|

市场调查报告书

商品编码

1645042

天花板灯和水晶灯-市场占有率分析、行业趋势、统计和成长预测(2025-2030 年)Ceiling Lights & Chandeliers - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

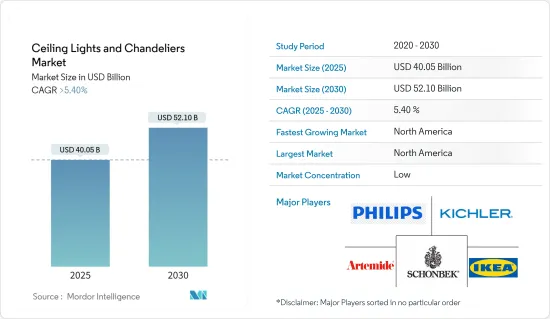

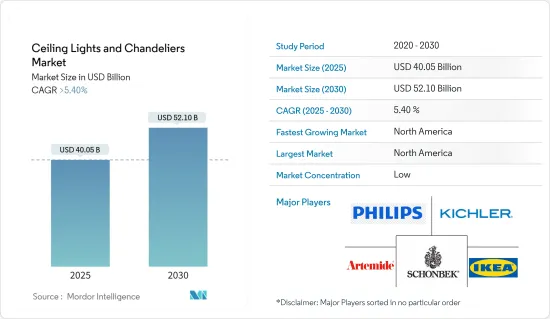

2025 年天花板灯和水晶灯市场规模估计为 400.5 亿美元,预计到 2030 年将达到 521 亿美元,预测期内(2025-2030 年)的复合年增长率将超过 5.4%。

关键亮点

- 天花板灯和水晶灯广泛应用于各种住宅空间,包括客厅、卧室、餐厅和入口。在商业环境中,它们通常出现在酒店、餐厅、零售店、办公室和大厅和活动场所等公共场所。市场提供各种各样的设计和风格,以满足不同的品味和室内美学。有多种选择可供选择,从传统华丽的水晶水晶灯到时尚简约的 LED 天花板灯。

- 现代设计通常采用玻璃、金属和织物等非常规元素以及再生材料和有机形式。电子商务的兴起对照明产业产生了重大影响,包括吸顶灯和水晶灯市场。

- 现在,许多消费者更喜欢在线上购买照明设备,这样他们可以浏览多种选择、比较价格、阅读客户评论并获取详细的产品资讯。该线上平台还提供便利性和可访问性,使消费者更容易从各种品牌和零售商探索和购买照明设备。

- 随着限制措施的放宽和消费者支出的增加,新冠肺炎疫情过后,天花板灯和水晶灯市场的现状正在逐步復苏。住宅维修和改造需求的激增导致人们对装饰照明解决方案的兴趣日益浓厚。此外,人们越来越关注能源效率和智慧照明技术。

吸顶灯和水晶灯市场趋势

LED 照明需求不断成长

- LED 照明比白炽灯和萤光等传统照明更节能。它消耗的电量明显更少,但亮度却一样高,甚至更亮。这种能源效率使得 LED 照明在天花板灯和水晶灯中的应用越来越多。

- LED 技术因其体积小巧且能够融入各种外形尺寸而提供了设计灵活性。这为设计师和製造商创造创新且视觉震撼的吊灯和水晶灯开闢了新的可能性。 LED 灯可以排列成各种图案、颜色和强度,从而实现可自订的照明设计,增强空间的美感。

- LED 照明被认为比传统照明更环保。它不含有萤光中的汞等有害物质。 LED 照明还可以回收,进一步减少我们对环境的影响。人们对环境永续性的认识和关注不断提高,推动了天花板灯和水晶灯市场对 LED 照明的需求。

美国主导市场

- 美国在照明产业有着创新和技术进步的历史。美国公司一直处于开发新型照明技术的前沿,例如LED(发光二极体)和智慧照明系统。这些技术创新帮助美国在全球市场上保持竞争力。

- 美国拥有成熟的生产照明产品的製造基础设施和专业技术。美国製造商可以生产各种各样的产品,从天花板灯和水晶灯等大量生产的产品到客製化设计的产品。

- 美国照明製造商以注重设计和美学而闻名。许多美国照明製造商提供各种风格,从传统到现代,以满足各种客户的品味。这种对设计的重视使得美国照明产品在国内和国际市场上都很受欢迎。

