|

市场调查报告书

商品编码

1645090

美国屋顶:市场占有率分析、行业趋势和统计、成长预测(2025-2030 年)United States Roofing - Market Share Analysis, Industry Trends & Statistics, Growth Forecasts (2025 - 2030) |

||||||

※ 本网页内容可能与最新版本有所差异。详细情况请与我们联繫。

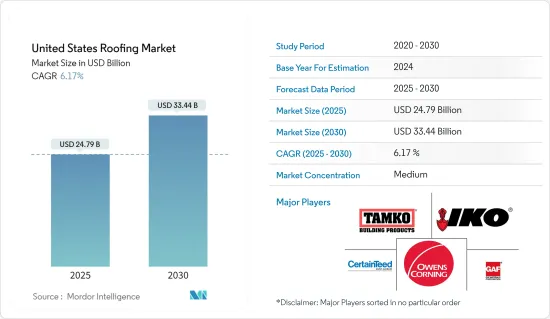

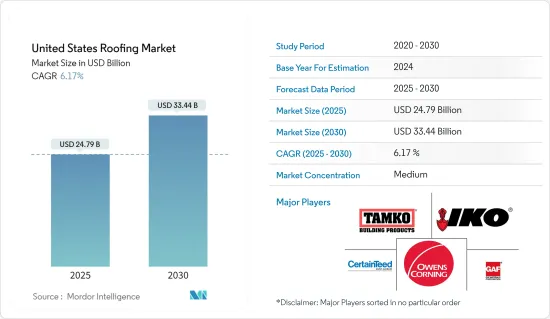

美国屋顶市场规模预计将在 2025 年达到 247.9 亿美元,到 2030 年将达到 334.4 亿美元,预测期内(2025-2030 年)的复合年增长率为 6.17%。

美国屋顶产业是世界上发展最快的产业之一。都市化、建筑、环境问题和技术创新都在促进屋顶产业的发展。屋顶市场为世界各地的住宅、商业和工业建筑提供各种各样的屋顶产品和技术。预计到 2022 年,美国屋顶承包行业在市场规模方面将排名第 17 位,在建设产业中排名第 213 位。

北达科他州屋顶承包商的平均薪资为 55,877 美元,而德克萨斯州屋顶承包商的平均薪资略高于 27,000 美元。预计 2018 年至 2023 年期间,屋顶承包商产业将在美国僱用 212,000 名工人,未来五年内将成长到 220,989 名。截至 2023 年,美国共有 79,139 名屋顶承包商,较 2022 年略有下降。屋顶承包商最多的州是加州,有 9,303 名,其次是德克萨斯州,有 6,561 名,佛罗里达州有 6,398 名。

随着越来越多的公司进入市场以及技术不断提高音质,美国屋顶市场预计将继续成长。由于屋顶在各行业的应用范围不断扩大,其市场多年来一直在稳步增长。汽车和建筑业在屋顶市场的成长中发挥着重要作用。

美国屋顶市场的趋势

单层屋顶可望赢得市场占有率

预计到 2027 年,美国单层屋面膜市场(塑胶和橡胶屋顶产品)都将成长,这主要是由于沥青膜市场份额下降。单膜相对于沥青膜的优异性能将成为推动该市场成长的主要因素。自黏单层薄膜由于使用方便,其使用量不断增加,预计将推动塑胶单层薄膜的需求,这对于时间紧迫、经常与缺乏经验的工作人员一起工作的承包商来说是一个关键因素。此外,塑胶屋顶膜也可用于凉爽屋顶用途,製造商正在努力提供具有更厚的片材以改善抗衝击和抗撕裂性能的产品。

美国的一项调查发现,最受欢迎的商业建筑系统是单层建筑,81% 的受访者采用这种建筑系统。该系统还占商业屋顶承包商销售额的 36%。单层屋顶销售主要由安装 TPO 系统的承包商 (41%) 推动。接下来是 EPDM(30%)、PVC(17%)和 KEE(10%)。平均而言,低梯度沥青销售额的 48% 为改质沥青 (SBS),其次是改质沥青 (APP),占 27%,然后是建筑屋顶,占 25%。 71% 的受访者使用低坡度沥青,约占销售额的 10%。使用单层屋顶的承包商也预期 2024 年商业销售额将会成长。

预计商业领域屋顶材料销售的成长将推动市场的发展。

2023年,商业领域的屋顶销售持续成长,成为经济的动力。在调查中,近四分之三的受访者(74%)表示,2023年的销售额将增加或维持不变,而26%的受访者表示,他们的销售额将与2022年相比大幅增加。此外,74% 的企业表示明年的年销售额将会增加,85% 的企业表示未来三年的销售额将会提高。另有 10% 的受访者表示销售量将下降,4% 的受访者认为销售量将大幅下降,7% 的受访者认为 2024 年后销售量将进一步下降。

