区隔

- 按服务

- 运输

- 仓储、配送和库存管理

- 其他服务

- 交通方式

- 路

- 铁路

- 航空

- 水路

- 其他交通方式

- 按最终用户

- 药品

- 化妆品

- 石油和天然气

- 特种化学品

- 其他最终用户

第六章 竞争格局

- 市场集中度概览

- 公司简介

- ALPS Global Logistics

- Koyo Kaiun Co., Ltd.

- Iino Singapore Pte Ltd

- Fairfield Chemical Carriers

- MCL Logistics Asia Pte Ltd

- Tatsumi Marine(Singapore)Pte Ltd

- MSR Green Corporation(S)Pte Ltd

- Aurora Tankers Management Pte. Ltd.

- Win-Bells Logistics & Services Pte. Ltd.

- DHL

- K" Line Pte Ltd"

- Bertschi Singapore Pte Ltd.

- Kaplan Logistics*

第七章:市场的未来

第 8 章 附录

The Singapore Chemical Logistics Market size is estimated at USD 11.26 billion in 2025, and is expected to reach USD 21.21 billion by 2030, at a CAGR of greater than 13.5% during the forecast period (2025-2030).

Key Highlights

- Singapore is one of the top energy and chemical centers in the world thanks to its potent combination of refining, olefins production, chemical manufacture, business, and innovation capabilities. Here are major activities for more than 100 international chemical companies. Singapore's main hub for petrochemical, specialty chemical, and refining operations is Jurong Island. Customers and suppliers are connected tightly by its highly integrated infrastructure, frequently literally over the fence through pipes. This integrated ecosystem, which includes utilities and logistical service providers, generates cost-saving production synergies for businesses. Investments totaling more than USD 37.27 billion have been made in Jurong Island. Singapore has positioned itself as a sustainable, highly productive base for chemical manufacture as the global industry evolves towards tailored blending and eco-friendly formulations.

- A new chemical warehouse and storage facility building is a very capital-intensive undertaking that necessitates adhering to a variety of criteria and acquiring approvals. Additionally, warehouses have very significant operational and maintenance costs. Due to the rising need for warehousing solutions, the sector is drawing a variety of investments. The efficient and effective operation of warehouses is a crucial duty, though. Some of the essential components needed for a practical and effective warehouse and storage facility are appropriate financial modeling, demand mapping, and infrastructural evaluations. The period needed to see a return on investment is lengthy since the cash involved in manufacturing and setting up a warehouse is irreversible. Consequently, the high expense of putting up and operating a warehouse and managing inventory loss is expected to limit the growth of the market during the forecast period.

- Even though Singapore is far from the European financial crisis, its chemical industry is directly affected by world events. It is dependent on the price of feedstocks because it is a close relative of the oil and gas sector, exposed to trade conflicts, and subject to changing consumer trends. Despite, and perhaps because of, the pandemic, almost all of the businesses GBR spoke to this year reported robust growth in the first quarter of 2022 and record-level growth in 2021. The future is uncertain, though, and depends on how well chemical companies can transfer costs to the next link in the value chain and ultimately to the customer.

- Performance chemicals are better positioned to pass on costs and generate healthy margins than bulk chemicals, which are directly impacted by rising feedstock and energy prices. The lack of available raw materials combined with ongoing logistical constraints has caused significant problems for companies in the specialty chemical industry, delaying orders and resulting in lengthy waiting lists for some items. The Singaporean sector is subject to the very good demographic fundamentals of Asia-Pacific in addition to the current market factors. The sector places a high priority on nutrition, with Singapore at the center of the fight against the difficulties of both food security and food sustainability.

Singapore Chemical Logistics Market Trends

Increase in chemical production driving the market

- As a result of lower production at the specialities and petrochemicals segments, Singapore's overall chemicals output in March decreased by 11.8% year over year, according to government figures released on Wednesday. The Economic Development Board (EDB) stated in a statement that "weak market demand and plant maintenance shutdowns" were to blame for the 20.3% year-over-year decrease in petrochemical production in March 2023. Due to lower production of mineral oil and food additives, the specialty segment's output for the month decreased by 6.5%, it stated. When compared to the same period in 2022, the total output of the chemicals cluster, which includes petroleum, declined 13.1% annually from January to March 2023. Singapore's overall industrial production declined in March 2023 at a less pronounced annual pace of 4.2% compared to a 9.7% contraction in February 2023.

- It is getting harder to distinguish Singapore's chemical industry from other sectors, such as food, renewables, and specialized bio-based materials ones. The biggest participants in the chemical and oil industries are also the biggest investors in new forms of energy, such as hydrogen, and chemical companies' research facilities are where the most cutting-edge innovations in carbon capture and sequestration and advanced molecular recycling are developed. While people, engineers, chemists, laborers, and managers travel across various industries more freely than ever, bio-polymers, bio-surfactants, and bio-fuels compete for the same raw materials as food components. They are commercialized on the same digital channels as food ingredients. The fate of the chemical industry is still inextricably linked to that of the oil and gas sector.