- 美国在国内和国际都拥有强大的分销网络,使得美国照明公司能够有效地接触到广泛的客户。这些分销网络和有效的营销策略使美国公司在全球市场上确立了强势地位。

吸顶灯和水晶灯产业概况

吸顶灯和水晶灯市场分散且竞争激烈,众多製造商、设计师和品牌争夺市场占有率。该报告介绍了在天花板灯和水晶灯市场运营的大型国际公司。就市场占有率而言,目前少数主要企业占据市场主导地位。主要参与企业包括飞利浦、Kichler、Schonbek、宜家和Artemide。然而,随着技术进步和产品创新,中小型企业透过赢得新契约和探索新市场来扩大其在市场上的份额。

其他福利

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场动态与洞察

- 市场概况

- 市场驱动因素

- 建设及开发计划增加

- 市场限制

- 高昂的安装成本和有限的客製化选项限制了市场

- 市场机会

- 语音和应用程式控制的照明系统等智慧照明解决方案带来了机会

- 产业价值链分析

- 产业吸引力-波特五力分析

- 新进入者的威胁

- 买家的议价能力

- 供应商的议价能力

- 替代品的威胁

- 竞争对手之间的竞争

- 市场创新洞察

- COVID-19 市场影响

第五章 市场区隔

- 按最终用户

- 住宅

- 商业的

- 按分销管道

- 超级市场/大卖场

- 专卖店

- 在线的

- 其他的

- 按地区

- 北美洲

- 加拿大

- 美国

- 北美其他地区

- 欧洲

- 英国

- 德国

- 欧洲其他地区

- 亚太地区

- 日本

- 印度

- 其他亚太地区

- 拉丁美洲

- 巴西

- 墨西哥

- 其他拉丁美洲国家

- 中东和非洲

- 沙乌地阿拉伯

- 阿拉伯聯合大公国

- 其他中东和非洲地区

- 北美洲

第六章 竞争格局

- 市场集中度概览

- 公司简介

- Philips

- Kichler

- Schonbek

- Inter IKEA

- Artemide

- Foscarini

- Moooi

- Hubbardton

- Flos

- Hudson Valley Lighting*

第七章 市场趋势

第八章 免责声明及发布者

The Ceiling Lights & Chandeliers Market size is estimated at USD 40.05 billion in 2025, and is expected to reach USD 52.10 billion by 2030, at a CAGR of greater than 5.4% during the forecast period (2025-2030).

Key Highlights

- Ceiling lights and chandeliers are used in a wide range of applications, including residential spaces such as living rooms, bedrooms, dining areas, and entryways. In commercial settings, they are commonly found in hotels, restaurants, retail stores, offices, and public spaces like lobbies and event venues. The market offers diverse designs and styles to cater to different tastes and interior aesthetics. From traditional and ornate crystal chandeliers to sleek and minimalist LED ceiling lights, there is a broad spectrum of options available.

- Modern designs often incorporate glass, metal, fabric, and even unconventional elements like recycled materials or organic forms. The rise of e-commerce has significantly impacted the lighting industry, including the ceiling lights and chandeliers market.

- Many consumers now prefer to purchase lighting fixtures online, allowing them to browse a wide range of options, compare prices, read customer reviews, and access detailed product information. Online platforms also provide convenience and accessibility, making it easier for consumers to explore and purchase lighting fixtures from various brands and retailers.

- The present scenario of the ceiling lights and chandeliers market post-COVID-19 is witnessing a gradual recovery as restrictions ease and consumer spending increases. The demand for home improvement and renovation projects has surged, leading to a growing interest in decorative lighting solutions. Additionally, there is a growing emphasis on energy efficiency and smart lighting technologies.

Ceiling Lights & Chandeliers Market Trends

Growing Demand for LED Source of Lights

- LED lights are highly energy-efficient compared to traditional lighting options such as incandescent or fluorescent bulbs. They consume significantly less electricity while producing the same or even higher levels of brightness. This energy efficiency has led to increased adoption of LED lighting in ceiling lights and chandeliers, as it helps reduce energy consumption and lowers electricity bills.

- LED technology offers design flexibility due to its compact size and ability to be integrated into various shapes and forms. This has opened up new possibilities for designers and manufacturers to create innovative and visually appealing ceiling lights and chandeliers. LED lights can be arranged in different patterns, colors, and intensities, allowing for customizable lighting designs that enhance the aesthetic appeal of spaces.