调查显示,53% 的受访者预计 2024 年销售额将小幅成长,另有 68% 的受访者预计 2026 年销售额将小幅成长。总部所在地对区域分布影响不大,东北部、中西部、南部和西部地区超过一半(54%)的用户预计年终收入将增加。该地区近 60% 的承包商预计与前一年同期比较的年销售额成长将持续到 2026 年。在中西部和西部,73% 的企业预计到 2026 年销售额将实现成长。

美国屋顶产业概况

美国屋顶产业是世界上最大的产业之一,竞争非常激烈。许多公司在美国屋顶市场占有重要地位。屋顶製造商正在实施多项措施,包括改变其製造和供应链,以满足日益增长的屋顶需求。进入该市场的公司包括 GAF Materials Corporation、CertainTeed Corporation、Owens Corning 和 IKO Industries。

其他福利:

- Excel 格式的市场预测 (ME) 表

- 3 个月的分析师支持

目录

第 1 章 简介

- 研究假设和市场定义

- 研究范围

第二章调查方法

第三章执行摘要

第四章 市场洞察

- 市场概况

- 屋顶产业的技术创新

- 产业价值链/供应链分析

- 政府法规和倡议对建设产业的影响

- 对政府基础设施发展计划的见解和说明

- 新冠肺炎疫情对市场的影响

第五章 市场动态

- 市场驱动因素

- 可支配所得增加和中阶扩大

- 提高对屋顶解决方案的认识

- 市场限制

- 假冒仿冒品屋顶的存在是一大挑战。

- 屋顶产业面临技术纯熟劳工短缺的问题

- 市场机会

- 快速都市化与建筑热潮

- 产业吸引力-波特五力分析

- 供应商的议价能力

- 消费者议价能力

- 新进入者的威胁

- 替代品的威胁

- 竞争对手之间的竞争

第六章 市场细分

- 按行业

- 商业建设

- 住宅建筑

- 产业建设

- 按材质

- 改性沥青

- 三元乙丙橡胶

- 热塑性聚烯

- PVC 膜

- 金属

- 瓦

- 其他的

- 依屋顶类型

- 平屋顶

- 斜屋顶

第七章 竞争格局

- 公司简介

- GAF Materials Corporation

- CertainTeed Corporation

- Owens Corning

- IKO Industries

- Tamko Building Products

- Atlas Roofing Corporation

- Beacon Building Products

- IronHead Roofing

- Centimark Corp.

- Tecta America

- Flynn Group

- Baker Roofing*

- *List Not Exhaustive

- 其他公司

第 8 章:市场的未来

第 9 章 附录

The United States Roofing Market size is estimated at USD 24.79 billion in 2025, and is expected to reach USD 33.44 billion by 2030, at a CAGR of 6.17% during the forecast period (2025-2030).

The US roofing industry is one of the fastest-growing industries in the world. Urbanization, construction, environmental issues, and technological innovation have all contributed to the growth of the roofing industry. The roofing market offers a wide variety of roofing materials and technologies for residential, commercial, and industrial buildings worldwide. The roofing contracting industry in the United States ranks as the 17th largest construction industry in terms of market size and the 213rd largest in the United States in 2022.

The median roofing contractor salary in North Dakota is USD 55,877, while the median roofing wage in Texas is just over USD 27,000. The roofing contractor industry employs 212,000 workers in the United States from 2018 to 2023 and is expected to grow to 220,989 workers in the next five years. As of 2023, the roofing contractor business in the United States totaled 79,139, a slight decrease from 2022. The state with the most roofing contractor businesses is California, with 9,303, followed by Texas, with 6,561, and Florida, with 6,398.

The US roofing market is expected to continue to grow as more companies enter the market and as technology continues to improve the quality of audio. The roofing market has been growing steadily over the years due to its growing applications in a variety of industries. Automotive and construction industries have played a major role in the growth of the roofing market.

United States Roofing Market Trends

Single-Ply Roofing Products are Expected to Gain Market Share

The US roofing single-ply membrane market is expected to grow for both plastic and rubber roofing products by 2027, mainly due to the decrease in bituminous membrane market share. The advantages of single-ply over bituminous in terms of performance will be the main drivers of this market growth. The demand for plastic single-ply membranes is expected to be driven by the increasing use of self-adhesive single-ply membranes due to ease of installation, an important factor for time-strapped contractors who often work with inexperienced crews, the ability of plastic roofing membranes to be used for cool roofing purposes, and manufacturer's efforts to provide products with thicker sheets that offer improved impact and tear resistance.