- The energy crisis brought on by the reduction in natural gas came as a rude reminder that we are still far from being ready to wean ourselves off carbon sources in a society that is virtuously promising to phase out fossil fuels. The fact that inflation is still present shows how closely the price (and, below it, the availability) of petrol affects the world economy. The picture for advanced countries is becoming more and more clouded by persistent and expanding inflationary pressures as well as aggressive tightening by central banks in response. Consumer and major customer industries, including the automobile and construction sectors, may have substantially declining demand for chemicals as a result of a persistent recession and continuous high inflation.

Investment in logistics services and infrastructure driving the market

- Due to growing device penetration, the average order value per transaction in the Singaporean e-commerce market will rise in the upcoming years. The transparency and security of the supply chain are predicted to improve with technological advancements, increasing cost-effectiveness. Additionally, in the upcoming years, commercial opportunities will be generated by the development of logistical infrastructures such as intermodal connectivity, logistics parks, and ports. The increase in the import and export of raw materials for food and mass-produced goods is the main reason fueling the expansion of the 3PL market in Singapore. The International Chamber of Shipping estimates that roughly 11 billion tonnes of cargo are transported annually on ships. Trade worldwide has significantly increased as a result of globalization. Machinery and transport equipment and petroleum are Singapore's major imports, while refined petroleum products are its largest exports. China, the United States, Indonesia, Malaysia, and Japan are the most important trading partners.

- It is challenging for manufacturers to keep track of supply operations due to market fluctuations. This is why 3PL is growing in significance. Additionally, the growth of international markets may help the sector even more. The market for 3PL usage will experience considerable growth throughout the projected period as firms increasingly view 3PL as a cost-effective option for importing and exporting goods. Due to ongoing labor shortages and supply chain issues, 3PLs have adopted automation and robotic technology to streamline operations across the whole lifecycle. Simultaneously, data-driven ordering, warehousing, and transportation technologies are being leveraged to enhance visibility and communication for consumers, brands, and logistics service providers. Thus, the 3PL market in Singapore is anticipated to show considerable growth due to the rising adoption of technology in logistics.

Singapore Chemical Logistics Industry Overview

The Singaporean chemical logistics market is highly fragmented, with a lot of local, regional, and global players. Some of the major players include ALPS Global Logistics, Koyo Kaiun Co., Ltd., Iino Singapore Pte Ltd, Fairfield Chemical Carriers, MCL Logistics Asia Pte Ltd, and many more. The sector has been observing many innovative and digital trends in recent years, like adopting big data analytics and IoT technologies to further fuel the growth of the chemical logistics industry.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

- 2.1 Analysis Method

- 2.2 Research Phases

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS DYNAMICS

- 4.1 Current Market Scenario

- 4.2 Market Overview

- 4.3 Market Dynamics

- 4.3.1 Drivers

- 4.3.1.1 Increase demand of Petrochemical is driving the market

- 4.3.1.2 Increase in Investments is driving the market

- 4.3.2 Restraints

- 4.3.2.1 High Cost of Operations

- 4.3.3 Opportunities

- 4.3.3.1 Technological Innovations

- 4.3.1 Drivers

- 4.4 Value Chain / Supply Chain Analysis

- 4.5 Porter's Five Forces Analysis

- 4.5.1 Bargaining Power of Suppliers

- 4.5.2 Bargaining Power of Buyers/Consumers

- 4.5.3 Threat of New Entrants

- 4.5.4 Threat of Substitute Products

- 4.5.5 Intensity of Competitive Rivalry

- 4.6 Technological Innovations in the industry

- 4.7 Government Initiatives to Attract Investment in the Industry

- 4.8 Insights into the 3PL Market (Market Size and Forecast)

- 4.9 Impact of COVID - 19 on the Industry

5 MARKET SEGMENTATION

- 5.1 By Service

- 5.1.1 Transportation

- 5.1.2 Warehousing, Distribution, and Inventory Management

- 5.1.3 Other Services

- 5.2 By Mode of Transportation

- 5.2.1 Roadways

- 5.2.2 Railways

- 5.2.3 Airways

- 5.2.4 Waterways

- 5.2.5 Other Modes of Transportation

- 5.3 By End-User

- 5.3.1 Pharmaceutical

- 5.3.2 Cosmetic

- 5.3.3 Oil and Gas

- 5.3.4 Specialty Chemicals

- 5.3.5 Other End-Users

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 ALPS Global Logistics

- 6.2.2 Koyo Kaiun Co., Ltd.

- 6.2.3 Iino Singapore Pte Ltd

- 6.2.4 Fairfield Chemical Carriers

- 6.2.5 MCL Logistics Asia Pte Ltd

- 6.2.6 Tatsumi Marine (Singapore) Pte Ltd

- 6.2.7 MSR Green Corporation (S) Pte Ltd

- 6.2.8 Aurora Tankers Management Pte. Ltd.

- 6.2.9 Win-Bells Logistics & Services Pte. Ltd.

- 6.2.10 DHL

- 6.2.11 K" Line Pte Ltd"

- 6.2.12 Bertschi Singapore Pte Ltd.

- 6.2.13 Kaplan Logistics*