- LED lights are considered more environmentally friendly compared to traditional lighting options. They are free from hazardous materials such as mercury, which is present in fluorescent bulbs. LED lights are also recyclable, further reducing their environmental impact. The growing awareness and concern for environmental sustainability have driven the demand for LED lighting in the ceiling lights and chandeliers market.

United States is Dominating the Market

- The United States has a history of innovation and technological advancement in the lighting industry. US companies have been at the forefront of developing new lighting technologies, such as LEDs (light-emitting diodes) and smart lighting systems. These innovations have helped the United States maintain a competitive edge in the global market.

- The United States has a well-established manufacturing infrastructure and expertise in producing lighting products. US manufacturers can produce a wide range of ceiling lights and chandeliers, including both mass-produced and customized designs.

- US lighting manufacturers have been known for their focus on design and aesthetics. Many US lighting companies offer a diverse range of styles, from traditional to contemporary, catering to various customer preferences. This emphasis on design has contributed to the popularity of US lighting products in both domestic and international markets.

- The United States has a robust distribution network, both domestically and internationally, which enables US lighting companies to reach a wide customer base efficiently. These distribution networks, coupled with effective marketing strategies, have helped US companies establish a strong presence in the global market.

Ceiling Lights & Chandeliers Industry Overview

The ceiling lights and chandeliers market is fragmented and highly competitive, with numerous manufacturers, designers, and brands vying for market share. The report covers the major international players operating in the ceiling lights and chandeliers market. Regarding market share, some of the major players currently dominate the market. Some major players are Philips, Kichler, Schonbek, IKEA, and Artemide. However, with technological advancements and product innovations, mid-size to smaller companies are increasing their market presence by securing new contracts and tapping into new markets.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET DYNAMICS AND INSIGHTS

- 4.1 Market Overview

- 4.2 Market Drivers

- 4.2.1 Rising Prevalence of Building and Development Projects

- 4.3 Market Restraints

- 4.3.1 High Installation Costs and Limited Customization Options Restrain the Market

- 4.4 Market Opportunities

- 4.4.1 Smart Lighting Solutions, such as Voice-Controlled and App-Controlled Lighting Systems to be an Opportunity

- 4.5 Industry Value Chain Analysis

- 4.6 Industry Attractiveness - Porter's Five Forces Analysis

- 4.6.1 Threat of New Entrants

- 4.6.2 Bargaining Power of Buyers

- 4.6.3 Bargaining Power of Suppliers

- 4.6.4 Threat of Substitutes

- 4.6.5 Intensity of Competitive Rivalry

- 4.7 Insights of Technology Innovations in the Market

- 4.8 Impact of COVID-19 on the Market

5 MARKET SEGMENTATION

- 5.1 By End-User

- 5.1.1 Residential

- 5.1.2 Commercial

- 5.2 By Distribution Channel

- 5.2.1 Supermarkets/Hypermarkets

- 5.2.2 Specialty Stores

- 5.2.3 Online

- 5.2.4 Other Distribution Channels

- 5.3 By Geography

- 5.3.1 North America

- 5.3.1.1 Canada

- 5.3.1.2 United States

- 5.3.1.3 Rest of North America

- 5.3.2 Europe

- 5.3.2.1 United Kingdom

- 5.3.2.2 Germany

- 5.3.2.3 Rest of Europe

- 5.3.3 Asia-Pacific

- 5.3.3.1 Japan

- 5.3.3.2 India

- 5.3.3.3 Rest of Asia-Pacific

- 5.3.4 Latin America

- 5.3.4.1 Brazil

- 5.3.4.2 Mexico

- 5.3.4.3 Rest of Latin America

- 5.3.5 Middle-East and Africa

- 5.3.5.1 Saudi Arabia

- 5.3.5.2 United Arab Emirates

- 5.3.5.3 Rest of Middle-East and Africa

- 5.3.1 North America

6 COMPETITIVE LANDSCAPE

- 6.1 Market Concentration Overview

- 6.2 Company Profiles

- 6.2.1 Philips

- 6.2.2 Kichler

- 6.2.3 Schonbek

- 6.2.4 Inter IKEA

- 6.2.5 Artemide

- 6.2.6 Foscarini

- 6.2.7 Moooi

- 6.2.8 Hubbardton

- 6.2.9 Flos

- 6.2.10 Hudson Valley Lighting*