According to a survey in the United States, the most popular commercial installation system in the survey was single-ply, which was used by 81% of respondents. It also generated 36% of revenue for commercial roofers. Single-ply sales were driven by 41% of contractors who installed TPO systems. EPDM followed with 30%, PVC with 17%, and KEE with 10%. On average, 48% of low slope asphalt sales were made of modified bitumen - SBS, followed by modified bitumen - APP with 27% and built-up roofing with 25%. Low-slope asphalt was used by 71% of respondents, accounting for about 10% of revenue. Contractors using single-ply roofs also indicated that they expected commercial sales to grow in 2024.

Increasing Sales of Roofing in the Commercial Sector is Expected to Drive the Market in the Future

Roofing sales increased in the commercial space again in 2023 as the economy gained traction. About three-quarters (74%) of respondents in a survey said sales increased or remained stable in 2023, while 26% said they expected sales to increase significantly compared to 2022. Another 74% said annual sales volume would increase next year, while 85% said sales would improve over the next 3 years. Another 10% said sales volume would decrease, with 4% expecting a significant drop and 7% expecting further declines in 2024 and beyond.

According to a survey, 53% expect revenues to increase slightly in 2024, and even more (68%) expect a slight increase through 2026. Geographic headquarters had little impact on the regional breakdown, and more than half (54%) of all contractors across the Northeast, Midwest, South, and West expected year-end sales growth. Around 60% of contractors across the same territory expected Y-o-Y sales growth in 2024 that would continue through 2026. 73% of contractors in the Midwest and West expected sales volume growth through 2026.

United States Roofing Industry Overview

The US roofing industry is one of the largest and most competitive in the world. Many companies have a significant presence in the US roofing market. Roofing manufacturers are implementing several measures to meet the increased demand for roofing materials, including increased manufacturing and supply chain changes. Some of the companies operating in the market are GAF Materials Corporation, CertainTeed Corporation, Owens Corning, and IKO Industries.

Additional Benefits:

- The market estimate (ME) sheet in Excel format

- 3 months of analyst support

TABLE OF CONTENTS

1 INTRODUCTION

- 1.1 Study Assumptions and Market Definition

- 1.2 Scope of the Study

2 RESEARCH METHODOLOGY

3 EXECUTIVE SUMMARY

4 MARKET INSIGHTS

- 4.1 Market Overview

- 4.2 Technological Innovations in the Roofing Sector

- 4.3 Industry Value Chain/Supply Chain Analysis

- 4.4 Impact of Government Regulations and Initiatives taken in the Construction

- 4.5 Review and Commentary on the Extent of Government Infrastructure Development Schemes

- 4.6 Impact of the COVID-19 Pandemic on the Market

5 MARKET DYNAMICS

- 5.1 Market Drivers

- 5.1.1 Increasing Disposable Income and Middle-Class Expansion

- 5.1.2 Increased Awareness of Roofing Solutions

- 5.2 Market Restraints

- 5.2.1 The presence of counterfeit or substandard roofing materials in the market poses a significant challenge

- 5.2.2 The roofing industry faces a shortage of skilled labor

- 5.3 Market Opportunities

- 5.3.1 Rapid Urbanization and Construction Boom

- 5.4 Industry Attractiveness - Porter's Five Forces Analysis

- 5.4.1 Bargaining Power of Suppliers

- 5.4.2 Bargaining Power of Consumers

- 5.4.3 Threat of New Entrants

- 5.4.4 Threat of Substitutes

- 5.4.5 Intensity of Competitive Rivalry

6 MARKET SEGMENTATION

- 6.1 By Sector

- 6.1.1 Commercial Construction

- 6.1.2 Residential Construction

- 6.1.3 Industrial Construction

- 6.2 By Material

- 6.2.1 Modified Bitumen

- 6.2.2 EPDM Rubber

- 6.2.3 Thermoplastic Polyolefin

- 6.2.4 PVC Membrane

- 6.2.5 Metals

- 6.2.6 Tiles

- 6.2.7 Others

- 6.3 By Roofing Type

- 6.3.1 Flat Roof

- 6.3.2 Slope Roof

7 COMPETITIVE LANDSCAPE

- 7.1 Company Profiles

- 7.1.1 GAF Materials Corporation

- 7.1.2 CertainTeed Corporation

- 7.1.3 Owens Corning

- 7.1.4 IKO Industries

- 7.1.5 Tamko Building Products

- 7.1.6 Atlas Roofing Corporation

- 7.1.7 Beacon Building Products

- 7.1.8 IronHead Roofing

- 7.1.9 Centimark Corp.

- 7.1.10 Tecta America

- 7.1.11 Flynn Group

- 7.1.12 Baker Roofing*

- 7.2 *List Not Exhaustive

- 7.3 Other Companies